My Thesis

Magnit PJSC’s [the biggest Russian grocery retail company] share buyback of shares from Western investors has driven up its stock price on MOEX significantly. Although the firm’s buyback can’t significantly impact the fund, in my opinion, Magnit’s move may incentivize other Russian companies to follow suit, presenting a bullish opportunity for The Central and Eastern Europe Fund, Inc. (NYSE:CEE), which marked to 0 a bunch of Russian stocks in its portfolio. Given the lack of current discussion, I think the market is not yet fully priced in this opportunity. So the potential for share buybacks in Russian public companies could be an overlooked investment opportunity for CEE investors at the moment.

The CEE Fund

Based on the fact sheet, The Central and Eastern Europe Fund, Inc. aims to achieve long-term capital growth by primarily investing at least 80% of its net assets in equity and equity-linked securities of companies based in Central and Eastern Europe. This fund is non-diversified, meaning it can hold larger positions in fewer investments, thereby increasing its risk potential – as per the latest filing [Seeking Alpha data], CEE holds almost 65% of its assets in just 10 holdings:

Seeking Alpha data, author’s notes

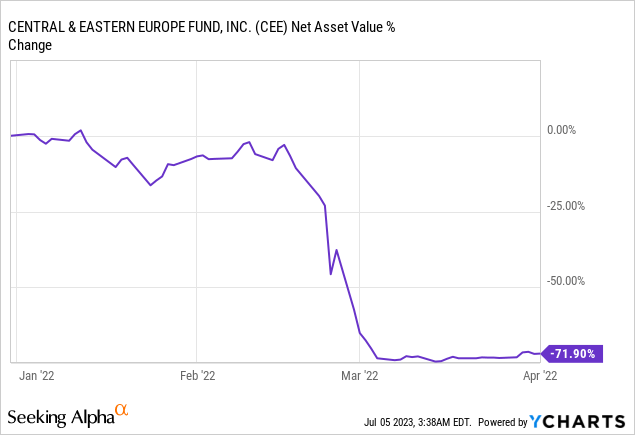

Emerging markets, such as those in Central and Eastern Europe, are often more volatile and less liquid compared to developed economies, with less diverse and mature economic structures and less stable political systems. Much to the regret of the fund’s investors, the political risks came true in 2022. CEE was considered one of the flagship U.S.-traded liquid closed-ended equity mutual funds with exposure to Russia, but the war in Eastern Europe forced it to zero out all of its Russian assets from 75% to just ~1%:

CEE fund’s website [author’s notes]

![CEE fund's website [author's notes]](https://ifintechworld.com/wp-content/uploads/2023/07/53838465-16885425357732558.png)

As a result of these events, CEE lost about 72% of its NAV for just a few weeks in early 2022:

The share price reacted in the same direction – for FY2022 CEE recorded a loss of -76.77%, according to the filings. Speculators unsuccessfully tried to buy the drawdowns in CEE stock, which kept the premium of the price to NAV at 10-20% (and even higher).

To be fair, however, it should be noted that CEE had relatively high premiums on its NAV even before the war in Ukraine, which I believe is primarily due to the liquidity and availability of those assets that the fund has held at various times in the past. Today, the premium on NAV of -0.9%, although it looks like a normal figure, is actually a very low one for CEE. This particular metric makes CEE fund more interesting today than, for example, in 2018-2021 (before the war):

CEFConnect.com [author’s notes]

![CEFConnect.com [author's notes]](https://ifintechworld.com/wp-content/uploads/2023/07/53838465-16896733700527892.png)

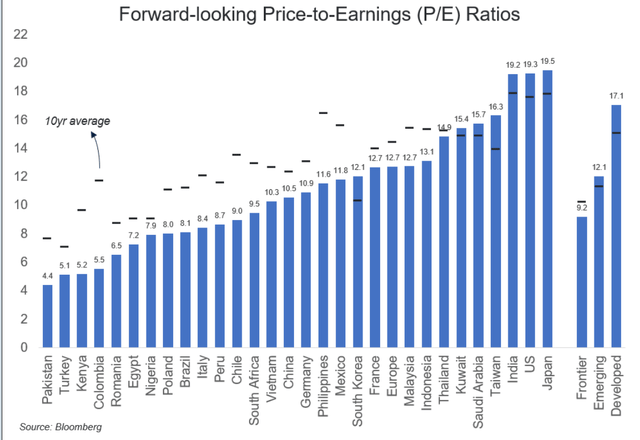

After the Russian assets of the fund were marked to zero, Poland took the first place with a share of 55.45% of total assets, overtaking Hungary [18.18%] 3 times:

CEE fund’s website

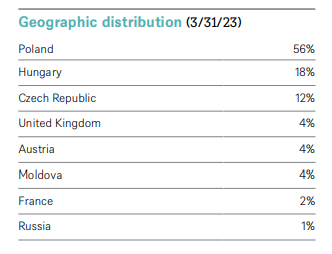

It’s very important to understand what the object of study looks like absent of a possible catalyst – it provides some level of confidence and margin of safety. In my opinion, CEE is well positioned for recovery even if the catalyst I’m going to describe below doesn’t play out. It’s all because the valuation of the main market for the fund – Poland – is ~30% below its historical average [based on the 10-year P/E ratio and the forward one]:

@akcakmak on Twitter, Bloomberg data

At the moment Poland looks like one of the most underestimated countries in Europe. Of course, this has its own explanation – since the start of hostilities in Ukraine, which borders the country, uncertainty has spooked a large part of investors. But as Warren Buffett said, be greedy when everyone is fearful – right?

