In this article, I will outline why I think T. Rowe Price Group, Inc. (NASDAQ:TROW) is a buy at this time. I will explain my thesis using price action, volume, momentum, and relative strength. I will offer two price targets and a stop loss in case my investment thesis doesn’t play out as anticipated.

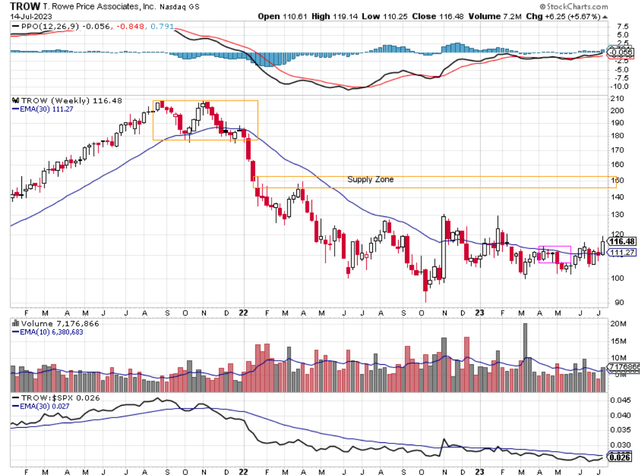

Chart 1 – TROW Weekly with 30 Week EMA, Momentum, Volume, and Relative Strength

www.stockcharts.com

When analyzing a stock for a trade idea I always start with price action. I want to see what the current market structure is and how that may develop in the future. I use price along with a 30-week exponential moving average (EMA) most of the time. The 30-week EMA is an intermediate to long term trend signal in my opinion.

Looking at Chart 1 you can see that TROW made its high in August 2021 at $208.59. A few weeks later it tried to make a higher high but came up a little short forming a double top formation in November 2021. That double top formation proved to be an area of distribution which is outlined with the orange rectangle. From there TROW went downhill. In December 2021, TROW closed below its 30-week EMA, shown in blue, which was a sign to reduce your exposure or to sell your whole position depending on your risk tolerance. I like to use the 30-week EMA as a gage to determine if I should be long or short the stock. In general, I want to own stocks that are above a rising 30-week EMA and I want to be out of or short, stocks that are below a declining 30-week EMA.

TROW sold off and made a low in March 2022 at $124.94. Then it rallied into April to $149.44. TROW couldn’t get back to its declining 30-week EMA. TROW then declined into June reaching a low of $100.31. This was a lower low than the one made previously in March. TROW then rallied to $127.72 in August which also failed to touch the declining 30-week EMA. It got closer to the EMA, but still failed to reach it. It also made a lower high than the one made previously in March. The series of lower lows and lower highs are the textbook definition of a downtrend. Something I try to avoid when owning stocks. The ultimate low was then made in October 2022 at $90.53. This low represented a 56% correction from the high of August 2021.

Since the low in October 2022, the market structure has changed, for the better. TROW rallied to $130.22 in November 2022. In doing so, it made two noticeable changes for those who pay attention to market structure. First is that it closed above the 30-week EMA for the first time in about a year. The second noticeable change was that it made a higher high. This closing high was above the high previously made in August. The volume, which will be discussed later, was impressive that week as well. After selling off to $104.81 in January 2023, TROW made another run into late February. Here it failed to take out the high set in November forming a double top again. This time TRWO sold off into March reaching a low of $99.98, a lower low, but above the low set in October. Since then, TROW has consolidated between $100 and $116. That changed last week as TROW closed back above its 30-week EMA at $116.48. This is the highest close it has had since January. Price is above its 30-week EMA and has made a series of higher lows since March. I see the price action as bullish.

Since I see the price action as bullish, I look for potential price targets. Since this is an intermediate to long term analysis for me, I see the first area of resistance at the orange box marked supply zone. This area was chosen as this area represented a high before a major decline. People who bought TROW in this area in March 2022 may be sellers if price gets back to this area. If price can get through this supply zone, the next area of supply is the $190 area which is where the decline began. I’m not saying TROW will get to either of these price targets. I just see these two areas as potential and reasonable price targets. I have no idea how long it may take to reach either of those two price targets.

I am encouraged by the recent price action of TROW, especially when I consider the volume. The third pane of Chart 1 shows the weekly volume along with the 10-week EMA of volume. Since the low set in October, almost all the big volume bars correspond with bullish price action. This shows that smart money or institutions are accumulating shares of TROW. It takes time for big money to accumulate their shares, and this often happens during areas of consolidation where there is horizontal price movement instead of vertical price movement. I see the volume pattern as bullish.

Next, I consider momentum when looking at trading decisions. The top pane of Chart 1 shows the Percentage Price Oscillator which is an indicator of momentum. It is easy to understand. Simply put, momentum is bullish when the black line is above the red line. Momentum is also bullish when the black line is above zero or the centerline of the chart. Bearish momentum is the opposite. Maximum bullish momentum is when black is above red and black is also above zero or the centerline. Maximum bearish momentum is the opposite. Today we have a tepid but improving momentum picture. Black is above red which is bullish. However, black is also below zero or the centerline at -0.056 which is bearish. However, you can see the momentum improving. It has made a series of higher highs and higher lows, just like price has. While not a prediction, if price closes higher next week, I expect the black PPO line to be above zero. I am cautiously optimistic about momentum for TROW.

The last part of my investment thesis is relative strength. I like to own stocks that are outperforming the SP 500 index. I use the indicator in the bottom pane of Chart 1 as my guide. This is a ratio of TROW to the SP 500 in black with the 30-week EMA of that ratio is blue. When the black line is rising that shows that TROW is outperforming the major index. When the black is falling that shows that TROW is underperforming the major index. I want to see the black line rising and I prefer to see it above a rising 30-week EMA. That condition has not been met yet, which gives me pause. If you buy TROW today, you may buy a stock that goes higher, but may not outperform the major index. That could change though. You can see that the black relative strength line is moving higher and could soon close above the 30-week EMA. Or it could turn lower from here. To be determined.

In summary, the market structure of TROW has changed from making a series of lower lows and lower highs to a more bullish structure of consolidation with higher highs and higher lows. Its recent close above its 30-week EMA is bullish. Volume is bullish. Smart money or institutions appear to be accumulating TROW. They would only accumulate shares for one reason. They think that TROW is undervalued at this level. Momentum is slightly bullish and could reach maximum bullish momentum soon. Relative strength is at best flat. It could be better and there is reason to believe that relative strength could improve soon. That is to be seen. All in all, I see TROW as a buy at this level. Whenever I buy a stock, I also have a stop loss. I know that my trade thesis could be wrong. I would look to reduce my exposure to TROW if it closed below the 30-week EMA and I would look to exit my position if TRWO closed below $104. If that happened, I would take my small loss and look for another opportunity.

Read the full article here