Investment Thesis

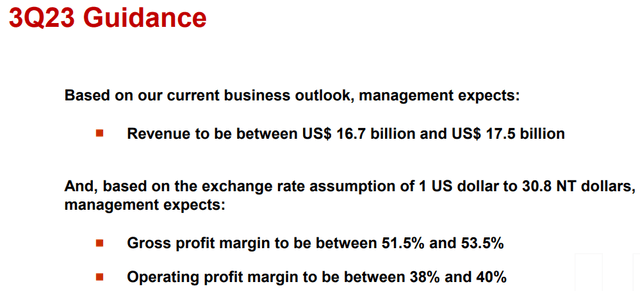

Despite reporting decent 2Q FY2023 results, Taiwan Semiconductor (NYSE:TSM) experienced a 5% drop in the aftermarket due to weak revenue outlooks. The company expects 3Q FY2023 revenue to grow by 9% QoQ, but this fell short of the street estimates, primarily due to the weak demand in PC markets and a sluggish recovery in China.

Looking ahead to 4Q FY2023, TSM is expected to see a 10% QoQ growth. However, their FY2023 revenue is expected to drop by 10% YoY, which is largely below the consensus of low and mid-single digit decline.

However, I still believe that TSM is a long-term value play as the stock is trading at a P/E Fwd of 16.5x, which is significantly below S&P 500 and other peers in the industry. While the production in the Arizona plant may be pushed out into FY2025, the company targets a growth rebound in FY2024, potentially leading to a double-digit revenue growth. Moreover, I believe the cyclical trough is behind us, and I’m bullish on the stock for the long term, viewing the recent pullback as a buying opportunity, especially considering its 32% YTD return, which is below Nasdaq’s 42%.

2Q23 Takeaway

2Q23 Presentation

While TSM beat on the revenue consensus in 2Q FY2023, we can see that the revenue fell 13.7% YoY, which reflects weaker demand recovery and end market growth. However, the year-over-year decline was already anticipated by the market. Investors were largely disappointed by its lackluster revenue outlooks in the following quarters. The management is expected to see a deeper downturn in its total sales in FY2023, which triggered an aftermarket selloff.

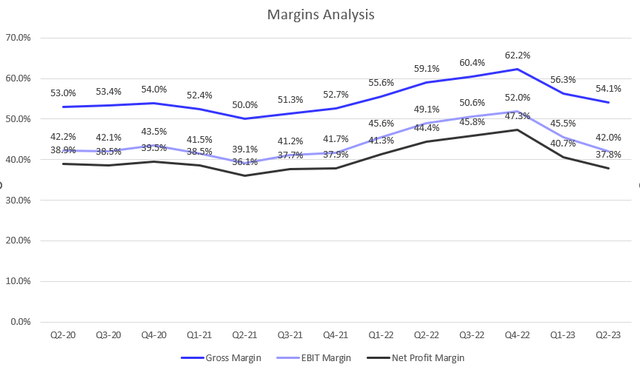

The company model

Looking at the chart, we can see that TSM’s margins have further contracted in 2Q FY2023, which had a negative impact on its profitability. Investors should be cautious that the numbers are declining and approaching a new low since 2Q FY2021. The company’s guidance for 3Q FY2023 gross margin is 52.5%, showing a further decline from 54.1% in 2Q FY2023. Additionally, the operating margin is expected to be 39%, reaching its lowest level in the last three years at 39.1%.

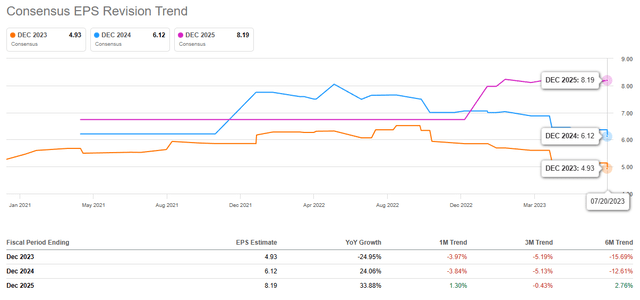

Moreover, due to the anticipated -10% revenue growth, the market currently expects to see a -20% growth YoY in TSM’s diluted EPS for FY2023.

