Introduction

Baker Hughes Company (NASDAQ:BKR) released its second quarter 2023 results on July 19, 2023.

Note: This article updates my June 27, 2023 article. I have followed BKR on Seeking Alpha since December 2020.

Baker Hughes’ unique portfolio enables us to weather a choppy macro environment. We have a diverse mix of long and short cycle businesses with leading technologies that play across value chains within today’s energy and industrial complex, and are well positioned to play a leading role into the future. (conference call)

1 – Second Quarter 2023 Results Snapshot

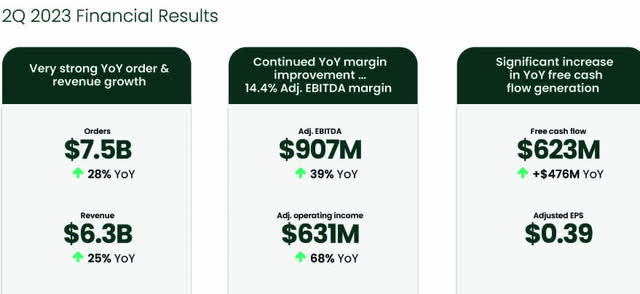

The company reported Second-quarter 2023 adjusted earnings of $0.39 per share, beating analyst expectations this quarter against $0.11 last year. Total quarterly revenues of $6,315 million were above expectations, with consolidated orders of $7,474 million.

The stronger-than-expected quarterly results were due to higher contributions from the Oilfield Services and Equipment and Industrial and energy Technology business units.

However, Halliburton, which released its 2Q23 results as well, warned that weaker oil and gas prices had pushed U.S. shale producers to slash the number of active rigs by 11% in 2Q23, reducing the need for drilling equipment and services, indicating a possible peak in demand.

Rival Baker Hughes also indicated it was seeing a decline, with CEO Lorenzo Simonelli noting that North American business is “leveling off,” with some customers even asking for discounts.

BKR 2Q23 Highlight (BKR Presentation)

CEO Lorenzo Simonelli said in the conference call:

We were pleased with our second quarter results and remain optimistic on the outlook for 2023. We maintained our order momentum in IET and SSPS. We also delivered strong operating results at the higher end of our guidance in both business segments, booked almost $150 million of New Energy orders and generated approximately $620 million of free cash flow.

Note: I regularly cover three companies in oilfield services. After Schlumberger (SLB) and Halliburton (HAL), Baker Hughes is my third choice.

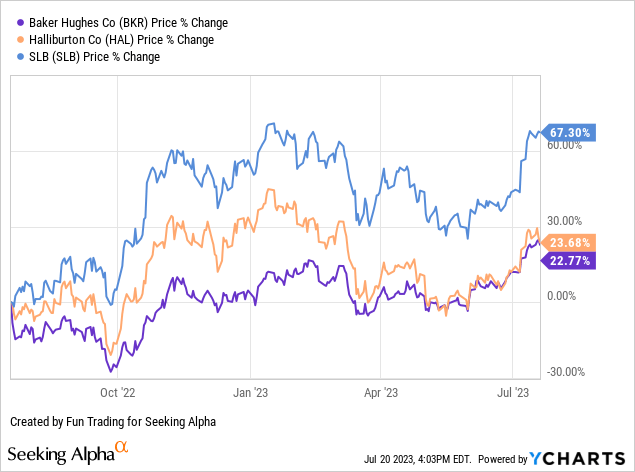

2 – Stock Performance

Baker Hughes and its peers have been doing very well since the start of 2023. BKR is up 23% on a one-year basis, underperforming its main competitor, SLB, which is up 67% YoY.

Baker Hughes – The Raw Numbers – Second Quarter of 2022

| Baker Hughes | 2Q22 | 3Q22 | 4Q22 | 1Q23 | 2Q23 |

| Total Orders in $ Billion | 5.86 | 6.06 | 8.01 | 7.63 | 7.47 |

| Total Revenues in $ Billion | 5.05 | 5.37 | 5.91 | 5.72 | 6.32 |

| Net Income available to common shareholders in $ Million | -839 | -17 | 182 | 576 | 410 |

| EBITDA $ Million | -321 | 463 | 664 | 1,093 | 997* |

| EPS diluted in $/share | -0.84 | -0.02 | 0.18 | 0.57 | 0.40 |

| Operating cash flow in $ Million | 321 | 597 | 898 | 461 | 858 |

| CapEx in $ Million | 226 | 226 | 269 | 310 | 276 |

| Free Cash Flow in $ Million | 95 | 371 | 629 | 151 | 582 |

| Total Cash $ Billion | 2.93 | 2.85 | 2.49 | 2.42 | 2.81* |

| Debt Consolidated in $ Billion | 6.66 | 6.66 | 6.66 | 6.66 | 6.64 |

| Dividend per share in $ | 0.18 | 0.18 | 0.19 | 0.19 | 0.19 |

| Shares Outstanding (Diluted) in Million | 1,001 | 1,008 | 999 | 1,018 | 1,015 |

Source: Company release.

