Dear readers/followers,

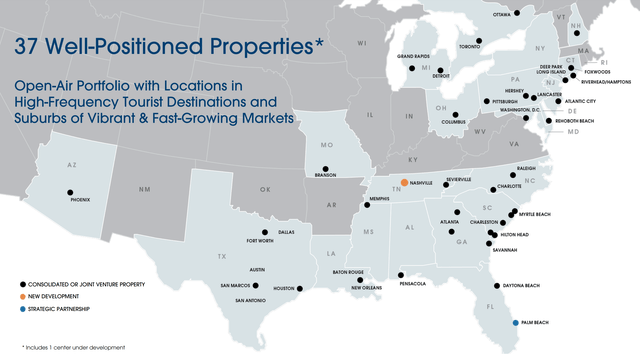

Tanger Factory Outlet (NYSE:SKT) is the largest outlet mall owner in the US with 37 outlet centers located across the Sunbelt and the Northeast. The vast majority of space (90%) is located near leading tourist destinations or top 50 MSAs and is leased to name-brand fashion retailers such as The Gap (GPS), Under Armour (UA) and Nike (NKE).

Tanger Presentation

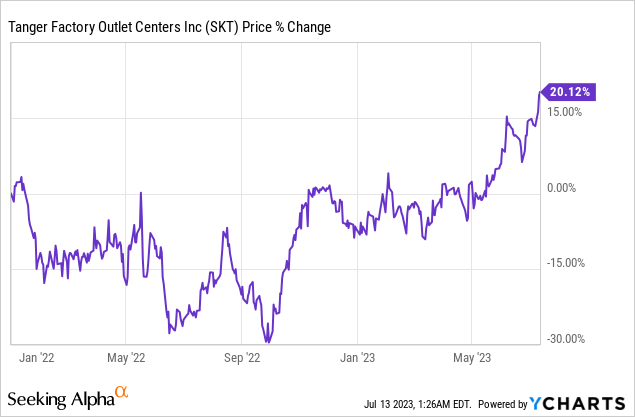

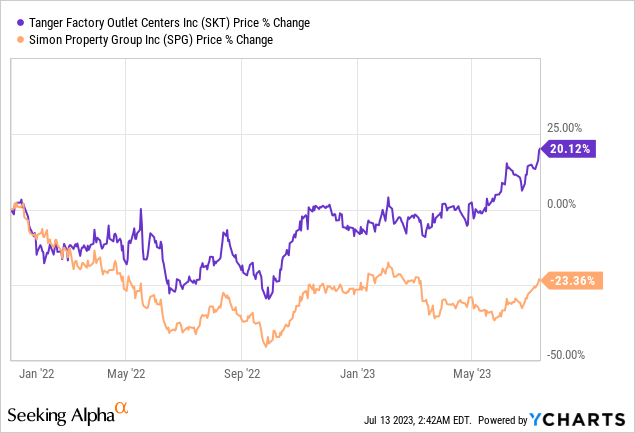

Tanger is one of only a handful of REITs whose stock price is up since the beginning of 2022, returning 20% since then. I find this very interesting and frankly somewhat puzzling, because despite good operational results, there are definitely risks to consider.

In this article, there are really three things I want to focus on to determine if the outperformance of Tanger relative to peers and the sector is justified.

- the outlook for the outlet sector

- the company’s operational performance

- valuation, especially a comparison to a company like Simon Property Group (SPG), which I consider to be better positioned than Tanger

1 – Outlet centers are at risk of a secular decline

This is true especially when compared to class A malls, such as the ones operated by SPG. As with most things in real estate, it all comes down to location. While prime shopping malls tend to be located in the city center, outlet malls are almost always located at least 30 minutes outside of the city.

This makes it much more of a destination, specifically one where people go just to shop. This makes the business model quite obsolete, especially in light of the ever growing e-commerce which is expected to reach 30% of all sales by 2023 (13% CAGR).

Outlet malls are at much higher risk of being replaced, than traditional shopping malls where people go not only to shop, but also to have fun. As the experiential factor becomes more popular among the young demographic, shopping malls are better positioned to include these because their layouts are much more flexible.

Outlet malls, on the other hand, can only compete on price, which is a difficult battle to win as indicated by declining sales of Tanger’s tenants (most recently sales per sft declined by 3.7% YoY to $447).

Previously people had to drive to outlet malls to get good deal, now they can simply buy anything they want at a good price at a click of a button. That’s ultimately why I think outlets centers may lose their appeal over time.

2 – Operational performance has been good

Looking at Tanger’s recent operational performance, one starts to understand why the stock price has done so well. In Q1 2023, occupancy has reached pre-pandemic levels, climbing 2.2 percentage points YoY to 96.5%.

