Atmos Energy Corporation (NYSE:ATO) is one of the largest regulated natural gas utilities in the United States. The utility sector in general has long been a favorite of conservative investors such as retirees because of its stable cash flows and high dividend yields. Atmos Energy is not an exception to this, as the stock yields 2.48% as of the time of writing, which is higher than many other things in the market today. However, this is not a particularly high yield for a utility company.

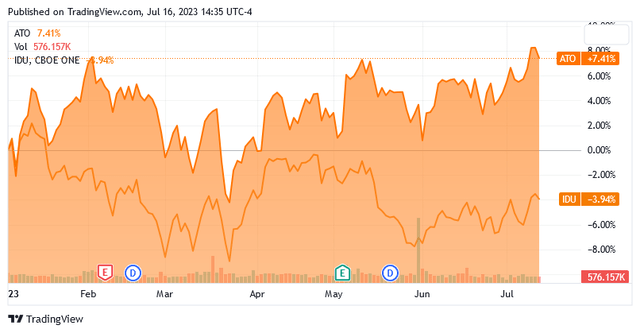

Atmos Energy has delivered a very reasonable performance year-to-date. The company’s stock is up 7.41% against the -3.94% return of the iShares U.S. Utilities ETF (IDU):

Seeking Alpha

This is somewhat surprising, since natural gas utilities have earned something of a dislike among some market participants. This is due to the perception that electricity will soon replace natural gas as a fuel source for space heating and render it obsolete. While this is highly unlikely to happen in the near term due partly to the fact that natural gas is much more efficient at producing heat than electricity, the perception remains. This has created something of an opportunity for investors though, as natural gas utilities tend to offer more affordable valuations than electric peers. Atmos Energy is no exception to this, either, as the stock trades at a very attractive valuation right now. Let us investigate and see if Atmos Energy could be a good addition to your portfolio today.

About Atmos Energy

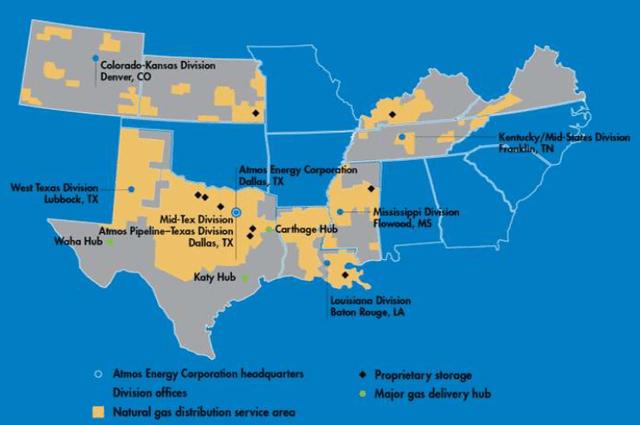

As stated in the introduction, Atmos Energy is one of the largest pure-play natural gas utilities in the United States, boasting operations in eight states throughout the South and Central parts of the nation:

Atmos Energy

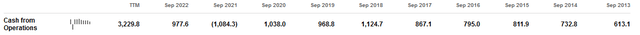

There are very few utilities in the United States that have such a breadth of operations. Unlike some other utilities that cover a considerably large geographic area, Atmos Energy’s territory includes some heavily-populated regions. As such, the company serves approximately 3.3 million residential and business customers. In previous articles, I pointed out that a utility’s size has little effect on a few of its most important features. In particular, companies like Atmos Energy tend to have remarkably stable cash flows over time. We can see this by looking at Atmos Energy’s operating cash flows on an annual basis. Here they are for each of the past ten years, as well as the trailing twelve-month period that ended on March 31, 2023:

Seeking Alpha

As we can clearly see, with the exception of the 2021 fiscal year, Atmos Energy’s operating cash flows were largely rangebound. The 2021 fiscal year was outside of the range due to events surrounding Winter Storm Uri in 2021, which was a very devastating Arctic blast that caused natural gas pipelines as far south as Texas to freeze and temporarily spiked natural gas prices to their highest levels ever for the region. That is an event that is unlikely to occur again during any of our lifetimes so it does not disprove the basic thesis here. Overall, we can conclude that Atmos Energy has relatively stable cash flows that show growth over time, as clearly evidenced by the fact that the company’s operating cash flows generally increased since 2013.

