This article was originally published on The Pragmatic Investor Investing Group

Thesis Summary

SoFi Technologies (NASDAQ:SOFI) is a revolutionary company operating in the FinTech space. The stock has garnered much attention in the last few weeks after a spectacular run-up in the stock price.

While this stock certainly doesn’t look cheap, it’s executing well in the fast and exciting environment of the fintech space.

I see a lot of potential for SoFi to leverage its existing client base and turn itself into a banking mammoth.

Company Overview

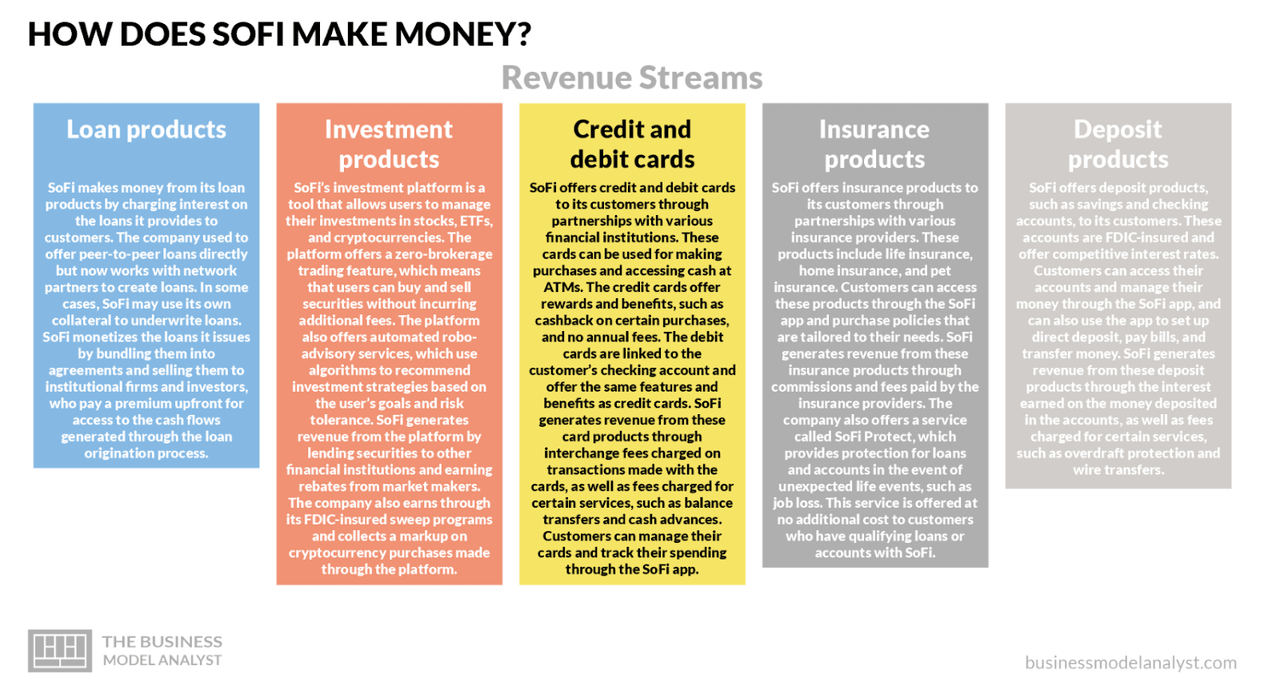

SoFi provides diversified technological solutions in the finance space, and as such, has various streams of revenue. Let’s break these down:

SOFI revenue streams (Tech business)

Loans are a big part of the company’s business, especially student loans. SoFi has a young client base, which it attracts through its student loan offerings, and then leverages through other offerings. SoFi also has an investing platform from which it accrues fees. It issues debit and credit cards, facilitates insurance products and also CDs.

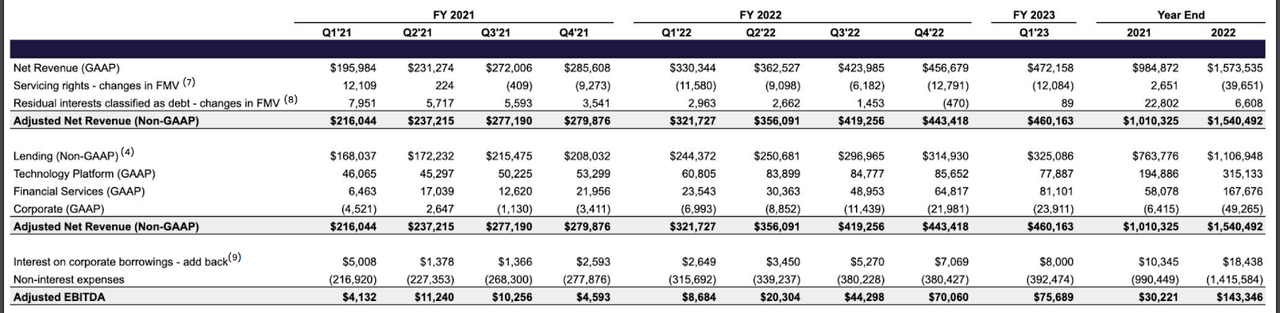

Now, let’s look at how each of these products fit into the company’s segments and how these have performed in terms of revenue over the last few quarters.

