One of the most attractive investment opportunities can often come as a result of the market failing to recognize an opportunity due to a persistent narrative being told again and again by analysts, various market commentators etc.

That is why, for investors who are willing to disregard the predominant narrative and look at a company with a fresh pair of eyes, the upside could be significant.

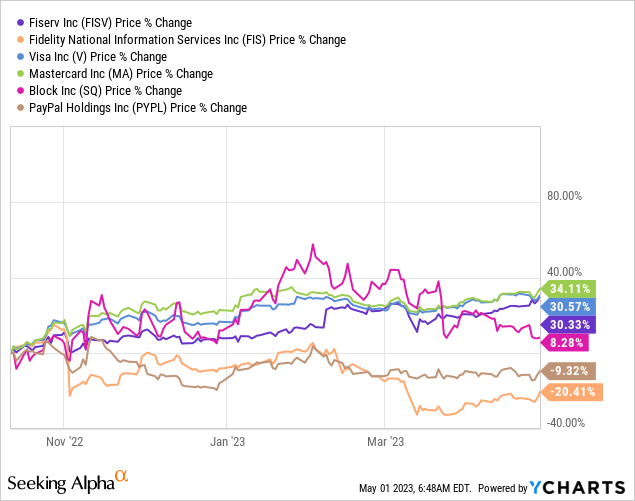

A very good example of such an opportunity is Fiserv (NASDAQ:FISV), which is hardly considered as one of the best businesses within the electronic payments space. And yet, for the past seven months FISV has delivered returns that are nearly at par with those of the most well-known names in the space – Visa (V) and Mastercard (MA).

Moreover, since October 12 of last year (the starting date of the graph above), FISV has returned more than 30% while some of its direct peers, such as Block (SQ) and Fidelity National Information Services (FIS), delivered +8% and a –20% returns respectively.

The reason why I am using October 12 as a starting date is that this is the first time that I outlined my full bullish thesis on the company and classified it as a high conviction idea.

Seeking Alpha

But what makes FISV so attractive? And is it too late to capitalize on this underappreciated business model? I will aim to answer these questions in the following lines.

Focusing On Profitability

Companies that are still largely associated with their legacy and old-fashioned businesses are often targets of excessive pessimism. People easily jump on conclusions that such businesses are heading for extinction and that their current business fundamentals cannot be relied upon.

However, when such companies are not only retaining their high profitability but are also consistently improving it, then you should properly re-evaluate the predominant narrative.

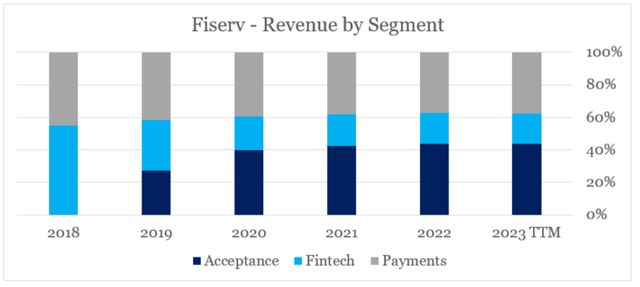

In the case of Fiserv, the company operates in three major segments – Acceptance, Fintech and Payments. With Payments being the so-called legacy business that is usually associated with sluggish growth (more on that later) and the other two – Fintech and Acceptance now making more than 60% of total revenues.

prepared by the author, using data from SEC Filings

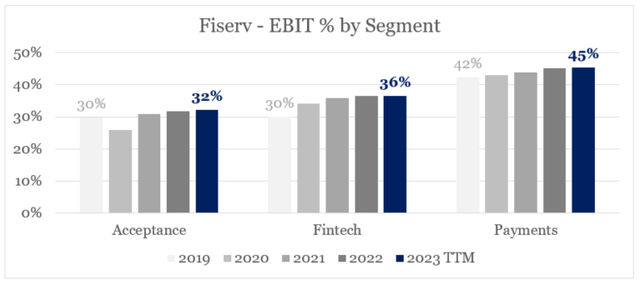

Although the Payments business unit is by far the most profitable one, since the merger between Fiserv and First Data Corporation in 2019 margins in all three segments have improved materially.

prepared by the author, using data from SEC Filings

In spite of the lower margins and reduced spending in the banking sector, profitability in the Fintech segment of Fiserv has also improved from 30% in 2019 to 36% for the past 12-month period.

