Investment thesis

Long story short, when it comes to Telefônica Brasil S.A. (NYSE:VIV), or simply Vivo (how users refer to it), I recommend a hold stance for investors who already have its shares.

This means retaining the shares in the portfolio and continuing to receive generous dividends. While Vivo remains a stable company, it may not offer significant growth opportunities compared to other investment options. Investors should be aware of the limitations and uncertainties surrounding Vivo’s growth prospects and evaluate the potential for better returns in other investment opportunities. While holding Vivo’s shares is unlikely to result in losses, the expected return may be slightly above inflation, which can swipe most gains from the company’s growth.

A brief description of Vivo

Telefônica Brasil, or simply Vivo (how users refer to it), is one of the largest telecommunications companies in Brazil and a subsidiary of Telefónica S.A. (TEF), a Spanish multinational telecommunications company. Vivo is a major player in the Brazilian telecommunications market, offering a wide range of services including mobile and fixed-line telephony, broadband internet, television services, and data transmission.

Vivo was formed in 2011 when Telefónica acquired the Brazilian operations of Portugal Telecom and merged them with its existing fixed-line and mobile operations in Brazil. The company operates under the brand name Vivo, which is well-recognized and widely used across the country.

Vivo has a vast customer base and a significant market presence in Brazil. It offers mobile services through its extensive network and has strong 4G and 4.5G coverage across the country. In addition to mobile services, Vivo provides fixed-line services, including voice, broadband, and television, both through traditional means and fiber-optic connections. The company has been investing in expanding its network infrastructure and improving its services to meet the growing demand for telecommunications in Brazil. Vivo is known for its focus on customer service and has a wide range of plans and packages to cater to different consumer needs.

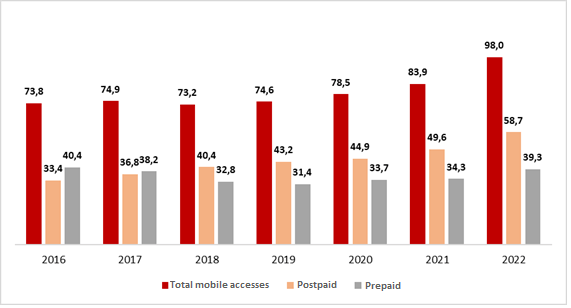

Currently, the company is the leader in the mobile telephony and fiber broadband markets, with just over 98 million mobile accesses, which account for 39% of the market share, and 5.6 million FTTH (Fiber to the Home) accesses, with approximately 17% of the share. Additionally, it has 6.9 million fixed-line customers, a segment that has become extremely challenging due to concession rules.

This combination of these factors, along with the high payout and successive share buyback programs, has helped bring more visibility to Vivo’s shares. This has contributed to the company becoming one of the favorites among investors in recent years. In 2015, there was another significant acquisition when the company bought GVT, a company that operated fixed-line telephony, pay TV, and internet services, to consolidate its presence in these sectors.

Understanding Vivo’s business model and sector

Mobile Market

Vivo’s main market is mobile telephony. This segment mainly includes mobile voice and data services, such as 4G and 5G, and is divided into three billing modalities. They are:

-

Prepaid: These are plans where the customer pays in advance for the service through the purchase of credits. These credits allow the user to make calls, use the internet, and send SMS, for example. Typically, these plans have a lower average ticket value.

-

Postpaid: It is the opposite of prepaid. The customer uses the necessary services first and, at the end of the month, pays according to usage. Generally, these are plans with higher added value.

-

Control: It is a mix between prepaid and postpaid. In this case, the customer pays the bill at the end of the month but has predetermined limits regarding the use of services.