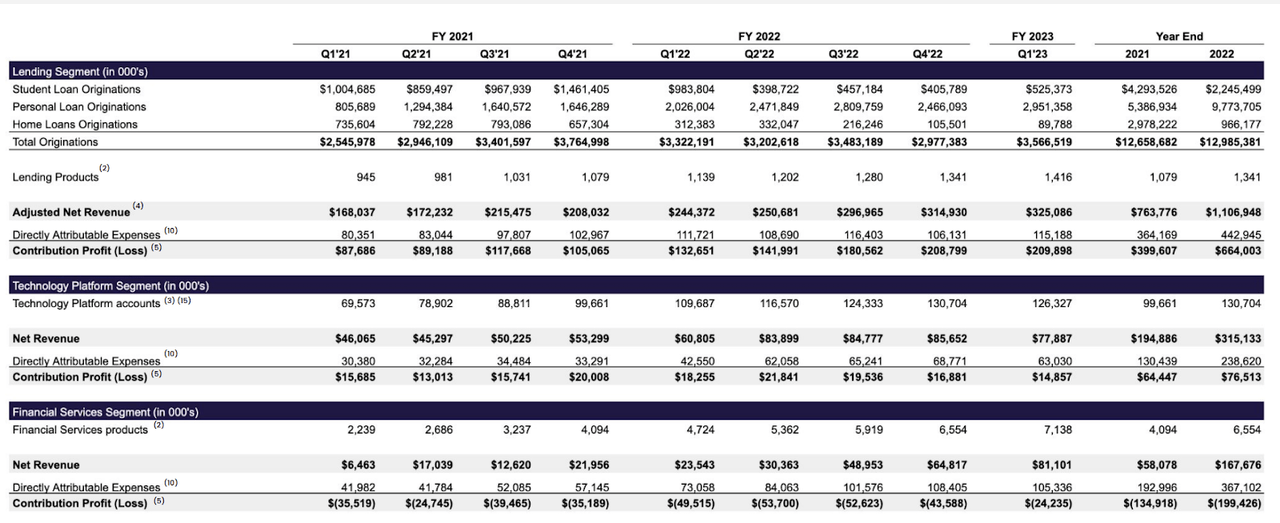

SoFi segment revenue (Investor slides)

As we can see, SoFi has three revenue-producing segments.

The lending segment is the most significant, contributing close to $13 million in revenues in 2022. Within this segment, we have home, personal and student loans. Student loans are SoFi’s largest market which is why the recent Supreme Court decision was such a big deal for SoFi.

Student loan originations came down through 2022 but have come back up in 2023.

The financial service segment was the second-largest revenue source in the last quarter. This includes provision of deposits, credit cards, brokerage accounts etc.

This has been the largest growth segment for the company, though we can see that it is still operating at a loss.

Lastly, we have the financial technology segment, which includes Galileo and the Technisys. These are B2B platforms that provide services to other neobanks. As we can see, this segment grew at a fast rate in 2022, but has moderated in Q1 of 2023.

