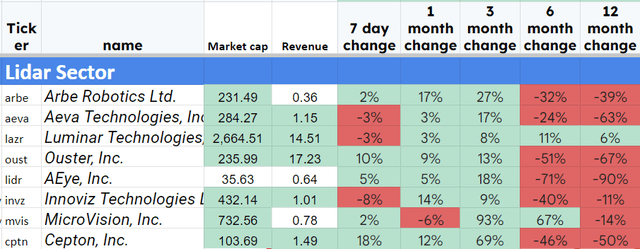

I track 7 companies trying to sell Lidar technology in the automotive industry. Commercialization of the technology is the key to success for these companies; once an auto manufacturer gives a contract to a supplier, it can run for 8-10 years, the key decisions are likely going to be made in the next two years, and as a result, if a lidar supplier has not managed to sign up a big player in that time frame the game may be over for them.

The Lidar company sector I track may have found a price bottom in the last three months and has made significant progress.

Share Price Movement (Author Database)

In February 2022, I recommended buying Innoviz Technologies (NASDAQ:INVZ) after publishing a study of 7 Lidar companies. I reviewed each company’s products, commercial progress, and financial situation in the article. At the time, I thought Innoviz was a clear winner, with Luminar and Aeye being the next best. I gave a target price of $8.40 for Innoviz, and on publication day, it stood at $4.29; today’s price is $3.47.

The market may be about to consolidate significantly; commercial success leads to clear winners and losers in this industry. The Ouster-Velodyne merger was probably just the first step.

Commercial Progress

By commercial success, I mean the award of contracts by automotive manufacturers.

Several Companies have not yet managed to announce any production customers. Aeva Technologies (AEVA), AEye Inc (LIDR), and MicroVision (MVIS) fall into this category. Arbe Robotics (ARBE) is a radar company that makes a competitive device for lidar. I have written about them twice, once speculating that they have signed with Tesla (TSLA). I still think that speculation may prove to be true, and if so, they have excellent prospects.

Innoviz, Luminar Technologies (LAZR), and Ouster (OUST) have announced significant contracts with manufacturers. Cepton Inc. (CPTN) is a relatively new entrant to my sector, they have a behind-the-windscreen lidar device that has signed up a significant OEM partner, and I will be watching their progress closely.

Ouster now falls into a different category; they have thousands of customers in four vertical markets, and 22% of their business is focused on automotive applications.

Luminar has signed contracts with Mercedes, Polestar, and China’s largest auto manufacturer SAIC.

I will write about Ouster and Luminar in the coming months.

Innoviz Commercial Progress

Last February, the commercial progress of the InnovizOne product stood out. Innoviz had a production contract with BMW with the OEM Magna for the BMW 7 series and was in advanced negotiation with Hirani and Harman. Obayashi announced it was adding Innoviz Lidar to its Crane offering.

The speed of commercialization has accelerated significantly since then.

After winning BMW 2018, it took us over three years to win our next production award. From them, it took us a full year to announce the next one. In the past year, we’ve already announced two production awards along with today’s new program. And looking forward, we think there are three to five programs that have the potential to make decision before the end of the year. I believe this timeline shows some solid evidence that the pace of LiDAR decision making is likely accelerating. We feel very confident about how we are positioned in the process, and we hope that we will have much more to share in the comic motors, and this outlook is embedded in our 2023 targets.

(INVZ: 2023 Earnings call Q1 2023 Transcript, 2023-5-17)

INVZ now has four series production awards, and they have added VW as a customer, quickly becoming INVZ’s largest.

The agreement with BMW has expanded to include more models (i5 and i3). A new commercial vehicle has been added from an existing customer (not named yet).

In 2022, following more than two years of extensive diligence and qualification, we were selected by Volkswagen as its direct LiDAR supplier for automated vehicles within the Volkswagen brands with our InnovizTwo next generation high-performance automotive-grade LiDAR sensor. Later in 2022, an Asia-based automotive OEM selected us to serve as its direct LiDAR supplier for series production passenger vehicles.

