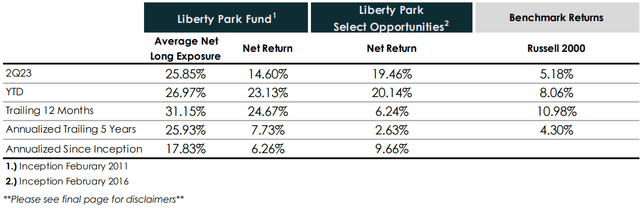

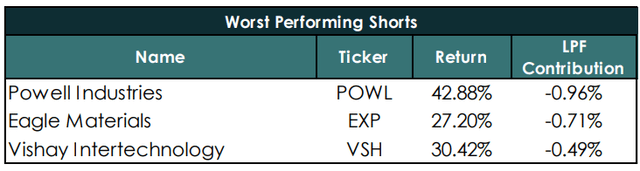

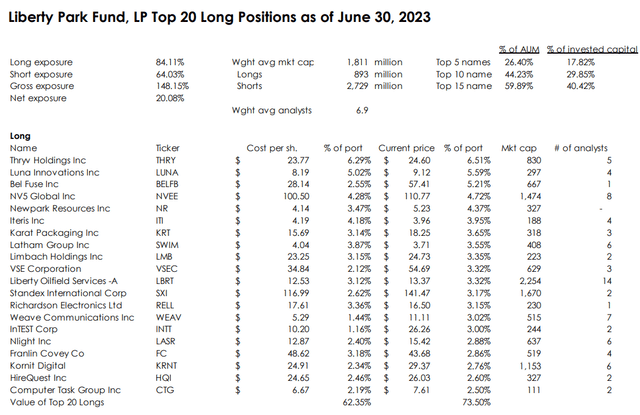

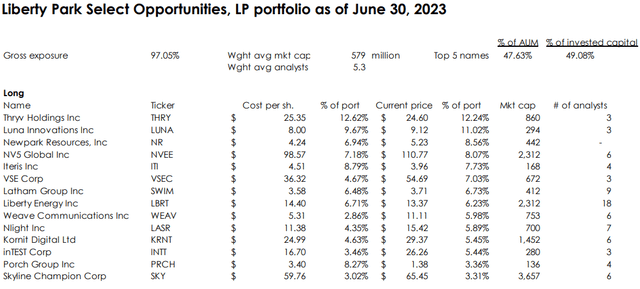

Liberty Park Fund, LP’s value increased 14.60%, net of fees, in the second quarter of 2023 vs. a 5.18% increase in the Russell 2000. The 17.47% increase in our long positions contributed 15.28% on a weight-adjusted basis, while the 0.07% increase in our shorts detracted 0.96% on a weight-adjusted basis. Gross exposure averaged 131%. Net exposure averaged 27%. Gross Pure Alpha1— our proprietary measure of returns generated from stock selection— was 10.10% for the quarter. Liberty Park Select Opportunities, LP’s value increased by 19.46%, net of fees, in the second quarter. Gross exposure averaged 96.03%.

2Q23 Performance Analysis

Both of Liberty Park’s funds had excellent performances in the second quarter, and each fund recovered large portions of last year’s drawdowns. We generated alpha on both the long and short sides of the portfolio, and we made progress on reducing our unintended exposure to factor tilts, which has reduced daily volatility.

The volatility of the past year created many opportunities to find long positions that were likely to beat expectations. Some of the best companies in the world traded down to single-digit price-to-earnings multiples. Other businesses were priced for imminent bankruptcy, despite years of cash left on the balance sheet and a clear path to profitability. Although we think there are still plenty of opportunities to generate alpha, we do not expect the major indices to continue to roar higher during the rest of the year.

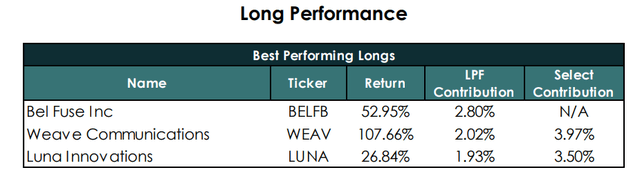

- BELFB reported accelerating revenue growth and record EBITDA margins for 1Q:23. The stock continues to trade at a fraction of the multiple of comparable companies despite its dramatic fundamental outperformance over the past 12 months. We expect the disconnect to narrow as the results of the turnaround are proven to be durable.