However, the management still remains optimistic about its long-term growth trajectory, citing the massive structural increase in demand for computation driven by the industry trends of 5G and HPC. During the earnings call, the CEO addressed,

“Even with a more challenging 2023, our revenue remains well on track to grow between 15 and 20 CAGR over the next several years in U.S. dollar terms, which is a target we communicated back in January 2022 Investor Conference.”

I believe that the recent surge in AI-related demand creates a secular tailwind for TSM, as generative AI requires higher computing power, driving an increase in semiconductor content. This positive trend is expected to lead to a growth acceleration in FY2024, supported by the further ramping up of N3 and the cyclical rebound in N5 and N7 demand.

Arizona Factory Faces Delay

Another reason that triggered the post-earnings selloff in my view was the labor shortage of skilled workers, leading TSM to push out the mass production schedule of its Arizona Fab from 2H FY2024 to FY2025. The Chairman added,

“We are encountering certain challenges, as there is an insufficient amount of skill workers with the specialized expertise required for equipment installation in a semiconductor grade facility.”

While I admit that the delay in production at the Arizona plant may add pressure on its top-line growth and gross margin expansion, I believe the company has already factored this into their revenue outlooks. As a result, I anticipate that street analysts will begin to lower the company’s earnings consensus for FY2024.

Downward Earnings Revision

Seeking Alpha

As we can see from the chart, TSM’s earnings consensus has been cut by 4% right after the 2Q FY2023 earnings report. This largely priced in a 5% post-earnings selloff without significantly changing its P/E FY2024. I believe that most fundamental investors would focus on buying stocks based on the consistency of earnings revisions, which can provide insights into the growth trend. Nevertheless, we should be mindful of a continued downtrend if the global economy starts to worsen in the near term.

Seeking Alpha

Looking at the 6M trend, TSM’s earnings revision for FY2024 has been reduced by 12.6% YTD. Interestingly, we can observe that the stock price also experienced a similar decline of 12.7% before reaching the YTD trough, after which it started participating in the broader AI thematic rally. While this price action could be just a coincidence, I think it could also be a healthy sign as it indicates a strong correlation between the stock price and its earnings revision. Under the current backdrop, it suggests that the stock is not purely trading based on market sentiment, distinguishing it from some other semiconductor peers.

Valuation

Seeking Alpha

Despite the recent rally in the broad-based semiconductor industry, TSM is currently trading at a P/E GAAP TTM ratio of 15.6x, which is lower than the S&P 500 index’s ratio of 20.8x. When considering its forward 12 months earnings estimates, the stock’s P/E forward multiple stands at 16.5x, indicating a negative YoY growth in its forward earnings. Nevertheless, the multiple is still below the S&P 500 index’s ratio of 20.4x.

Based on the valuation multiple methods and considering the past 5-year horizon, I believe TSM is undervalued if its P/E significantly falls below the 5-year average. We know that the recent surge in AI demand should elevate growth expectations for semiconductor stocks, subsequently driving their valuation multiples higher. However, looking at the chart, despite the recent 16% rally since late May, we still can see the current multiple sits 28% below its 5-year average of 21.5x, indicating that TSM is still undervalued.

While geopolitical risks may put some pressure on its valuation, I think TSM remains a value stock with significant growth potential under the secular growth tailwind. Therefore, considering the attractive risk and reward profile, I continue to be bullish on the stock over the long term.

Conclusion

In sum, despite facing weaker revenue outlooks and continued margin contraction, I still believe that TSM is well-positioned to achieve a growth acceleration in FY2024 and beyond, driven by the increasing demand for AI-related technologies. Moreover, the stock’s high correlation between price and earnings revision indicates it is not purely driven by market sentiment, setting it apart from some semiconductor peers. Therefore, with TSM currently trading at a significantly lower P/E multiple than the broader S&P 500 index, I’m bullish on the stock in the long term as it presents an attractive value investment with strong growth potential under the secular demand tailwind in the semiconductor industry.

Read the full article here