In my last article about the Bank of Nova Scotia (NYSE:BNS) I wrote that patience will be rewarded as I expected lower stock prices in the coming quarters. But now – about eight months later, the stock is trading almost for the same price as in November 2022 when my last article about the bank was published.

In the meantime, a lot has happened in the financial and banking world. Especially in March 2023 the collapse of two major U.S. banks and Credit Suisse being on the brink of collapse sent small shockwaves around the world. And as I predicted in my last article, earnings per share started to decline in the last three quarters and the Bank of Nova Scotia had to report declining earnings per share. Despite the turmoil, the market calmed down again, and this seems like a good time to look at the bank again and try to answer the question if a crisis had been prevented.

Second Quarter Results

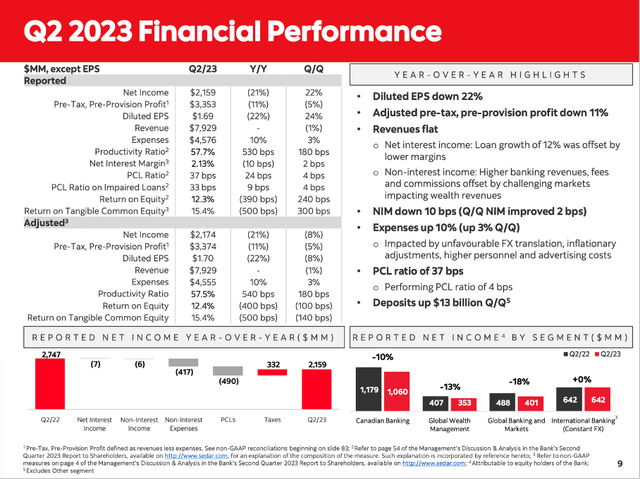

Bank of Nova Scotia reported second quarter results for fiscal 2023 in May and total revenue declined slightly from $7,942 million in Q2/22 to $7,929 million in Q2/23 – a decline of 0.2% YoY. Non-interest income declined 0.2% to $3,463 million while net interest income declined 0.2% to $4,466 million. Basic earnings per share declined from $2.16 in the same quarter last year to $1.70 this quarter – resulting in 21.3% YoY decline. The main reason is the increased provision for credit losses, which increased from $219 million in Q2/22 to $709 million in Q2/23.

Scotiabank Investor Presentation May 2023

Additionally, we are also looking at the four different segments in which the Bank of Nova Scotia is reporting:

- Canadian Banking could increase its revenue 8% year-over-year to $3,134 million while net income declined 10% to $1,060 million. This decline was primarily due to higher provision for credit losses and non-interest expenses.

- Global Wealth Management saw its revenue decline 4% year-over-year to $1,300 million and net income declined even 13% year-over-year to $353 million.

- Global Banking and Markets saw revenue increase 7% year-over-year to $1,352 million while net income declined 18% year-over-year to $401 million. This decline was primarily due to lower mutual fund fees and brokerage revenues.

- International Banking reported 8% YoY revenue growth to $2,752 million and net income stayed the same as in the same quarter last year ($642 million). This was also due to higher provision for credit losses.

Risks On The Horizon

When talking about Bank of Nova Scotia – similar to most other major Canadian banks – we can identify two major risks. The first risk we are often talking about is the housing market, which seems overheated in many countries – and Canada seems to be one of the countries where it is most extreme. The second risk is a risk banks face all the time: The risk of losing trust and depositors pulling funds.