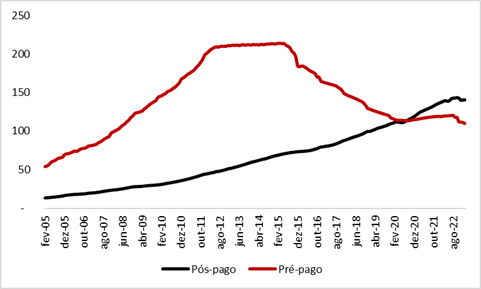

In Brazil, this is an extremely mature market. Currently, there are just over 250 million telephone accesses, of which about 56% are postpaid or control plans and 44% are prepaid, as we can see below:

Brazil’s telephone accesses. Data in millions of accesses. Blue for Postpaid and Red for prepaid (Anatel)

To be honest, I do not expect to see significant growth in the number of mobile accesses in Brazil, since the number of telephone accesses is already higher than the country’s population. The only scenario that is likely to remain is the shift in the mix, which has been a trend observed since 2015, with a decline in the number of prepaid plans and growth in postpaid plans.

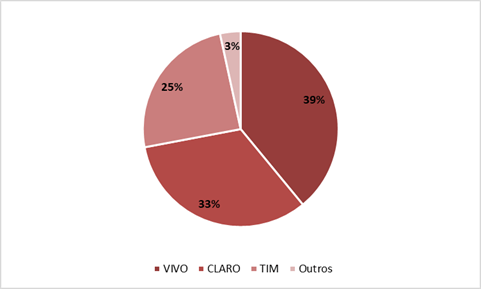

In this regard, I see Vivo as a leader in both prepaid and postpaid services, with 39.3 million and 58.8 million accesses, respectively. This reflects a market share of 39% within the telecommunications market, as we can see below:

Brazil’s market share for the mobile telephony sector. (Anatel)

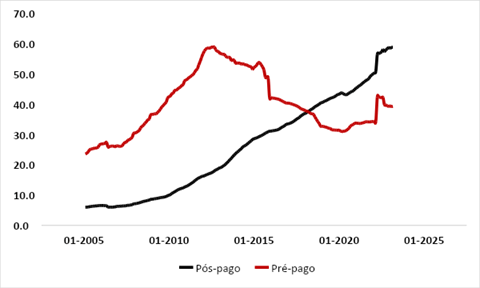

Historically, Vivo has always been among the sector leaders, with a market share hovering around 40%, and the postpaid share being higher than the prepaid share. Additionally, the evolution of access points has shown a very similar behavior to the segment as a whole, with a significant decline in prepaid accesses, while postpaid has shown steady growth since 2013.

Vivo’s data in millions of accesses. (Anatel)

From what I see, in order to have the capacity to sustain mobile services, it is crucial that companies have the necessary infrastructure and spectrum to serve all their customers. The infrastructure includes all the facilities required for signal transmissions, such as antennas, towers, and data centers.

On the other hand, the spectrum is composed of electromagnetic frequency bands in which signals can be transmitted. In general terms, companies seek to have a mix of different spectrum frequencies, as lower frequencies allow operators to cover larger areas with lower performance, while higher frequencies offer greater capacity and speed but with more limited coverage.

It’s worth saying that this trait is extremely relevant to the sector because the scale of a mobile operator directly influences operational efficiency. This is because an operator with more spectrum heap more benefits from each new tower, while an operator with many towers takes advantage from each additional MHz of spectrum. Technically, it is possible to expand network capacity by increasing either the number of towers or the spectrum alone, but usually, the cost-benefit is better when the proportion between both grows steadily.

As we can see, scalability is the name of the game for telecom companies and, because of that, is almost certain that Brazil’s mobile telephony will forever be an oligopoly composed of Vivo, Claro, and Tim S.A (TIMB). As a native Brazilian who lives in the country, I must say this might sound great for shareholders but definitely not that great for customers, as those mature and established companies basically implement their own rules until Anatel (National Telecommunications Agency) decides to step in.

