Thesis

With renewable energy facing multi-decade tailwinds from a combination of macro factors and the Inflation Reduction Act, I find myself researching companies that are involved in storage, distribution, and management. Currently, our electric grid is managed by humans with the aid of software, and is supplied by sources that require time to come online. Not only must changes in demand be accurately forecast, we also have to intentionally over-produce by a small amount to avoid shortfalls during unexpected demand spikes. Our continuously oversupplied grid suffers from significant waste.

As we continue to add both intermittent sources and storage capacity into our grid, emphasis will shift away from continuous oversupply and toward instantaneous management. The need to intentionally overshoot forecasted demand will disappear. Because a human will never be able to keep pace with changes in demand, we will have to rely on artificial intelligence. The energy management model we have been using since the birth of our electric grid will have to be replaced with one that is actively managed by A.I. and merely supervised by humans.

Because base load providers are currently seen as the single most vital part of our grid, they are used to enjoying superior pricing power at the negotiating table. With the rise of decentralized production, I believe storage providers will gain the title of most important player as they disrupt the entire industry.

Stem, Inc. (NYSE:STEM) has already established themselves as a leading installer of grid scale storage, and is working toward also becoming the dominant supplier of energy management software. Their flagship A.I. software package is known as Athena, and is already being offered for lease. In addition to leasing out their software, if they also manage to gain direct control over enough storage facilities, Stem should be able to benefit from the long-term shift in pricing power. In my opinion they are very well positioned to benefit from the ongoing changes our electric grid is experiencing. Currently, Stem is not profitable. However, I believe their cash flow situation will improve over the next several of quarters. I presently rate Stem as a Buy.

Company Background

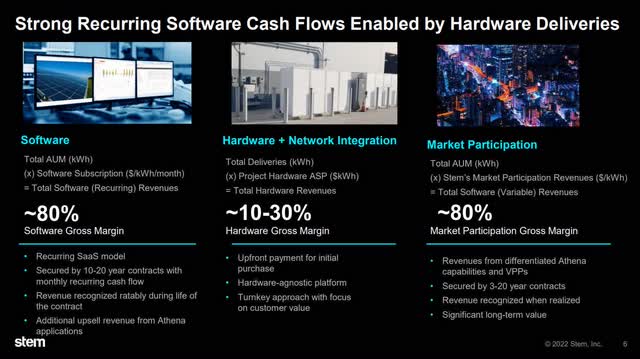

Stem was founded in 2009 and is a pioneer in clean energy optimization. The company expects to eventually be able to reach an impressive 80% gross margins on the software side of its business. At the same time, they project to eventually reach 10-30% gross margins on the hardware side. I believe these projections are achievable, and as the company matures, they may become a reality.

The company purchases and installs grid scale energy storage hardware from companies like Tesla (TSLA). The reason this is advantageous for Stem is because they are typically able to secure a long-term service contract with the customer. This is not a high-margin portion of the business, nor is it ever expected to become high-margin. As its primary purpose is not to make money from the installation, but to hand Stem recurring revenue, even if it ends up becoming profitable, it is probably correct to view this aspect of the business as a loss leader. Installation revenue is both demand dependent and capital intensive, as well as subject to swings in the price of Lithium and other industrial metals.

Stem’s flagship A.I.-driven software, Athena, is designed to coordinate a large number of energy assets at scale. Leasing out their software to storage providers is expected to carry excellent margins. As demand for storage increases, demand for their software will grow with it. Any storage provider which does not develop their own management software will be faced with the prospect of renewing their contract with Stem or finding a new provider when their contract ends. As long as Stem maintains a reputation for capability and reliability, this aspect of their business will likely produce repeat business.

In addition to leasing their software to others, Stem stands to benefit from their A.I. participating in energy markets. As even more intermittent sources are incorporated into our system, the daily arbitrage opportunities presented to storage providers are expected to become more lucrative.