Canadian Housing Market

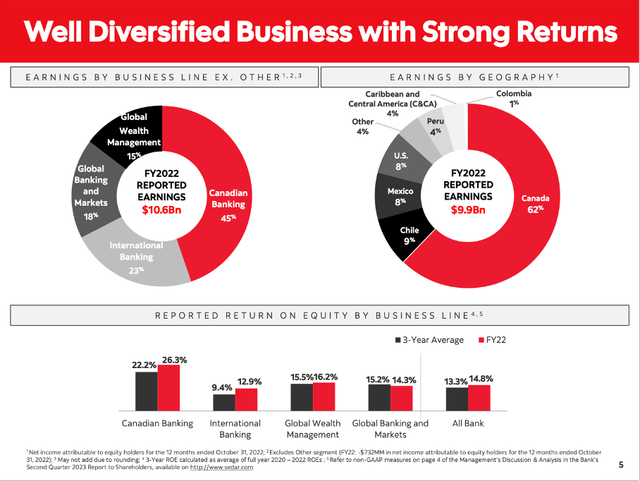

We start by looking at the Canadian housing market and in case of the Bank of Nova Scotia we can especially focus on Canada as the country is responsible for 62% of the company’s earnings (in fiscal 2022). Aside from Canada, the Pacific-Alliance Countries (including Mexico, Peru, Chile, and Colombia) are responsible for 22% of earnings (all four countries combined). The United States are responsible for only 8% of earnings and are therefore playing a subordinate role für earnings.

Scotiabank Investor Presentation May 2023

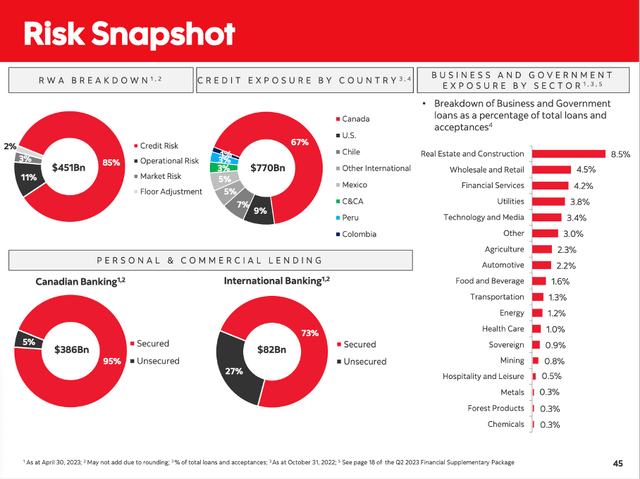

When looking at credit exposure the picture is similar. The Bank of Nova Scotia has 67% of its total credit exposure to Canada. And the biggest part of the bank’s loans are in residential mortgages with a volume of $353.6 billion (out of $1,373 billion in total assets). Additionally, 8.5% of business and government loans ($298.0 billion in total) are in real estate and construction resulting in $25.3 billion in additional exposure. And $300 billion in mortgages are in Canada. Therefore, the Bank of Nova Scotia has a huge exposure to Canada, to real estate and especially to the Canadian real estate market.

Scotiabank Investor Presentation May 2023

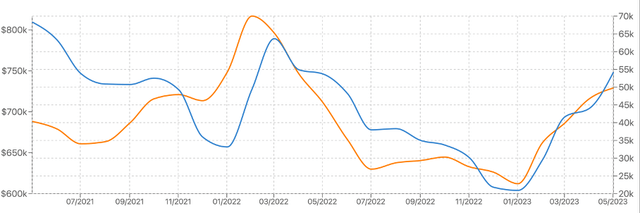

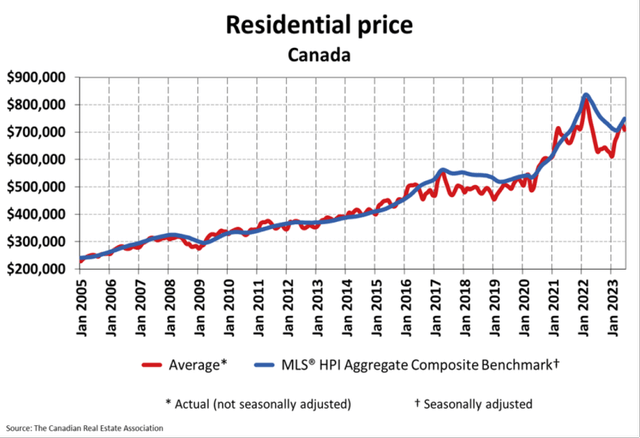

When looking at the Canadian housing market, we see a troubling year 2022 with declining prices and a declining number of transactions. But in 2023 the situation seems to be improving again. The number of transactions per months increased constantly – from only 21k in January 2023 to 54k in May 2023 – and the average selling price per house is also increasing again – from $612k in January 2023 to $729k in May 2023.

