With their above average margins, multilevel marketing (MLM) companies have long been a favorite of institutional investors. For example of nine public MLMs – USANA (USNA), Tupperware (TUP), Nature’s Sunshine (NATR), Mannatech (MTEX), LifeVantage (LFVN), Nu Skin (NUS), Herbalife (HLF), Primerica (PRI), and Medifast (MED) – the following institutional holders have shares in three or more:

|

Top Institutional Holders |

Stock in # of 9 MLMs |

|

Blackrock |

9 |

|

Vanguard Group |

9 |

|

Renaissance Technologies, LLC |

7 |

|

State Street Corporation |

6 |

|

Acadian Asset Management. LLC |

5 |

|

Dimensional Fund Advisors LP |

5 |

|

Geode Capital Management, LLC |

4 |

|

Charles Schwab Investment Management, Inc. |

3 |

|

Morgan Stanley |

3 |

|

Millennium Management LLC |

3 |

|

Bank Of New York Mellon Corporation |

3 |

Yet, the performance of these nine MLM companies can hardly be described as heartening. As of July 14, 2023, Tupperware, Mannatech, Nu Skin, Herbalife, and Medifast, are down when measured against YTD, 1 Year, and 5 Year. USANA and LifeVantage are both up YTD but well below their share price five years ago. Just two of the nine, Nature’s Sunshine and Primerica, have logged positive results relative to all three benchmarks.

|

MLM Company |

YTD |

1 Year |

5 Year |

|

USANA |

▲ |

▼ |

▼ |

|

Tupperware |

▼ |

▼ |

▼ |

|

Nature’s Sunshine |

▲ |

▲ |

▲ |

|

Mannatech |

▼ |

▼ |

▼ |

|

LifeVantage |

▲ |

► |

▼ |

|

Nu Skin |

▼ |

▼ |

▼ |

|

Herbalife |

▼ |

▼ |

▼ |

|

Primerica |

▲ |

▲ |

▲ |

|

Medifast |

▼ |

▼ |

▼ |

Clearly individual companies can have ups and downs, but seven of nine companies all in the same industry experiencing share declines relative to 2018 may be more than just a coincidence.

First, however, the exceptions. Nature’s Sunshine is up 50% relative to August 1, 2018, though down 34% relative to a high water mark on April 1, 2021. As with others (e.g., Herbalife and LifeVantage) they face headwinds in the Americas, which for Nature’s Sunshine means Net Sales from that region are down double digits from 2021 to 2022. Asia remains a bright spot and the company expects to continue to focus on non-US markets, “International operations have provided, and are expected to continue to provide, a significant portion of our total net sales.”

Primerica differs from the others by having a more diversified revenue base with returns associated with representing multiple vendors and invested assets. Despite bringing in 300K+ new recruits per year, the company maintains a fairly stagnant number of independent sales representatives licensed to sell life insurance. Even in the face of a decline in the annual number of new policies issued (from 2020 to 2021 and 2021 to 2022), Primerica’s earnings per share increased slightly.

US Retail Sales and DSA data

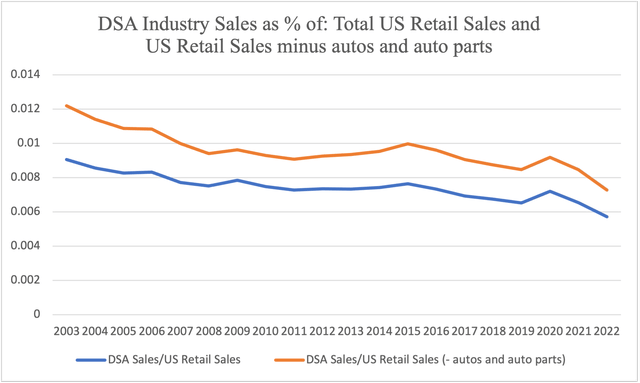

The bulk of the nine public MLM companies, however, face a steadily declining home market. Data for 2022 from the Direct Selling Association (DSA), comprised overwhelmingly of MLM companies, shows a continuation of its two-decade slide relative to US Retail Sales. Since 2003 the percent of Total US Retail Sales declined 40%. This chart updates data this author presented in 2020.

Often promoted as a means by which individuals can earn part or full-time income, direct selling saw an uptick of industry participants during the pandemic only to backslide afterward. From 2021 to 2022 the DSA reports a decline in “Direct Sellers,” “Discount Buyers,” and “Preferred Customers.” Comparing the industry to itself in terms of participants and, more importantly, revenue generating segments, cannot be accomplished prior to 2017 because of changes in reporting and labeling. And, of course, the data reported remains unverifiable.

Still, the fact remains that the future US market for MLM companies looks negative, if not grim. While the relative weakness of an individual company may be company-specific, even self-inflicted (e.g., Tupperware), the MLM model is in trouble, and not just in the US. The DSA in the United Kingdom reports an increase in “UK Direct Sellers,” yet a puzzling halving of the industry’s “Economic Contribution” from 2018 to 2022 (see here and here). One UK industry observer reported “The Direct Selling and Marketing industry is expected to perform poorly in the coming years… a fragile economic climate is expected to weigh on industry revenue. In addition, the level of criticism faced by the industry and inferences to pyramid schemes are likely to continue in the coming years.” In the US industry media report “Anti-MLM groups are gaining traction on social media, threatening a reputation revitalization for the channel.”

Regulatory actions continue with a recent comprehensive FTC win over the MLM Success By Health, Spain taking action against IM Academy (the fifth country to do so), and last year’s government accusations in India against Amway. Job security for MLM lawyers and the outside firms they hire.

The DSA regularly touts the benefits of self-regulations yet its own data documents years of decline in the face of regulatory warnings and legal actions, exposé-type documentaries, articles in the popular press, and vocal social media activists. As these environmental factors are not isolated to the US, institutional holders may wonder to what extent declines in the US and UK will move globally.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here