Applied Industrial Technologies (NYSE:AIT) is a distributor of a variety of a long list of products. According to last year’s annual report, these include:

bearings, power transmission products, engineered fluid power components and systems, specialty flow control solutions, advanced automation products, industrial rubber products, linear motion components, tools, safety products, and other industrial and maintenance supplies.

The products are supplied by thousands of manufacturers and distributed to thousands of customers. The customer base ranges from very large companies to very small ones. Customers are in a variety of sectors, ranging from agriculture and food processing to chemicals and petrochemicals. The company also serves fabricated metals, forest products and numerous other industries.

Applied Industrial “serves a segment of the industrial market that requires technical expertise and service” (again quoting the annual report). The reason for this is that the company’s products support their customers’ production and efficiency efforts. To better serve this segment, the primary focus of the company is the company’s service centers. These are put in place to respond critical “break-fix” situations requiring knowledge of the customer’s facility, an understanding of inventory, and capabilities of timely delivery.

CEO Neil Schrimsher highlighted the company’s service centers in the most recent earnings call. The company has added more employees and has invested in process improvements in recent years. The investment has paid off:

[The service center segment] had another solid quarter with organic sales growth of 16% and strong incremental margins. On a two-year stack basis, segment organic growth was up nearly 30% during the quarter, while year-to-date segment operating margins are up nearly 240 basis points from adjusted operating margin levels two years ago. Reflecting on these results, it’s clear, our Service Center network is much stronger and more productive business today.

The company’s engineered solution segment also did well, showing double-digit growth and organic sales up 13% from the prior year. This segment includes “fluid power, flow control, and automation offerings.”

Solid Fundamentals, Improved Earnings

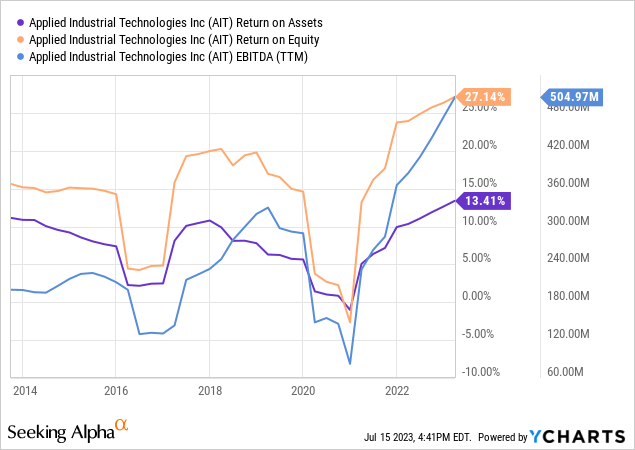

The pandemic hit the company hard, but the company has since recovered. It has substantially improved its EBITDA and Return on Assets:

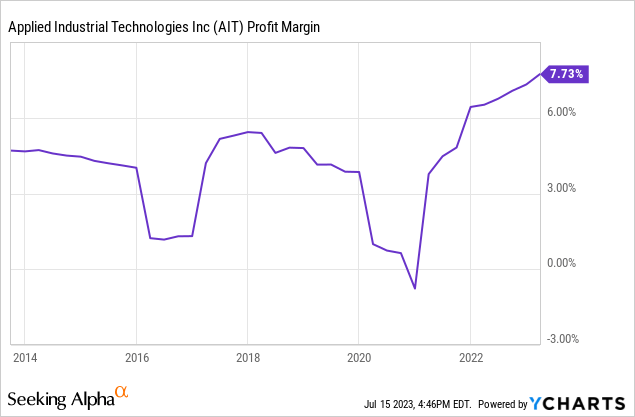

Management fielded several questions about profit margins during the earnings call. Unsurprisingly, the pandemic hurt profit margins just as it hurt earnings, but the margins have significantly improved:

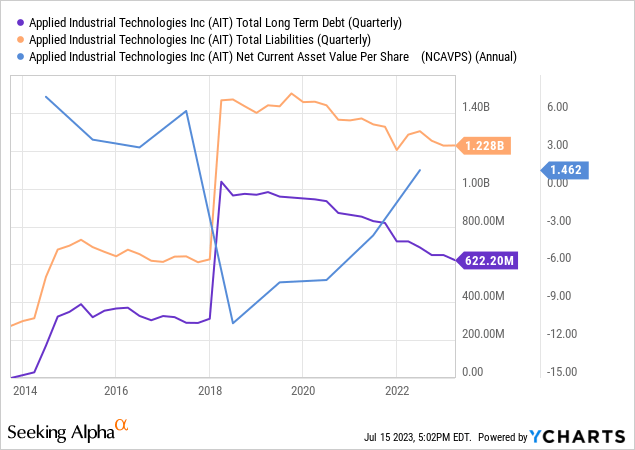

This is likely the result of the company working on reducing its debt levels. CFO David Wells mentioned debt reduction as part of his prepared remarks during the earnings call.

The conservative balance sheet allows the company to make bolt-on acquisitions and still reduce its debt load. The most recent acquisition was Advanced Motion Systems, which was the company’s sixth acquisition in four years, according to the earnings call. CEO Schrimsher said in the call:

Year to date, organic sales across our automation platform are up a healthy double-digit level despite ongoing supply chain headwinds, and we continue to see favorable growth in many of our core industry verticals and applications. We’ve remained very excited about the potential of our automation platform, including an active pipeline of strategic M&A opportunities that we expect to further scale and optimize our competitive position going forward.

