Sixth Street Specialty Lending, Inc. (NYSE:TSLX) has been a strong performer in 2023, with its common shares up a big 15% on a total return basis. The business development company (“BDC”) is focused on providing capital to middle-market U.S. firms primarily through senior secured loans. The $1.6 billion market cap TSLX is externally managed by an affiliate of San Francisco-based Sixth Street, a global investment firm with $65 billion in assets under management. Income is the prize here, and the BDC last declared a regular quarterly cash dividend of $0.46 per share, in line with its prior payout and for a 9.4% annualized forward yield. This was from a loan portfolio that included 99 Cents Only Stores, Anthology, and Avalara.

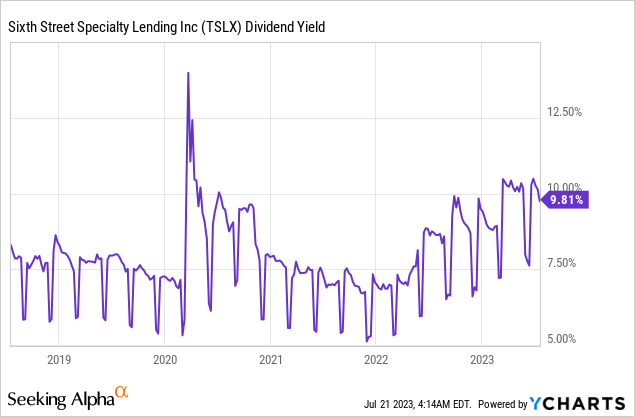

The BDC is also heavy on paying out supplementals with supplemental payouts of $0.13 declared so far in 2023. Hence, assuming another $0.13 in supplementals through to the end of the year, shareholders would see an incremental 1.3% dividend income. The yield has moved to its highest level since 2020 on the back of what’s been a base quarterly dividend that has grown 12% from $0.41 per share to its current level. This has come with a stock currently trading at an 18% premium to net asset value per share of $16.59 as of the end of its fiscal 2023 first quarter. Critically, NAV per share was a sequential growth of $0.11 over $16.48 in the fourth quarter

NAV Trendline Looks Upward Even As Pressures Mount

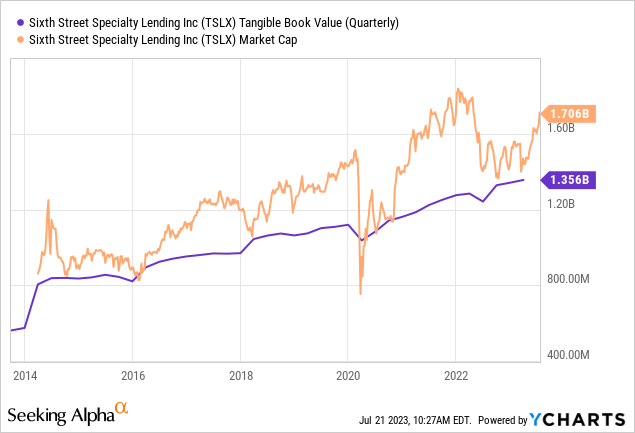

The first metric I look at when assessing whether or not to allocate capital to a BDC is the direction of NAV. This is one of the core factors to heavily influence the movement of a BDC’s common stock. To be clear, a narrow focus on just dividend yield could see negative total returns if a fat yield is set against the backdrop of a NAV in decline. TSLX has managed NAV, as expressed by tangible book value, on a nominal level on a near upward basis over the last decade. NAV was $1.12 billion going into the pandemic and currently sits at $1.36 billion as of the end of the first quarter. However, NAV on a per share basis has waned, with a peak of $17.18 in the third quarter of 2021 as the BDC sometimes sells shares to raise capital.

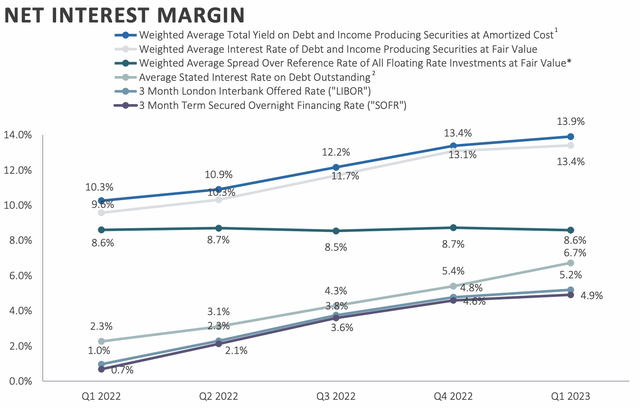

This has, of course, come on the back of a Fed funds rate hiked ten consecutive times to its highest level in over a decade at 5% to 5.25%. The market is currently pricing in a 99.8% chance of the FOMC hiking rates by another 25 basis points at its upcoming June 26th meeting. Crucially, the rate hikes have provided a boost to TSLX’s net interest margins but have the countering effect of weighing down on market sentiment and the fair value of its loans.

Sixth Street Specialty Lending Fiscal 2023 First Quarter Presentation

The BDC saw its weighted average total yield on debt and income producing securities at fair value come in at 13.4% for the first quarter, up around 30 basis points sequentially from the fourth quarter. This uptrend in total yield chargeable on loans has of course come with higher financing costs with the BDC’s weighted average spread over the reference rate of all its floating rate investments at fair value coming in at 8.6% during the first quarter. TSLX generated a first-quarter total investment income of $96.5 million, up 43.2% over its year-ago comp and a beat by $2.8 million on consensus estimates.

Spillover Income Set To Drive More Supplementals As Dividend Coverage Comes In Healthy

TSLX generated adjusted net investment income per share of $0.55, a small beat of $0.01 on consensus estimates and growth from $0.49 in the year-ago comp. This meant the most recent regular dividend was 120% covered by first quarter NII, with spillover income as of the end of the quarter at around $0.87 per share. Hence, is TSLX a buy as elevated interest rates through to 2024 bolster NII and spillover income? It depends. This is a broadly high-quality BDC focused on NAV growth set against what’s now a rapidly ramping NII and dividend payment profile.

There will be more supplementals paid out and there is scope for another hike to the base dividend payment. However, bears would flag broader macro risks and a potential recession as reasons to pause. The BDC has always traded at this premium, but this has in recent months moved higher as the specter of a recession stalks the U.S. economy. As of the end of the first quarter, loans on non-accrual status were less than 0.7%, with no new portfolio companies added during the period. Hence, these concerns could very much be negated, especially as recession expectations get pulled back. Goldman Sachs recently cut its chances of a U.S. recession to 20% from 25%. TSLX is a buy against this.

Read the full article here