Thesis

The global telecom company, Telefonaktiebolaget LM Ericsson, has revealed its Q2 2023 earnings, posting an EPS that fell short by $0.04 and revenue that missed by a staggering $6.02 billion, representing a 100% YoY decrease. Despite promising growth in the Southeast Asian, Oceania, and Indian markets buoyed by 5G rollouts, the company suffered a severe 42% drop in North America, a 9% organic reduction in overall sales, and an unsettling net loss of SEK 0.6 billion for the quarter. A high dividend payout ratio, eroding gross margin, and the significant decline in North American revenue further underscore the challenges Ericsson faces. Even though 5G promises growth and the company remains committed to its EBITA margin target, the financial instability and operational inefficiency make this stock a risky proposition.

Company Profile

Anchored in Stockholm, Sweden, Telefonaktiebolaget LM Ericsson (NASDAQ:ERIC) and its subsidiaries are players in the telecommunications and related sectors. The company’s four business segments, namely Networks, Cloud Software and Services, Enterprise, and Other, contribute to its comprehensive market coverage across North America, Europe, Latin America, the Middle East, Africa, Southeast Asia, Oceania, India, Northeast Asia, and beyond.

Telefonaktiebolaget LM Ericsson’s Q2 2023 Earnings Highlights

In its Q2 earnings announcement, Ericsson met its forecasted targets, with noteworthy growth observed in Southeast Asia, Oceania, and India. This was largely spurred by a doubling of network sales year-over-year, courtesy of swift 5G rollouts, especially pronounced in India. This upward trend counterbalanced a 42% drop in North America, attributed to lower capital expenditure and reduced inventory. However, the North American market also saw a 10% increase in Cloud Software and Services, buoyed by the demands of 5G.

Europe and Latin America witnessed a 3% decline in sales overall, with Europe falling by 6% and Latin America modestly growing by 3%, a result of extended 5G deployments in Brazil.

Despite these regional differences, Ericsson reported a 9% organic reduction in overall sales, ending at SEK 64.4 billion. The downturn was pinned on various elements including gross margin decrease and business mix alterations. A brighter spot in the report was the increased revenue from Intellectual Property Rights (IPR), which rose by SEK 1.7 billion year-over-year.

The gross margin for Enterprise fell from 52.8% to 46.3%, a result mainly of Vonage’s integration into Ericsson. Concurrently, research and development expenses escalated, partially due to the inclusion of Vonage and further investment in Enterprise Wireless Solutions.

From a financial perspective, Ericsson documented a net loss of SEK 0.6 billion for the quarter. However, when considering a rolling four-quarter basis, the firm’s EBITA margin was 9.1%, edging towards their ambitious target of 15%-18%. Pre-mergers and acquisitions, the free cash flow was at a deficit of SEK -5 billion, weighed down by an increase in working capital and lower EBIT.

As Ericsson gazes into the third quarter of 2023, they predict the gross margin for Networks to range from 38% to 40%. The company also expects that cost reduction activities will start to have a slight but incrementally growing impact over time. The EBITA margin for Q3 is projected to be in line with or slightly above Q2, with the firm foreseeing a positive free cash flow in the second half of 2023, particularly in Q4.

Lastly, management was upbeat about 5G’s growth. They estimated that subscriptions will surge to SEK 1.5 billion by the end of 2023 and surpass SEK 4.6 billion by 2028. Ericsson anticipates gradual recovery of mobile network market by the end of 2023 with stronger upturn in 2024 allowing it to potentially capitalize on this trend; and overall, Ericsson remains committed to its goal of hitting an EBITA margin target between 15%-18% by 2024.

Expectations

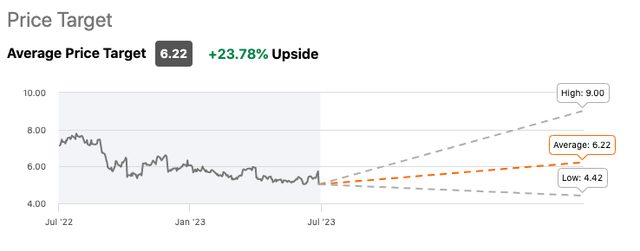

Ericsson is covered by seven Wall Street analysts with an average “Hold” rating on the stock with a rather generous +23% upside potential for its price target.

Seeking Alpha

Performance

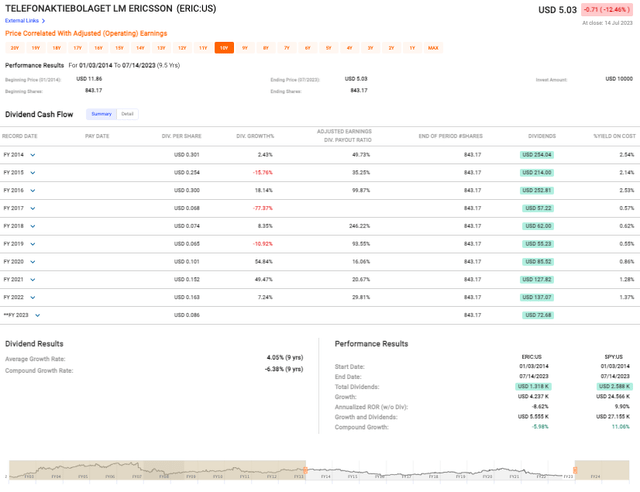

At first glance, dividend performance may appear strong: an average growth rate of 4.05% over 9 years may seem promising; but when combined with its compound growth rate of -6.38% it quickly becomes clear that dividends have been inconsistent. 2017 witnessed a huge drop in dividend per share payments compared to 2016, dropping 77.37% versus previous years; though some recovery was seen over subsequent years until 2023 when dividend per share dropped again significantly to $0.086 per share.