Fiber Market

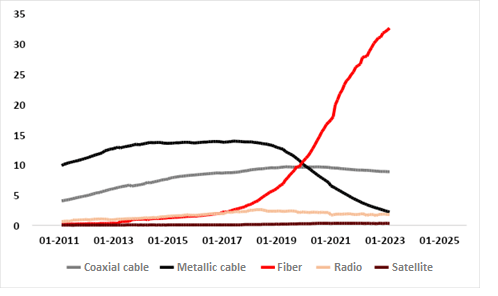

Fiber optic broadband is relatively new in Brazil, as its growth started to accelerate rapidly only in 2017, becoming the main venue for fixed internet access by the end of 2019 only.

Brazil’s fixed internet market. Data in millions of accesses. (Anatel)

Until 2016, the demand for faster connections led to a significant increase in the demand for fiber optic internet. However, there was a significant gap in fiber optic infrastructure in Brazil, making it challenging for the major telecommunications players to address it alone. This mismatch between supply and demand, along with relatively low barriers to entry, led to the emergence of regional internet service providers (ISPs) offering fiber optic internet. These ISPs were responsible for providing this service in areas where other networks did not reach.

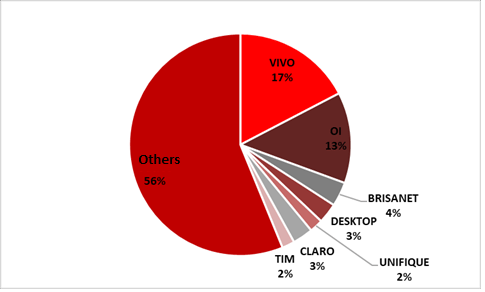

As a result of the emergence of these ISPs, the market share of companies like Vivo plummeted during this period, dropping from nearly 50% in 2016 to 17.4% by the end of March 2023. Despite the decrease in market share, Vivo continues to be the leader in the sector.

Fiber market share in Brazil. (Anatel)

Currently, Vivo has visited 24.4 million households, those are households that already have the fiber network structured, but that may not have necessarily subscribed to the service. From those, a little over 5.6 million are connected households and since 2016 this number has grown by over six times.

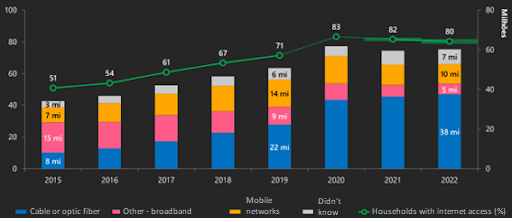

Despite the fiber market has experienced strong growth in previous years, in my opinion, I expect a slowdown from now on. This is backed by the data from the Regional Center for Studies on the Development of the Information Society (CETIC) and the Brazilian Institute of Geography and Statistics (IBGE), which state that more than 80% of households in Brazil have access to fixed internet, and more than half is through fiber. Please, see the images below for data on the progress by connection type in the country.

Households with internet access. Data per type of connection. (CETIC)

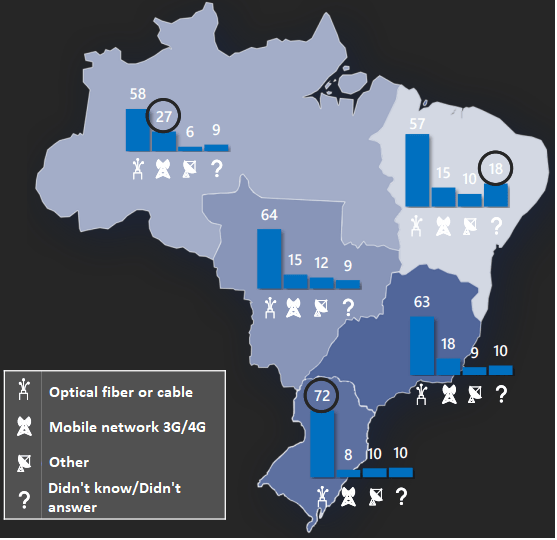

Main connection type per region. (CETIC)

Furthermore, less favorable macroeconomic conditions lead to suppressed consumer demand for several reasons. According to CETIC research, among households without internet access, 28% state that they do not have the service because it is too expensive, while 23% have no interest or need.

