Introduction

According to the 2022 10K, ExlService Holdings (NASDAQ:EXLS),

is a leading data analytics and digital operations and solutions company that partners with clients to improve business outcomes and unlock growth.

And how EXLS does that is by

… bringing together deep domain expertise with robust data, powerful analytics, cloud, artificial intelligence (“AI”) and machine learning (“ML”), we create agile, scalable solutions and execute complex operations for the world’s leading corporations in industries including insurance, healthcare, banking and financial services, media, and retail, among others.

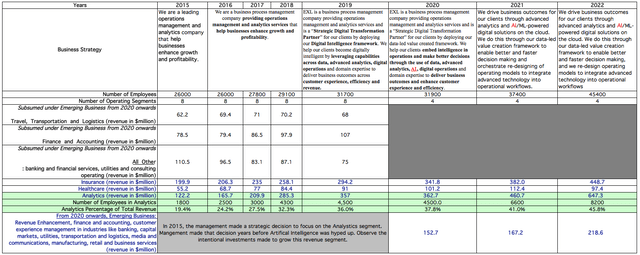

The company did not always operate in these segments. The comparison table below shows the changing evolution of EXLS over time. Click on the image to enlarge the table.

Author’s. Data sourced from 10Ks from 2015 to 2022

In the following, I will share the six reasons why I like this company.

6 Reasons Why I Like EXLS

1. Excellent Management

You will observe the following from the table above:

One, EXLS’s business strategy shifted over time, starting in 2015 when the management, led by CEO Rohit Kapoor, who is still the CEO now, to focus on the Analytics segment. Not just the segment’s importance as a main revenue driver grew, but its percentage of the company’s total revenue grew from 19.4% in 2015 to 45.8% in 2022. The Analytics segment’s revenue contribution increased more than five times from $122.2 million in 2015 to $647.3 million in 2022. Since 2015, the other segments grew too but to a much smaller degree; the Insurance segment grew by more than 2x in revenue, the Healthcare segment grew by 76%, and revenue from various other industries are grouped under Emerging Business and as a collective shrunk by 13.2% from $251 million in 2015 to $218.6 million in 2022.

Two, EXLS’s management not only made the decision to pivot toward the Analytics segment, but it also pivoted hard, pouring huge amounts of resources into it. EXLS has been hiring throughout the past many years as it expanded operations, growing the 26000 strong team in 2015 to a massive 45400 by December 2022. As a percentage of the total employee number, the number of professionals in the Analytics segment increased even more. In 2015, 7% of EXLS’s team came from the Analytics segment. By 2022, that percentage has increased to 18%.

It is easy for a management team to “pivot” half-heartedly, expending just a small fraction of the company’s scarce resources to grow one division, just in case the experiment did not work out. If EXLS’s management had not pivoted hard as it did, it would not have performed as well today. More on its performance in point 2.

Three, management’s Business Strategy changed ahead of the crowd, with increasing emphasis on artificial intelligence and machine learning. No, that was not management riding the artificial intelligence hype train. In fact, in the 2019 10K, before the pandemic-led catalyst to all-things-in-the-cloud, and before the ChatGPT and Bard AI craze took over the market in the first half of 2023, EXLS management described their operations management business in the following way:

The key differentiators and salient features of our BPM services include our agile operating and delivery model utilizing domain and data expertise and process excellence, the Digital EXLerator FrameworkTM , our ability to deploy a Business Process-as-a-Service (“BPaaS”) delivery model, business process automation (including robotics), consulting-driven digital transformation and our industry vertical focused approach. The Digital EXLerator FrameworkTM, is our integrated approach to operations management which enables us to drive better customer outcomes by using advanced automation (such as robotics, advanced analytics and artificial intelligence), process optimization (lean six-sigma), along with smart workflow, driving better orchestration of human talent and technology.

That is why I believe that the management has done an excellent job in adapting to the changing environment and even foreseeing the future of their industry and positioning the company years in advance.