* Estimated by Fun Trading.

Analysis: Earnings Details

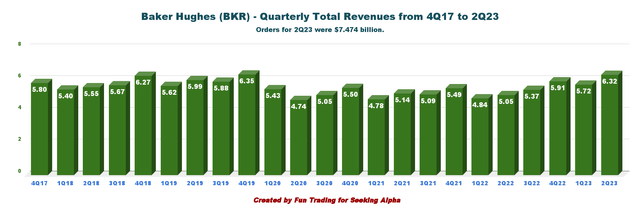

1 – Revenues and other income were $6.315 billion in 2Q23

BKR Quarterly Revenues History (Fun Trading)

BKR’s total orders from all business segments in the second quarter of 2023 were $7,474 million. Revenues were $6,315 million this quarter, up 30.6% from the same quarter a year ago and up 10.5% quarter-over-quarter. Adjusted operating income was $395 million for the quarter. Adjusted EBITDA was $907 million for the quarter.

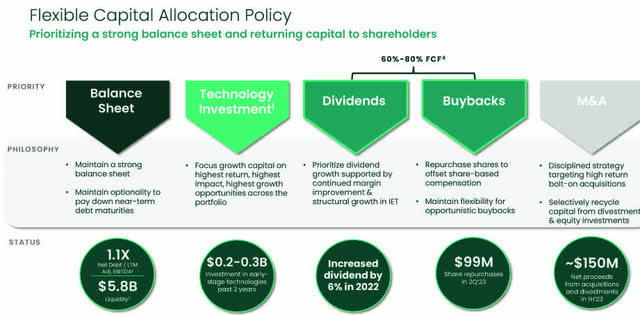

BKR Capital Allocation (BKR Presentation)

The company posted total costs and expenses of $5,801 million in the second quarter, up from the year-ago quarter’s $5,072 million.

Baker Hughes reorganized its company from four segments to two operating segments. Effective Oct 1, 2022, the two operating segments are Oilfield Services and Equipment and Industrial & Energy Technology.

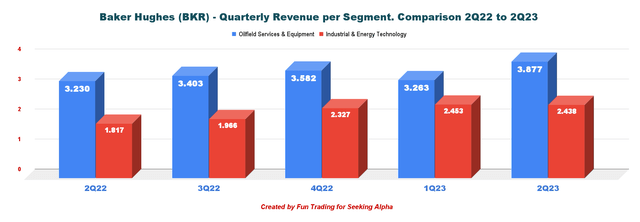

BKR Quarterly Revenue per Segment (Fun Trading)

1.1 – Oilfield Services & Equipment

Revenues were $3.877 million, up 20% from last year’s $3,230 million. Operating income from the segment was $417 million, up from $249 million in the second quarter of 2022 due to higher revenues in most product lines.

1.2 – Industrial & Energy Technology

Revenues totaled $2,438 million, up 34.3% from the last year or $1,816 million. The segment reported an income of $311 million from $236 million in 2Q22.

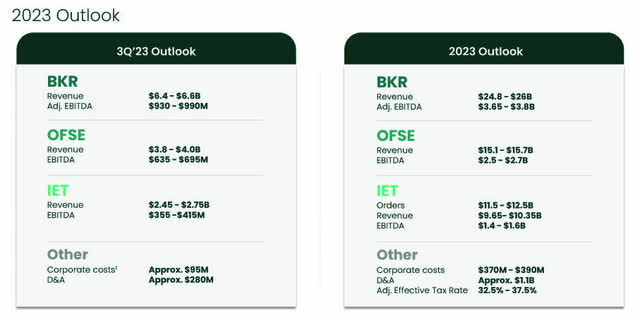

1.3 – 3Q23 and FY23 Positive outlook

Based on the mid-point, revenue for 3Q23 is expected to be between $6.4-$6.6 billion or up 3% QoQ. Total revenues for 2023 are expected to be between $24.8 billion and $26 billion.