The reason for the relative stability of the company’s cash flows should be fairly obvious. After all, Atmos Energy provides a product that most people consider to be a necessity for our modern way of life. There are very few people that do not have some sort of heating system in their homes, and for people that are on a natural gas line, that heating system will almost certainly be powered by natural gas. As such, the company’s customers will generally prioritize paying their natural gas bills ahead of making discretionary expenses during periods in which money gets tight. That is the situation for many consumers today, as I explained in a recent blog post. Economists and analysts are predicting that the American economy will descend into a recession during the second half of this year, which will exacerbate the financial pressures on consumers since recessions are usually accompanied by job losses and layoffs. The fact that Atmos Energy will not be too impacted by this should make it somewhat appealing for a portfolio today.

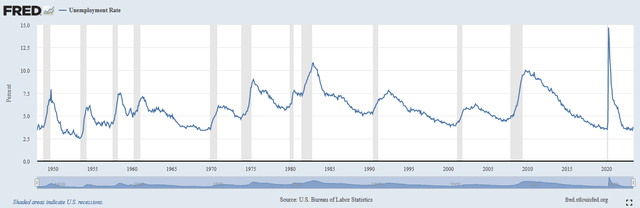

We can see further evidence that the company should not be affected much by an economic downturn simply by looking at the company’s operating cash flows above. In 2020, it reported an operating cash flow of $1.038 billion, which was an increase over the $968.8 million that it had in the 2019 fiscal year. The company thus managed to deliver growth despite the fact that the COVID-19 pandemic induced governments all throughout the company’s service area to shut down their economies and require people to stay at home. This caused massive layoffs, as shown here:

Federal Reserve Bank of St. Louis

As we can see, in 2020, the unemployment rate in the United States hit an all-time high. This had no impact on Atmos Energy’s cash flows though as the company still showed year-over-year growth. We can assume that the same thing will happen should a near-term recession cause the unemployment rate to shoot up again. The company can thus serve as an anchor for your portfolio and reduce your exposure to consumer discretionary companies that will probably be much more negatively impacted by such an event. This is one of the reasons why utilities like Atmos Energy are so appealing as “sleep well at night” investments for retirees and others that do not want to have too much risk.

Growth Opportunities

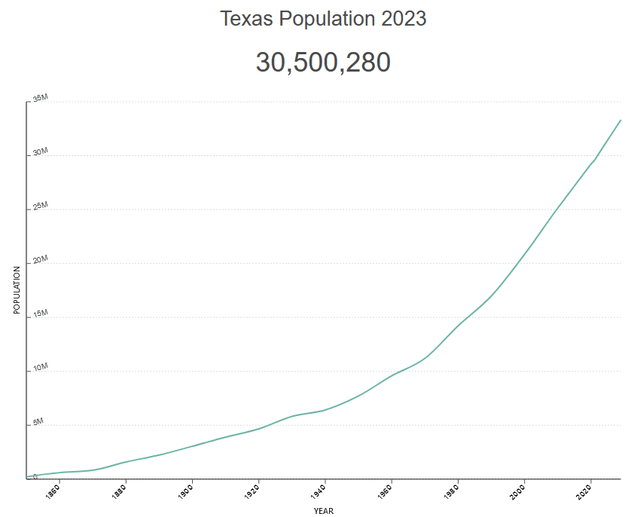

Naturally, as investors, we are unlikely to be satisfied with mere stability. We like to see any company that we are invested in grow and prosper with the passage of time. Fortunately, Atmos Energy is well-positioned to do that. One way through which this will be accomplished is by growing its customer base. As Atmos Energy is a utility, its ability to do this is somewhat limited as it is confined to operating in a specific area by regulators and cannot really expand to any great degree. However, Texas is one of the most rapidly-growing states in the nation, as we can see here:

World Population Review

Overall, the state’s population is growing at a 1.34% annualized rate as of January 2023, which puts it third in the United States. As we saw earlier, Atmos Energy also operates in Colorado, which is the sixth most rapidly growing state at a 1.26% annualized growth rate. As 2.1 million of the company’s 3.3 million customers are in Texas, which is by far the most important state for the company’s operations. The fact then that this state is exhibiting rapid growth should benefit the company going forward as it means that a growing number of people will be paying their monthly utility bills and providing Atmos Energy with a growing revenue base. All else being equal, that should result in more money making its way to the company’s bottom line.

