Investment Thesis: I expect Lindt & Sprüngli (OTCPK:LDSVF) to continue to see upside from here, on the basis of continued growth in free cash flow and organic sales.

In a previous article back in December, I made the argument that Lindt & Sprüngli had seen encouraging sales growth to date, but cost inflation and a rise in cocoa prices may make investors apprehensive of the stock.

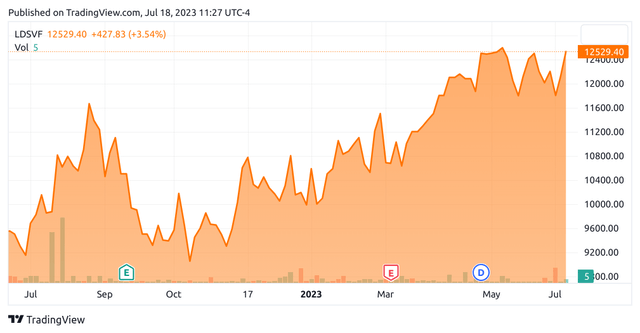

Since then, the stock has ascended to a level of 12529.40 at the time of writing:

TradingView

The purpose of this article is to elaborate on why I currently take a bullish view on Lindt & Sprüngli, and what I will be keeping my eye on when half-year results are released later this month.

Performance

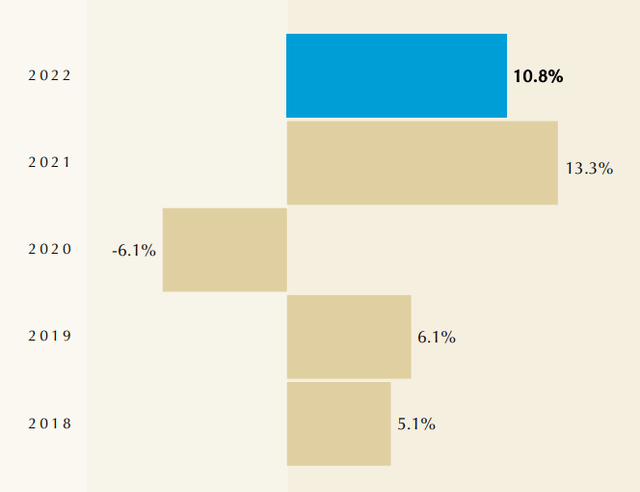

When looking at organic sales growth for Lindt & Sprüngli on a longer-term basis, we can see that organic sales growth (%) has been particularly high for 2021 and 2022.

Lindt & Sprüngli: Financial Year 2022 Results

While some of this growth can be attributed to a bounce back from the decline that we saw during 2020 as a result of COVID-19, as well as the result of price increases due to inflation – the fact that organic growth has remained substantially above that of previous years has been encouraging and indicates that while volume growth may have been more modest – demand has not fallen excessively as a result of price increases and overall growth is still on an upward trajectory.

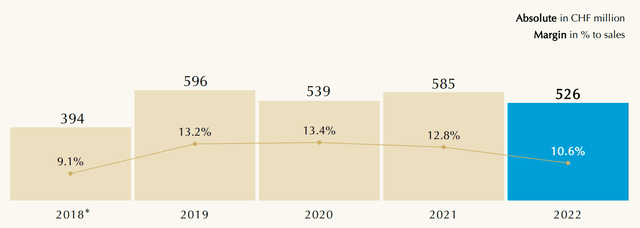

Additionally, we can see that in spite of higher inventories – free cash flow has continued to show growth over the past five years:

Lindt & Sprüngli: Financial Year 2022 Results

Taking sales growth and free cash flow into consideration – I take the view that Lindt & Sprüngli has continued to perform well despite inflationary pressures.

Upcoming Half-Year Earnings: What I Will Be Paying Attention To

When considering upcoming half-year results, there are a number of factors that I will be looking for to determine the extent to which the stock can continue rising from here.

Firstly, I will be paying particular attention as to whether volume will account for a greater portion of organic growth going forward. As we have seen for the full-year 2022 – only 2.6% of growth came from volume while 8.2% came from price/mix.