On the other hand, the highly profitable Payments segment allows Fiserv’s management to reinvest profits in its main growth driver – the Merchants Acceptance business.

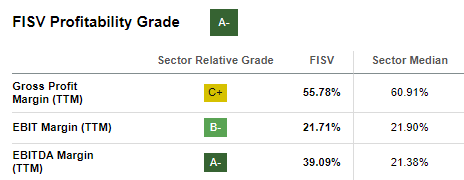

Given the lower margins of the high growth Acceptance segment, however, it is easy to get an illusion that FISV profitability is not going anywhere. That is why, at the moment Fiserv’s margins are largely in-line with the sector median.

Seeking Alpha

As a matter of fact, margins of both the Fintech and Acceptance segments would benefit significantly from larger scale.

The power of our business model is in the virtuous cycle of generating revenue growth across a scaled business, leading to greater operating margins. That profit produces significant cash to reinvest in the business for faster organic growth and value-accretive acquisitions while the remainder is returned to shareholders through share repurchase.

Source: Fiserv Q1 2023 Earnings Transcript

As Fiserv Merchant’s service offerings are already well-recognized in the United States, the company is making good progress across Latin America, Asia and Europe.

Deutsche Bank Website

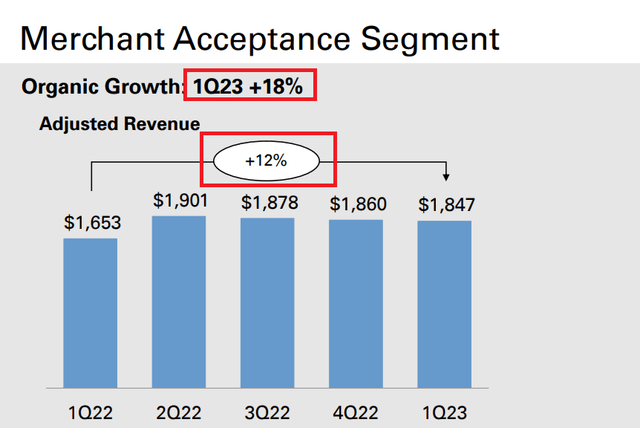

Merchant acceptance continues to be a very strong grower, posting 18% organic revenue growth in the first quarter, including significant strength in Latin America and Asia and continued gains in North America.

Source: Fiserv Q1 2023 Earnings Transcript

As a result, there is a significant long-term opportunity ahead for Fiserv to further improve its margins and thus drive an upward multiple repricing.

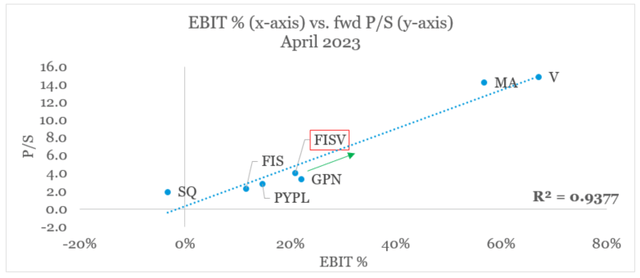

As we see in the graph below, on a cross-sectional basis operating margins could explain almost the whole variance in Price-to-Sales multiples which highlights the importance of profitability over high and unsustainable revenue growth.

prepared by the author, using data from Seeking Alpha

The Growth Driver

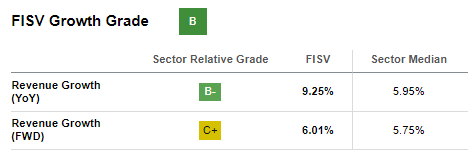

In addition to the opportunity for margin expansion, Fiserv revenue growth is also accelerating and to the surprise of many is now well-above the industry median.