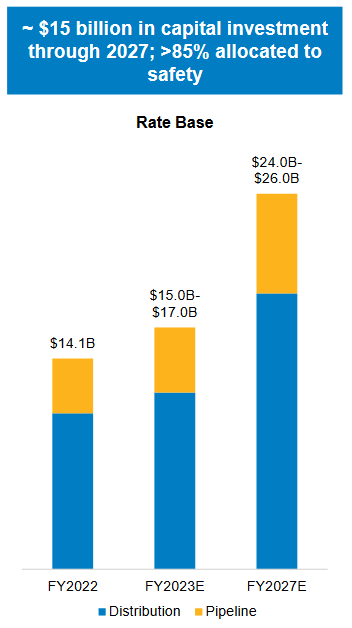

Atmos Energy has another method through which it can generate growth, which is good because most investors will not be satisfied with the approximately 1% year-over-year growth rate that the company might be able to obtain by depending solely on population growth. This alternative method is by growing the size of its rate base. The rate base is the value of the company’s assets upon which regulators allow it to earn a specified rate of return. As this rate of return is a percentage, any increase to the rate base allows the company to raise the prices that it charges its customers in order to earn this allowed rate of return. The usual way that a utility will grow its rate base is by investing money into upgrading, modernizing, or even expanding its utility-grade infrastructure. Atmos Energy is planning to do exactly this as the company has unveiled a $15 billion capital spending plan effective from 2023-2027 that is devoted to this purpose. The intent is for this to grow the company’s rate base from $14.1 billion today to $24 billion to $26 billion by the end of 2027:

Atmos Energy

As some readers might point out, the projected increase in the size of the company’s rate base will be much less than the actual amount that it is investing into its growth. This may be a bit of a turn-off at first, but it is quite normal and understandable. The biggest reason for the discrepancy is depreciation, which is constantly reducing the value of the assets that the company has in service. As a result of depreciation, if the company were to invest nothing into its assets in a given year, the rate base would actually decrease. In order to grow, it needs to invest enough to both offset the depreciation and then more to achieve growth.

Overall, the projected growth in the company’s rate base should allow it to grow its earnings per share at a 6% to 8% compound annual growth rate over the period. When we combine this with the current 2.48% dividend yield, we get an 8.5% to 10.5% total average annual return over the 2023 to 2027 period. This is admittedly not as good as some of the company’s peers have promised, but it is still very reasonable for a conservative utility company. It is an especially reasonable return if economic growth comes in tepid over the period, which is quite possible due to the debt overhang in the economy, higher interest rates than we have seen in fifteen years, and the possibility of a near-term recession.

Financial Considerations

It is always important that we investigate the way that a company is financing its operations before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. This is usually accomplished by issuing new debt and using the proceeds to repay the existing debt because very few companies have sufficient cash on hand to completely repay their debt as it matures. That can cause a company’s interest expenses to increase following the rollover in certain market conditions. As of the time of writing, interest rates in the United States are at the highest levels that we have seen in more than fifteen years so this is a very real concern today. In addition to interest-rate risk, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes a company’s cash flows to decline could push it into financial distress if it has too much debt. Although utilities like Atmos Energy typically have remarkably stable cash flow, bankruptcies have occurred in the sector so this is not a risk that we should ignore.

One metric that we can use to analyze a company’s financial structure is the net debt-to-equity ratio. This ratio basically tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well a company’s equity will cover its debt obligations in the event of bankruptcy or liquidation, which is arguably more important.

As of March 31, 2023, Atmos Energy had a net debt of $6.3637 billion compared to shareholders’ equity of $10.2052 billion. This gives the company a net debt-to-equity ratio of 0.62 today. This is a lot better than the 0.81 ratio that the company had the last time that we discussed it. The company has long been one of the least leveraged companies in the sector, as we can see here:

| Company | Net Debt-to-Equity |

| Atmos Energy | 0.62 |

| NiSource Inc. (NI) | 1.43 |

| Spire Inc. (SR) | 1.51 |

| New Jersey Resources (NJR) | 1.55 |

| Southwest Gas Holdings (SWX) | 1.46 |

| Northwest Natural Holding (NWN) | 1.24 |

As we can clearly see, Atmos Energy is less reliant on debt to finance its operations than any of its peers. This is a very good position for the company to be in, particularly given the rapid rise in interest rates that we have seen over the past year. We should not have to worry too much about Atmos Energy’s debt load as it does not appear to be relying too heavily on it as a source of financing.