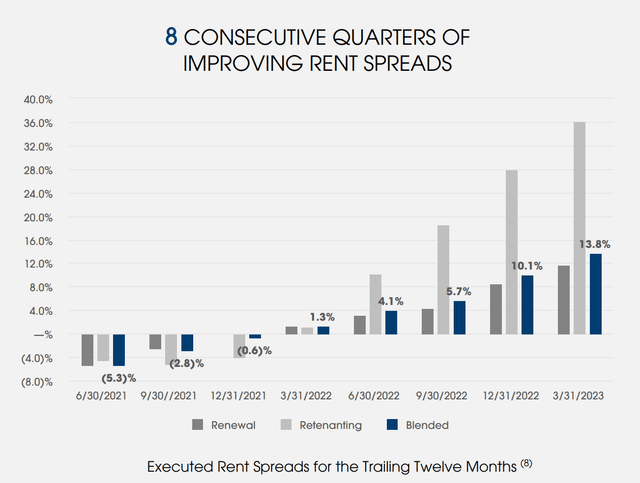

More importantly, rent spreads have reached double digits for two consecutive quarters. As, over the last 12 months, the company has executed 414 leases for a total of 1.7 Million sft of space at 13.8% higher rents.

This is very reassuring, as rent spreads are a very good indication of how much tenants value their space. The fact that Tanger has been able to increase rents so much, despite retailer sales slowing, speaks volumes.

Tanger Presentation

Following such high rent increases, and a 7.4% YoY increase in portfolio NOI, management has (quite surprisingly) guided towards 2023 FFO of just $1.82-1.90 per share, up only about 2% YoY at midpoint. Based on the assumption of just 2.75%-4.75% in same-store NOI growth, this suggests that management expect growth to slow.

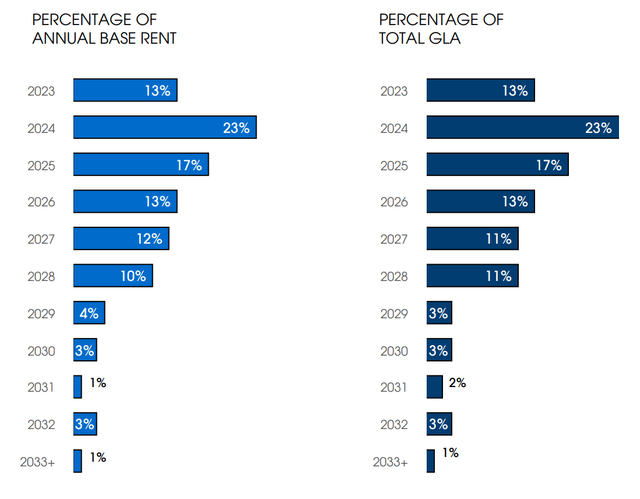

And I likely know why. Tanger has a very large percentage of leases that will expire over the next two to three year. In fact over 50% will have expired by the end of 2025.

Such high expirations can represent an opportunity to raise rents on a large portion of the portfolio, but can also pose a threat to occupancy.

With the Fed still trying to weaken the economy and the consumer, and retailer sales already slowing over the past 12 months, I’m not convinced that tenants will be eager to renew their rents at much higher rates and view high expirations as more of a risk and opportunity. And management’s guidance which is very conservative in light of recent rent spreads confirms this view.

Tanger Presentation

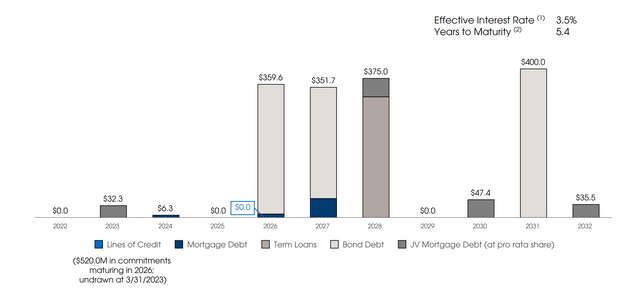

The company maintains a BBB- rated balance sheet with net debt / EBITDA of 5.4x. Interest rate risk is low, with 93% of debt fixed and minimal debt maturities before 2026.

Tanger Presentation

3 – Valuation is expensive, especially compared to SPG

SKT currently trades at $23 per share which corresponds to a forward P/FFO of 12.4x and yields 4.25%. It hasn’t traded this high since 2017 (with a small exception of several months during the height of the 2021 bull market).

For comparison, SPG has:

- better and more e-commerce resistant assets

- similar FFO per share growth forecast

- much lower near-term lease expirations (12% vs 23% next year)

- lower leverage

- much better A- credit rating

- a higher 6% dividend yield

Yet, it trades at just 10.3x forward FFO and has significantly underperformed Tanger.

With high economic uncertainty, now is not the time to bet on Tanger being able to renegotiate nearly a quarter (23%) of their leases next year at significant rent spreads, especially as retailer sales have been slowly declining due to e-commerce.

While recent operational performance has been great, I see SKT as too risky at current elevated levels and therefore rate the company a SELL here at $23 per share.

Frankly I see no justification for the divergence relative to SPG. So much so that I would even suggest a pairs trade of going short SKT and long SPG to exploit the mispricing while at the same time hedging retail-specific downside. The risk to this strategy is of course that Tanger will be able to roll-over the quarter of their leases that expire next year, which the market would most likely reward by further outperformance relative to SPG.

Short trade considerations

Of course, when shorting one should always consider the borrow fee, which currently stands at an APR of 0.26%.

With regards to managing the pairs trade, the thesis would be invalidated if Tanger manages to roll over their leases at significant double digit spreads. In that case, I would probably close the short at a loss.

If the trade goes my way, it’s best to take profits on the way. The final take profit should occur when the spread between SPG and SKT gets small enough.

Read the full article here