Therefore, considering that fiber has a higher cost for consumers and is intended for those who desire faster connections, it is plausible to assume that it will not be an option for households that still lack internet access. Moreover, many of these households are located in areas where it is not feasible to build a fiber network.

In my opinion, another relevant factor for the deceleration of fiber expansion is the high investment required for network construction. As a capital-intensive sector, during budget constraints, companies tend to be more conservative regarding capital allocation. This factor causes companies’ strategy to shift from a focus on network expansion to increasing the utilization of existing networks.

There is also a new participant within the fiber sector: the neutral operator. This type of company emerged to try to solve two main problems. The first, as I mentioned earlier, is the need for capex. When an internet provider chooses to use a neutral network instead of their own network, they delegate the need for infrastructure investment to the neutral operator, so the provider’s only cost is related to network rental and service provision. This reduces the capital requirement for fiber players.

The second factor, I’d like to mention is the lack of availability of access points on utility poles. In Brazil, there is a limited number of ports on poles, typically between four and six, which means that the number of cables that can be passed through is finite. This prevents all internet companies from accessing new regions, as most poles in Brazil have more connections than they should, with a significant number of them being irregular. With a neutral network operator, it is possible for a single cable to be shared among multiple providers.

Fixed-line telephony market

My thoughts on the fixed-line telephony market are that it is extremely challenging for players that operate within it, and this difficulty stems from one main point: obsolescence.

It is clear that the use of landline phones has fallen out of favor. With the popularity of mobile phones, it no longer makes sense for most people to have a landline. Due to this shift in consumer behavior, we have seen a significant decline in the number of landline connections over the past years.

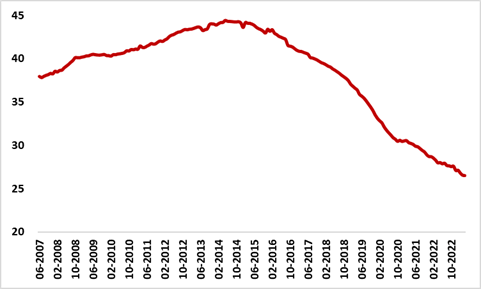

As we can observe in the graph below, the number of landline connections has dropped dramatically from its peak between 2013 and 2015, when it surpassed 44 million accesses, to only 26.5 million at the beginning of 2023.

Fixed-line telephony. Data in millions of accesses. (Anatel)

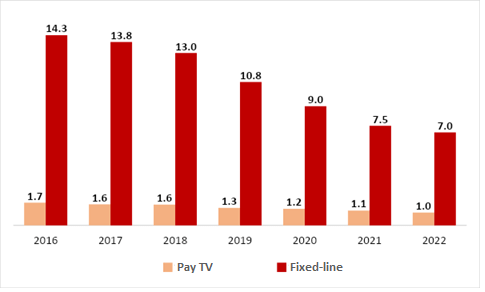

This behavior was no different for Vivo, which saw its number of fixed voice accesses cut in half since 2016, dropping from approximately 14.3 million to less than 7 million in the first quarter of 2023. My personal take is that the number of accesses will continue to decline in the coming years, eventually becoming irrelevant within the operations of companies in the sector.

What happened to Vivo’s financials over the years

Vivo is a telecommunications giant that has recently stood out for its strong presence in the fiber and B2B services market, which is great. On the other hand, the company still has significant exposure to legacy technologies, primarily fixed-line telephony, as well as some services that have been discontinued, such as DTH (satellite TV).

