Shares of Charles Schwab (NYSE:SCHW) soared more than 12% on Tuesday after the financial brokerage company released its earnings report for the second quarter. Charles Schwab beat top line and bottom line expectations for the second quarter and delivered strong profitability as well, with close to $1.5B in earnings and a net profit margin exceeding 30%. Charles Schwab’s strong Q2’23 earnings release comes just a few weeks after it passed the Fed’s stress test with flying colors.

Since I previously said that I see Charles Schwab’s fair value at about $75 and shares are now trading much higher than before earnings, at $66, I’m getting ready to sell my shares in the financial brokerage and downgrade SCHW from strong buy to hold. I plan to close my position in the company at around $75 and would then rate the financial services company as a sell!

Strong earnings release for Q2

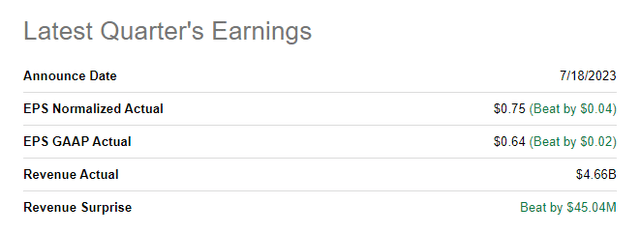

Charles Schwab reported second quarter revenues of $4.66B yesterday, beating the average prediction by $45M. On an adjusted basis, the financial services company generated $0.75 per share in earnings compared against an estimate of $0.71 per share.

Source: Seeking Alpha

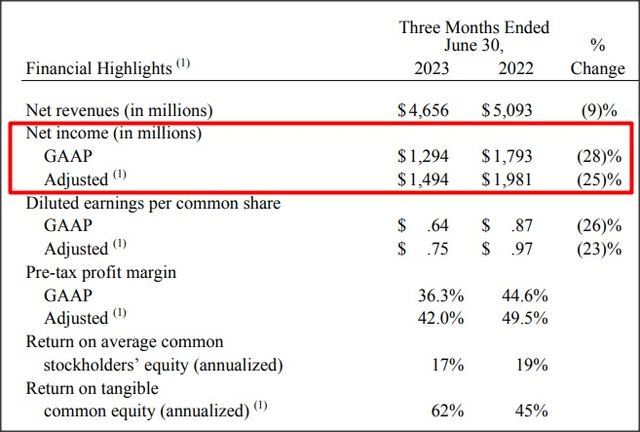

Charles Schwab executed well in the second quarter and, despite a double-digit year-over-year decrease in net income, the financial brokerage had a strong quarter regarding profitability.

Charles Schwab generated $1.49B in adjusted earnings for the second quarter, showing a decline of 25% year over year. However, the company remained a deeply profitable financial services franchise in the second quarter with a net profit margin of 32%, indicating that the market was indeed wrong in Q1’23 when investors sold in a panic after Silicon Valley Bank failed.

The firm’s strong underlying profitability as well as Charles Schwab’s ability to attract new assets even in difficult markets were two reasons why I previously recommended the brokerage to investors as a strong buy.

Source: Charles Schwab

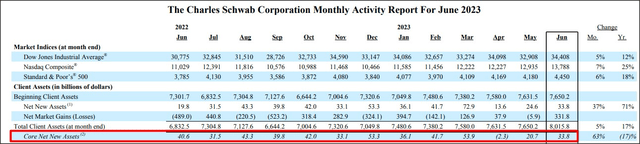

Core net new assets kept flowing to Charles Schwab in Q2’23

Charles Schwab ended the second quarter with $8.0T in total client assets and the firm attracted $52.2B in core net new assets during Q2’23, a time when many other financial services companies and depositary institutions were worried about significant deposit outflows. In June alone, $33.8B in core net new assets made their way to Charles Schwab, showing a month-over-month increase of 63%.