(INVZ: 2022 20-F, 2023-3-9)

Innoviz appears to be making excellent progress across the board with manufacturers.

Between the programs we’ve already announced in the 10 to 15 in the RFI and RFQ pipeline, we’ve either have already won business or are actively quoting new awards with eight out of the top 10 global automakers.

(INVZ: 2023 Earnings call Q1 2023 Transcript, 2023-5-17)

Start of Production

This is the key commercial time frame; once a project makes SOP, it could be worth tens of millions of dollars annually per car model. The BMW i7 accounts for 43% of all series 7 sales, and BMW sells around 50,000 units per year, which would imply somewhere in the region of 86,000 lidar units per year. BMW has not yet said which 7 series cars will have lidar, and it could be more than just the i-version. (price expectation is $500-$1,000 per unit, so the BMW order should generate upwards of $43 million a year)

The latest guidance from the Q1 2023 earnings call regarding the start of production was as follows:

BMW Q4 2023

Shuttle Program Q4 2023

Asian OEM Q4 2024

Light Commercial mid-decade

VW Mid decade

The Light Commercial is an interesting deal; INVZ is replacing a supplier already selected and moved to the development phase, hence the accelerated time scale. Test vehicles are already on the road, so I expect some revenue next quarter.

The deal may have other positives, it is the second contract with this particular OEM, but the LIDAR is being integrated into a new Compute program. A compute program is the software that controls the vehicle sensors. INVZ aims to integrate with every compute program.

This opens the possibility of working with the compute program manufacturer on other contracts; as the original lidar supplier was rejected, they may prefer to go with INVZ in the future.

Strategy Changes

INVZ decided to become a Tier–1 supplier to the automotive industry. This means they deal directly with the manufacturer rather than through an OEM; this allows direct technical negotiation and possibly offers greater pricing flexibility. It does come at a cost, as INVZ will need the personnel and the procedures to deal directly with these large international companies. In the earnings call, the CEO said this decision had led directly to design wins in Europe and Asia.

Some manufacturers choose the compute program and integrate sensors with it; others choose them in parallel. Being integrated with as many compute programs as possible is an aim of Innoviz, and they continue to negotiate with Nvidia (NVDA).

We are in discussion with NVIDIA about being integrated into sales production programs, leveraging their Hyperion platform. These conversation span multiple major OEMs and could introduce RFI and RFQ activity that ultimately would be incremental to the NVIDIA based programs that are already in our pipeline.

(INVZ: 2023 Earnings call Q1 2023 Transcript, 2023-5-17)

Cariad

Cariad is the software integration company at VW. Cariad are building a unified Tech Stack that will be used by all 9 VW brands ( Porsche, Audi, Volkswagen, Volkswagen Commercial, SEAT, Skoda, CUPRA, Lamborghini, and Bentley). It includes Software and Hardware, sensors, cameras, and actuators. The Cariad website says they will control electric cars in three zones Body, Motion, and Energy. Being a supplier inside the Cariad system will be a guarantee of huge volume. VW produced almost 9 million vehicles last year (down from a peak of 11 million in 2018), representing a potential 36 million lidar units. Innoviz would appear to be the front-runner to win this business.

Cariad has a vision of the car as a partner, it would act as your valet, parking itself. It is a chauffeur on the highway and, combined with CISCO (CSCO), a communication, business, and entertainment center.

Next, I want to give a quick update on our largest customer, Volkswagen. There have been several industry headlines lately regarding changes in the internal software company, CARIAD, and we are happy to say that we continue to work towards a mid-decade SOP for our existing series production. I’m also happy to announce that we continue to explore new ways to grow our relationship with the company, and we are working with both Volkswagen and CARIAD on additional programs, including several that are advanced stages of discussion.

(INVZ: 2023 Earnings call Q1 2023 Transcript, 2023-5-17)

Cariad has enormous potential. I searched through the SEC filings of all the Innoviz competitors (mentioned in this article). Cariad was mentioned nine times in Innoviz earnings calls during 2022 and 2023 but not by any competitor. This does not mean that the competitors are not trying to get the Cariad business, just that the relationship is not yet sufficiently advanced for them to obtain permission to mention it.