Canada Real Estate Market: Average Sold price (Yellow) and transactions (Blue) (WOWA)

And when looking at the last two decades, the correction we saw in 2022 was probably the biggest during the last 20 years. But it remains questionable if that correction was already enough to cool off the Canadian housing market and avoid potential worse outcomes.

The Canadian Real Estate Association

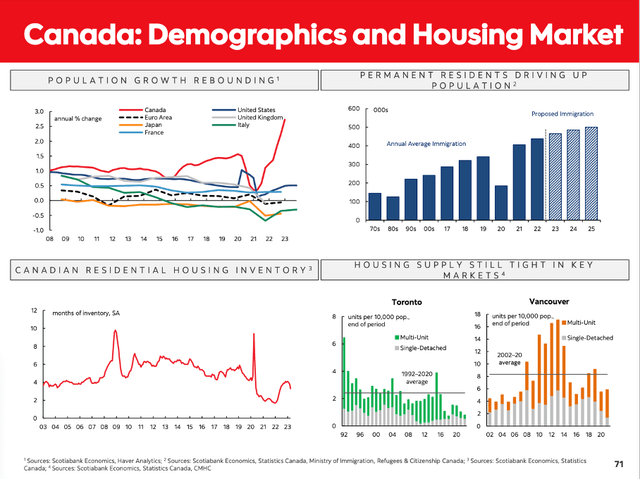

As I have mentioned in several articles already (see here for example), the Canadian housing market can be seen as a market with rather high regulations and safety nets put in place. Additionally, the Canadian population is growing, which is increasing the demand for real estate and is a long-term tailwind for the real estate market.

Scotiabank Investor Presentation May 2023

Nevertheless, I would remain cautious about the Canadian housing market as prices are high and are therefore posing the risk for a severe correction which could have huge negative impacts on different banks – including the Bank of Nova Scotia.

Eroding Trust and Liquidity Issues

Real estate exposure and a declining or collapsing housing market as major risk for banks seems to be on everybody’s mind since the Great Financial Crisis. And while this is a potential risk, this is of course not a common scenario but rather a “once in a lifetime” problem. Another risk that seems to be very present right now is the scenario that brought Silicon Valley Bank to its knees: People losing confidence and pulling funds combined with a bank having to sell assets for a loss.

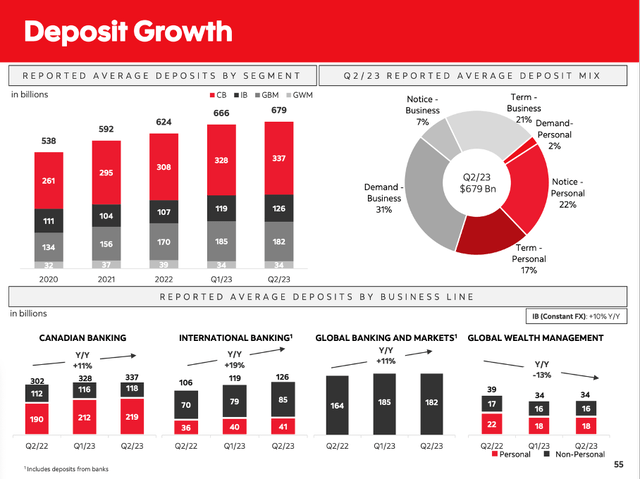

Of course, we have no hint that depositors are losing trust in the Bank of Nova Scotia. In fact, deposits are still growing while amounts for many U.S. banks are already shrinking. In total, reported average deposits were $679 billion in Q2/23 – an increase of $13 billion compared to the previous quarter.

Scotiabank Investor Presentation May 2023

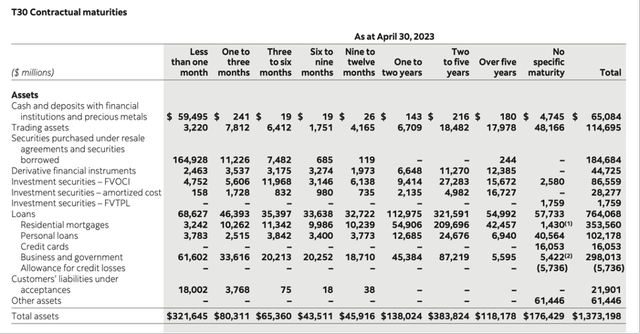

We might point out that the Bank of Nova Scotia is almost 200 years old and customers might have a huge level of confidence in these banks as they have proven their stability again and again. However – as I have already explained in the past – trust can erode rather quickly. Rumors can start to spread and fueled by social media a panic can arise rather quickly and lead to a potential bank run. In such a scenario, the Bank of Nova Scotia has at least $65 billion in cash and deposits with financial institutions (extremely liquid assets) to meet these demands.

