Investment Thesis

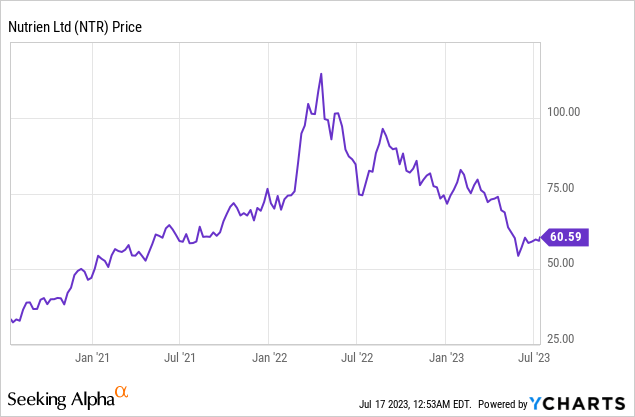

After an excellent performance from 2020 to 2022, Nutrien (NYSE:NTR) is now down over 40% from its all-time high last year. Despite the huge pullback, I remain cautious about the company’s near-term outlook. The rapidly declining inflation continues to put significant pressure on pricing, which subsequently hurts revenue. The impact is shown in the latest earnings, as the guidance was slashed substantially amid the headwinds. The current valuation looks cheap but the multiple is expected to jump as the bottom line plummets. Considering the current uncertainties around the economy, I believe the company may still have some more downside moving forward.

Macro Headwinds

Nutrien is a leading agricultural company that provides potash, nitrogen, and phosphate products to customers across the globe. It also offers retail agriculture solutions for crop protection, crop nutrients, seeds, biologicals, and more. The company plays an important role in the world’s agriculture supply chain but its commodity nature also makes it very volatile and highly reliant on pricing.

Inflation has soared in the past two years amid the global COVID stimulus and the Russia-Ukraine war which disrupted the supply chain. This has benefited Nutrien as inflation significantly boosted the company’s overall pricing. However, this tailwind is now turning into a headwind as inflation continues to plummet in the past few months amid tighter financial conditions.

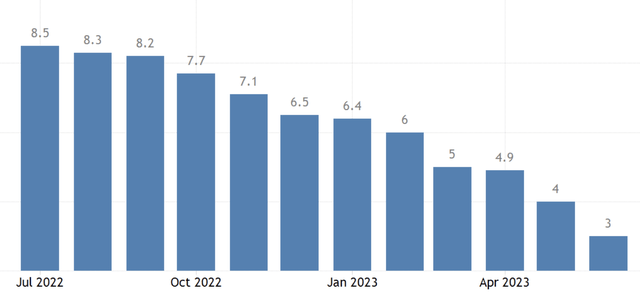

For instance, the latest US CPI (consumer price index) came in at just 3% YoY (year over year), down from 4% in the prior month and 9.1% in the prior year. The figure is expected to continue its decline as the Federal Reserve aims to keep interest rates at restricted levels for a while. Not to mention demand will likely take a hit as well if the economy slows down further. The US economy remains resilient so far but the whole Eurozone has already entered a recession. With pricing and demand both under significant pressure, the company will likely continue to struggle financially in the near term.

Trading Economics

Weak Financials

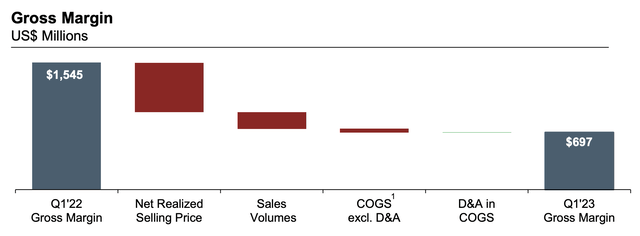

Nutrien’s latest earnings reflected easing inflation continues to put significant pressure on pricing. The company reported revenue of $6.11 billion, down 20% YoY (year over year) compared to $7.66 billion. The decline was mostly attributed to lower pricing, as prices for Potash, Nitrogen, and Phosphate dropped 38%, 23%, and 6% respectively. Sales volume for Potash and Phosphate also decreased by 13% and 16%, as demand continues to weaken. With costs of sales largely flat YoY, the gross profit plummeted 41% from $3.26 billion to $1.91 billion. The gross margin contracted from 42.6% to 31.3%.