STEM Long-Term Margin Estimates (March 2022 Investor Presentation pg. 6)

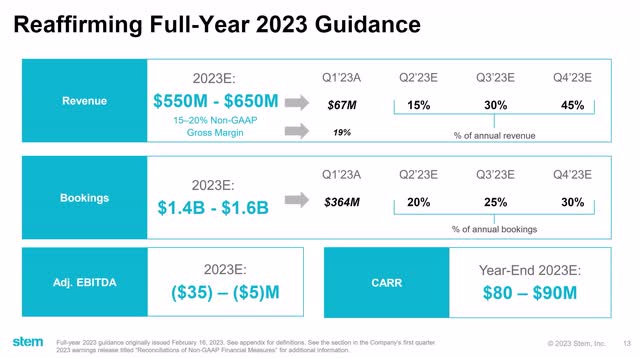

Recent forward looking guidance indicate they expect Adjusted EBITDA to stay negative for 2023. Their expected percent of annual revenue indicates they project for revenue to continue rising. They also expect their amount of new bookings to continue rising each quarter. With them expecting rising revenue, it would appear Stem will be worth keeping an especially close eye on as the end of 2023 approaches.

STEM 2023 Guidance ( Q1 2023 Earnings Presentation pg. 13)

Long-Term Trends

The global smart grid market is expected to experience at a CAGR of 18.2% through 2030. The grid-scale battery market is estimated to have a CAGR of 26.1% through 2031. The United States renewable energy market is projected to have a CAGR of 10.1% until 2028, while the global market is expected to experience a CAGR of 16.9% through 2030.

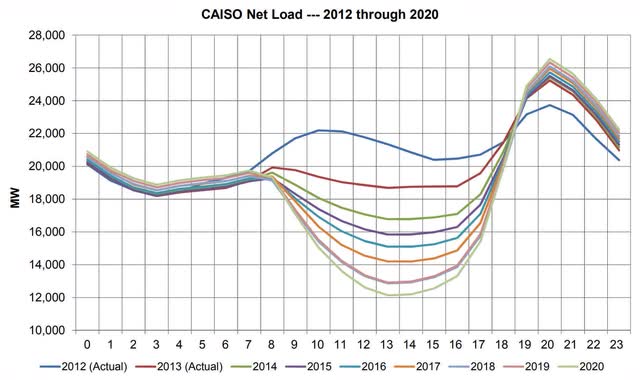

The inclusion of intermittent sources is warping our daily supply and demand curve. This warping is referred to as the Duck Curve, and it shows this problem visually. In order to prevent damage to the system, It has already reached the point where commercial scale solar has to be disconnected from the grid during the middle of the day. With solar currently holding the title as our cheapest source of electricity, further incorporation of intermittent sources appears inevitable. Our energy grid requires more storage.

The Duck Curve (Brad Bouillon; Stanford University)

I believe the addition of storage will also mean the base load providers will finally lose their pricing power. Our inverter technology has reached the threshold where base load is no longer the only way to maintain a stable frequency signal. As the rise of storage providers undermines the need for the continuously supply, and even more decentralized sources are incorporated into the system, the negotiating power of individual producers will diminish. Once storage capacity within the system becomes large enough, storage providers could afford to adopt a we don’t need you attitude for any single source provider, even especially large ones. This means only the most cost-effective base load providers are likely to stay with us over the coming decades.

Similarly, the need for peaker plants will also slowly go away. Peaker plants are typically natural gas powered, and are designed to be able to reach full power from a cold start within a few minutes. They are asked to come online to handle the spikes in demand that occur every evening, and also during events, like the Super Bowl, which cause macro-changes to usage habits.

While it is easy to see how their projected 80% margins that come from leasing the software is appealing, I am far more impressed by the long term potential of the projected 80% margins that they think will come from taking advantage of the arbitrage opportunities. This is because the 80% margins from leasing the software is capped by the number and size of customers they secure, yet the 80% margins from arbitrage is capped by the volume of electricity they can get their hands on.