Dividend Analysis

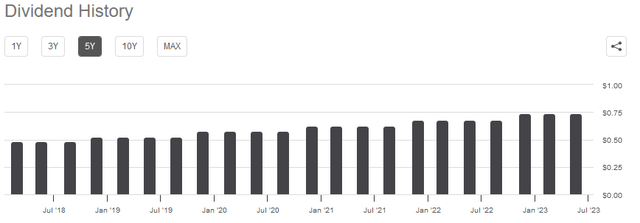

As mentioned in the introduction, one of the biggest reasons why we purchase shares of utility companies like Atmos Energy is the very high yields that these companies tend to possess. This comes from the fact that they are typically slow-growing companies, so investors cannot depend on capital gains to the extent that they can with other companies. Thus, the utility company will pay out a sizable percentage of its cash flow to the shareholders in order to provide a reasonably attractive investment return. For its part, Atmos Energy currently yields 2.48%, which is not especially high for the sector. In fact, it is lower than the 2.53% yield of the U.S. Utility Index (IDU). However, Atmos Energy still has a substantially higher yield than the S&P 500 Index (SPY), which only yields 1.45% at the current price. Atmos Energy also has a long history of increasing its dividend on an annual basis:

Seeking Alpha

This sort of dividend growth is very nice to see during inflationary periods, such as the one that we are in today. This is because inflation is constantly reducing the number of goods and services that we can purchase with the dividend that the company pays out. That can make it feel as though we are getting poorer and poorer with the passage of time. This problem can be particularly astute for those that are depending on their portfolios for income, which is a category that includes most retirees. The fact that the company increases the amount that it pays out each year helps to offset the effect and ensures that the dividend maintains its purchasing power over time.

As is always the case though, it is critical that we ensure that the company can actually afford the dividends that it pays out. After all, we do not want to be the victims of a dividend cut since such an event would reduce our incomes and almost certainly cause the company’s stock price to decline.

The usual way that we judge a company’s ability to maintain its dividend is by looking at its free cash flow. The free cash flow is the amount of money that was generated by a company’s ordinary operations and is left over after it pays all of its bills and makes any necessary capital expenditures. This is therefore the money that can be used for things such as reducing debt, buying back stock, or paying a dividend. During the full-year period that ended on March 31, 2023, Atmos Energy reported a levered free cash flow of $530.2 million. However, the company only paid out $402.7 million in dividends during the period. Thus, it appears that the company is generating sufficient cash flow to cover the dividends. We should not really need to worry too much here.

Valuation

It is always critical that we do not overpay for any assets in our portfolio. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of a utility like Atmos Energy, we can value it by looking at the price-to-earnings growth ratio. This is a modified version of the familiar price-to-earnings ratio that takes a company’s earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that a stock may be undervalued relative to the company’s forward earnings per share growth and vice versa. However, very few stocks are actually undervalued in today’s richly-valued market. That is especially true in the low-growth utility sector. As such, the best way to use this ratio today is to compare Atmos Energy against its peers in order to determine which company has the most attractive relative valuation.

According to Zacks Investment Research, Atmos Energy will grow its earnings per share at a 7.48% rate over the next three to five years. This is in line with the growth rate that we calculated earlier based on the company’s projected rate base growth so it seems like a solid estimate. At this growth rate, Atmos Energy has a price-to-earnings growth ratio of 2.65 today. Here is how that compares to the company’s peers:

| Company | PEG Ratio |

| Atmos Energy | 2.65 |

| NiSource, Inc. | 2.50 |

| Spire Inc. | 3.51 |

| New Jersey Resources | 2.92 |

| Southwest Gas Holdings | 3.89 |

| Northwest Natural Holdings | 4.34 |

As we can see, Atmos Energy is not the most attractively-valued company here, but it is very reasonable compared to most of its peers. When we consider that Atmos Energy has a much stronger balance sheet than NiSource, which is the only company here that appears to be cheaper, the current entry price for Atmos Energy appears very reasonable. Despite the fact that the stock has outperformed the broader utility index so far this year, it may still represent a good value today.

Conclusion

In conclusion, Atmos Energy Corporation is a very large natural gas utility that enjoys many of the characteristics that we like with companies such as this. In particular, the company should prove to be financially stable regardless of whatever happens in the broader economy, while still providing a respectable level of growth. This is exactly the kind of thing that we should find appealing in the current uncertain economic environment. The market seems to realize this, as Atmos Energy has outperformed the broader sector, but it still has a reasonable valuation. Overall, Atmos Energy Corporation stock looks like a buy today.

Read the full article here