Dear readers/followers,

My stances and investment history on the Rogers Corporation (NYSE:ROG) have been a history of success, objectively speaking. I’m saying that because since my first bullish article on Rogers after the M&A deal fell through, the investment is up 67.44% – and that is since November 2022. You can find my first article on the company here, titled Rogers: Why The Company Is Worth More Than $100 After Third-Quarter Results.

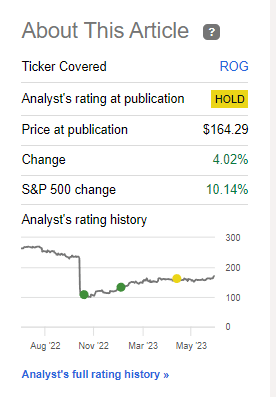

Since that stance though, I went to a “HOLD” and neutral rating in my last article and even discussed potential rotation. Why did I do this?

Seeking Alpha ROG RoR (Seeking Alpha)

Because I’m a value-oriented conservative investor. I realize that after a company does a 60-120% RoR in a short time, chances are, unless it’s a ZIRP-oriented growth stock, there might at some point be a stop to how much it can advance after. Or, as in Rogers, I actually believe that based on a conservative outlook, the company is fully valued.

A fully-valued no-dividend company on the right side of a failed M&A is not a business I’m looking to get exuberant about – not in this market.

Still, Rogers has an upside and has some good parts still – so let’s look at these parts and give an update and a look into 2H23.

Rogers – Plenty to like, but not necessarily at this valuation

Rogers is, all things considered, a very good business. That is why I invested in it in the first place (that and the fact that it was massively undervalued). The history goes back over 160 years’ time, even though the early operations hardly had anything to do with what the company is doing today…

ROG IR (ROG IR)

The company has manufacturing bases and representation across the world, with sites in the US, UK, Germany, Hungary, Korea, and China. Almost a billion dollars of 2022A revenue with 5,000 customers in 70 countries makes this business a not-insignificant player, and a proven way, at the right valuation, to make a decent profit.

The company is a major player in Material and Electronics solutions. It solves issues for its customers, such as signal integrity (RF), power efficiency, and polymer material performance for areas like communication, electronics durability, reliability, energy conversion, autonomous driving, EV tech, and other areas. Here are the company’s brands and some of its key end markets and customers.

ROG IR (ROG IR)

Some of the company’s key potential lies in the growth rate prospects for the business. This is correlated to GDP growth, and growth in key end markets like renewables, portable electronics, aerospace/defense, ADAS, EVs, and others. The company has ambitious 2025E growth targets, expecting a 10-20% sales growth and improvements in EBITDA margins of no less than 800-1000 bps, or 8-10%, derived from things like OpEx scaling, manufacturing efficiency, improving its SCM, design improvements and other tailwinds – though impacted by things like inflation, cost increases, and continued CapEx.

I personally don’t guide that 8-10% margin improvement, though I can believe the top-line growth. It’s my stance that the current macro will ensure that improvements are likely to be lower, and we would be smart to not expect a similar outperformance right on the tail end of the last one. The company has moved from reversal to what I consider to be its financial momentum phase. It’s undeniable to me that we’ll see significant top-line and bottom-line improvements to the company – the question is just how much. In 2022, the company managed 1% of sales in FCF – this is expected to go up to double digits within a few years, mostly due to margins. The company expects its EPS to almost double, again by margin and top-line expansion.

That’s the linchpin here. If the company does manage its significant margin expansion, there is no reason not to see a doubling here within 2-3 years. But I consider forecasting 40-70% of this materializing as being suitably conservative, based not only on inflation but other macro challenges. There’s too much uncertainty in the mix here at this time to really be sure that the company could deliver this.

However, it’s fair to say that the future prospects for Rogers are positive. The 1Q23 results start to showcase some of these trends, with higher-margin wins in ADAS, EV, and renewable markets, with customer expansion/growth after a weaker 2H22. Especially the renewable segment is showing strong sales, and the company is busy executing its profitability improvement actions.