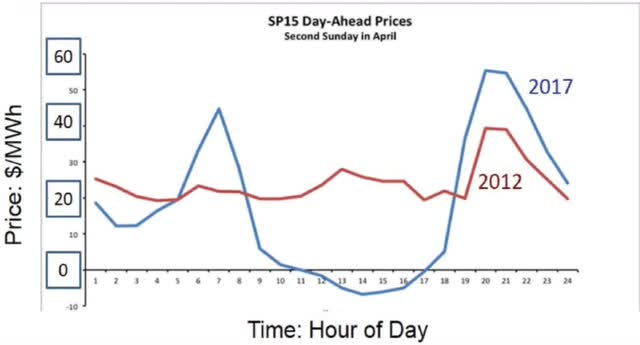

As the storage industry attempts to establish itself, we may see a price war break out. I do not expect any of the source providers to be able to compete with actively managed storage providers. This is because the storage providers can pick up free or almost-free electricity from overproduction during the middle of the day and then wait to sell that electricity every evening when it’s trading at its highest. Those wanting to aggressively expand the volume of electricity they can arbitrage may even attempt to install storage into the service areas of rival utility providers. Even if they take a more passive role and merely lease out their software, I believe the arbitrage business has the potential to eventually scale into a truly massive source of cash flow for Stem.

Wholesale California Electricity Prices Over 24 Hrs. on a Spring Day (Charles W. Forsberg; ResearchGate, May 2020)

Financials

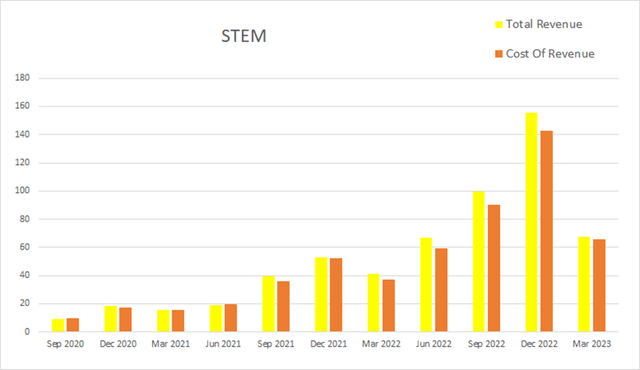

Their revenue has been growing at a truly impressive rate. Through 2022 they experienced almost exponential revenue increases. Revenue has since had a significant pullback. Eight quarters ago Stem had a quarterly revenue of $15.4M. Four quarters ago that had grown to $41.1M; by this most recent quarter that had further increased to $67.4M. This represents a total two-year rise of 249.2% and an average quarterly rate of 31.15%.

STEM Quarterly Revenue (By Author)

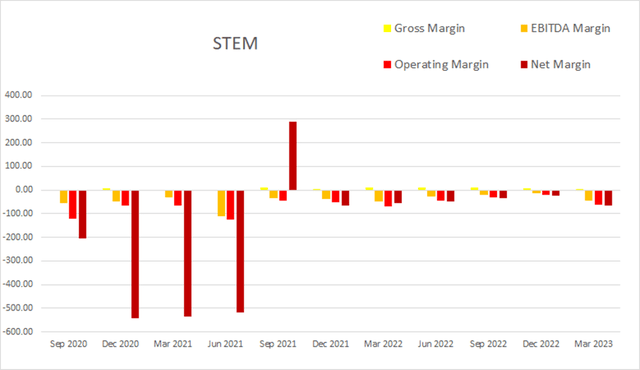

Although their margins vary from quarter to quarter, they have been improving since 2020. As of the most recent quarter, gross margins were 2.67%, EBITDA margins were -45.40%, operating margins were -62.02%, and net margins were at -66.47%.

STEM Quarterly Margins (By Author)

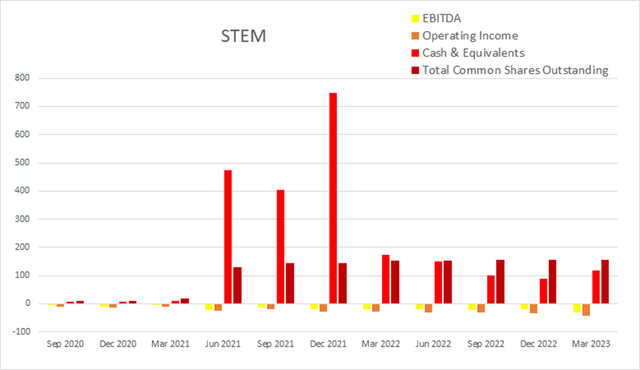

The company experienced a significant rise in share count in 2021, and a second, much smaller round of dilution at the beginning of 2022. As of the most recent quarter, cash and equivalents was $117.9M, short-term investments was $87.7M, EBITDA was at -$30.6M, and quarterly operating income was $-41.8M.