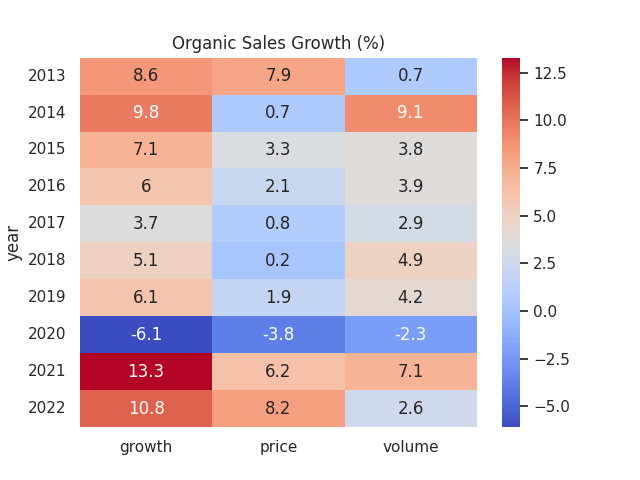

To put these figures into a wider context, here are the contributions of both volume and price/mix to organic growth in previous years:

Figures sourced from historical Lindt & Sprüngli full-year results presentations. Heatmap generated by author using Python’s seaborn library.

We can see that at 8.2%, price growth is higher than that of the previous nine years – while volume growth of 2.6% is among the lowest in the last ten years, with only 2013 and 2020 being lower.

Excluding 2020 due to COVID, volume saw average growth of 4.35% over the period.

Taking the above into consideration, I take the view that the company should show at least a 4% growth in volume in upcoming half-year results to ensure further organic growth going forward. The main risk for Lindt & Sprüngli at this point is that price growth starts to plateau, but volume does not rise in response – leading to lower organic growth overall.

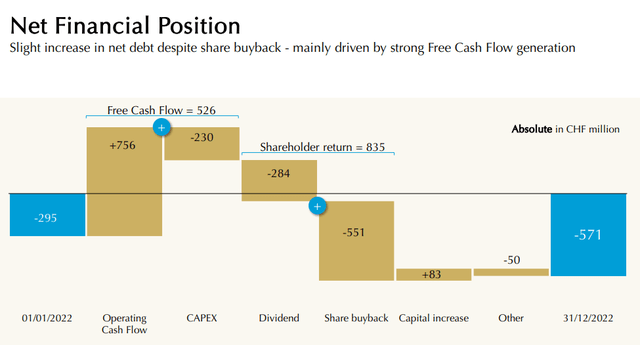

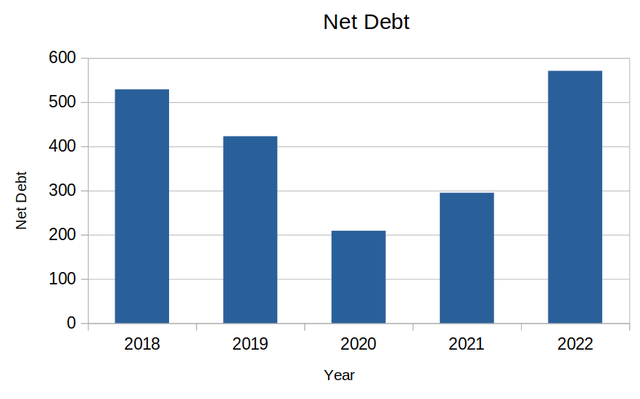

Moreover, I will also be looking for evidence that net debt for Lindt & Sprüngli will start to decrease in upcoming half-year results.

We previously saw that net debt for 2022 had increased to CHF 571 million – driven in large part by the debt incurred as a result of share buybacks:

Lindt & Sprüngli: Financial Year 2022 Results

We can see that net debt now stands at a five-year high – with the same being significantly below current levels in the previous three years.

Figures sourced from historical Lindt & Sprüngli Financial Results. Graph generated by author.

According to the company, the share buyback started in August 2022 and is set to last until July 2024 at the latest. In this regard, while there is a possibility that net debt could stand to rise further in the upcoming half-year results – I will be looking to see if Lindt & Sprüngli has the capacity to significantly bolster free cash flow further so as to offset a potentially higher debt load incurred from further share buybacks. Given the strong free cash flow generation that we have seen to date – I take the view that the company has the capacity to see further cash growth – particularly given strong organic sales growth to date.

Conclusion

To summarise, I take the view that Lindt & Sprüngli has shown resilient growth overall given macroeconomic pressures with respect to inflation.

With that being said, I will be looking for evidence in upcoming half-year results that the company can:

- Bolster the contribution of volume to organic sales growth – I take the view that 4% growth is a reasonable target

- Further increase free cash flow to offset rising net debt from share buybacks

Should the company show evidence of growth in sales volume and free cash flow, then I take the view that Lindt & Sprüngli can sustain its upward growth trajectory from here. Given resilient performance to date, I am optimistic that Lindt & Sprüngli has the capacity to achieve these goals given performance to date and revise my view on the company to bullish for this reason.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here