- WEAV had its public offering in late 2021 and quickly suffered a dramatic drawdown as investors shunned new issues in 2022. In WEAV’s case, the selloff was overdone. We decided to buy shares near the March lows after seeing the new management team’s progress on cutting costs and reinvigorating sales growth. More evidence of progress on growth and profitability was provided when the company reported its first quarter results. Shares quickly rerated closer to other vertical software peers.

- LUNA reported a better-than-expected first quarter and held its first-ever investor day in May. The company continues to deliver on its targets of 20% top-line growth and operating leverage.

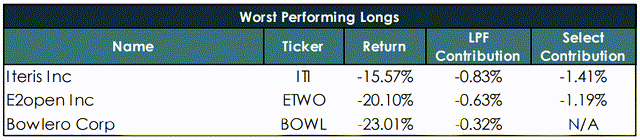

- ITI’s 1Q:23 revenues were in-line with analyst estimates, but unexpected timing and staffing issues reduced EBITDA margins by nearly six percentage points (margins would have beaten estimates meaningfully without these issues). The issues now are behind the company and should reverse and provide a tailwind for margins for the rest of the year. ITI currently trades at 10x 2022 cash flow despite rapidly growing software and high-margin hardware businesses and a growing competitive moat in its smart mobility infrastructure management niche.

- ETWO reported much lower-than-expected forward guidance when it announced its fiscal 2023 results. Given the tailwinds that other supply chain software companies are taking advantage of, we lost confidence in the company’s current ability to execute and closed the position. We continue to view the supply chain software space favorably and would consider revisiting the stock in the future.

- We sold BOWL before the company reported earnings to make room for higher- conviction ideas. We attribute the pre-earnings decline to concerns about slowing same-store sales growth occurring at other leisure businesses.

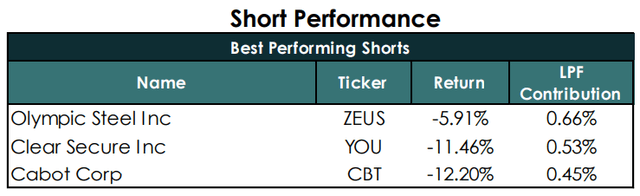

- ZEUS reported better-than-expected results as spreads remain elevated. Returns for Liberty Park Fund were generated from selling the stock at highs before earnings.

- YOU reported earnings that were slightly above consensus estimates; however, the company continued to show declines in customer retention. We think YOU is at risk of significant churn if its partnership with American Express is not renewed, and we contend the opportunity with airports is more than fully priced into the shares.

- CBT and other commodity chemical producers reported much weaker-than- expected results as a result of inventory destocking at retailers and slowing demand for goods.

- POWL reported much better-than-expected earnings. The company is benefiting from record LNG and petrochemical spending. Given the cyclical nature of these end markets and the weaknesses that are starting to appear, we do not expect the good times to last.

- EXP rose along with homebuilders as builder sentiment improved. Commercial construction end markets have been strong throughout the past year and residential construction seems to have turned a corner as home buyers are forced to build due to a lack of existing inventory.

- VSH reported better-than-expected results and guidance when it reported the first- quarter results.

Portfolio Outlook

The strength in equities, particularly “risk-on” tech equities, in 1H:23 tells us that market participants believe the Federal Reserve has succeeded in its quest for a “soft landing.” In the soft landing scenario, inflation gradually recedes to 2% and the economy continues to grow, albeit at a modestly slower rate. While we think there is good evidence for the soft landing hypothesis— for example, June’s CPI report showed only a 0.16% month-to-month increase (or ~2% annualized)— the market already is pricing in this view while significant risks and counterpoints remain.

The rapid interest rate hikes of 2022 weighed heavily on equity prices and consumer spending initially, but after that hard reset, people seem to be adjusting and going back to their old ways. Commodity prices have risen sharply in recent months and speculative tech stocks are back in vogue: these sorts of things are not indicative of a “disflationary” environment. We worry and many datapoints suggest that inflation may re-accelerate in coming months. As such, we think rate cuts by the Federal Reserve are highly unlikely in 2H:23 or even 1H:24. If anything, we think the Federal Reserve may opt for 2-3 more rate hikes in the next 6-9 months to fully extinguish inflation.

Given the market’s view that rate hikes and above-2% inflation are in the past, we think near- term risks are to the downside. In our view, the Fed will be “hawkish-for-longer”, and this will prevent equity markets from reaching new highs soon. The microeconomic outlook for our funds, however, is still quite positive. Many of our stocks were pummeled in 2022 despite the fundamentals not changing all that much; the obscure/niche/small-cap nature of our companies just requires more time to elapse for investors to digest the fundamentals and price the shares to their reality.

