Investment thesis

LSI Industries (NASDAQ:LYTS) stock has rallied more than 100% over the past twelve months. My valuation analysis suggests the stock is still massively undervalued. The underlying assumptions for the valuation analysis are very conservative, and I have simulated two different scenarios to demonstrate that the margin of safety is vast. The company operates in an intensely competitive market, but I think it is well-positioned to continue revenue growth and expand profitability metrics. I think the stock is a “Buy” for investors seeking a small-cap high-quality business with the potential for the stock price to increase many-fold over the long term.

Company information

LSI Industries is a leading producer of non-residential lighting and retail display solutions. Non-residential lighting consists of high-performance lighting solutions. Retail display solutions include graphics solutions, digital signage, and technically advanced food display equipment for strategic vertical markets. LSI also provides comprehensive project management services in support of large-scale product rollouts.

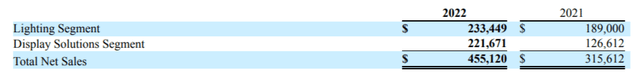

The company’s fiscal year ends on June 30. The business is organized in two segments: Lighting Segment and Display Solutions Segment. In FY 2022, sales were split almost equally between the two segments.

LSI’s latest 10-K report

Financials

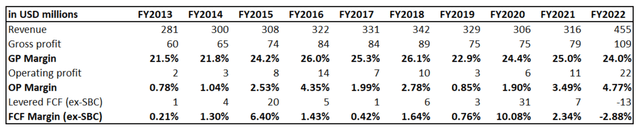

Over the past decade, the company’s financial performance has been relatively volatile, with year-over-year ups and downs. But generally, financial performance improved over the decade. Revenue grew at about 5% CAGR, and profitability metrics expanded notably.

Author’s calculations

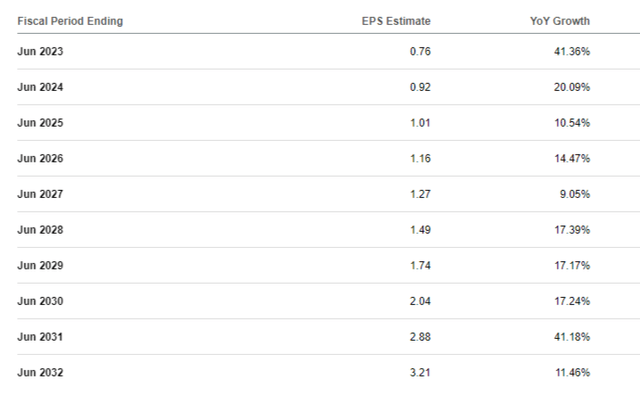

LSI has a substantial 20% SG&A to revenue ratio. That said, the company has notable room for improvement here because the operating margin is razor-thin. I think this is the most apparent area where the company can improve profitability. Consensus estimates forecast the EPS to expand double digits in nine of the next ten years.

Seeking Alpha

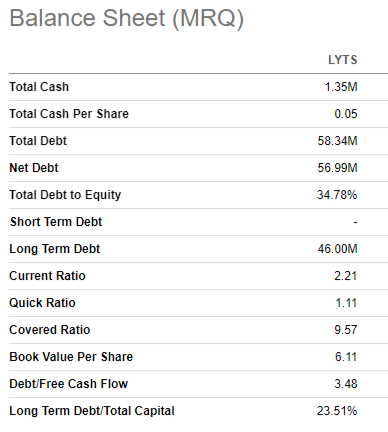

The expected expansion in EPS is good news for dividend investors because the company pays out about of quarter of its bottom line as dividends. The forward yield is 1.65% at the moment. LSI has paid out dividends for 18 consecutive years. The company’s capital allocation strategy looks sound because LYTS manages to balance between delivering steady revenue growth, paying dividends, and maintaining a solid balance sheet. Leverage and liquidity ratios are prudent.