The following from the 2022 10K captures this thinking behind management present thinking very well:

Over the past two years, we have seen a significant acceleration in the shift to digital and cloud-based solutions across all our target markets, including as a result of the COVID-19 pandemic. Capturing data and enriching data has become a key differentiator for clients and their speed of decision making necessitating the adoption of advanced AI and ML techniques. The accelerated adoption of cloud-based solutions has increased our clients’ needs for a suite of cloud migration and enablement capabilities. We expect the trend in increased demand for analytics solutions to continue, and to capture these new opportunities, we are building a scalable and customizable multi-cloud cross-sector AI and advanced analytics platform with pre-built accelerators and packaged solutions. This platform will expand our target addressable market and help monetize our intellectual property through ‘as-a-service’ models.

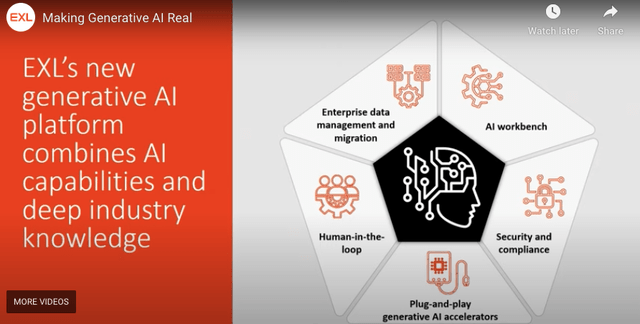

Four, management has a clearly articulated vision of the use of artificial intelligence. In a virtual event on 31 May 2023, EXLS introduced its new generative AI platform to “combine AI capabilities and deep industry knowledge”.

Screen grab from EXLS virtual event on May 31, 2023, where it launched its generative AI Platform

The vision of introducing a human element resonated with me. In the virtual conference, CEO Rohit shared this,

In our platform we always have humans in the loop so there is always adult human supervision in terms of whatever content we are putting out and whatever model outputs that are coming out.

He was also able to make the case for real applications of generative AI in a well-thought-through and safe environment,

One of the biggest issues of using generative AI that we hear constantly from our clients is that they don’t want to have their data get compromised and go into the external world so that it can be misused. We have built very strong safeguards and mechanisms and this AI workbench allows us to play in a sandbox that is very well protected. We’ve got adequate amount of security and compliance, tools built in that make sure that we can maintain the integrity of the data and that we don’t have co-mingling of datasets taking place so that the external data is kept separate and the internal data is used separately as well.

In that same event, after showing a demonstration of EXLS’s AI in action to resolve a client’s health care query through a chatbot, Anita Mahon, EVP & Global Business Head, further explained the role of the human element in how EXLS thinks about generative AI.

One important note on the accuracy. When a member reaches out to a health plan like this, they are typically experiencing some kind of a health care need so it is critical that we are getting them the answers that they seek. A use of generative AI like this, providing answers direct-to-consumers is going to require ongoing human-in-the-loop validation done with an expert understanding of the domain and the operations and a validation that is achieving intended outcomes. There may be a risk that the AI could respond inappropriately but the question is not really whether generative AI will ever get an answer wrong but “can we tune the model such that it is doing as well or better than our member services agents” and as you can imagine, generative AI can support those (human) agents too.

The many demonstrations at the virtual event of how EXLS’s generative AI platform enhanced service delivery and raised the customer experience were proof that EXLS is already positioned to provide solutions to many existing pain points.

2. EXLS Has Been A Strong Historical Performer

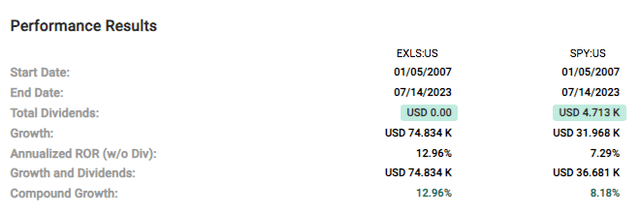

ExlService Holdings is a business that has performed consistently well over the past 17 years. Despite facing two recessions during this time period, EXLS outperformed the S&P 500 (SPY) by almost 500 basis points, rewarding long-term shareholders who invested $10,000 in EXLS in 2007 with a return of $74,834 versus half of that from a similar investment in SPY.