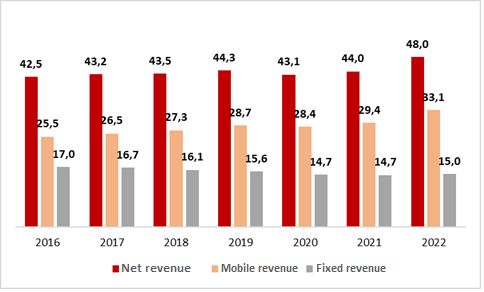

In my opinion, these characteristics, along with the saturation of the mobile telephony sector in Brazil, have led to Vivo’s revenue experiencing limited growth in recent years. This can be observed by analyzing the chart below, which demonstrates the company’s evolution over time.

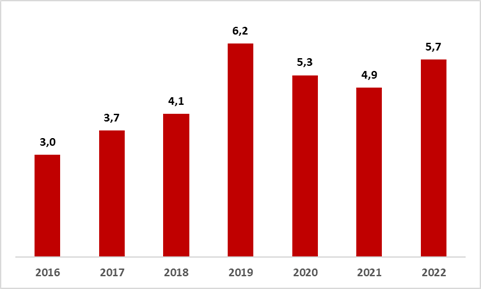

Vivo’s revenues in R$ billion. (Investor Relations)

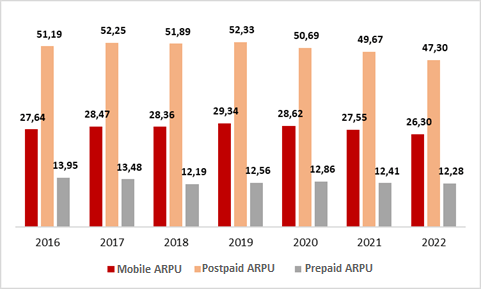

As we can observe, since 2016, mobile revenue has shown moderate growth, while fixed revenue has declined, despite the expansion of the fiber market. In my opinion, this fact is a consequence of two main factors. Firstly, there is a challenge in passing on prices to consumers in the mobile telephony sector, as reflected by the declining ARPU (Average Revenue Per User) in both prepaid and postpaid segments since 2016. Please take a look at the graph below:

Vivo’s monthly ARPU in R$ (Investor Relations)

It is important to highlight that in 2022, there was a dilution in the ARPU due to the influx of customers from Oi Móvel, a Brazilian telecom company that filed for bankruptcy and had to sell part of its operations, which were bought by Vivo, Claro, and Tim. This dilution had a negative impact on the ARPU, and although I expect it to improve in the coming years, it is unlikely that Vivo, along with other mobile operators, will be able to make significant adjustments to mobile plans.

However, the stagnant ARPU was partially mitigated by the growth in the customer base, particularly from 2020 onwards, with a significant boost in 2022 following the completion of the acquisition of Oi Móvel. It is noteworthy that there was an inverse relationship between the customer base and ARPU, as the number of accesses increased, the ARPU decreased. The graph below illustrates the evolution of the company’s number of accesses, highlighting the growth in the customer base over time.

Millions of accesses. (Investor Relations)

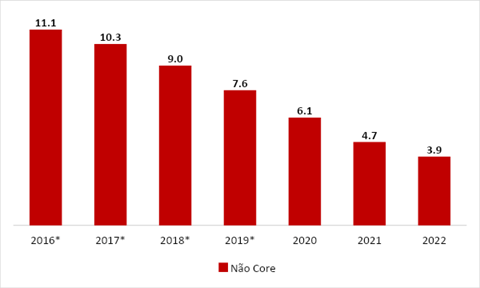

In my opinion, the second factor hindering the growth of Vivo’s consolidated revenue is fixed-line telephony. This segment, which used to have substantial 14 million customers and accounted for a significant portion of total revenue (20%), has experienced a drastic decline. Today, there are just under 7 million customers, responsible for less than 10% of total revenue. Furthermore, other services such as DTH and xDSL, which are considered non-core revenues, have also experienced a decline. The charts below clearly illustrate how the decline in these services has negatively affected Vivo’s consolidated results.