Seeking Alpha

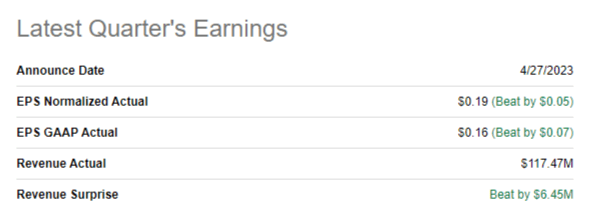

LYTS announced its latest quarterly earnings on April 27, smashing consensus estimates in revenue and EPS. Revenue grew about 7%, and the adjusted EPS expanded from $0.13 to $0.16.

Seeking Alpha

The gross margin expanded notably YoY, from 24% to 27%. So did the operating margin, which increased from 4.7% to 6.6%. Expansion of profitability metrics allowed to significantly improve the FCF, from $1.9 mln to $10.6. During the earnings call, the management reiterated its commitment to innovation having 20 brand-new organic products on the roadmap. That said, the management takes action to fuel further growth, which is why I am optimistic about the company’s future.

The upcoming quarter’s earnings are expected to be announced on August 18. Revenue is expected to decline by 7% YoY due to the end customers’ headwinds in the current challenging macro environment. But I want to emphasize that despite an expected decline in revenue, consensus estimates project that the adjusted EPS will slightly expand.

Seeking Alpha

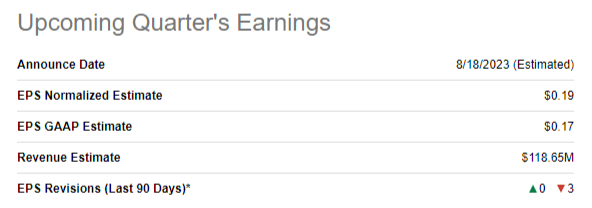

Seeking Alpha Quant rates LYTS as a “Strong Buy” since the company has solid ratings across the whole factor grades board. It is important to mention that the factor grades have improved notably compared to three months and six months ago.

Seeking Alpha

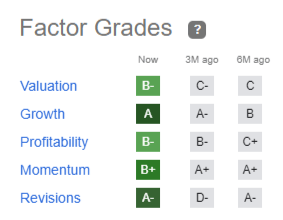

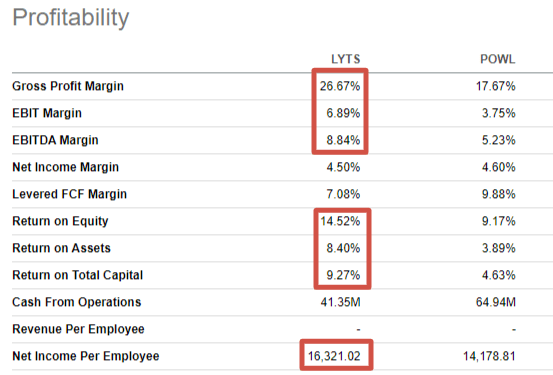

The company is ranked fourth in the Electrical Components and Equipment industry, behind companies with much bigger market caps. Powell Industries (POWL) is number one in the industry, according to the Seeking Alpha Quant ranking. POWL’s market cap is two times higher than LYTS, but revenues are about comparable. I would like to look at how LYTS’ profitability metrics compare to POWL’s. As you can see, LYTS outperforms the industry’s top stock almost across the board, and it is a very bullish indicator for me.

Seeking Alpha

I think that strong profitability is the best indicator of the company’s solid positioning to absorb future industry growth. Secular trends for LSI’s end markets are favorable. For example, North American LED lighting market is expected to grow at 11% CAGR up to 2030, according to Grand View Research.

