Last week I described how the unprecedented success of Taylor Swift’s Eras Tour was likely delivering outsized revenues to certain hotel REITs. I prefaced the article with citing that Sweden’s Central Bank had attributed Beyonce’s European Tour’s extreme success for triggering outsized inflation in their economy. Tit for tat, this week the Fed’s Beige Book gave the nod to Taylor Swift’s tour for amping up the US economy.

We covered Swift’s Tour first because it kicked off here in the States and will be a big profits driver for hotel REITs’ 2Q23 results. We follow on now with the schedule for the North American leg of Beyonce’s Renaissance Tour because it hit the States in July. We want to see how hotel REITs are impacted by Beyonce’s tour and how that might layer and complement the Taylor Swift impact.

The Exercise

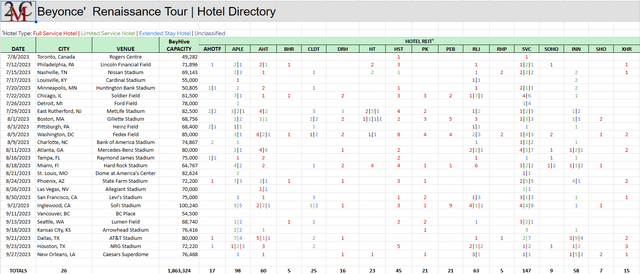

Portfolio Income Solutions maintains a Property Directory that identifies commercial real estate owned by public real estate companies across the nation’s top 50 MSAs. In a thematic investment pursuit such as this, we could use the directory to screen for who owned the hotels in the submarket for each of Beyonce’s 26 stadium shows.

Portfolio Income Solutions

Included in the screen are the 16 US-based, publicly traded hotel REITs as well as Canada-based, but US hotel-owning, American Hotel Income Properties (OTC:AHOTF, HOT.UN). The hotels identified in the tour cities are color-coded by property type (Full-Service Hotel, Limited Service Hotel, Extended Stay Hotel, and Unclassified).

The bottom line tallies the parameters of the screen.

*The tour has twenty-six shows in twenty-six cities.

* The stadiums accommodate seating for almost two million BeyHive fans. Presumably, some of those 2MM fans will need a place to stay.

* Each REIT had at least some “Event Night” exposure across the path of the tour. The bottom line tallies the number of property level “Event Nights” each REIT has for the entire North American tour.

The Winners

With 147 Event Night exposures, Service Properties Trust (SVC) is the hands-down winner. SVC has properties in 24 of the tour cities.

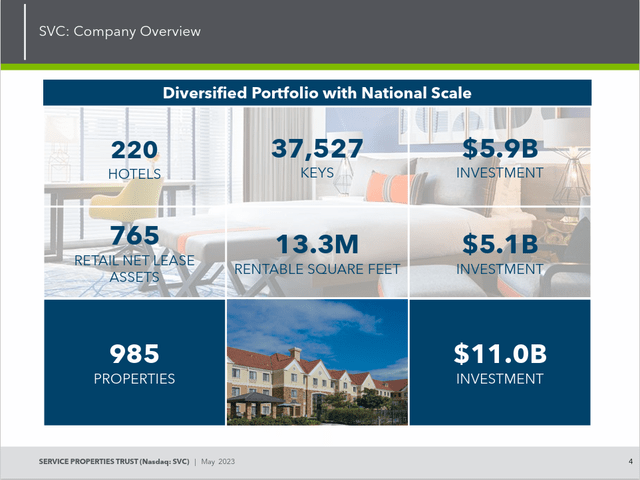

SVC

SVC

SVC owns 220 hotels with more than 37,000 rooms, so 147 event nights don’t necessarily make the quarter, but if those event nights create significantly higher occupancy, room rates, and REVPAR, that improvement all translates to margin expansion. The point is that the concert exposure is extra.

With 98 Event Nights, Apple Hospitality (APLE) was a very strong 2nd on the screen. APLE has properties in 23 of the tour cities.

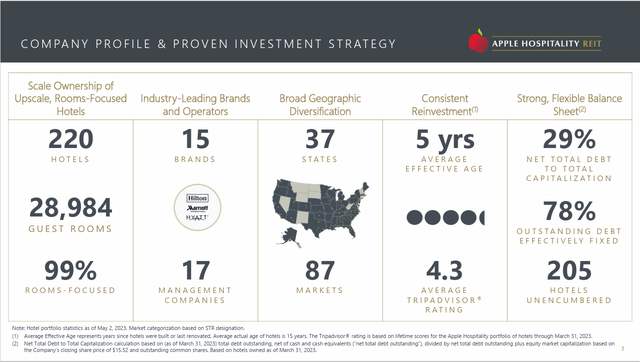

APLE

APLE

APLE also has 220 hotels with almost 29,000 rooms. While the mega concerts are a bonus, Apple has a focus on being in cities that have a busy, year-round events calendar, like Austin, TX, where APLE owns seven hotels. Austin is the home of the 51,000 student University of Texas, as well as the State Capitol and the world headquarters for Tesla, Inc. (TSLA).

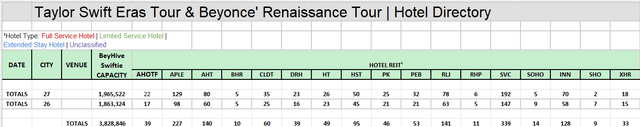

The Additive Effect

If we were just considering the economic effects of Beyonce’s tour in the markets on her schedule, we would conclude the tour will have a very positive impact for the 3rd quarter earnings results of Service Properties Trust and Apple Hospitality. If we look back a week and layer the 2Q and 3Q compliments of Taylor Swift’s economic impact onto the Beyonce numbers, we see unprecedented growth in revenue.

Portfolio Income Solutions

If Tesla forecasted that it would deliver 1,000,000 vehicles against a prior forecast of 800,000, the stock price would likely go up. Tesla repeatedly cut prices during the period they forecast higher unit delivery. The stock price still went up.

During 2Q and 3Q 2023 certain hotels are likely to rent more rooms at significantly higher rates in response to America’s resurgent interest in and willingness to spend on pop music live performance. Service Properties Trust and Apple Hospitality portfolios are geographically ideally positioned to repeatedly capitalize on this trend.

In light of this trend, SVC and APLE are cheap. They are cheap on an NAV consideration, on a price/FFO consideration, and cheap relative to their peers. They are cheap in the economic trend.

We are long both SVC and APLE.

Read the full article here