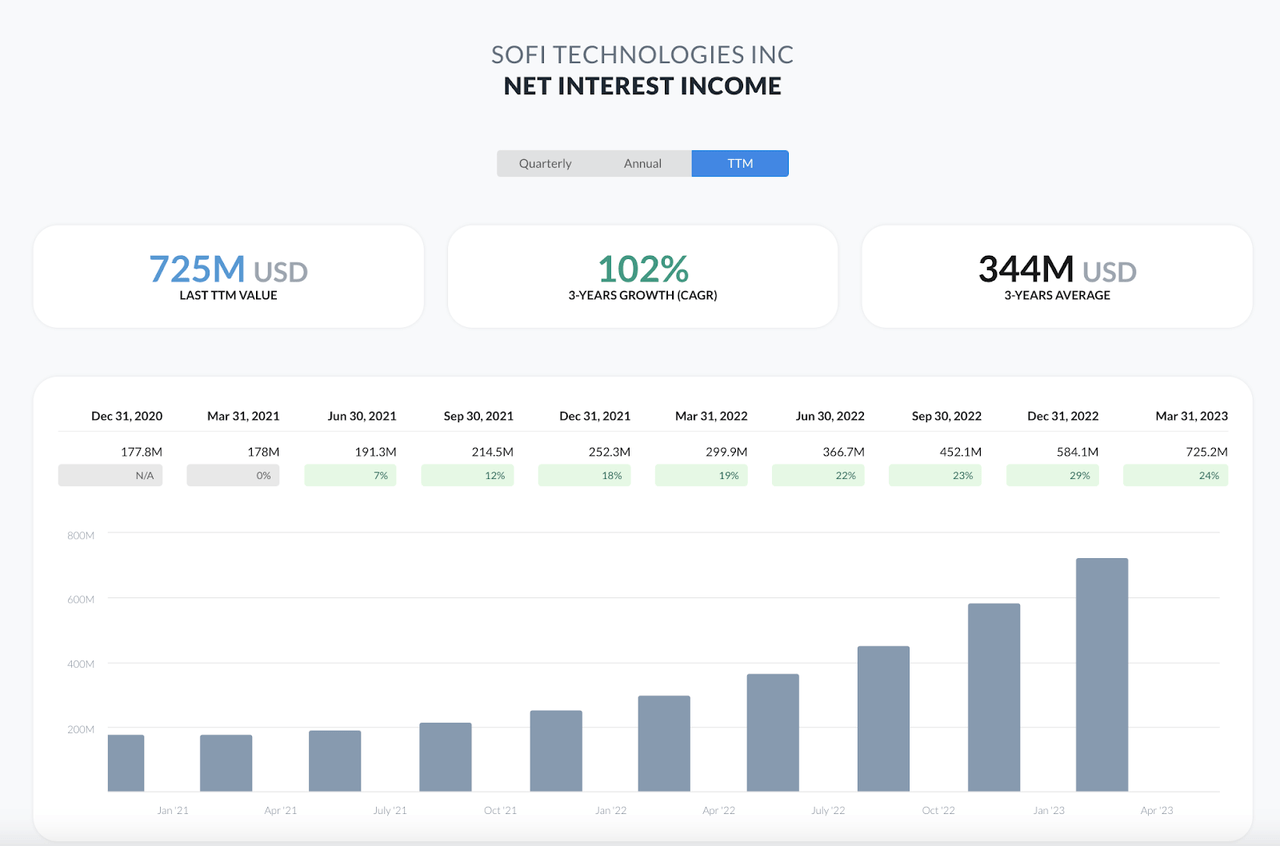

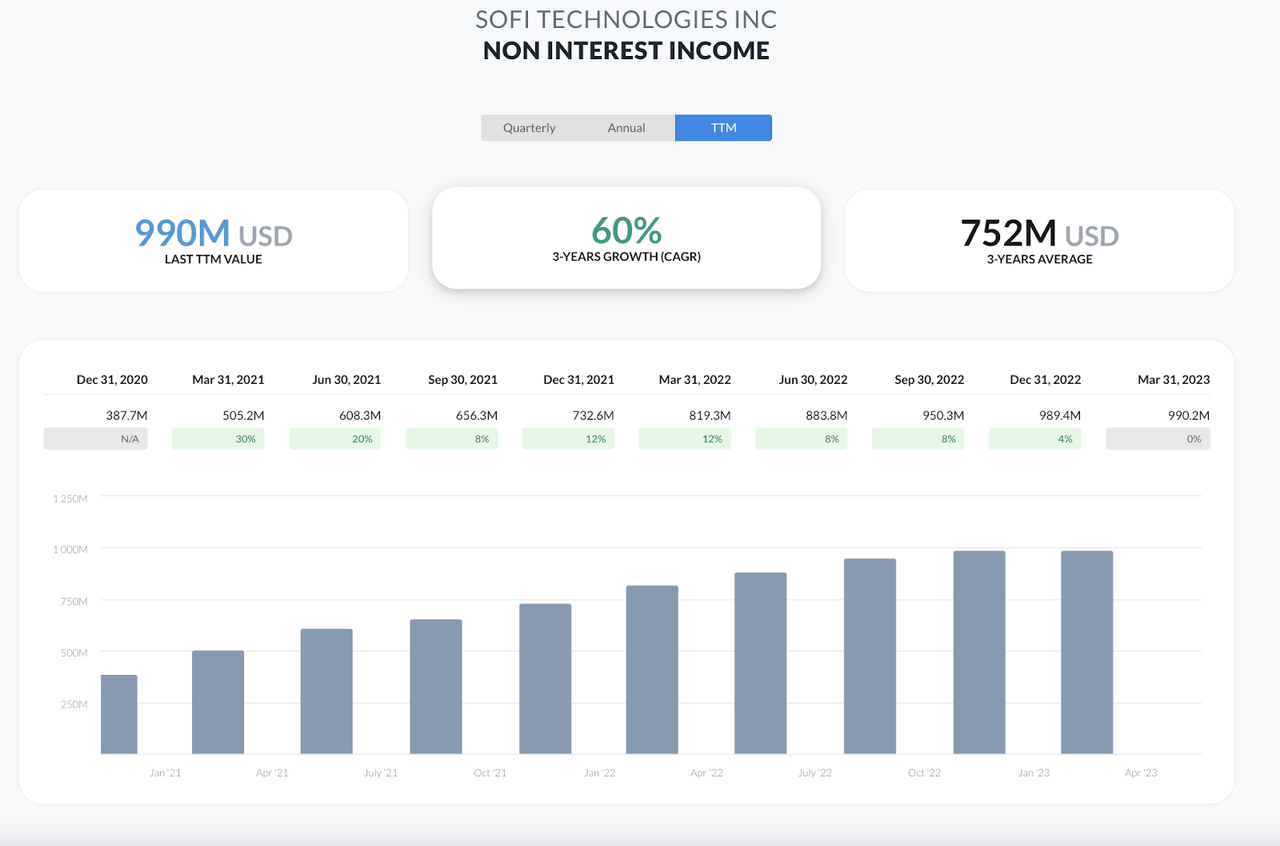

Now, let’s look at the top-line number in terms of interest and non-interest income:

SoFi Income (alphaspread) SOFI non-interest income (alphaspread)

As we can see, net interest income has grown at a 102% 3-year CAGR, while non-interest income has grown at 50% CAGR.

Now let’s see how this translates in terms of how this translates to adjusted EBITDA/Net income.

SOFI EBITDA (Investor slides)

SoFi has quickly moved from barely breaking even to making over $75 million in Adj EBITDA by Q1 2023.

Profitability has been increasing at a very fast click, which is great to see. This was perhaps one of the most standout notes from the latest quarterly report:

We delivered another quarter of record financial results and generated our eighth consecutive quarter of record adjusted net revenue, which was up 43% year-over-year. We also generated our third consecutive quarter of record adjusted EBITDA at $76 million, representing a 48% incremental EBITDA margin and a 16% margin overall, as well as a 54% incremental GAAP net income margin…

Source: Anthony Noto, CEO of SoFi Technologies, Inc.

Why I Like SoFi

Here’s what I really like about this company.

In the last few quarters, we have seen concrete evidence of how the company can greatly increase its profitability.

