We’re upgrading Snowflake Inc. (NYSE:SNOW) to a buy ahead of earnings season and after the Snowflake Summit 2023. The stock is up 35% YTD, outperforming the S&P 500 (SP500) by around 17%. We see a mixed-demand environment for Snowflake in 2H23 as the macroeconomic backdrop is predicted to worsen, and inflation is expected to remain sticky. Still, after the Snowflake Summit 2023, we believe the stock’s risk-reward profile will become increasingly favorable into 2024 and recommend investors explore favorable entry points on pullbacks.

Snowflake is a cloud computing-based data warehousing company founded in 2012 and launched its IPO in 2014. Now, the company is leveraging generative A.I. for data through its Snowflake Data Cloud as it extends its partnership with Microsoft (MSFT) and announces a new partnership with Nvidia (NVDA). Last quarter, in 1Q24, the company beat top and bottom lines, reporting revenue of $623.6M, up 47.6% Y/Y, and a Non-GAAP ESP of $0.10. We think the company will continue to beat consensus and experience Y/Y revenue growth after last year’s post-pandemic slump and due to the softer consensus estimates, given the worsening macro headwinds.

Management is guiding for $620-625M in product revenue for growth of 33-34% Y/Y; product revenue accounts for the majority of the total sales. We expect the growth percentage to slow sequentially in 2H23 due to macro headwinds but still expect to see double-digit revenue growth Y/Y. We understand investor concern over the company’s guidance; the stock dropped 13% in pre-market after management lowered FY24 product revenue guidance to $2.6 from the previous view of $2.71B. However, we’re not too worried about the lowered guidance as we believe management is trying to de-risk the stock from the macro headwinds that’ll likely impact earnings in 2H23. We recommend longer-term investors leverage the pullback to explore attractive entry points, as we expect Snowflake to outperform into 2024.

Expanding A.I. Opportunity

Our upgrade is driven by our belief that the A.I. boom will generate net tailwinds for the company. The company announced it’ll extend its partnership with Microsoft Azure and start a new partnership with Nvidia, expanding its A.I. growth exposure.

Generative A.I. has become a crucial part of the conversation for Snowflake, and we think the company’s platform is uniquely positioned to work with data and compute for A.I. Snowflake stands out from the peer group as few companies have the mature, established base to be able to jump into A.I. strategies this early. The extended Microsoft partnership will enable new product integrations “across A.I., low code/no code application development, data governance, and more.” Microsoft is currently leading the A.I. race on the software/hardware front; the partnership will enhance joint go-to-market strategies and improve A.I. field collaboration, delivering joint solutions to customers directly. Judson Althoff, Microsoft executive vice president and chief commercial officer, touched on this, noting:

“Through our expanded partnership, we will combine Snowflake’s Data Cloud expertise with Microsoft’s cloud technologies and AI capabilities to help customers across industries build intelligent solutions to better manage, understand, and govern their data.”

Shifting the focus to the new partnership with Nvidia announced at the Snowflake Summit 2023, the partnership is aimed to “create an A.I. factory that helps enterprises turn their own valuable data into custom generative A.I. models to power groundbreaking new applications – right from the cloud platform that they use to run their business” in the words on Nvidia CEO Jensen Huang. The partnership monetizes generative A.I. to bring new opportunities to enterprises using their own proprietary data within Snowflake Data Cloud. We remain cautious about how the partnerships will impact Snowflake earnings in 2H23 as enterprise IT budgets tighten this year due to macro headwinds. Still, we expect the partnership to be a growth catalyst for Snowflake into 2024.

Snowflake’s rival, Databricks, does compete with the company in the space, but we believe the A.I. and data market is large enough to encompass both as the transition to the cloud accelerates. While we noted that we expect softer cloud/enterprise spending in 2H23 in our quarterly review and preview, Back to the Future 4.0, we believe generative A.I. remains a growth area despite the macro backdrop. Hence, we’re constructive on Snowflake being in bed with the two most prominent winners of the A.I. boom: Nvidia (guiding for 50% above revenue consensus for next quarter) and Microsoft (in a multi-billion multi-year partnership with ChatGPT parent, OpenAI).

Valuation

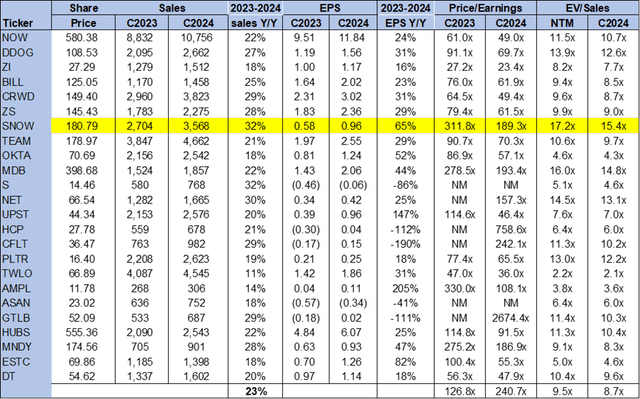

Snowflake is trading well above the peer group average at premium multiples. On a P/E ratio, the stock is trading at 189.3x C2024 EPS $0.96 compared with the peer group average of 240.7x. The stock is trading at 15.4x EV/C2024 Sales versus the peer group average of 8.7x. We think Snowflake is a growth stock and recommend investors look into favorable entry points into the stock despite the higher valuation.

The following chart outlines Snowflake’s valuation against the peer group.

TSP

Word on Wall Street

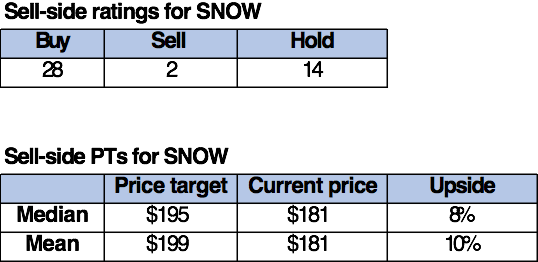

Wall Street shares our bullish sentiment on the stock for the longer-term investor. Of the 44 analysts covering the stock, 28 are buy-rated, fourteen are hold-rated, and the remaining are sell-rated. We understand the bearish sentiment on the stock given the worsening macro backdrop pressuring IT spending in 2H23 and lofty valuation. However, longer-term investors can benefit from pullbacks in 2H23 to get into the stock at favorable levels and ride the upward trend in 2024.

The stock is currently priced at $181 per share. The median sell-side price target is $195, while the mean is $199, with a potential 8-10% upside.

The following charts outline Snowflake’s sell-side ratings and price targets.

TSP

What to do with the stock

We’re upgrading Snowflake to a buy post the Snowflake Summit 2023. We’re constructive on Snowflake’s new and extended partnerships with Nvidia and Microsoft. Snowflake is gaining wallet share among customers, with data analytics becoming increasingly important; we expect the company will have a rough 2H23 but continue to expect the stock to outperform. While overall consumption growth may be slowing, A.I.-related demand is still up.

Snowflake Inc. stock’s valuation remains lofty, and worsening macro headwinds are pressuring product revenue; however, we think guidance has been de-risked. We recommend longer-term investors begin exploring entry points into the stock as we see Snowflake outperforming into 2024.

Read the full article here