Non-core revenues (R$ billion). *Estimated figures. (Investor Relations)

Millions of accesses. (Investor Relations)

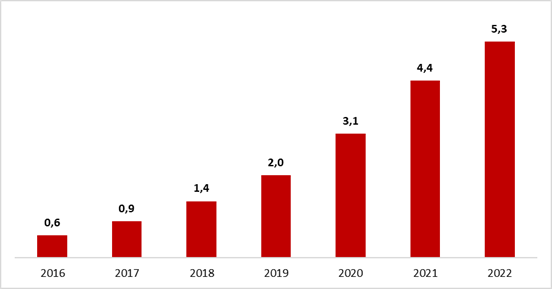

It is worth noting that, despite certain challenges in these segments, fiber deserves attention. From 2016 to the end of 2022, the revenue from the service went from just under R$ 1 billion to over R$ 5.5 billion, multiplying more than six times. Additionally, digital services for businesses have also shown significant growth, already representing an annual revenue of approximately R$ 3 billion. I expect this niche to continue growing, especially with 5G, which will provide more solutions such as IoT (Internet of Things) and private networks, for example. Please see the chart below for the evolution of revenue from fiber.

FFTH revenue (R$ billion). (Investor Relations)

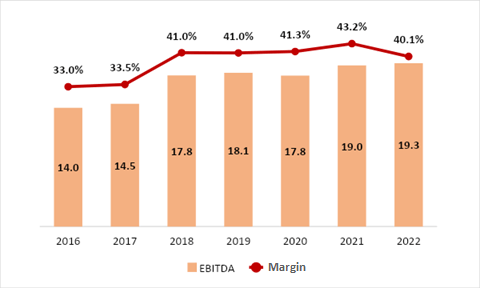

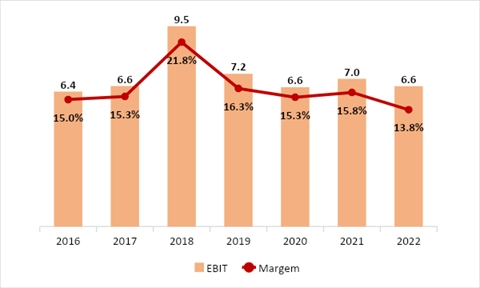

As a result of these observations, we have seen relatively stable EBITDA and EBIT since 2016, both in nominal value and margins, as we can observe below:

EBITDA (in R$ billion) and EBITDA margin over the years. (Investor Relations) EBIT (in R$ billion) and EBIT margin over the years. (Seeking Alpha)

It is worth noting that the EBITDA and EBIT showed strong results in 2018 due to a non-operational effect of a favorable judicial decision regarding the ICMS (state tax) collection, which generated a non-recurring revenue. Additionally, starting in 2019, IFRS 16 became mandatory, which changes the way leases are accounted for and inflates the EBITDA and consequently its margin. Therefore, the evolution of the indicator had a strong impact from non-recurring results (in 2018) and changes in accounting rules (from 2019). In my opinion, this fact can be attributed to the sluggish growth of the company’s top line, coupled with costs that have remained relatively stable over the years.

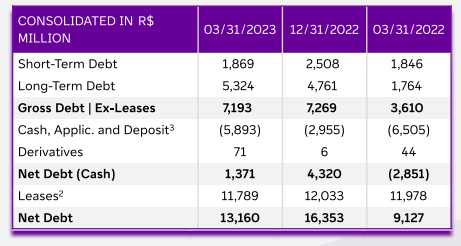

Indebtedness

From what I see, Vivo’s financial position has been relatively stable in recent years, with a consistent gross debt of around R$ 6 billion. However, after the acquisition of Oi Móvel, the company’s debt level increased, reaching R$ 7.2 billion in the first quarter of 2023. Despite this increase, Vivo’s cash position of over R$ 5.8 billion allows for a healthy net financial debt of approximately R$ 1.3 billion. It is worth noting that there is an additional R$ 11.8 billion in debt resulting from leasing arrangements, bringing the total net debt to R$ 13.2 billion.