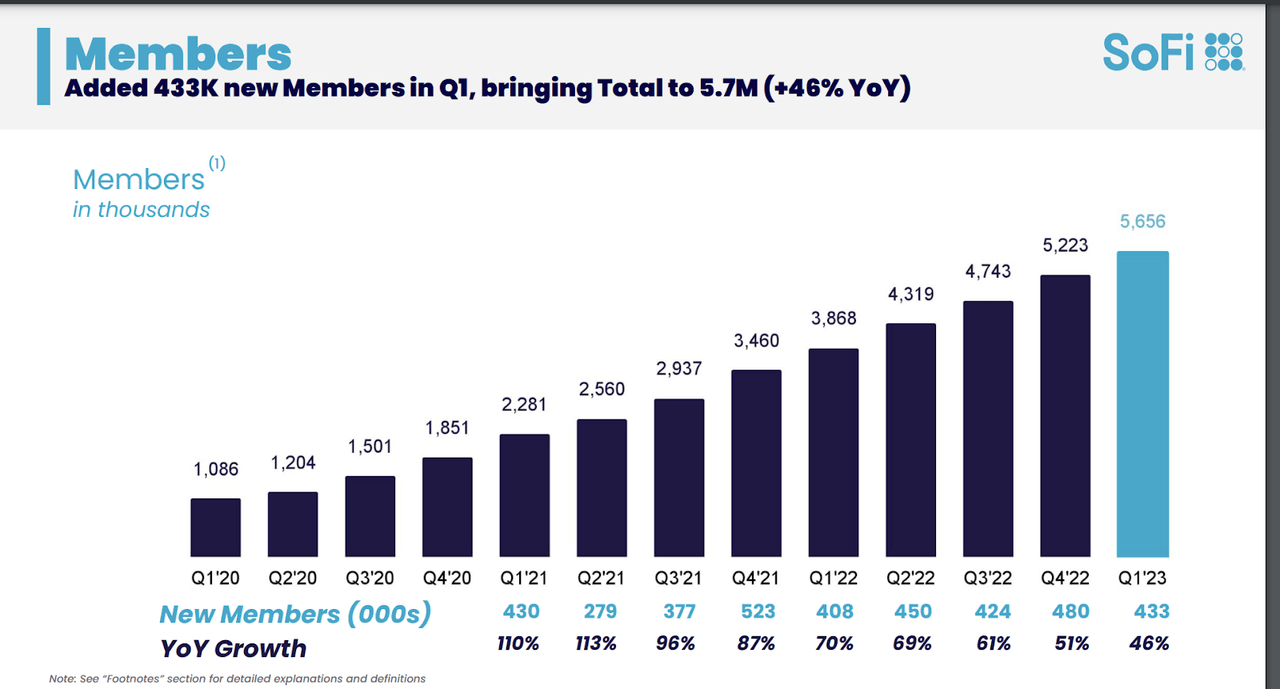

In the third quarter of 2022 SoFi spent almost $115 million on sales and marketing which generated 377,000 new memberships. This adds up to a per-customer acquisition cost (CAC) of about $305.

In Q4, SoFi invested around $130 million on sales and marketing and brought in 523,000 new members. The CAC was then $248.

With that said Q1 2023, the company spent $175 million on sales and marketing, adding 433 thousand new members. This means the CAC was actually close to $404. Granted, this seems like a step back, but we must understand that each new client is a great revenue-adding opportunity for the company, especially in the future.

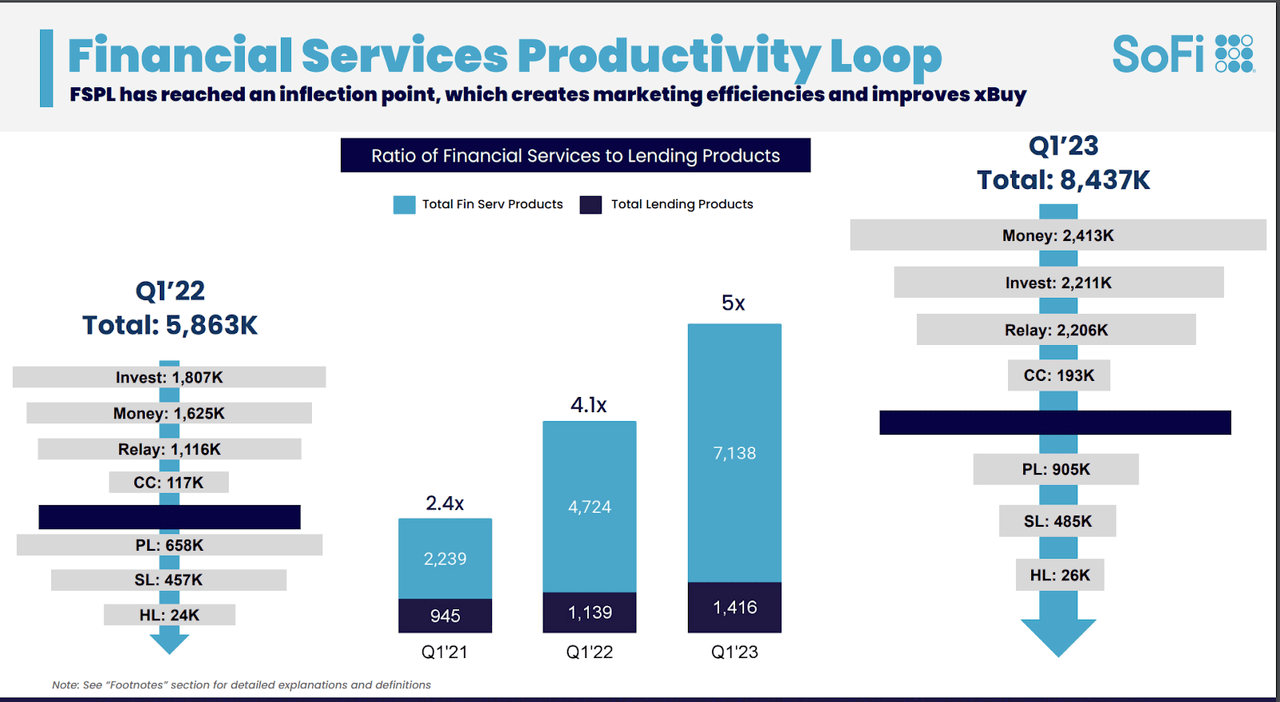

Productivity loop (Investor slides)

As we can see from the chart above, SoFi users tend to start by opening a brokerage account or a CD, and then slowly move into using other products, and even taking loans, which is the highest margin activity for SOFI.

Granted, we have been and continue to be in a tough environment for financial stocks, but this is why I believe SoFi’s revenues could explode once the environment for credit is more favourable.