Applied Technology’s Valuation

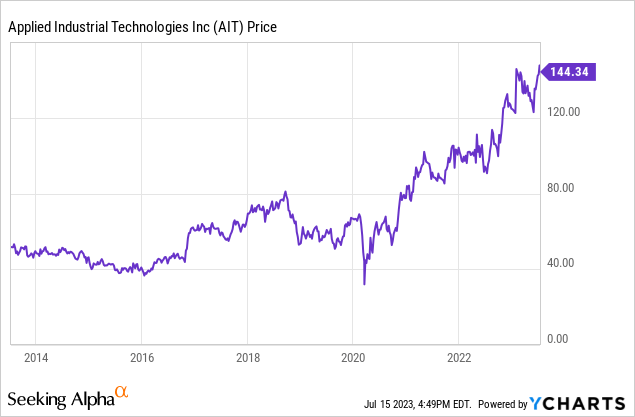

The company is a favorite of investors. They have cheered the company’s returns and profit margins, taking the company’s stock ever higher since early 2020:

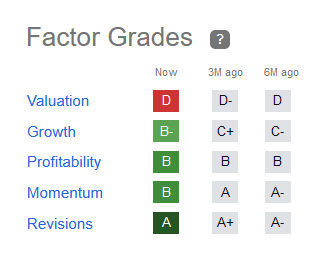

The stock valuation is in fact the one complaint that Seeking Alpha’s Factor Grades has with the company:

Seeking Alpha

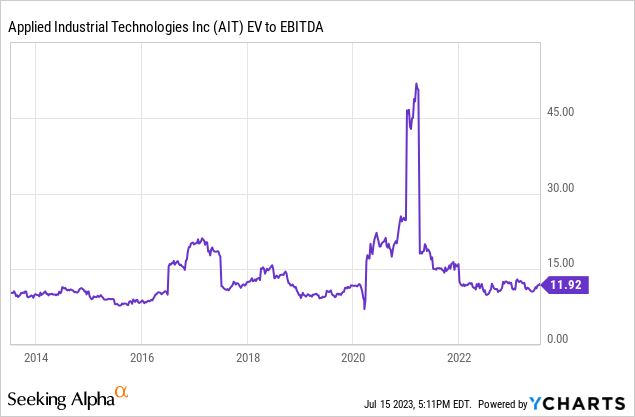

Nevertheless, looking at EV to EBITDA, the stock is valued about where it has been both for the year and for the decade:

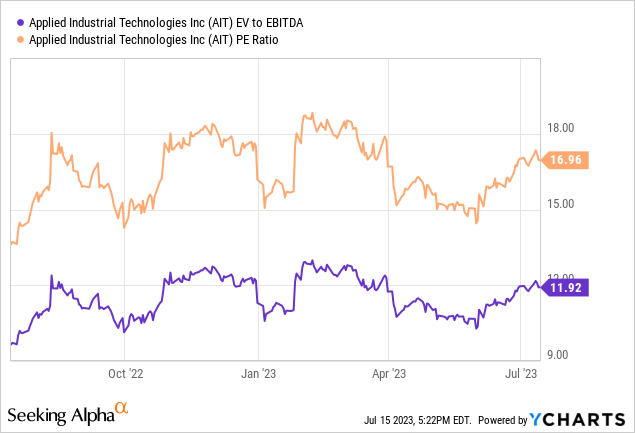

To see this better, a one-year chart is provided below. The P/E Ratio has been added to this as well:

The dividend is sitting at only 1%. While this is not likely a dividend that will attract income investors, dividend growth investors might appreciate it. The dividend has grown steadily since 2011, more than a dozen years, even despite the ravages the pandemic made on earnings.

Risk Factors

The risks are what might be expected of a distributor. Applied Technology needs its customers to keep running. It also needs to have a reliable supply chain. The lack of either will be problematic. Take away both, and the result on earnings can be plainly seen in the charts above.

The macro environment is not helping any, but that is true across the board.

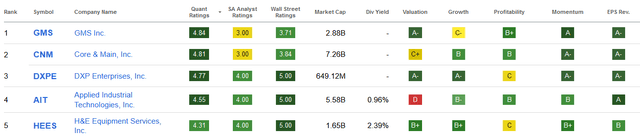

The company operates in a highly competitive sector. Having said that, Applied Technology ranks 4th of 47 of Seeking Alpha’s top Trading Companies and Distributors Stocks. It ranks the highest of dividend payers in that list:

Seeking Alpha Top Trading and Distributors Stocks (Seeking Alpha)

The valuation is roughly in the middle of historic lines and the current stub of $144 may well drop 10% or more; it was at about $125 less than two months ago.

Summary

The company is fundamentally solid, and this is reflected by the company increasing its dividend through thick and thin. The balance sheet allows the company to simultaneously reduce its debt load and make acquisitions.

Risks include a high level of competition in an uncertain economy. The current stock price may well drop more from its current level.

I put a “Buy” rating on this stock, because I think the stock will continue to go up long term. However, I do not think the stock is a buy at any price. I consider this more a “buy the dip.” I will be looking to initiate a position at about $130.

Read the full article here