For now, Innoviz is the front-runner for this huge business.

Manufacturing

R&D is based in Israel with a smaller facility in Germany and accounts for 297 staff members. (out of a total of 468) Innoviz does not currently have a manufacturing facility. Magna International (MGA) is building the InnovizOne for BMW at its US facility (Michigan). A small production line exists in Germany.

InnovizTwo, the product for VW, is currently being built at the small Innoviz line. However, that line is incapable of volume production. Innoviz is designing a 200k unit capacity machine, and they intend to replicate this high-capacity line placing them with contract manufacturers as needed. Innoviz does not currently intend to build, own or operate manufacturing facilities (final question Q1 earnings call)

I think INVZ may rethink this strategy; they are trying to be a tier 1 supplier dealing directly with the manufacturer, which may require them to build their own factories eventually.

Financials and Forecasts

Income before the start of production

Before the start of production, INVZ receives income for the units it sends for testing, and I expect to see the light commercial vehicle income start to arrive next quarter.

The first SOP is due towards the end of this year and should show up as revenue from Q1 2024. Before then, Lidar companies make income from what is known as NRE’s. Pre-production test units shipped in the hundreds as auto manufacturers build test cars and work on designs. These pre-production models sell for between $5,000 and $15,000. They are extremely high margins and pay for much of the capital expenditure required.

The pre-production and test models represent millions of dollars of income but don’t always count as revenue. They are cash collected, and Innoviz has decided to publish this measure from now on. They gave guidance of $20-$30 million in what they are dubbing cash collection (that’s revenue plus NRE’s).

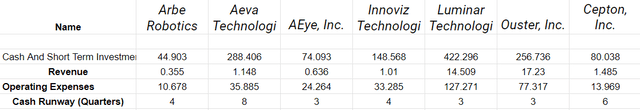

The cash collection transforms the following data (in $million for last published quarter)

Financial Summary (Author Database)

I will try to determine a comparative cash collection metric at Ouster and Luminar. It implies that cash collection will be 8 times as big as revenue for 2023 and that Innoviz has more than one year of cash available.

In the latest earnings call, they said commercial production will begin in 2023.

Two of those awards BMW, Shuttle program are on target to SOP in the back half of this year.

If that happens, then Innoviz will have made it to production from the SPAC launch in April 2021 without raising any debt and with zero shareholder dilution (they deserve some kind of award)

Innoviz has guided to a price per lidar of between $500 and $1,000 when in full production. The Cariad deal could end up approaching 36 million x $500 = $18 billion. Even if Innoviz managed to secure all of that business, which is extremely unlikely, it would be decades before every VW has a complete Cariad system.

Innoviz has zero debt and only $60 million in total liabilities, with $149 million cash plus $69 million in long-term assets. It is in a pretty solid financial position.

Conclusion

Innoviz appears to be moving towards full commercialization of its products and has signed up both BMW and VW as customers.

In the second half of this year, I will be looking for Innoviz to deliver on the $20-$30 million cash collection they have guided to and to see the start of production announced on the BMW and the Shuttle programs.

Innoviz has said they will announce an additional 1-3 design awards in the year’s second half.

They are a young company and have somewhere in the region of 1 year’s cash on hand. They need to deliver on the cash collection and start serial production later this year to ensure that the cash reserve is sufficient to make it to the major production ramp-up expected in the middle of the decade.

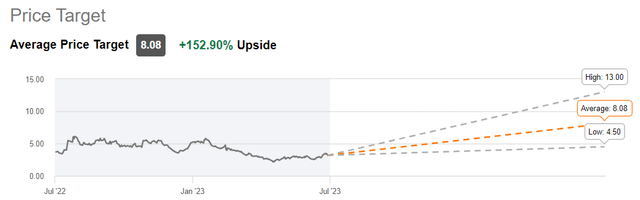

They still look like an excellent Investment; I will hold on to my position from last year and re-affirm my price target of $8.40, which is now in line with Wallstreet.

Wall Street Price targets (seeking Alpha)

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here