BKR 3Q23 and FY23 Outlook (BKR Presentation)

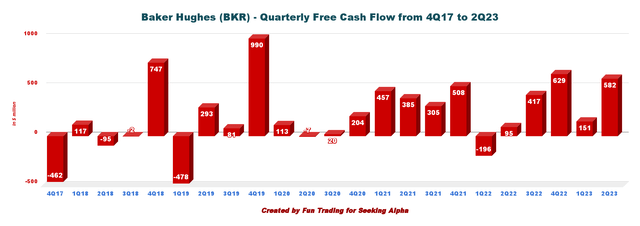

2 – Free cash flow was $582 million in 2Q23

BKR Quarterly Free Cash Flow History (Fun Trading)

Note: Generic free cash flow is cash flow from operations minus capex. The company calculated Free cash flow differently and indicated $623 million for 2Q23.

Trailing 12-month free cash flow came in at $1,733 million, and the company had a free cash flow of $582 million in 2Q23.

This quarter, the quarterly dividend is $0.19 per share or an annual cash payment of $760 million. The dividend yield is now 2.20%.

The company repurchased $99 million worth of shares in 2Q23.

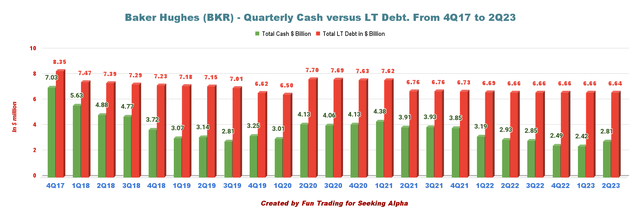

3 – The net debt was $3.84 billion in 2Q23

BKR Quarterly Cash versus Debt History (Fun Trading)

As of June 30, 2023, the company had cash and cash equivalents of $2,805 million, down from $2,928 million in the second quarter of 2022.

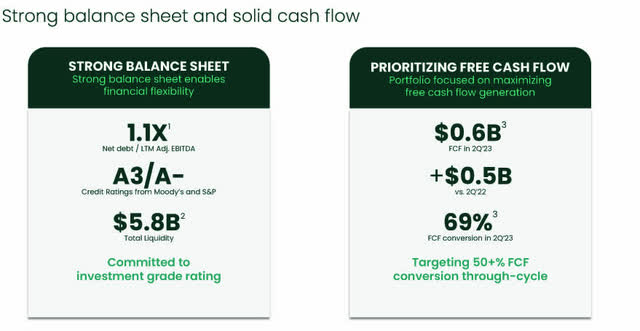

At the end of the second quarter, Baker Hughes had a long-term debt of $6,644 million (including $797 million in current debt), with a Net debt / LTM Adj. EBITDA of 1.1x (see chart above). Liquidity is $5.8 billion in 2Q23.

BKR Balance Sheet (BKR Presentation)

Technical Analysis (Short Term) and Commentary

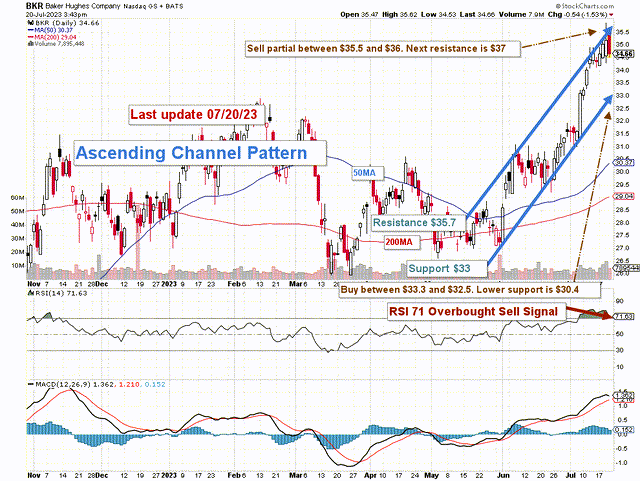

BKR TA Chart Short-term (Fun Trading StockCharts)

Note: The chart includes the effect of the dividend.

BKR forms an ascending channel pattern with resistance at $35.7 and support at $33. RSI is 71, which is considered oversold with a sell signal.

Ascending channel patterns are short-term bullish, but these patterns often form within longer-term downtrends as continuation patterns. Thus, be careful here.

The general strategy I usually promote is to keep a core long-term position and use about 40% to trade LIFO while waiting patiently for a higher final price target to sell your core position above $36-$37.

Thus, I recommend selling partially between $35.5 and $36 with a possible higher resistance at $37. Conversely, buying back BKR on any weakness between $33.3 and $32.5 is reasonable, with possible lower support at $30.4.

Warning: The TA chart must be updated frequently to be relevant. It’s what I’m doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Read the full article here