By Maya Beyhan

The S&P 500® ESG Leaders Index is constructed using securities from the S&P 500 ESG Index that meet stricter sustainability criteria, while maintaining similar overall industry group weights as the S&P 500.1 The S&P 500 ESG Leaders Index takes its underlying index up a notch by applying additional exclusionary screenings based on business activities such as shale energy, nuclear power, alcoholic beverages and gambling.

Previously, we performed a real-world performance test for the S&P 500 ESG Index’s improved sustainability profile, after nearly four years since the index’s launch. From its launch date until the end of June 2023, the S&P 500 ESG Index outperformed its benchmark, the S&P 500, by a cumulative 13.3% (impressive in the context of a benchmark that is notoriously hard to beat). We found out that underweighting the lowest ESG-scoring constituents contributed the most to the S&P 500 ESG Index’s outperformance.

Now, taking a closer look at the S&P 500 ESG Leaders Index with its live performance data approaching 18 months since its launch, it also outperformed the S&P 500, by a cumulative 2.7%. But given the S&P 500 ESG Leaders Index is designed to meet stricter sustainability criteria than the underlying S&P 500 ESG Index, how important were higher or lower ESG-scoring constituents in generating this excess return? Were there similar patterns as the S&P 500 ESG Index’s outperformance?

To measure this, we adopted a similar approach as we did for the S&P 500 ESG Index and created hypothetical ESG “quintile portfolios,” reconstituted annually by ranking the S&P 500’s constituents by their ESG score and assigning each to one of five portfolios, from highest to lowest ESG score. The hypothetical cap-weighted performance of these portfolios was then calculated and used to create a Brinson-like2 “ESG attribution,” teasing out the importance of ESG exposures in the returns of the S&P 500 ESG Leaders Index.

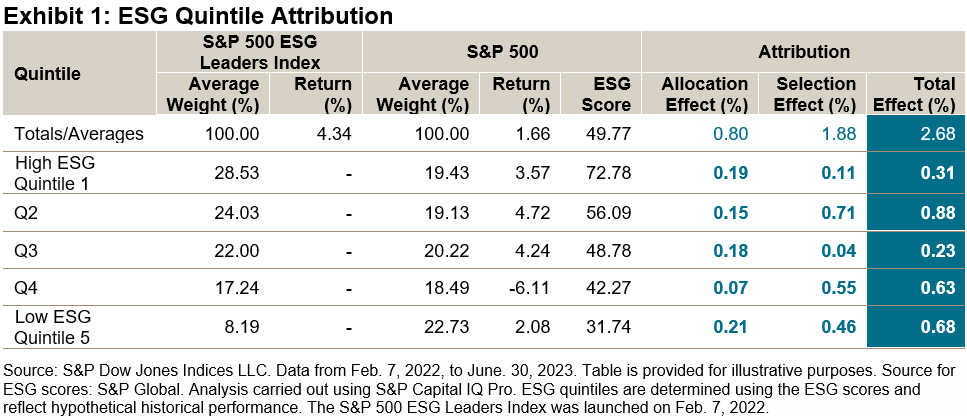

Exhibit 1 summarizes the results of this analysis, including the average weights of the S&P 500 ESG Leaders Index and the S&P 500 in each ESG quintile (from high to low scoring), the corresponding portfolio and index returns, as well as a summary of the corresponding allocation and selection effects over the full period.3

The allocation, selection and total effects from over- and underweighting across and within the ESG quintiles was positive in every quintile. Underweighting the lowest ESG-scoring constituents, on average, contributed 0.21% to the S&P 500 ESG Leaders Index’s outperformance. But the highest ESG-scoring constituents also contributed a significant proportion of the S&P 500 ESG Leaders Index’s relative performance. The High ESG Quintile 1 and Q2 outperformed the S&P 500 by 1.9% and 3.1%, respectively, and the S&P 500 ESG Leaders Index overweighted these quintiles by an average of 9.1% and 4.9%, respectively, leading to a total contribution of 0.34% from allocation effects to these top quintiles.

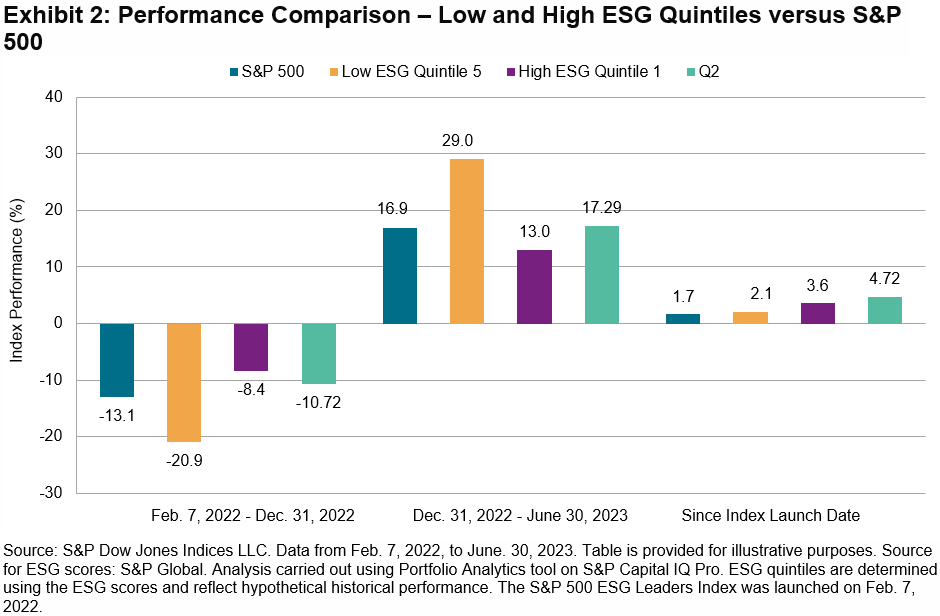

Drilling down, Exhibit 2 compares the performance of the lowest and highest ESG quintiles to the S&P 500 since the launch of the S&P 500 ESG Leaders Index and two further sub-periods. The second-highest ESG-scoring quintile (Q2) outperformed consistently in 2022 and YTD in 2023. The Low ESG Quintile (Q5) underperformed by 7.8% in 2022 but outperformed by 8.1% YTD. Underweighting this quintile contributed positively to relative index performance in 2022.

Exhibits 1 and 2 together show that, in short: the S&P 500 ESG Leaders Index methodology of seeking the best-scoring constituents, as well as avoiding the worst-scoring constituents, worked in its favor overall.

Market participants sometimes consider ESG as being about avoiding the “worst.” The S&P 500 ESG Leaders Index’s outperformance since launch suggests that there may be value in following the leaders, too.

Performance drivers surely do change over time. Investors can utilize ESG-based attribution analysis such as these to gain insight and perspective as markets and conditions evolve. Similar attributions for our range of flagship indices are now available—updated as of the most recent quarter-end—in S&P DJI’s Sustainability Index Dashboard.

1 How & Why the S&P 500 ESG Leaders Index Work

2 Similar to our previous analysis with Carbon Quintiles, the quintile portfolios are each assigned an equal number of benchmark constituents, and the impact of weighting to stocks with higher or lower ESG scores is measured analogously to the way sector or country effects are measured by a traditional Brinson attribution.

3 Analysis carried out using the Portfolio Analytics tool on S&P Capital IQ Pro.

Disclosure: Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI, please visit S&P Dow Jones Indices. For full terms of use and disclosures, please visit Terms of Use.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here