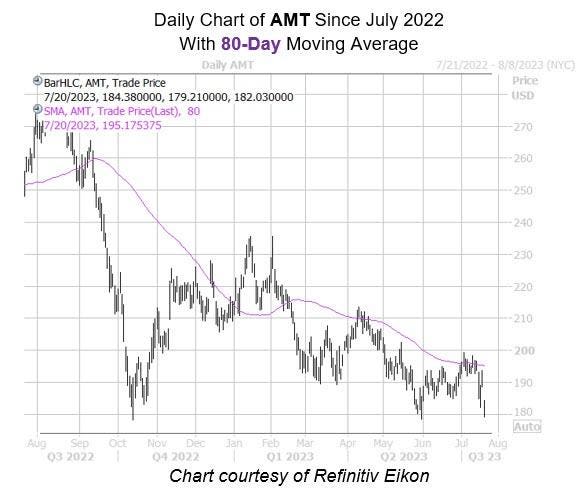

Shares of American Tower (AMT) are moving lower this afternoon, down 3.5% at $182.52 at last check. The real estate investment trust (REIT) has struggled long term, shedding 27% over the past 12 months. Overhead resistance is looming as well, from a trendline with historically bearish implications.

Per Schaeffer’s Senior Quantitative Analyst Rocky White, American Tower stock is now within one standard deviation of its 80-day moving average. In the past three years, the shares have seen seven similar signals, and were positive one month later just 14% of the time, averaging an 2.3% loss. A move of comparable magnitude would put AMT back below $179, or within a chip-shot of the stock’s October lows.

Optimism looks ready to be unwound in the options pits. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), American Tower stock’s 50-day call/put volume ratio of 2.36 ranks in the highest percentile of its annual range. Echoing this, the equity’s Schaeffer’s put/call open interest ratio (SOIR) of 0.71 sits higher than only 34% of annual readings.

Now looks like an affordable time to weigh in with options, too. The stock’s Schaeffer’s Volatility Index (SVI) of 29% stands in the 29th percentile of readings from the past 12 months. In simpler terms, options traders are pricing in relatively low volatility expectations — a boon for buyers.

Analysts could also chime in with downgrades. Heading into today, 14 of the 16 covering brokerage firms sport a “buy” and “strong buy” rating.

Read the full article here