Scotiabank Q2/23 Quarterly Report to Shareholders

But similar to The Toronto-Dominion Bank (TD) – I already talked about this in my last article – the biggest part of assets (most loans) has between two and five years till maturity ($384 billion in assets) and about $118 billion in assets have a maturity of five years and more. These assets most likely declined in value in the last few quarters due to the rising interest rates. And if the Bank of Nova Scotia would be forced to sell these assets (if depositors are pulling funds), it could be catastrophic for the bank.

Other Risks

In hindsight many risks that brought banks to their knees seem obvious. In hindsight it also seems obvious what led to the Great Financial Crisis in 2007 and what mistakes the banks – especially in the United States – made. And when looking back, it seems obvious what mistakes Silicon Valley Bank made.

However, for investors it is more important to see risks not only in hindsight but anticipate what might happen. This is much more difficult, but we can often identify risks accurately beforehand. The problem is – we often don’t draw the right conclusions. The risks that led to the Great Financial Crisis were obvious beforehand but only a few investors were drawing the right conclusions.

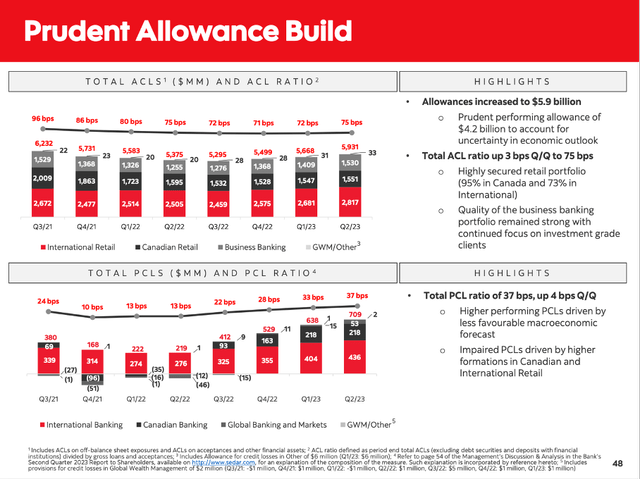

It is therefore important to be rather cautious and not become reckless – especially for banks. One important step are provision for credit losses. In Q2/23, the Bank of Nova Scotia reported $709 million in provision for credit losses and the total allowance for credit losses was $5,931 million at the end of Q2/23.

Scotiabank Investor Presentation May 2023

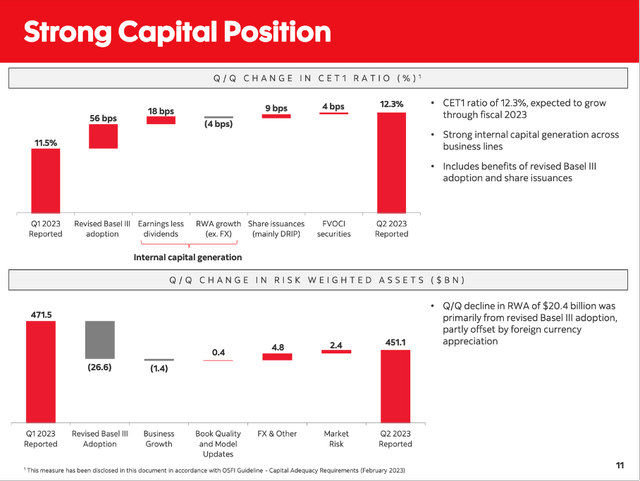

Additionally, the Bank of Nova Scotia could also improve its Common Equity Tier 1 (CET1) capital ratio from 11.5% at the end of Q1/23 to 12.3% at the end of Q2/23.