FAST Graphs

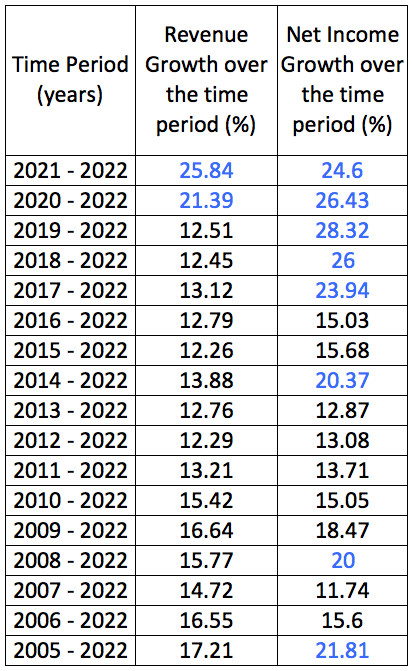

During this same time frame, EXLS grew revenue and net income by double-digits with a CAGR of 17.21% of revenue growth and 21.81% of net income growth.

FAST Graphs

Typically, as companies grow larger, their revenue and net income growth rate slows down. That is hardly the case for EXLS.

Author’s table; data from FactSet, sourced from FAST Graphs

Not just has EXLS’s revenue and net income been growing consistently at double-digit rates for each of the past 17 years, but the revenue growth rates were supercharged during the years from 2020 to 2022, growing above 20% from 2020 to 2022.

This points to two things. Either EXLS is gaining market share, or the total-addressable market that EXLS is serving is expanding at a far higher rate so there is a greater piece of the pie for everyone, or both.

3. EXLS Is Definitely Gaining Clients In An Industry Backed By Secular Growth Trends, And Fans

I do not know if the total addressable market has expanded but I do know for sure EXLS’s clients have been increasing over the years.

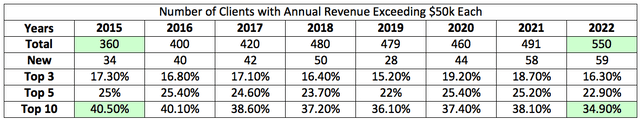

Author’s. Data from 10Ks from 2016 to 2022

EXLS’s services and products have proven to land more customers, bringing in $50 thousand per year. That is not surprising given the market size of Artificial Intelligence, depending on which research report, is backed by a strong secular growth trend that is expected to grow this market anywhere between 21% to 37% in the decade to come.

And by “fans”, I refer to investors with deep pockets. According to Stockcircle, in Q1 of 2023, billionaire hedge fund manager Ken Griffin increased his stake in EXLS by 6100.4% while another billionaire hedge fund manager Jim Simons started a new position by purchasing 140 thousand shares. Now, as I mentioned in my article on Fidelity National Information Services: Why did Seth Klarman Own 4.3% of FIS, I do not buy or sell shares based on what smart money does but knowing that they always make me think about “Why“.

4. EXLS Has Sustainable Future Growth

The past is not indicative of the future, and astute investors do not invest in a company based on its past, no matter how glorious. It is the future that matters.