I am not a geopolitical or military expert, but from what I can see on both sides of the media barricades (I live in CIS and see what is shown on Russian TV channels), it seems clearer to me by the day that the situation is moving further and further away from Russia’s control. Today’s war may last for a long time, but the European economy has recovered quickly and started to adapt to new challenges. Therefore, I expect investors’ uncertainty and fear about Poland and all of Eastern Europe (excluding Russia) to gradually dissipate. The discount to Polish companies’ assets should eventually narrow – CEE will be the main beneficiary in this case.

But all of the above is not my main argument for buying CEE – let us get to the catalyst that no one is talking about yet.

The Catalyst – Magnit PJSC’s Buybacks Offer

On June 16m 2023, Magnit PJSC announced a tender offer for up to 10,191,135 of its ordinary shares. The purpose of the tender offer is to provide Western investors who wish to exit their stake in Magnit with liquidity. The purchase price per share has been set at RUB 2,215 (50.9% lower than the price on MOEX as of June 15, 2023). As the announcement went, the tender offer “aims to address the restrictions faced by international shareholders in trading their shares and exercising their rights due to international sanctions and limitations.” The participation in the tender offer is voluntary, and shareholders can make their own assessment and decision, the firm said.

This management decision resulted in phenomenal buying power on the MOEX – of course, because in effect, such a tender offer means that the company is making a buyback at a ~50% discount [at that time]. That is, the number of shares outstanding is reduced by a significant amount for only half of their real value [on MOEX]. Imagine Walmart buying back 10% of its outstanding shares at a price of only $80 each – it is clear that Russian investors were extremely pleased.

TradingView, Magnit and RTSI on MOEX [author’s notes]

![TradingView, Magnit and RTSI on MOEX [author's notes]](https://ifintechworld.com/wp-content/uploads/2023/07/53838465-16896732310598812.png)

Moreover, Western investors were also so excited about the possibility of somehow getting rid of Russian assets that their delight made the company triple the size of the buyback:

Reuters [author’s notes]

![Reuters [author's notes]](https://ifintechworld.com/wp-content/uploads/2023/07/53838465-16885462224815736.png)

More than 60% of Magnit’s shares are free-float, with shareholders including major Western asset managers such as Blackrock, Pictet and Dodge & Cox, Refinitiv data shows.

Magnit said substantial interest from shareholders that significantly exceeded initial expectations had led to its increasing the offer to 29.8% of shares outstanding from 10% previously.

Source: Reuters, author’s emphasis added

In fact, this unique case is a win-win situation for both Russian and Western investors, as well as for the management that is making this tender offer at such a large discount. I think that such offers by Russian corporations will appear more and more frequently in the headlines in the foreseeable future – this should have a direct positive impact on CEE. Why?

Based on the latest USDRUB exchange rate [89.9], the fund, which previously held 63,909 shares in Magnit on its balance sheet, can potentially gain ~$1.6 million as the share price is expected to go from zero to 2,225 rubles per share. This particular positive impact may already be reflected in the share price, as it has risen by 6.75% since the announcement of Magnit’s offer.

However, what is not yet priced in CEE’s share price are the potential new tender offers from other Russian companies, which represented a much higher percentage of assets before they were zeroed out:

CEE’s Holdings as of 2023-05-31 [author’s notes]

![CEE's Holdings as of 2023-05-31 [author's notes]](https://ifintechworld.com/wp-content/uploads/2023/07/53838465-1688543774437464.png)

If we imagine that Sberbank and Gazprom (2 Russian companies out of 18 on the balance sheet of CEE) want to do the same, then the fund should receive a total of ~$9.5 million assuming a 50% discount. That’s +18% to CEE’s common assets, and this will be just the tip of the iceberg.

Risk Factors You Should Consider

While I’m quite confident in my bullish thesis on CEE based on Magnit’s share buyback and likely future buybacks by other Russian companies, it is important to consider the associated risks.

-

Geopolitical and Regulatory Risks: The geopolitical tensions and regulatory environment surrounding Russia, particularly due to its actions in Ukraine, pose ongoing risks for investments in Central and Eastern European companies. Further escalation or geopolitical instability could negatively impact the investments held by CEE.

-

Volatility of Emerging Markets: Central and Eastern European markets, including Russia, are classified as emerging markets, which are known for their higher volatility and lower liquidity compared to more developed economies. I mentioned it above as an illustration of why CEE’s premium to NAV was so significant in the past (even before the war). But these factors may negatively impact the performance of CEE, so all investors should be aware of that.

-

Concentration Risk: CEE’s non-diversified nature and larger positions in fewer investments increase its risk potential. The fund’s significant exposure to a limited number of holdings amplifies the impact of any adverse events specific to those companies or the region.

-

Currency Risk: Investing in European securities exposes CEE to currency fluctuations, particularly in relation to the USDPLN (US dollars to Polish zlotych) exchange rate. Changes in the exchange rate can impact the fund’s returns when converting zlotych-denominated investments back to the fund’s base currency.

-

Market Sentiment and Investor Behavior: The success of my thesis relies on the assumption that other Russian companies will follow Magnit’s example, presenting a bullish catalyst for CEE. However, market sentiment, investor behavior, and the willingness of companies to undertake share buybacks can be influenced by various factors, and there is no guarantee that the expected catalyst will materialize as I anticipate it.

Your Takeaway

The risk factors I described above make my thesis quite risky – therefore I classify this investment idea – the CEE itself – as a Hold.

But despite my rating, I see a lot more positives for CEE right now than negatives. Russian assets effectively became a perpetual call option for the CEE, where it was not clear when it would work. The downside risk Of holding this option was capped at 0, and all that remained was to wait for the situation to clear itself. Magnit PJSC’s actions signaled that it was time to remember this option. Remember, however, that when it comes to investing, there is nothing better than doing your own due diligence on a particular idea. This is exactly what I recommend if you want to make an investment decision after reading my article.

Good luck with your investments!

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here