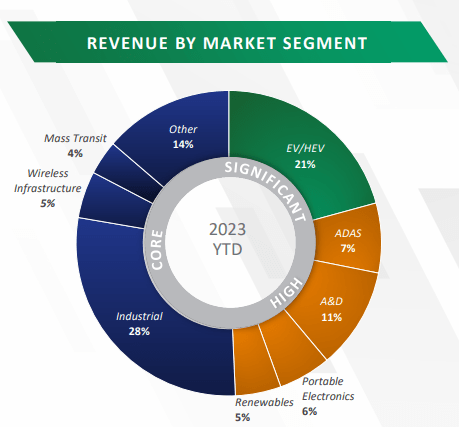

The company’s current top-line sales mix is an attractive one, heavily weighted towards industrial, but with key exposures towards new technologies and segments as well.

ROG IR (ROG IR)

Rogers has a lot of things going for it, even on a forward basis. It manages above-average margins even today before its improvements in most respects in its sector. And this is not an easy sector to outperform in. Other players in Rogers sector are businesses like Amphenol (APH), Samsung (OTCPK:SSNLF), Delta, Corning (GLW), Plexus, TE Connectivity (TEL), and others, many of which have a 20-30x market cap of Rogers. So Rogers is a small fish in a big pond, but it’s nonetheless attractive.

What to be on the lookout for in this company for me is easy – forecasted margin improvements. The company can do its part to execute these, but a big part is the geopolitical macro exposure and cyclicality, which affect all companies in this space.

Cadence and expectations for EV/Renewables are obviously a big part of that. The company forecasts continued strong sales in the sector given recent wins. It’s equally important to remember that because of the company’s significant diversification, its trends can be very “lumpy”, and the company relies on one segment doing better when another is doing worse to not have massively volatile earnings and sales trends.

The company expects the actions that they themselves will take to bring the gross margins to about a 34-35% level – the guided 35-40% level in 2025E is, therefore, a product of a mix of better revenue/sales mix, and margin improvements as well as a good macro. All of these things are mostly outside of the company’s control, which is why I prefer staying very conservative when it comes to such expectations.

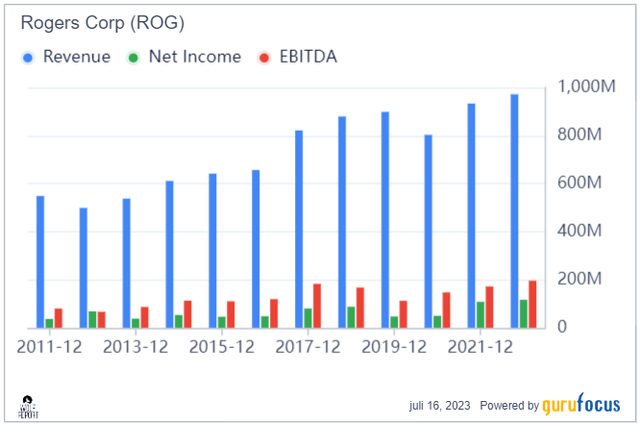

Overall, the 1Q23 quarter was a good one, and I see no reason on the company level why the 2Q23 should be in any way worse or negatively different here. The company is already a well-working machine in terms of revenue/net, managing COGS of less than 67% and less than 27% OpEx, resulting in a potential double-digit net margin. The company is also very cash-heavy, and despite what the share price has done over the past year or so, is a consistently profitable business, generating significant net income and EBITDA.

ROG Revenue/net (GuruFocus)

The company also has one of the best shareholder-equity ratios that I’ve seen on a company this size, with a very high amount of the company being “owned” by the shareholders in terms of % of total assets. There has also been some insider trading activity since the business cratered, and some institutional investors like Paul Tudor Jones, Jim Simons, and Chuck Royce have been recent buyers of shares in the company, already seeing double-digit returns on their stakes – though obviously not as much as if they had bought in November.