The bottom line was also extremely weak as the top line cratered. The adjusted EBITDA declined 46% YoY from $2.62 billion to $1.42 billion. The adjusted EBITDA margin decreased from 34.2% to 23.2%. The net income was down 58% from $1.39 billion to $576 million, as it was impacted by higher finance costs. The adjusted EPS was $1.11 compared to $2.7. Amid the unfavorable trends, the company also lowered its full-year guidance significantly. The adjusted EBITDA is now expected to be in the range of $6.5 billion to $8 billion, down from the range of $8.4 billion to $10 billion. The adjusted EPS is now expected to be in the range of $5.5 to $7.5, down from the range of $8.5 to $10.7.

Potash Gross Margin (Nutrien)

Caution From Peers

FMC Corporation (FMC), another major agricultural company, has recently announced a surprising revenue cut after raising its guidance in May, which further indicates the rapid deterioration in the industry. The company has decided to slash its full-year revenue from the range of $6.08 billion and $6.22 billion to between $5.2 billion and $5.4 billion. The adjusted EBITDA was also revised from the range of $1.5 billion to $1.56 billion to between $1.3 billion and $1.4 billion. At the midpoint, this represents a substantial revenue and adjusted EBITDA cut of 14% and 12%, respectively.

The company said that the downward revision was mainly attributed to the significant decline in volumes, as partners are cutting down on inventory levels. This suggests a weaker-than-expected demand across the board, which should pressure Nutrien meaningfully as well.

Mark Douglas, FMC CEO, on guidance cut:

Towards the end of May, we experienced unforeseen and unprecedented volume declines in three out of our four operating regions, as our channel partners rapidly reduced inventory levels.

Uncertain Valuation

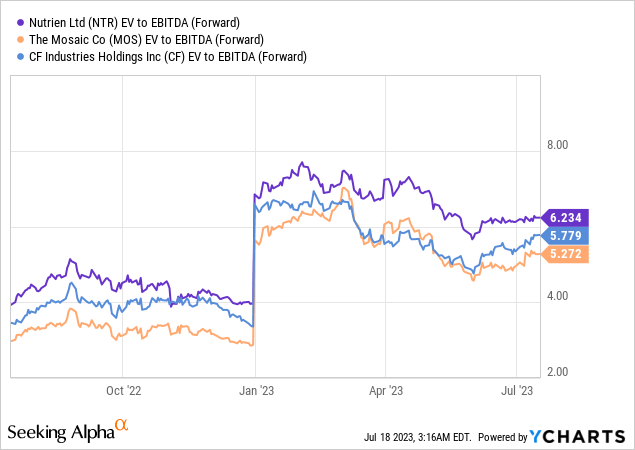

After the massive drop, Nutrien looks cheap at first sight. The company is currently trading at an EV/EBITDA ratio of 4.3x, which is extremely discounted (I am using EV/EBITDA as it can take the company’s debt into account). For instance, this is 52.7% below its 5-year average EV/EBITDA ratio of 9.1x. However, the ongoing deterioration in the bottom line is expected to push up its forward multiple meaningfully. For instance, its fwd EV/EBITDA of 6.4x is 48.8% higher than the current multiple. The forward multiple is also higher than other major agricultural peers such as CF Industries (CF) and Mosaic (MOS), as shown in the chart below. I believe the huge uncertainty around growth will continue to weigh on its valuation.

Investors Takeaway

Nutrien is down substantially but the worst might not be over yet. The easing inflation and the slowing economy are putting meaningful pressure on both pricing and volume. With interest rates expected to stay at elevated levels, the headwinds will likely last for a prolonged period of time. The deterioration is clearly shown in the company’s latest earnings and the recent guidance gut from FMC. Its forward valuation is also higher than peers and could increase further if earnings continue to decline. With so many uncertainties and headwinds in the near term, I believe the company is a sell.

Read the full article here