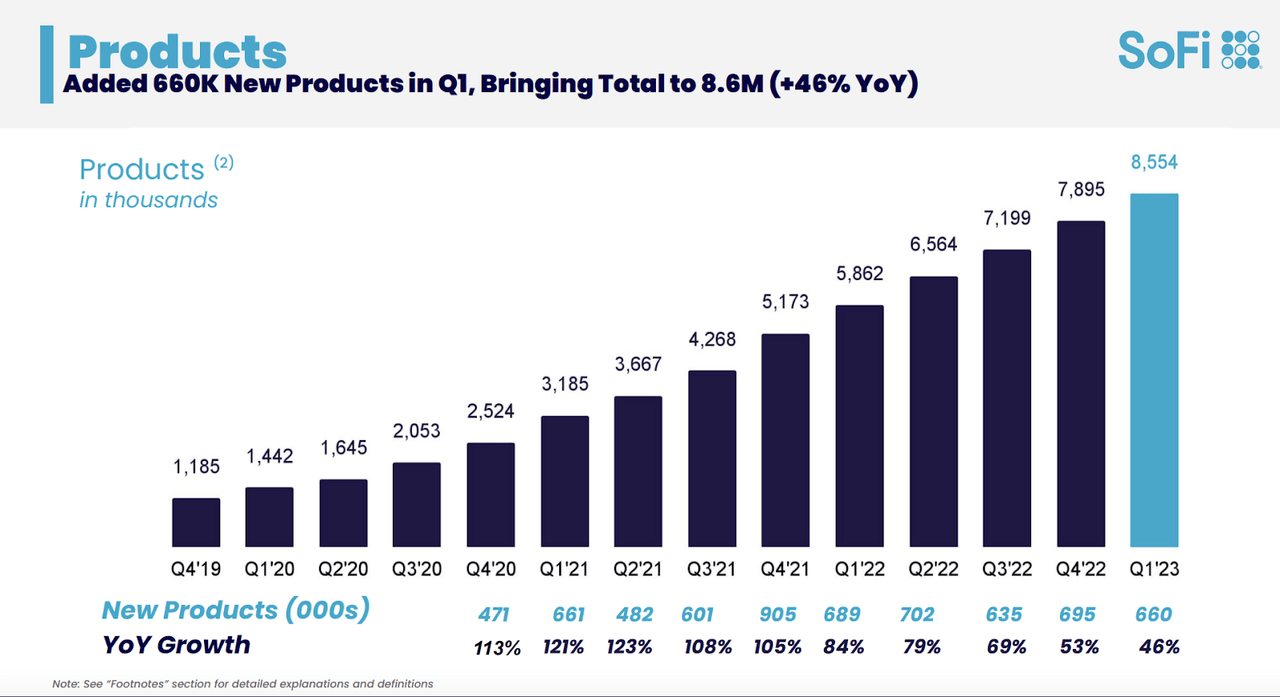

With that said, the other thing I like about SoFi, and what is obviously attracting a lot of investors too, is the high growth rate.

Despite the harsh environment, SoFi has been posting steady growth across the board:

SoFI products (Investor slides) Members (Investor slides)

Both in terms of members and products, we have very sold YoY growth.

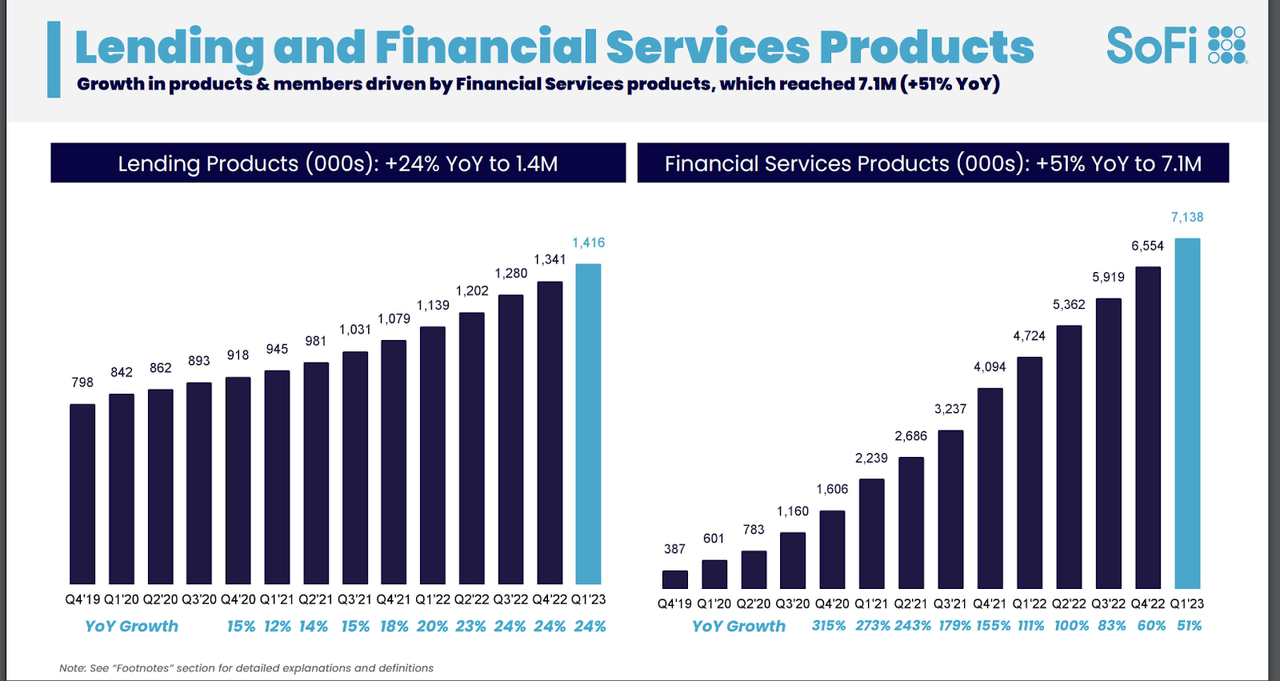

Lending and financial services products (Investor slides)

We can also see this when we break down lending and financial service products. Furthermore, we can actually see very strong QoQ growth, showing an acceleration from previous quarters.