Let’s move on to valuation and let me show you why I, despite everything, have started viewing Rogers as a rotation target here.

Rogers Valuation – The valuation upside is limited

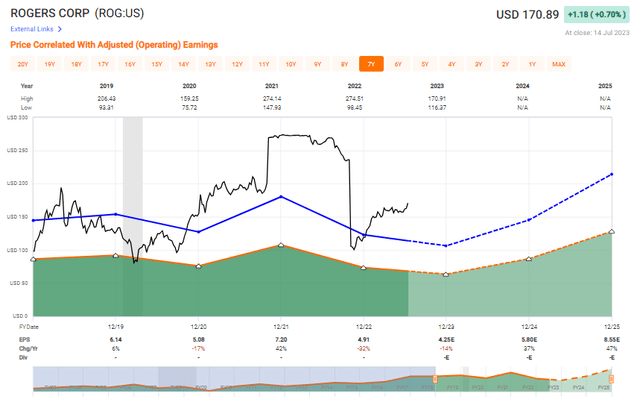

Rogers has a tendency to trade at a very high premium – this was doubly true when there was talk and plans of M&A’ing for the business. At a current price of $170/share, Rogers trades at 37.5x P/E, compared to a normalized Premium of 25.06x. This premium is based largely on the growth potential that analysts see in the business beyond 2023E as a result of margin and sales expansion.

ROG valuation (F.A.S.T. Graphs)

It’s my belief that this stance and expectation are too optimistic by half and that I don’t really want to own Rogers at this valuation if those growth estimates are even 20-40% off. At this point, we need to understand that analysts miss negatively on this company almost 40% of the time on a 2-year basis with a high margin of error. Back in 2022, analysts expected EPS to be 41% better than it turned out to be (Source: FactSet). That is not a small miss.

Because of this, I tend to err on the side of caution here. Impacting the company’s results by 20-30% and expecting the premium of 25x gives us a potential negative 2% to about 2-3% positive annualized RoR for this investment. This is not good enough for me to consider going close to. That’s a 25x P/E, remember? The company has no dividend, no credit rating – very little debt, yes, but still some fundamentals that are worth looking into.

In my last article, I made it clear that I was rotating/selling Rogers. I kept a small amount of the company in my portfolio – but as of last Friday, I’m completely out of Rogers for the time being.

S&P Global analysts would disagree with my assessment and stance here. The company has 2 analysts following the business, both at “BUY” or equivalent, and they give the company an average PT of $210/share.

Current estimates do call, on the part of most analysts, even from S&P Global, for an increase in sales, as well as EBITDA growth. But in the end, I consider Rogers to contextually be too small, too unsafe, no yielding, and too much of a “risk” to go into here. It was different when the company cratered after the failed M&A – I had a high conviction that I could see positive returns on the part of the business.

At this time, I’m not sure at all what we’ll see from Rogers. My bearish expectation is either flat or slightly negative, with a base case at around slightly positive to 6-7% annualized RoR.

That’s not enough for me – and here is my thesis due to this.

Thesis

- This was an undervalued play following a failed merger with DuPont, in specialty materials and engineered components/substrates for various attractive end uses and industries. This sort of company typically deserves a premium – and if the company had size, a credit rating, and yield, it would have deserved more. For now, though, Rogers is valued at a too high level compared to what else is available and its lack of a dividend.

- As it still stands in 2023, I’m willing to give the company a 15x normalized P/E as an introductory price target. This comes to a PT of $150/share, and I am not changing this price target at this time.

- I work with a rating of “HOLD” here, and I’ve in July 2023 sold what remained of my stake.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I’m unsure as of this article of the upside of the company – so the company now only fulfills two of my fundamental criteria for investing.

Read the full article here