Core Long Positions

Newpark Resources (NR)

Newpark Resources should see significant earnings growth from its DURA-BASE® composite mat over the next decade. Combine that earnings growth with the potential for multiple expansion as the legacy oilfield fluids business is divested or shuttered and you have a company that could be worth multiples of its current value in the next few years.

Today, Newpark has two operating segments: Fluids and Industrial.

The industrial business primarily derives its revenues from the rental and sale of worksite access matting systems (aka DURA-BASE®). These engineered thermoplastic mats are designed to lock together to form a structurally-sound work surface that provides protection for workers and equipment. Composite mats are displacing legacy work surface technologies like timber. Traditional timber ground protection mats only last up to three years, are prone to rotting, contain splinters and nails, do not lock together, and weigh 3x as much per square foot covered. Composite mats can be laid faster with less people and equipment, conform to the ground, can be cleaned after use, and can be infinitely recycled once they reach the end of their 12-year life. Worksite mats are used by over twenty different industries, but the industry driving the growth is power transmission.

Composite mats currently have only ~15% share of the worksite access market (and most of this adoption has occurred over the past 5 years) while the rest of the market belongs to timber. We expect composite will continue to take market share from timber.

Combine the share gains with the high-single-digit growth we expect from the power transmission market, and Newpark should be able to grow its industrial segment at a high- single-digit/low-double-digit rate for the next several years. Moreover, the industrial segment generates EBITDA margins above 30%. We believe these margins should be sustainable over the medium-term given the demand for composite mats and Newpark’s scale advantages.

The Fluids business sells drilling, stimulation, and completion fluids to oil and gas markets. This business is profitable, but it is capital-intensive and very cyclical. Fluids accounts for most of Newpark’s revenues and assets, but a small percentage of the company’s profits. Management is in the process of shrinking this business and has announced strategic alternatives for the division.

The Fluids segment has $210 million dollars of working capital, a large portion of which should be released as cash as the business is right-sized or paid for by an acquirer.

Management has pulled $100 million in cash out of this business over the past year and used the proceeds to fund growth in the Industrial segment and to buy back stock.

Additionally, as the Fluids segment has shrunk, management has been able to reduce corporate costs (down 27% versus 2019). Over time, we expect the Industrial segment to overtake Fluids in revenue; we also expect industry classification systems such as Bloomberg and MSCI to reclassify Newpark as an industrial company. In our view, the industry reclassification will bring in new investors and cause Newpark shares to re-rate closer specialty rental peers like WillScot Mobile Mini (WSC) and McGrath RentCorp (MGRC), which trade at low-double-digit EV/EBITDA multiples. (Newpark trades below 7x today, and closer to 4x if you give the company credit for the value of the Fluid segment’s working capital.)

Disclaimers

This quarterly letter, furnished on a confidential basis to the recipient, does not constitute an offer of any securities or investment advisory services. It is intended exclusively for the use of the person to whom it has been delivered by Liberty Park Fund, LP and it is not to be reproduced or redistributed to any other person without the prior written consent of the Fund.

This information has been compiled by Liberty Park Capital Management, LLC and while it has been obtained from sources deemed to be reliable, no guarantee is made with respect to its accuracy. The Fund does not represent that the information herein is accurate, true or complete, makes no warranty, express or implied, regarding the information herein and shall not be liable for any losses, damages, costs or expenses relating to its adequacy, accuracy, truth, completeness or use.

This quarterly letter is subject to a more complete description and does not contain all of the information necessary to make an investment decision, including, but not limited to, the risks, fees and investment strategies of the Fund. Any offering is made only pursuant to the relevant private offering memorandum, together with the current financial statements of the Fund, if available, and a relevant subscription application, all of which must be read in their entirety. No offer to purchase interests will be made or accepted prior to receipt by an offeree of these documents and the completion of all appropriate documentation.

Liberty Park Fund, LP and Liberty Park Select Opportunities, LP returns are audited; however, all other figures are estimated and unaudited. Net results reflect the net realized and unrealized returns to a limited partner after deduction of all operational expenses (including brokerage commissions), management fees and performance allocations. Performance data assume reinvestment of all distributions. Actual returns will vary from one limited partner to the next in accordance with the terms of the fund’s limited partnership agreement. Past performance is not indicative of future results and investors risk loss of their entire investment. Performance results are shown for the period from March 2011 through June 2023.

References in this presentation are made to the Russell 2000 Index for comparative purposes only. Liberty Park Fund, LP and Liberty Park Select Opportunities, LP may be less diversified than the Russell 2000 Index. The Russell 2000 Index may reflect positions that are not within Liberty Park Fund, LP’s investment strategy.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here