Charles Schwab has been able to attract new core assets to its financial services platform even during times of heightened uncertainty and crisis which underlines the firm’s value for both depositors and investors. Year-to-date, the brokerage has seen $183.9B in core net new asset inflows.

Source: Charles Schwab

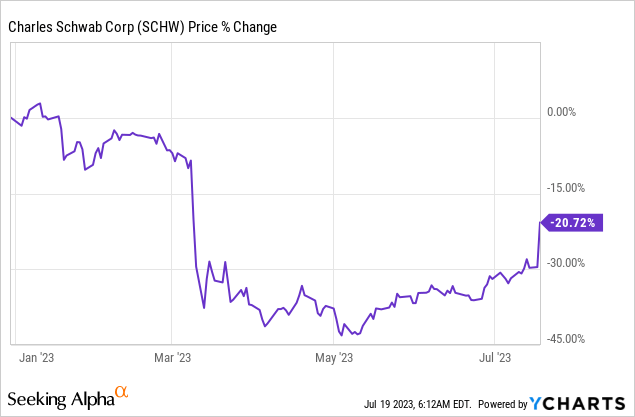

Updating recommendation, Charles Schwab recovers valuation losses

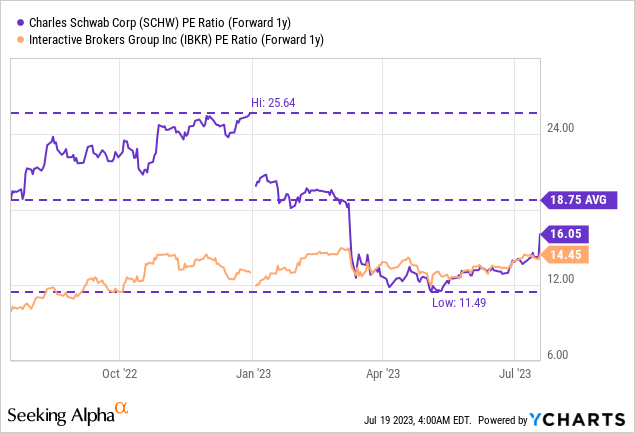

Another reason for me why I recommended and bought Charles Schwab previously — besides consistent client asset growth and deep profitability — was that the brokerage was very attractively valued with a P/E ratio in the low teens after the failure of Silicon Valley Bank. With shares of Charles Schwab now recovering most of their losses sustained during the March financial meltdown, I think shares of the financial brokerage company are no longer a bargain, however.

SCHW is currently trading at a P/E ratio (FY 2024) of 16.1X which is a big difference to the 11X P/E ratio that Charles Schwab traded at when an explosion of fear in March made the brokerage a very attractive recovery investment in my eyes. Charles Schwab is now trading at $66 after soaring 12% on Tuesday. This means shares are trading approximately 12% below my fair value estimate of $75 — the firm’s pre-crisis valuation level — and I am therefore changing my recommendation from strong buy to hold. Interactive Brokers (IBKR) is slightly cheaper than Charles Schwab, with a price-to-earnings ratio of 14.5X, but shares have already fully recovered from their sell-off in the first-quarter.

Risks with Charles Schwab

Like any financial services company, Charles Schwab faces a risk that higher interest rates push depositors and savers to move bank deposits over to money market funds that promise them a higher yield. What would change my mind about Charles Schwab is if the brokerage were to see a decline in its asset base or failed to attract net new core assets to its platform going forward.

Closing thoughts

I recommended Charles Schwab ahead of the Q2 earnings release because I expected strong underlying profitability for the second quarter and the company’s stress test results were very reassuring. Considering that shares of Charles Schwab have seen a significant upward revaluation in the stock after Q2 earnings, I am down-grading the brokerage to hold and plan to exit my position completely at about $75. I continue to believe that Charles Schwab is a solid financial services franchise with favorable fundamentals and profitability, but with shares now trading much closer to their pre-crisis valuation, I am getting ready to sell into strength!

Read the full article here