Valuation

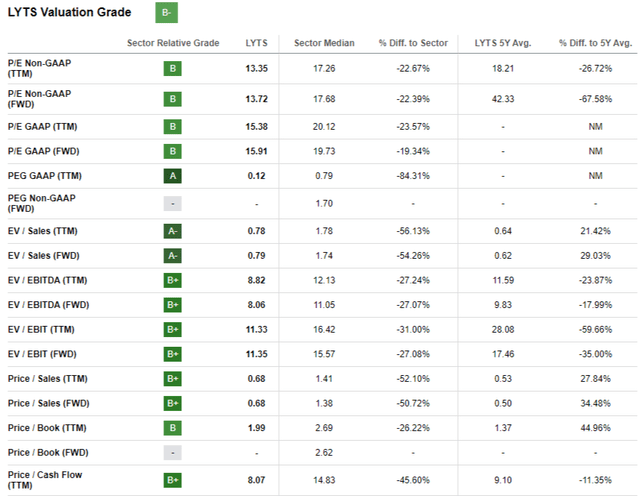

The stock price declined about 1% year-to-date, significantly underperforming the broad market. LYTS has a decent “B-” valuation grade from Seeking Alpha Quant. Multiples are substantially lower than the sector median and the company’s five-year averages across the board.

Seeking Alpha Quant

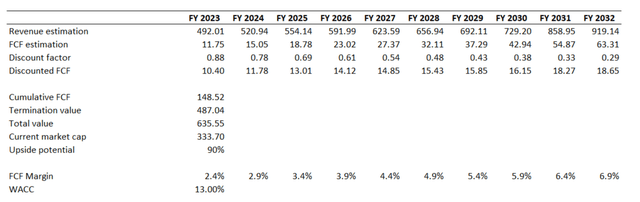

I want to cross-check the multiples analysis with the help of discounted cash flow [DCF] valuation approach. Due to the company’s small market cap, I use an elevated 13% discount rate. I have earnings consensus estimates, projecting revenue growth at about 7% CAGR over the next decade. For the FCF margin, I take the past five years’ average, which is at 2.4%. I expect the FCF margin to expand by 50 basis points yearly as the business scales up.

Author’s calculations

As you can see, the stock is massively undervalued with about 90% upside potential. This might look too good to be true. Therefore, I would like to simulate a more conservative scenario. For the second scenario, I use a 5% revenue CAGR for the next decade, the past decade’s revenue growth pace. I expect the FCF margin to expand by 40 basis points yearly under more modest revenue growth projections. Other assumptions remain unchanged.

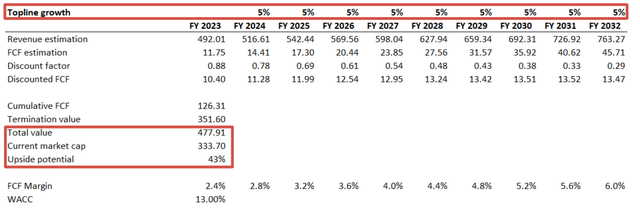

Author’s calculations

Even under substantially more conservative assumptions, the stock is about 43% undervalued. Even if we subtract a net debt amount of $57 million, the business’s fair value is still about $420 million, which is 25% higher than the current market cap.

Risks to consider

LSI’s earnings are vulnerable to lower levels of economic activity in the end markets. Earnings are expected to draw down amid downward economic cycles. The U.S. economy seems to be in a “soft landing” mode and is likely to avoid recession. On the other hand, Federal Funds rates are at their highest since the Great Recession, and Deutsche Bank analysts even called the recession in the U.S. “inevitable”.

The fierce competition and LSI’s thin margins suggest intense price competition. The company should deliver exceptional operating performance to achieve maximum efficiency. In highly competitive industries, the most efficient is the one who wins the race. The management has done well in it, but past success does not guarantee future wins.

Risks of competitors copying LSI’s technology and unique knowledge might be a big problem. The company needs to be cautious in protecting its intellectual property. Otherwise, competitive advantage can be lost.

Bottom line

To conclude, LYTS is an attractive investment opportunity. The stock is substantially undervalued and offers a decent forward dividend yield to investors. The addressable markets are expected to grow and compared to competitors, LYTS is well-positioned to absorb the favorable secular tailwinds. The stock is a “Buy” in my opinion.

Read the full article here