Vivo’s indebtedness (Investor Relations)

At this level of indebtedness, the net debt/EBITDA ratio is around 0.7x, and the net debt/equity ratio is 0.2x, which in my opinion are comfortable and manageable levels. The fact that most of this debt is tied to the CDI (Interbank Deposit Rate) or IPCA (Consumer Price Index) has resulted in a significant increase in interest expenses. This has ultimately led to a negative financial result of R$ 1.7 billion in 2022, marking a substantial yearly increase of 56.8%. Unfortunately, the trend continued into 1Q23 with a negative financial result of R$ 657 million, indicating a 25.5% rise compared to the same period in the previous year. Furthermore, according to the debt repayment schedule, approximately R$ 5.5 billion is expected to be paid this year, with an additional R$ 3.4 billion in each of the next two years.

Net profit and cash generation

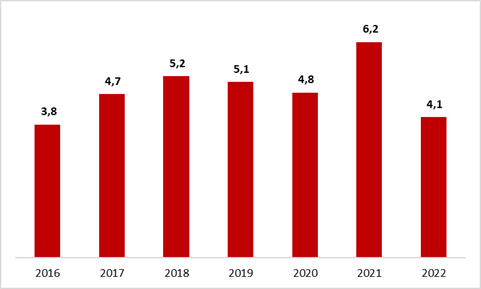

As a result of the combination of operational and financial results, net profit remained relatively stable over the past few years, except for years in which non-recurring results occurred, such as in 2021, when there was a gain due to tax-related issues.

Net profit (in R$ billion) over the years. (Investor Relations)

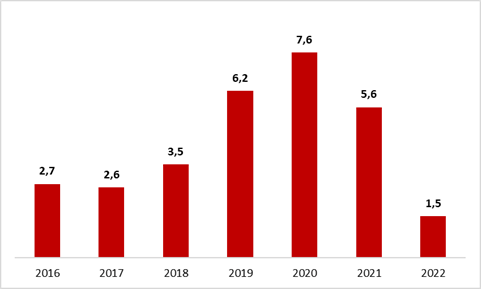

For the telecommunications sector, it’s normally easy to spot a discrepancy between net profit and cash generation, primarily due to time differences in financial statements. Looking specifically at Vivo, the company has consistently reported profits ranging from R$ 4 billion to R$ 5 billion in recent years. However, what stands out is that Vivo’s free cash flow has been even higher during most of these years, particularly after the implementation of IFRS 16 in 2019.

Free cash flow (in R$ billion) over the years. (Investor Relations)

It is worth mentioning that in 2022 there was a payment for the acquisition of Oi’s mobile division, which exceeded R$ 5 billion. So it’s safe to expect that the free cash flow will gradually return to levels close to those observed in 2020 and 2021, especially from 2024 onwards, assuming everything remains constant.

Dividends

One of the most well-known characteristics of Vivo is the fact that the company is a generous dividend payer, often presenting a payout ratio exceeding 100%, with a distribution of practically all its free cash flow. This has resulted in a high dividend yield, which historically remained around 7%, occasionally surpassing 10%. Below, we highlight the evolution of dividend distribution.

Dividends distributed (in R$ billion) (Investor Relations)

In my opinion, the dividend outlook for Vivo in 2023 is quite promising. Considering the dividends already paid and provisioned, it is expected that the company will distribute a total of R$ 3.9 billion. Additionally, there is a possibility of a capital reduction of R$ 5 billion, which, if approved, would serve as an additional dividend for the years 2023 and 2024. Taking these factors into account, I anticipate a yield on cost of around 10% starting from 2024, assuming favorable conditions regarding capex and fiscal matters.