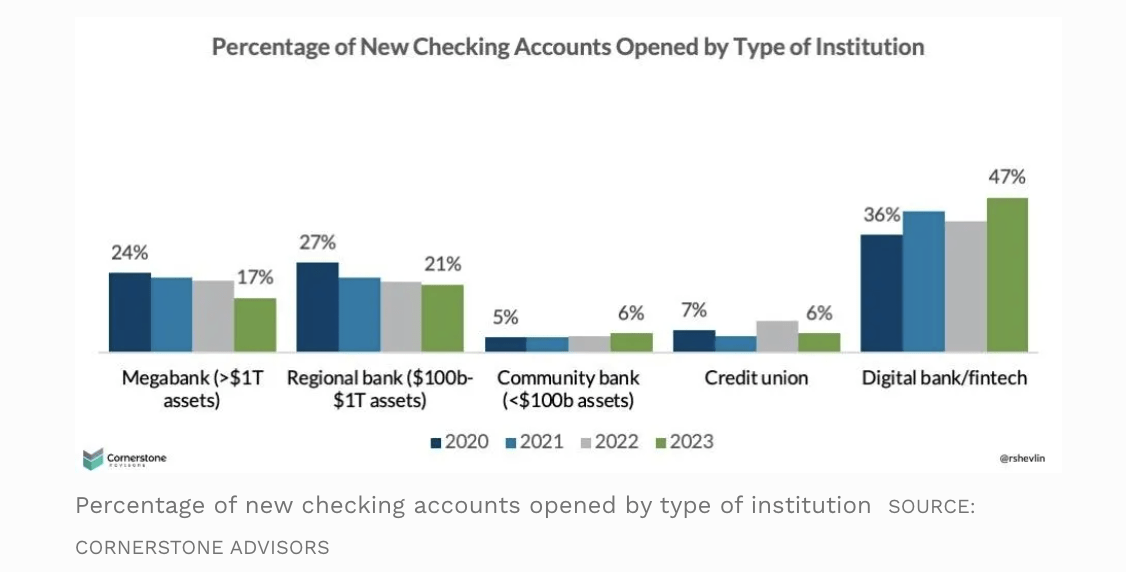

SoFi is performing very well and leaving traditional banks in the dust. A recent study by Cornerstone Advisors found that FinTech plays are absolutely dominating the market in terms of new checking accounts.

New checking accounts by institution (Cornerstone)

In 2020, SoFi accounted for 1% of new account openings and Wells Fargo’s share was 8.1%. In the first half of 2023, SoFi’s market share quadrupled to 4% while Wells Fargo’s share dropped by more than a half to 3.5%.

Source: Forbes

Consumers have made up their minds and it is clear in the trends. SoFi is popular amongst the young generations of today, which will be the big spenders of tomorrow.

Forecast and Valuation

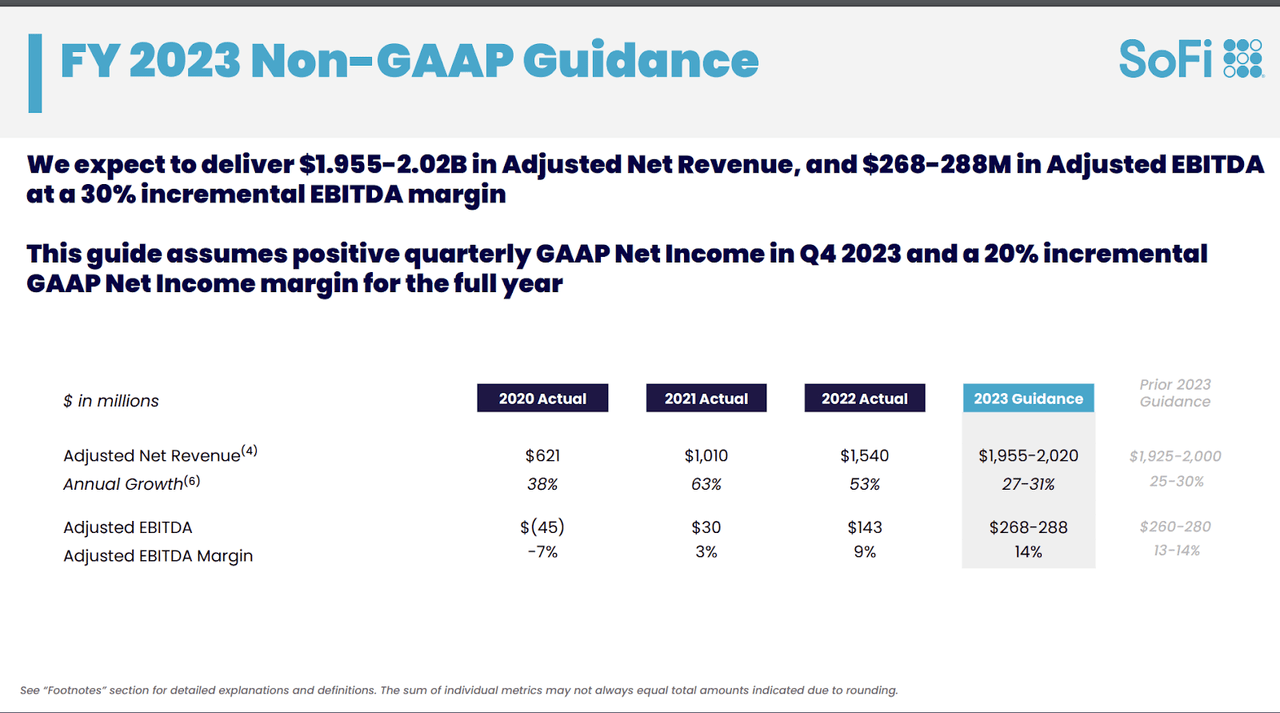

Moving forward, the company has guided towards 30% revenue growth in 2023, and a 14% adj EBITDA margin, showing a continued increase in profitability.