Fast Graphs

This erratic dividend behavior mirrors the company’s adjusted earnings and dividend payout ratio over the years, revealing a deeper instability within the company’s operations. In 2016, we saw a payout ratio dangerously close to 100%, an unsustainable level for any firm, followed by a significant spike in the ratio to 246.22% in 2018, indicating that the company was paying out more in dividends than it was earning, which is frankly alarming. This high payout ratio might signal a desperate move to maintain shareholder confidence amid poor financial performance.

Then there’s the matter of Ericsson’s share price, which has suffered a marked decrease, falling by over 57% since 2014. To put this into perspective, the annualized rate of return without dividends was -8.62% for Ericsson, while the S&P 500 Index provided a return of 9.90% over the same period. This poor stock performance and the lackluster growth rate in comparison to the broader market reflects Ericsson’s struggle to deliver shareholder value.

Valuation

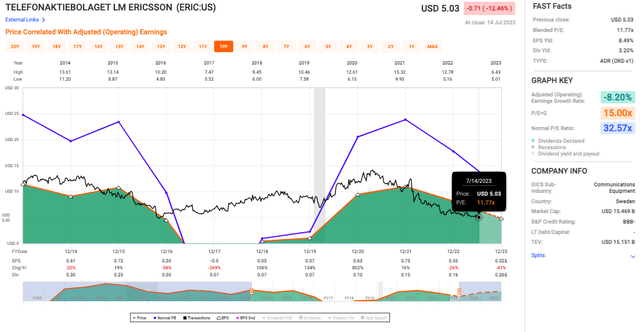

Ericsson’s adjusted operating earnings growth rate is at a concerning -8.20%. This is an obvious red flag and it indicates that the company’s operations are not driving growth.

Fast Graphs

The blended P/E ratio is another figure that raises eyebrows. At 11.77x, it’s significantly lower than the normal P/E ratio of 32.57x. The lower P/E ratio, although could signal an undervalued stock, might be justified due to the negative earnings growth rate.

The EPS yield of 8.49% is rather high, which, again, could signal a good buy if the company was stable or growing. But, coupled with negative earnings growth and lower than normal P/E, it merely underlines the risk involved.

And the dividend yield, standing at 3.20%, tells me that while Ericsson is trying to appease its shareholders with dividends, this might be a maneuver to distract from the underlying operational issues. Altogether, taking these factors into account, I’m led to a simple conclusion: Ericsson is a company that appears to be struggling.

Risks & Headwinds

One of the critical issues that caught my attention is the significant downtrend observed in the North American market. The organic revenue has registered a sharp YoY contraction of 42%, with reduced capital expenditure and inventory trimming cited as the primary reasons behind this downturn.

Now, the North American market is vital for Ericsson’s comprehensive health. If the current deceleration persists, it could severely hamper Ericsson’s overall performance, casting an ominous shadow on the future growth trajectory. The potential ramifications of this could further escalate if recovery strategies fail to effectively arrest the decline or if external market conditions continue to be unfavorable.

Additionally, the company has been struggling with its gross margin which appears to be in disarray. When adjusted for restructuring effects alone, there has been a contraction of 390 basis points YoY, taking its gross margin down to 38.3%. The primary contributors to this drop are lower sales volumes and a decrease in the Networks segment’s gross margin. This gross margin erosion is symptomatic of serious issues with operational efficiency and cost management, with the potential to erode profitability in the longer term if not addressed.

Turning to the bottom line, Ericsson has reported a net loss of SEK 0.6 billion. It’s a stark contrast from the SEK 4.7 billion net income clocked in the corresponding quarter of the previous year. The shift from profit to loss signifies deeper-rooted problems that the company needs to tackle, and fast.

Lastly, another area of acute concern for me is the negative cash flow from operating activities, which has tumbled to SEK -2.9 billion. And on top of that, let’s not overlook the significant restructuring charges that Ericsson has been dealing with. This quarter saw restructuring costs amounting to SEK 3.1 billion, primarily linked to redundancy expenses associated with cost-cutting measures. While restructuring is often a necessary step towards improving operational efficiency, it comes with a short-term cost, further pressuring profitability at a time when the company is already grappling with other financial challenges.

Final Takeaway

Based on Ericsson’s high dividend payout ratio, negative earnings growth, and disappointing performance in North America, as well as uncertainty over operational efficiency, I would rate this stock a “Sell”. While management is optimistic about 5G’s future, the jigsaw puzzle of risks tied to their current fiscal status and a conspicuous failure to churn out steady shareholder value, convinces me there’s a trove of brighter, more enticing opportunities elsewhere in the market.

Read the full article here