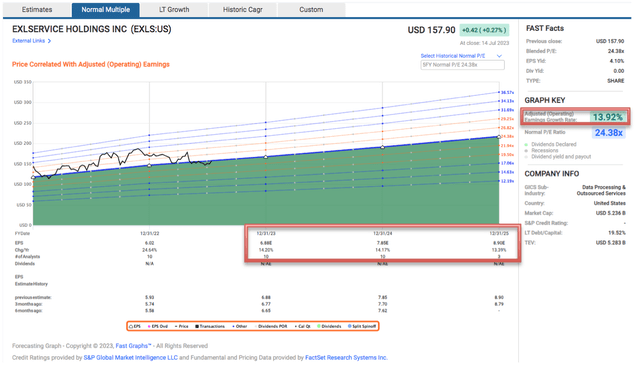

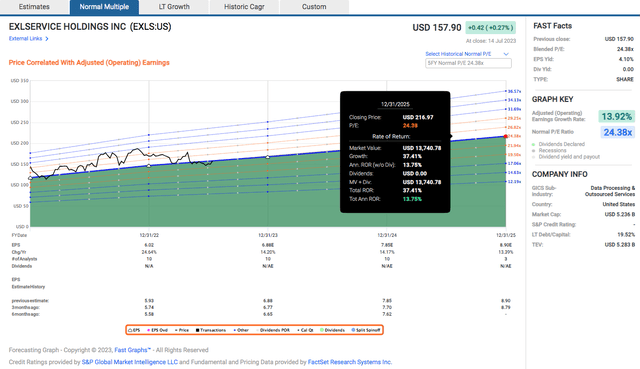

Although EXLS’s growth is expected to moderate to pre-COVID levels, it is still expected to grow adjusted operating earnings at double-digit rates of 13.92% for the next three years, according to FactSet analysts.

FAST Graphs

That 13.92% forecasted growth rate is in line with the five-year growth rate of 14.55% per annum that analysts at Yahoo Finance forecasted, and the next three-to-five-years earnings growth rate of an average of 15.09% per year forecasted by SPGI analysts.

To be conservative, I will consider the lowest estimated growth rate of 13.92%. That is a reliable and achievable growth rate based on two reasons.

Firstly, the company achieved growth rates between 12.26% and 25.84% in the past 17 years so it is not difficult to see that 13.92% is easily achievable.

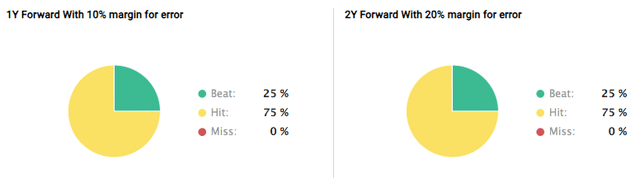

Secondly, the company has either met (75%) or beaten (25%) FactSet analysts’ 1-year and 2-year earnings and sales forecasts and had never missed these forecasts.

FAST Graphs

This tells me that EXLS’s revenue stream and costs are predictable, and that management knows their business well and has been able to give accurate guidance.

5. EXLS Has Industry-leading Profit Margins

According to EXLS’s 2022 10K, its closest direct competitors are Genpact Limited (G) and WNS (Holdings) Limited (WNS).

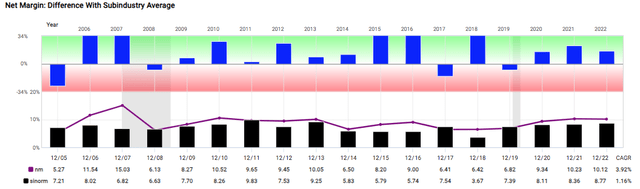

FAST Graphs

Well, EXLS’s net margin has been better than the competitor most of the time over the years, so it is no wonder EXLS outperformed G and WNS by a mile and more. More on this below.

6. EXLS Bested All Its Competition

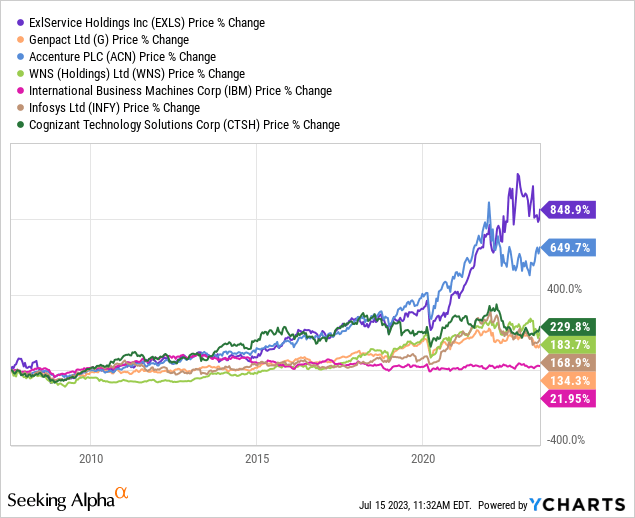

In addition to these two direct competitors G and WNS, EXLS also faces off against “large global companies with digital operations and solutions and operations capabilities” like International Business Machines Corp (IBM), Accenture (ACN), Infosys (INFY), and Cognizant Technology Solutions (CTSH).

