Since the last time I wrote about the sugar alternatives company Whole Earth Brands, Inc. (NASDAQ:FREE) in April, its price has risen by a massive 78%, making up for the price losses seen this year (see chart below). The article was titled “Whole Earth Brands: Due For A Price Rise,” which obviously alluded to the likelihood of a price increase going forward. But I could not have predicted the extent or how the increase would come about.

Price Chart (Source: Seeking Alpha)

Acquisition offer

The impetus for the price rise came late last month as Martin Franklin, who already owns a 21% stake in the company made an acquisition offer via Sababa Holdings. The offer price is USD $4 per share, which was a significant increase as noted above, from the then trading price. Interestingly, though, at the last close, FREE was trading above the offer price of USD $4.2.

This is quite likely on speculation that the offer price can be increased. The company hired the investment bank Jefferies to review the proposal last week. Its CEO, Michael Franklin is also now on leave of absence, to avoid a conflict of interest. As it happens, he is also a partner at the family investment firm Mariposa Capital, which was founded by his father Martin Franklin.

If the acquisition goes through, Franklin intends to combine Whole Earth Brands with charcoal manufacturer Royal Oak Enterprises LLC, of which he is the Executive Chairman.

To me, this raises the question of whether the company will remain publicly listed if it does. There is no indication that it won’t, but it’s still something to bear in mind. If it doesn’t, the best that investors can expect is an increase in the current share price to an upwardly negotiated offer price. If it doesn’t go through, the company’s fundamentals will determine what happens next to its stock price.

Why the offer price can rise

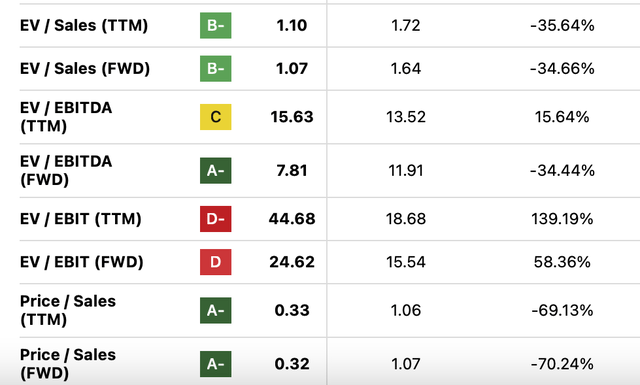

Going by the company’s market valuations, it is quite likely that if the deal goes through, it will be at a higher price. Here are the arguments for why. Consider two forward ratios, enterprise value-to-sales (EV/S) and EV/EBITDA.

Market Multiples, Column 3- FREE, Column 4 – Consumer Staples Sector, Column 5- Difference from sector (Source: Seeking Alpha)

FREE’s forward EV/S is at 1.07x, which is lower than the 1.64x for the consumer staples sector. The company’s EV as of the last close was at USD $594 million. If the true EV of the company were indeed at that implied by the EV/S for the sector, then its EV would have to rise by over 53%.

This increase in EV would have to come from a much higher market capitalization since the company’s debt and liquid assets are unlikely to change. This, in turn, means that the target price is closer to USD $12. This is three times the current offer price. Considering the valuation from the EV/EBITDA perspective reveals almost the same level of price.

If we consider the forward price-to-sales (P/S) ratio, the price rise is even bigger. FREE is trading at a P/S of 0.3x compared to the consumer staples sector at 1.07x. This implies a potential price that is over 3x more than the offer price at a little over USD $14.

Why the offer price is fair

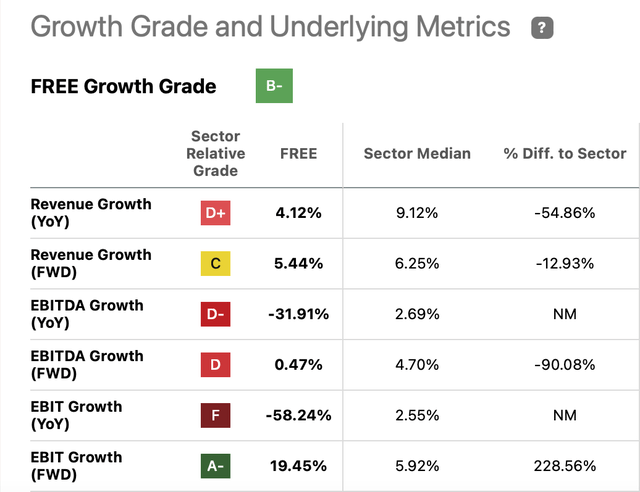

But that’s just one side of the story. There is a justification for the consumer staples sector to have a higher valuation, and that is growth in both sales and EBITDA. The company lags behind the sector both on a past and forward basis (see table below).

Source: Seeking Alpha

Next, consider the trailing twelve months [TTM] multiples. While the P/S is similarly low like the forward ratio compared to the sector, the EV/EBITDA is very different. It is at 15.6x compared to 13.7x for the sector. This actually indicates that the price can correct from current levels. With an offer price already on the table, this would not happen of course. Still, it does indicate that the company’s negotiating power might be limited.

What if the deal falls through?

Finally, there’s the possibility that the deal doesn’t go through at all. In this case, the question is whether FREE’s price will decline from its current levels. To assess that, let’s look at its first quarter (Q1 2023) numbers. Whole Earth Brands reported revenue growth of 1.4% at market exchange rates, which is below the 2-5% range it expects for 2023. In constant currency terms, it did grow faster, by 2.8%. So there’s hope for improvement, but in the current macroeconomic environment, I’m not holding my breath.

On the positive side, it reported an operating profit, after a loss last quarter. The EBIT margin is small at 2.6% compared to 6.6% in Q1 2023 though. It also sustained a net loss for the third consecutive quarter on interest expenses and foreign currency losses. Essentially, we have seen some improvement, but to really see the fruits of investment, an investor will need to wait for another couple of years at least until Whole Earth Brands is on more stable and profitable grounds.

What next?

If the company was on shaky grounds after its acquisition drive in recent years, it is even more so now after the acquisition offer. There is no doubt that there is a case for some improvement in the offer price for Whole Earth Brands. So, a speculative investment can be made in the stock.

But I am more inclined to look at it from the medium-term perspective. The future of the company hangs in balance, as we don’t know what’s going to happen next. Its financials, while improving, have some way to go. Its valuations look attractive in more respects than not, but faster growth in both revenues and profits would be needed to justify further price increases.

If the deal were to fall through, I think Whole Earth Brands, Inc. stock can still be a really good long-term investment. The company has a leading position in the growing sweeteners market and has consolidated it over the past years as well. But we have to wait and watch. With the company, as has been since the first time I wrote about it in October last year, in flux, there is no option but to maintain a Hold rating on Whole Earth Brands, Inc.

Read the full article here