STEM Quarterly Share Count vs. Cash vs. Income (By Author)

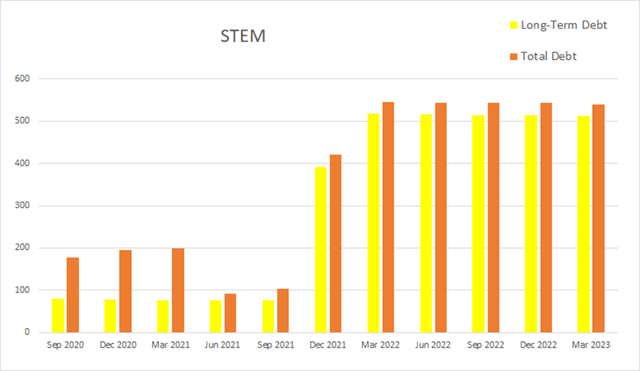

This most recent quarter, Stem had -$1.8M in net interest expense; their regular debt obligations are relatively small. As of the most recent quarterly report, total debt was at $540M, and long-term debt was at $511.1M.

STEM Quarterly Debt (By Author)

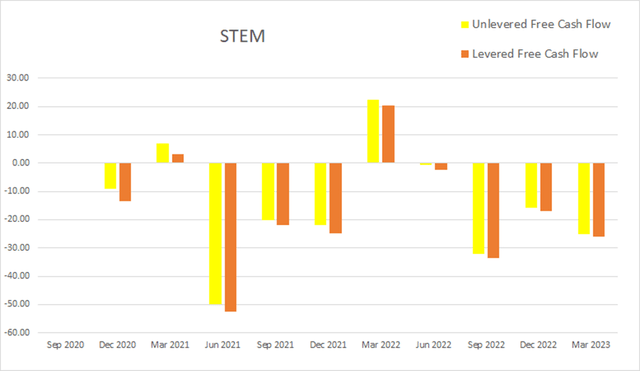

Their present ability to generate cash is rather lackluster. Until they manage to bring cash flow into consistently positive values, they will be unable to effectively pay down their debt, and may eventually face further dilution. As of this most recent earnings report, quarterly unlevered free cash flow was at -$25M, while levered free cash flow was at -$26.1M.

STEM Quarterly Cash Flow (By Author)

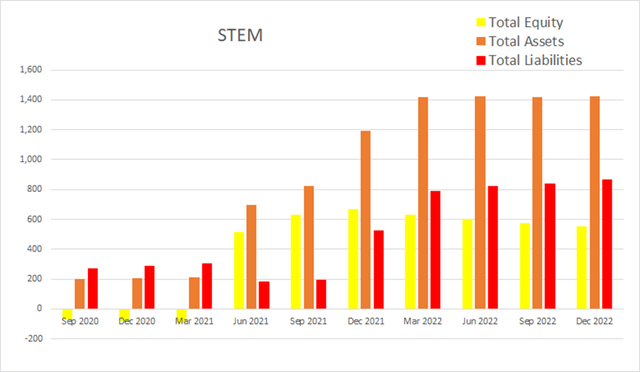

Total equity is slowly dropping. This is typical for companies still trying to develop their capabilities. Once they become consistently cash flow positive, I expect equity to begin rising.

STEM Quarterly Total Equity (By Author)

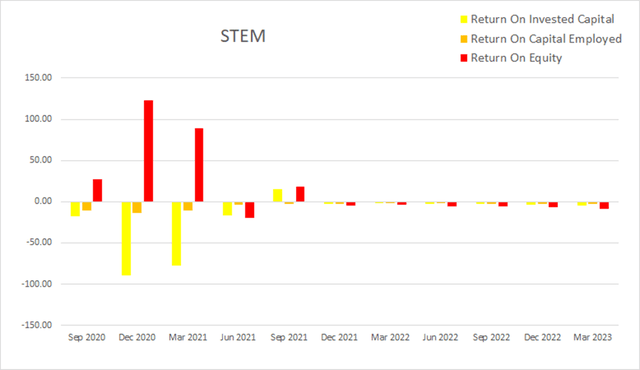

The relatively wild returns Stem was experiencing in 2020 and early 2021 appear to have stabilized. The company has projected increasing revenues, yet negative Adjusted EBITDA for the remainder of 2023. The increased revenue will likely drive margin expansion and help push returns into positive territory. I will watch for these returns to possibly improve near the end of the year. As of the most recent earnings report, ROIC was -4.24%, ROCE was -3.06%, and ROE was at -8.66%.