And EXLS’s performance crushed all the competition.

EXLS’s outperformance against these companies held true also for comparisons over 1-year, 3-year, 5-year, and 10-year periods.

2 Risks

The first is Customer Concentration Risk

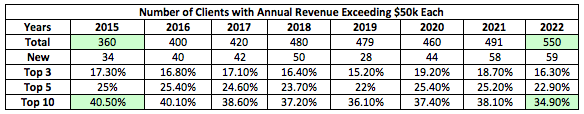

Back in 2015, the top 3 customers made up 17.3% of the total revenue, the top 5 customers comprised of 25% of the total revenue, and the top 10 customers made up 40.5% of the total revenue.

Author’s, with data sourced from 10Ks from 2015 to 2022

Management is aware of the potential danger this can bring since if any one of these companies were to face delays or difficulties in making payments, or if they were to terminate their contract with EXLS, it would result in a huge decline in revenue for the company. Over the years, management has actively reduced this risk.

As of December 2022, the customer concentration has declined for the top 3, 5, and 10 customers to 16.3%, 22.9%, and 34.9% respectively. Management accomplished it by diversifying the revenue sources across more industries. In 2015, other than the main segments of insurance, healthcare, and analytics, ELXS also served in 5 more industries (travel, transport, and logistics; finance and accounting; banking and financial services; utilities; consulting). Now, EXLS has expanded to more industries like capital markets, media and communications, manufacturing, retail, and business services.

The Second is Business Cycles

EXLS business is associated with business cycles. If the economy slows, and EXLS’s clients are in a tight spot, they may hold their spending. If a certain industry the EXLS serves like the banking industry gets hit by adverse events, EXLS may be impacted. If clients find alternative service providers or do not renew their agreements, EXLS will face attrition.

Although CEO Rohit insisted that EXLS business is “focused on helping… clients grow revenue, reduce costs and improve end customer experience… [and] are relevant… in all kinds of economic environments“, and I believe there is truth in that, the fact remains that there is some level of attrition. The good news in Q1 2023 is the historically low attrition rate of 26%.

Besides attrition rates, clients can withhold spending.

In the most recent Q1 2023 earnings call, CEO Rohit, in response to queries by analysts, said,

Now, there is a possibility that given the volatility in the first quarter [regarding SVB banking crisis], we might see banks hold back their decision making, particularly associated with discretionary spending in the second quarter or in the rest of the year.

However, we believe that as the regulatory compliance and risk management is stepped up in the banking industry vertical, EXL will benefit from that because our clients will need to strengthen their analytical business models around regulatory compliance and around risk management…

Now, we are seeing marketing analytics services slow down and that’s scenario where clients are holding back their investments. We may see delayed decision making around — on some of the discretionary spend that our clients have and that’s something, which we see specifically.

Generally, EXLS’s approach to mitigating business cycles and revenue fluctuation to some extent is to enter into agreements with its clients. For digital operations and solutions other than consulting, EXLS signs long-term agreements with initial terms between 3 to 5 years with its clients. During this period, EXLS strives to build a long-term relationship with its clients to continue to extend the agreements when the initial term ends and to upsell and cross-sell services to the customers. The consulting jobs have shorter 6 months to 12 months duration, and the analytics services have agreements lasting between 1 to 3 years.

Valuation

Management expects business in 2023 to be better than it had expected and it raised EXLS’s revenue and earnings guidance for 2023. Revenue guidance increased from the previous range of $1.56 billion to $1.6 billion to $1.595 billion to $1.62 billion, representing year-over-year growth of 13% to 15%. Earnings per share were guided up to the range of $6.75 to $6.90, representing year-over-year growth of 12% to 15%.

In view of the latest guidance, FactSet analysts upped the EPS forecast from $6.77 to $6.88 for 2023, expecting it to grow adjusted operating earnings at an average annual rate of 13.92% for the next three years. Based on this projection, EXLS could be worth $216.97 by the end of 2025 if it trades at the current blended P/E of 24.38, which is in line with its historical normal P/E, suggesting that EXLS is fairly priced now.

