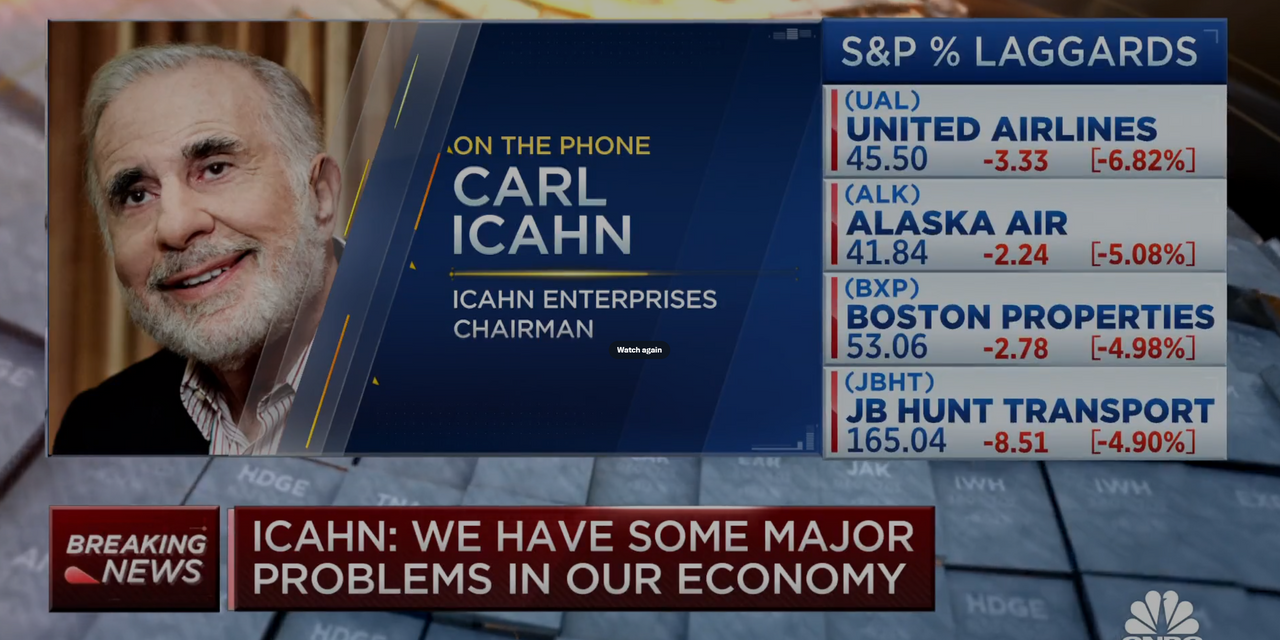

Icahn Enterprises LP shares fell another 20% on Wednesday, extending their prior-day losses in the continued fallout from a short seller’s report that was critical of the investment arm of activist investor Carl Icahn.

The stock IEP closed down 20% on Tuesday to notch its biggest one-day decline on record after short seller Hindenburg Research accused the company of inflating its value. The market-cap loss was about $4 billion. If today’s slide holds, it will cost another $2.6 billion in market cap.

…

Read the full article here