Seeking Alpha

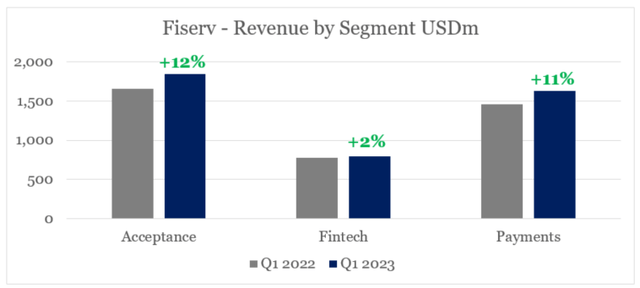

On a segmented basis, the supposedly low-growth legacy payments segment continues to grow at double digit rates and at similar levels to Fiserv’s main growth driver – the Acceptance business unit. In Fintech on the other hand, growth remains sluggish, but FISV’s management is laying the groundwork for its operating system for financial institutions and merchants that are looking to offer embedded finance solutions.

prepared by the author, using data from SEC Filings

The Revenue growth in Merchant Acceptance segment is likely to come under pressure should we enter into a deeper than currently expected recession, however, at the same time it also benefits heavily from the inflationary environment.

Fiserv Investor Presentation

The double digit growth rate, however, is hardly a product of the macroeconomic environment. The ecosystem that Fiserv is developing with its Clover and Carat offerings is one of the best globally.

Clover Website

For small- and medium-sized businesses, we developed a cloud-based SaaS operating system for their payment needs with Clover. Now we’re allowing these businesses to easily accept multiple payment types and we are seamlessly integrating software services to address their broader business needs.

Source: Fiserv Q1 2023 Earnings Transcript

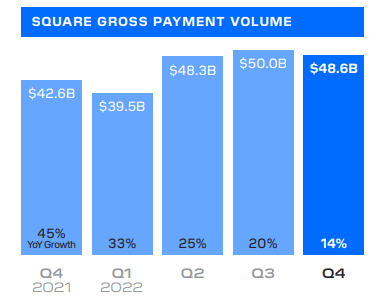

Even though it is usually Block’s Square offering that gets all the media attention, Clover is one step ahead in terms of gross payment volume (GPV). As we see down below, the former had a GPV of around $186bn over the past 12-month period.

Block Shareholder Letter 2022

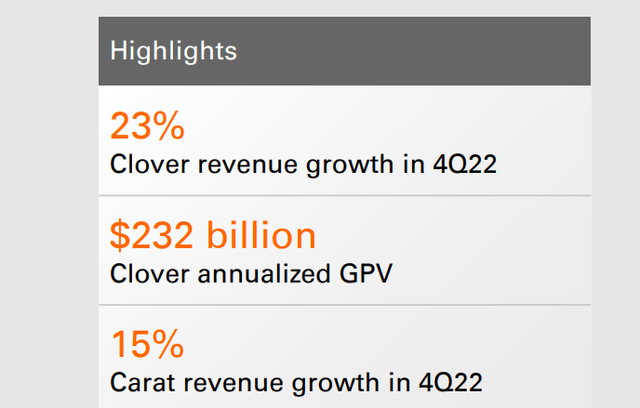

During the same period, Clover alone had a GPV of $232bn, while the omnichannel commerce operating system Carat that has debuted only recently is also growing at mid-teen levels.

Fiserv Q4 2022 Investor Presentation

Investor Takeaway

As we saw above, high quality business models could fly under the radar for most investors due to undeserved pessimism and too much attention being paid to the overall narrative. In my view, Fiserv is a good example of the market failing to recognize the company’s future potential which ultimately led to the returns we saw in the past few months. Looking ahead, I see further potential for FISV to continue to perform in-line with the likes of Visa and Mastercard.

Read the full article here