FY 2023 (Investor slides)

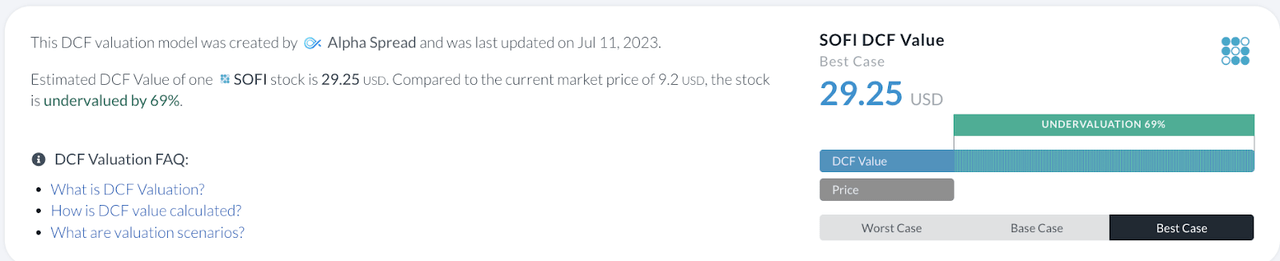

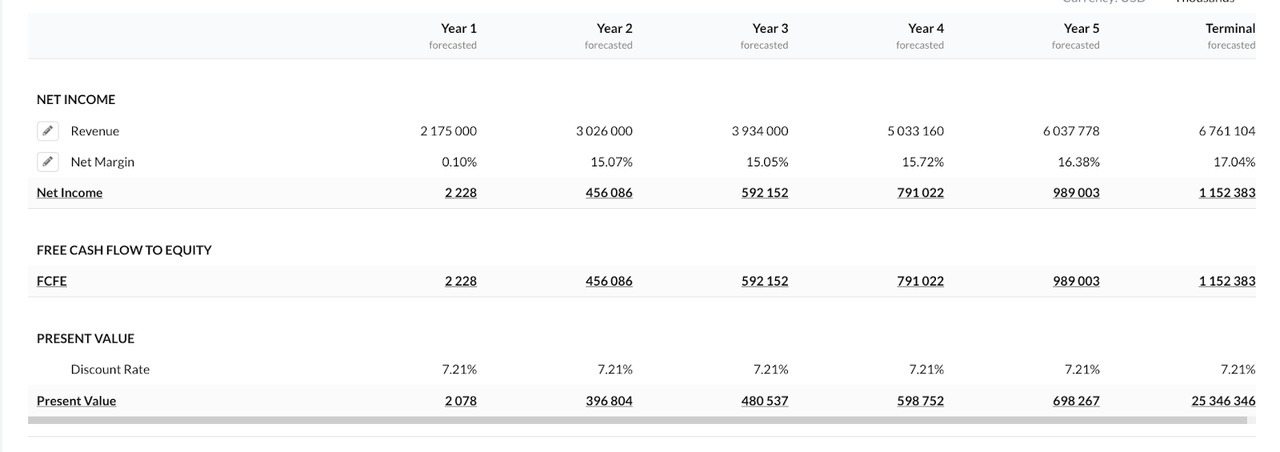

In terms of valuation, the best-case scenario DCF model provided by Alphaspread shows SoFi could be worth close to $26:

DCF value (alphaspread) DCF valuation (alphaspread)

This model assumes that the company could reach 6.7 billion in revenues by 2028, with a net income of 1.15 billion.

This implies SoFi can slowly increase its net margin to 17%, and continue to grow at a CAGR of 25% over the next five years.

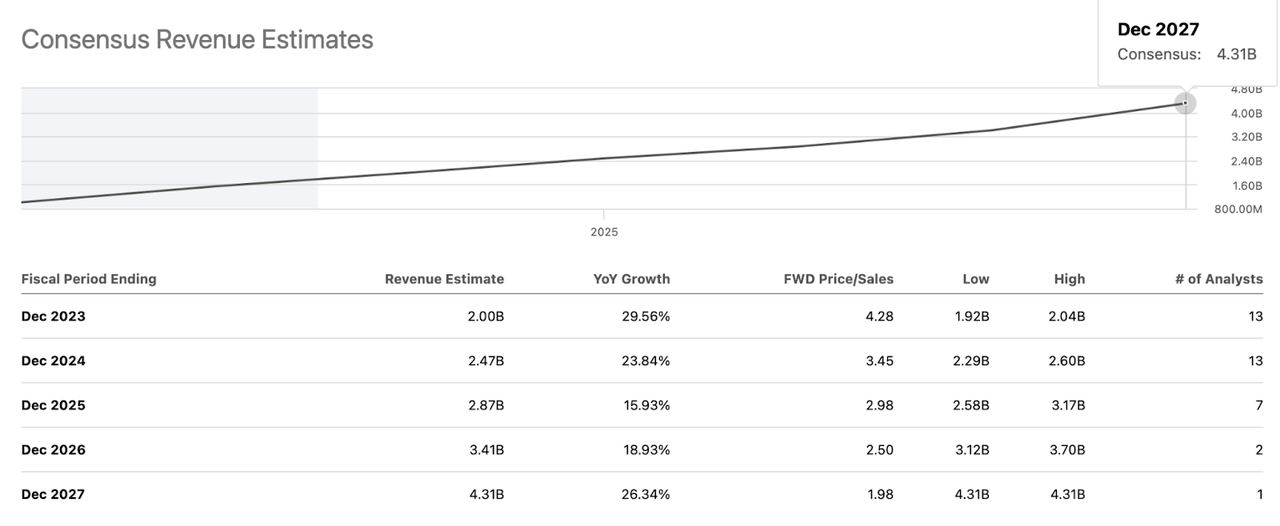

The revenue growth rate seems to be a bit more optimistic than what analysts expect:

Revenue estimates (SA)

Consensus has SoFi reaching 4.31 billion by 2027, which applying another 27% growth, would have us at 5.5 billion by 2028, a bit below this estimate.