Potential risks and my not-so-great forecasts

I believe there are certain operational risks associated with the company’s core and non-core services. Specifically, in the mobile telephony sector, I see challenges for the company in passing on inflation costs to its customers. Over the past years, there has been a decrease in ARPU, indicating a trend that runs contrary to the increasing number of subscribers.

In the best-case scenario, I think Vivo will only be able to pass on inflation costs and potentially achieve minimal real growth in ARPU. Furthermore, I don’t anticipate significant growth in the number of mobile subscribers, especially considering that it already exceeds 250 million in Brazil. As a result, the company will heavily rely on the migration of prepaid customers to postpaid or control plans, which also have their limitations.

In my opinion, I believe that non-core revenues for the company will decrease significantly in the medium term. Currently, they contribute to less than 10% of the total revenue, and this percentage is expected to continue declining. Moreover, there is an ongoing dispute concerning the fixed-line telephony concession, which has the potential to result in substantial cash outflows for Vivo, depending on the decisions made by Anatel and the government.

Furthermore, I anticipate a slowdown in the growth of fiber infrastructure in the coming years. This slowdown has already been observed recently as the network expansion has been closing the fiber infrastructure gap. Although fiber will remain a primary driver of the company’s overall growth, I believe that the expansion cannot be sustained at its current levels for much longer.

Conclusion

In my opinion, Vivo is a company that has a strong presence in its markets but also faces several challenges. One of the challenges is the difficulty in adjusting prices in the mobile telephony sector, which can impact its profitability. Additionally, there are expectations of slowing growth in FTTH services, which may limit the company’s expansion potential in that area. Furthermore, uncertainties surrounding the migration of fixed-line telephony concessions add to the challenges Vivo has to navigate.

Considering these factors, which directly affect Vivo’s cash generation, I believe there is a limit to its growth potential. As a result, I don’t see significant room for the stock to experience substantial growth. However, I do believe that Vivo will continue to be a good dividend payer, which can be an attractive aspect for investors. At current levels, I expect a moderate nominal return per year in the long term, primarily driven by dividends and potential share buybacks.

Therefore, after this analysis and evaluation of the company, I have chosen to assign a hold recommendation due to two main reasons.

-

1. Opportunity cost.

-

2. Uncertainties regarding real growth capacity.

From my view, there are other options in the market that present more favorable prospects and, therefore, represent more interesting opportunities for capital allocation at the moment, like Cosan S.A (CSAN) or Hewlett Packard Enterprise Company (HPE) for instance.

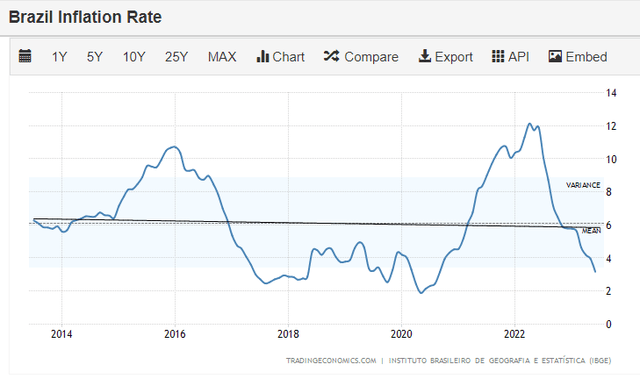

This hold decision does not mean that I dislike the company, as I believe it is unlikely for shareholders to lose money with it if everything remains constant. However, I expect the return delivered by the company to be just over inflation, which represents quite limited real growth. We must remember that inflation in Brazil has a history of being high (around 6% per year) when compared to developed markets, so it can easily swipe all the gains from Vivo’s hard-earned growth.

Trading Economics

Slightly above inflation is not a bad return per se, but I believe that other companies will deliver a better long-term return, so the opportunity cost of allocating resources to Telefônica Brasil, commonly known as Vivo, is significant. In summary, the best course of action now is to hold onto the shares you already have and continue receiving generous dividends.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here