Tesla stock was rising on Monday after the electric vehicle maker produced the first Cybertruck on its assembly line in Austin, Texas. The electric pickup is the company’s first major launch since the Model Y in early 2020.

The new truck enters an increasingly crowded market for electric pickups.

Rivian Automotive

(ticker: RIVN) has its R1T battery-powered truck.

Ford Motor

(F) makes the F-150 Lightning. And

General Motors

(GM) launches the electric Silverado this year.

Rivian’s business is mostly electric pickups, so it makes sense that its shares were reacting the most of the three on Monday, with a loss of 0.9% in premarket trading. Ford and GM stocks weren’t doing much.

Tesla

shares got a Cybertruck boost, rising 1.6% to $286. Futures on the

S&P 500

were down 0.1%.

Nasdaq Composite

futures are flat.

A point to remember is that one truck won’t be enough to help Tesla shares out for long. Just how many Cybertrucks Tesla can build and deliver in the second half of 2023 will go a long way to determining how the stock will perform the rest of the year.

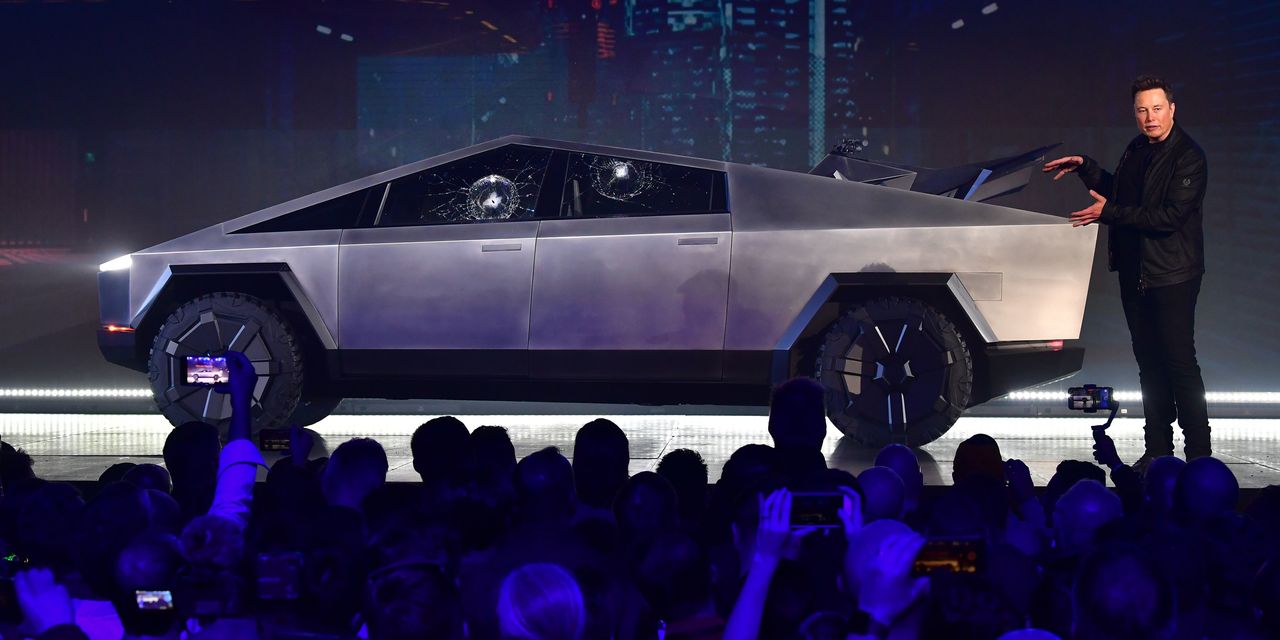

The Cybertruck’s arrival is a positive for the company, but there are still plenty of questions to be answered. Prices were originally set at roughly $40,000 to $70,000, but that was back in 2019, before inflation took hold.

Whether Tesla will keep the original pricing on all of the early orders and what that means for margins isn’t clear.

Some answers could be forthcoming in Tesla’s second-quarter earnings report, slated for Wednesday evening. Wall Street expects Tesla to produce about $2.7 billion in operating profit from $24.8 billion in sales, compared with $2.7 billion in profit from $23.3 billion of sales in the first quarter. The second-quarter estimates don’t look like a stretch, especially since Tesla delivered more than 466,000 vehicles in the second quarter, up from about 423,000 in the first quarter.

The second-quarter estimates indicate Wall Street thinks Tesla’s operating profit margins will still be in the 11% range, a little lower than in the first quarter. That might be conservative too, but analysts don’t want to get burned again. Tesla’s operating profit margins fell short of expectations for the first quarter and shares dropped almost 10% after earnings were reported April 19.

“This should be the low point of auto margin but commentary about future price cuts versus benefits to margin will be key,” wrote Baird analyst Ben Kallo on Monday, previewing the quarterly report. “Margin tailwinds should trump additional price adjustments.”

Kallo rates Tesla shares at Buy. He raised his target for the stock price to $300 from $252 a share on Monday.

Coming into Monday trading, Tesla stock is up about 70% since the dip after earnings and up almost 130% so far in 2023. Several factors have boosted shares, including rising deliveries, deals with auto makers allowing them to use Tesla’s supercharging network for their EVs, and the approaching Cybertruck.

The oddly-shaped pickup won’t help profit margins in the second quarter, but investors will still be interested in an update about it on Wednesday.

Analysts project about 10,000 Cybertruck deliveries for all of 2023. If Tesla is producing the truck off its assembly line now, that estimate could turn out to be light. Cybertruck’s body panels are made out of stainless steel, which isn’t typical. And the frame uses some new technology for Tesla. It has been harder to bring to market than the Model Y. Still, Tesla made roughly 80,000 Model Ys in its first three quarters of production.

Write to Adam Clark at [email protected]

Read the full article here