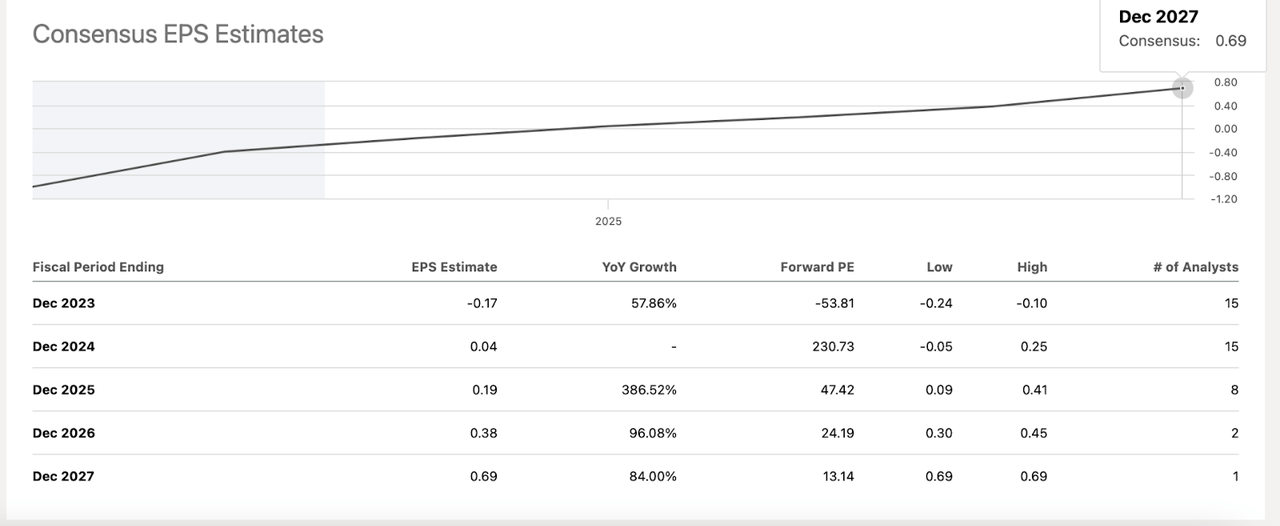

Net Income of $1.152 billion would imply, given no dilution, EPS of $1,2, also a bit optimistic based on the analyst consensus.

EPS estimates (SA)

With that said, I think that the profitability potential is underestimated. Financial companies average around a 20% net income margin, and I’d expect a company like SoFi to be able to do reach this if not more.

In any case, even if we adjust the DCF valuation, SoFi should be worth, in my opinion, at least $20, which is twice its current price.

Technical Analysis

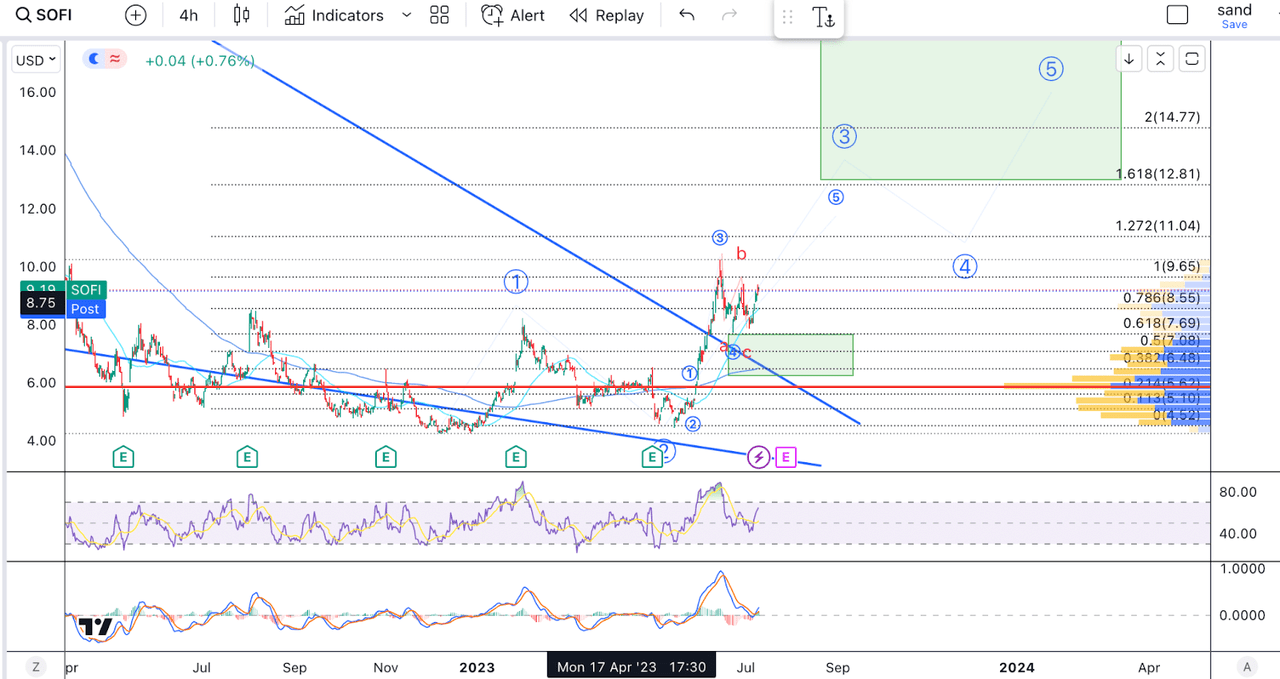

Looking at the SoFi chart, we have already run quite a bit, and why might not get another great spot to add from a short-term perspective?

SOFI TA (Author’s work)

I believe we are close to completing wave 3, which should take the stock into the $12-$14. Following this, we might see a retracement in wave 4 that will take us back to these levels.

If we do break below recent lows, then we can see that we have very strong volume support back at $6, but I’d be very surprised if we went this low. The 200 day MA and the downward trendline should provide support well before that.

This is still only an initial five-wave impulse, off what I’d consider to be the start of a much larger trend. SoFi has a lot of room to run to the upside over the next decade.

Other considerations

While SoFi could be a great long-term investment, there are a few things to consider.

Firstly, there is still some political risk concerning its student loan portfolio. However, this has largely dissipated, with the Supreme Court stopping Joe Biden’s plan to pardon them.

It’s also important to note that the company, which is still running at a loss, might have to carry out some dilution if it does not break even in 2023.

Lastly, as pointed out above, there isn’t an excellent entry point after the recent run-up, and a lot of the more immediate gains have been realized.

Final Thoughts

SoFi is a fast-growing company with strong fundamentals. While it is hard to value, I think this should be worth at least $20 as of today and will be worth a lot more in the future. Until proven otherwise, it seems like SoFi is a consumer favourite, executing well in terms of growth and profitability.

Read the full article here