FAST Graphs

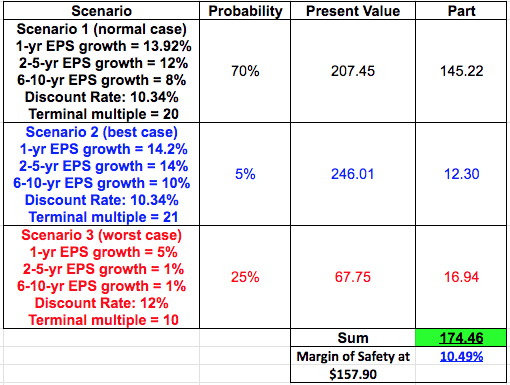

Using a discounted cash flow model with three different assumptions (see table below), I came to an intrinsic value of $174.46 per share.

Author’s DCF

I believe my assumptions to be conservative, bearing in mind EXLS’s normal P/E has been around 24 and none of my assumptions suggests that EXLS will trade at 24. My bear-case scenario even factored in a black swan event that slashed earnings growth from years 2 to 10 to just 1% per year. Even my exuberant best-case scenario included a decline in growth rate from years 6 to 10. Despite these conservative figures, EXLS still provides a small 10.49% margin of safety at $157.90.

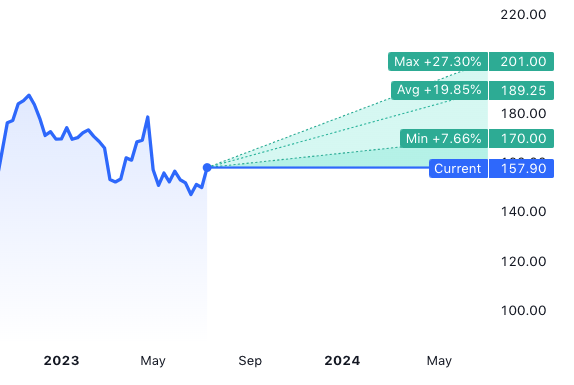

This gives me a range of between $174.46 (10.49% upside) to $216.97 (37.4% upside), which is slightly more optimistic than analysts’ projected range of between $170 (7.66% upside) to $201 (27.3%).

TradingView

Finally, what if the company continues to grow but at a slower rate than analysts had forecasted? Say EPS grows at 10% in 2023 (rather than the projected 14.2%), and EPS growth declines to 8% annually in years 2 to 5 (versus the forecasted 13.92% for the next 3-5 years), and EPS growth declines even further to 6% annually from years 6 to 10. And due to the slower growth, investors no longer believe that EXLS deserves a premium and shares trade down to a blended P/E of 17 (which was around what it traded for between 2010 and 2014). If the above were to happen, the shares could be worth $148.38, meaning the shares of EXLS would then be overvalued by 9% at the present price of $157.90.

Conclusion

As a stockpicker, if I were to pick a stock with winning characteristics, ExlService Holdings will be one that I would love to own.

Performed consistently well as a profitable and growing business from the beginning? Check.

Beat the SPY? Check.

Crushed the competitors? Check.

Have industry-leading margins? Check.

Gaining market share and new customers? Check.

Operates in an industry backed by secular growth trend? Check.

Expected to have double-digit growth for the next 3 years? Check.

Great management team with foresight and guts to make the change? Check.

Is EXLS a BUY at the current price? I believe it is. The intrinsic value range I found lies between $174.46 to $216.97. Of course, as Seth Klarman once said,

Valuation is an art, not a science. Because the value of a business depends on numerous variables, it can typically be assessed only within a range.

Let’s say I am wrong and the fourth scenario happens, which simulates a progressively declining EPS growth rate and it is possible to see the share price falls by 9% due to it being overvalued under those assumptions, the decline will not be catastrophic in a well-diversified portfolio. Therefore, the downside seems pretty limited in light of the more probable upside potential.

Whether you think EXLS is undervalued or overvalued depends on your input variables. Personally, I will prefer a larger margin of safety (hence the BUY rather than STRONG BUY) but I like the other aspects of the business sufficiently so for me to initiate a small position. EXLS comes close to being my dream stock but I will take it.

Read the full article here