Scotiabank Investor Presentation May 2023

And these financial ratios all look solid – the problem is that banks often look solid on the surface right up until disaster.

Low Valuation, Looming Risks

In this last section we are not just focusing on the Bank of Nova Scotia but talk a little about banks in general. I will rather focus on data from the United States, but we should make no mistake – if banks in the United States crumble it will have a huge negative impact on the whole world and Canada probably won’t be spared.

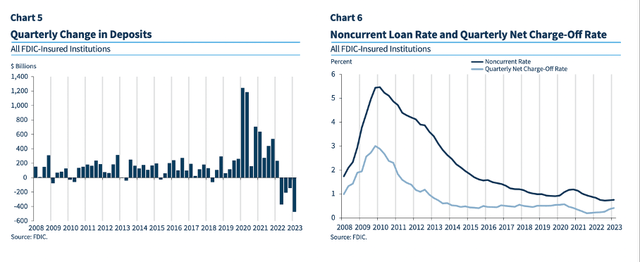

And maybe I am too pessimistic, but in my opinion investors and analysts are making a huge mistake as they already seem to have forgotten the three major FDIC-insured bank failures we saw in March and May 2023. These were the first warning signs of what might be coming. Of course, this is only my opinion and speculation to some point, but different metrics are sending warning signs. For starters, the net operating income of banks is still increasing constantly – as it has been since 2008 (with a few exceptions). But we can’t ignore the signs we are already seeing on the horizon – while deposits are decreasing a few quarters in a row, quarterly net charge-offs are increasing.

FDIC Quarterly 1st Quarter 2023

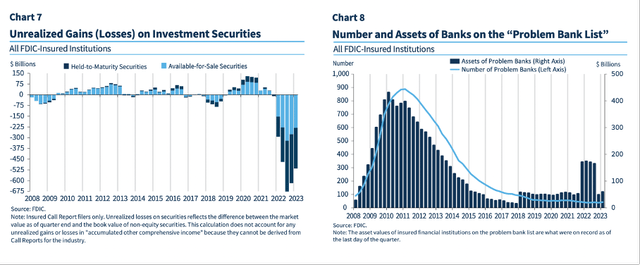

And even more important – and much more frightening – are the huge amounts of unrealized losses on investment securities the banks have on their balance sheets via held-to-maturity securities and available-for-sales securities.

FDIC Quarterly 1st Quarter 2023

This is implying that risks in the banking system are rather high right now and we should move with extreme caution.

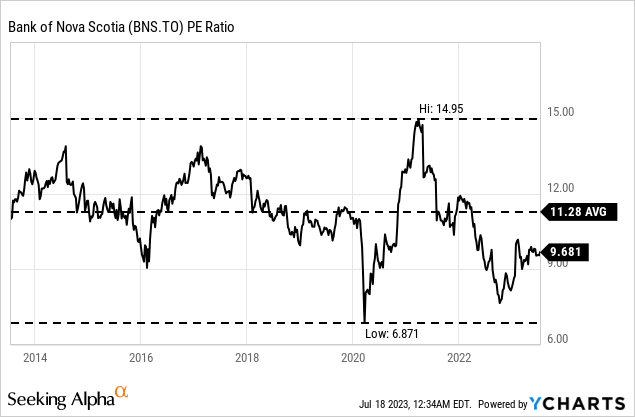

On the other hand, almost every major bank in the United States, in Canada or in Europe is trading for a single digit P/E ratio or a low double-digit P/E ratio and seems like an extreme bargain. The Bank of Nova Scotia is trading for 9.7 times earnings right now – nevertheless I would still be cautious as I have a feeling that we are at the eve of a “potential” storm in the financial world.

Conclusion

The situation is unchanged for several quarters in a row. Banks in the United States and Canada seem extremely cheap, and a dividend yield above 6% is clearly tempting. But declining deposits in the United States, slightly increasing charge-offs, extreme amounts of unrealized gains or the first banks already collapsing in March 2023 are strong warning signs to better stay away from banks – even if the stocks appear cheap.

Bank of Nova Scotia is one of the better picks and will stay on my watchlist, but I would like to repeat the statement I made last time: Patience might be rewarded and in my opinion, it is still time to wait.

Read the full article here