STEM Quarterly Returns (By Author)

Valuation

As of July 14th, 2023, Stem had a market capitalization of $1.06B and traded for $6.59 per share. Considering their consistently negative returns, I view their forward EV/Sales of 2.3x, Price/Sales of 1.75x, and Price/Book of 2.23x as showing the company as relatively close to fair value but unappealing. If the company were generating positive EBITDA, these valuations would actually look quite attractive. Also, its price to book ratio is too high to treat Stem as a cigar butt play.

STEM Valuation (Seeking Alpha)

Risks

Stem has $117.9M in cash and equivalents and another 87.7M in short-term investments. Their recent quarterly leveraged free cash flow of -$26.1M indicates they are not in imminent threat of further dilution. However, if the revenue increases the company is projecting do not occur, or if they do not come with margin improvements, then the company may face another round of dilution before it begins consistently generating positive cash flow.

I expect that arbitragers will have extreme control over the price of electricity as supply and demand both vary throughout the day, but this may not come to fruition. The achievable profits are considerable enough that the general public may view it as a form of exploitation. Like many other utilities, storage may one day face regulations related to price manipulation.

Stem is not alone in this field. They already face competition from companies such as Fluence Energy (FLNC). It is possible that Athena ends up being outclassed by a competitors’ product and Stem is forced into irrelevancy. With countless numbers of startups currently working toward their own A.I. projects, it would not be implausible for serious competition to emerge.

Catalysts

The grid scale storage the industry uses is currently lithium-ion based, but I expect this to change in the future. As the recent developments made in Iron-Air batteries come to market, the cost of grid scale storage should decline significantly.

Their installation service incurs high upfront capital costs, but also brings recurring revenue. As new projects come online and the company establishes their cash flow, they should be able to increase their pace of new installs.

This company is currently losing money and will continue to trade at suppressed valuations until it can prove otherwise. I typically put little faith in mere forward guidance to be able move the share price of an unprofitable company, but I would expect that posting an earnings report with positive EBITDA will come with an improvement in valuation. With the business model targeting revenue streams that are expected to come with high margins, should the company post positive net income and guidance that it will continue, I would expect the share price to experience a significant reaction.

If, or when, Stem eventually establishes itself as a leader in the energy arbitrage industry, I expect it to provide the company with a significant revenue stream. The disruption that storage arbitragers can cause over the current system makes them attractive as a long-term investment.

Conclusions

Being able to adaptably manage a variety of energy sources in real time is a requirement for our future grid. I believe the companies that are able to make a functional smart grid a reality will be in a position to receive significant benefits from managing it. Stem is setting themselves up to be one of those companies.

Overall, Stem is currently very early into its business life cycle and it appears that it will eventually become extremely appealing as a long-term investment. Currently, their business is mostly hardware based, this plagues them with low margins and leaves them overly exposed to changes in the price of Lithium and other industrial metals. As the Iron-Air battery industry comes online, the cost of the grid-scale storage will go down. I expect that this cost improvement will come with an increase in overall demand.

Their transition from largely a hardware installer, to more of a software service provider, is not one that will happen overnight. As their amount of revenue coming from licensing their software increases, so should their margins. Once it establishes itself financially, I believe Stem has the potential to become a long-term compounder with high returns.

I believe the best time to invest into Stem is either already here or quickly approaching. Because of the long-term potential of their high margin revenue streams, I believe once this company reaches consistently positive cash flow, the market is going to hand it a significant valuation improvement. This leads me to believe that waiting for Stem to actually reach positive cash flow may be a mistake. I do not currently own any shares of Stem, but I plan on dollar cost averaging into a position over the coming months. Because I strongly believe in the long-term potential of their business model, once they establish consistent a income I will find it very difficult to sell.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best AI Ideas investment competition, which runs through August 15. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!”

Read the full article here