Introduction

Reneo Pharmaceuticals (NASDAQ:RPHM) is a clinical-stage company developing therapies for rare genetic mitochondrial diseases, characterized by impaired mitochondrial ATP production. The company’s primary product, mavodelpar, is a potent PPARδ agonist that enhances mitochondrial function and fatty acid oxidation, possibly increasing new mitochondria creation. PPARδ, highly present in muscle, kidney, brain, and liver tissues, regulates energy metabolism and homeostasis. Mavodelpar has shown promise in trials, demonstrating enhanced gene expression linked to mitochondrial function, improved muscle strength, and symptomatic relief in patients with primary mitochondrial myopathies [PMM] and long-chain fatty acid oxidation disorder (LC-FAOD).

Recent developments: Reneo Pharmaceuticals has been included in the broad-market Russell 3000 index, marking a significant milestone in the 2023 annual Russell index’s reconstitution. Furthermore, the company priced an underwritten public offering of approximately 6.88 million shares at $8.00 per share, raising around $55 million.

Q1 2023 Earnings

In Q1 2023, Reneo Pharmaceuticals reported a net loss of $15.1 million, a slight increase from the $13.0 million loss in the same period of 2022. As of March 31, the company held $93.8 million in cash and short-term investments. R&D expenses rose to $11.0 million due to a $1.4 million increase in clinical study costs related to mavodelpar. G&A expenses were $5.1 million, up from $3.7 million, mainly due to facility and personnel costs from new hires. In May, the company raised $58.2 million through a public offering and an additional $4.7 million through a private placement to Abingworth Bioventures.

RPHM Stock Assessment

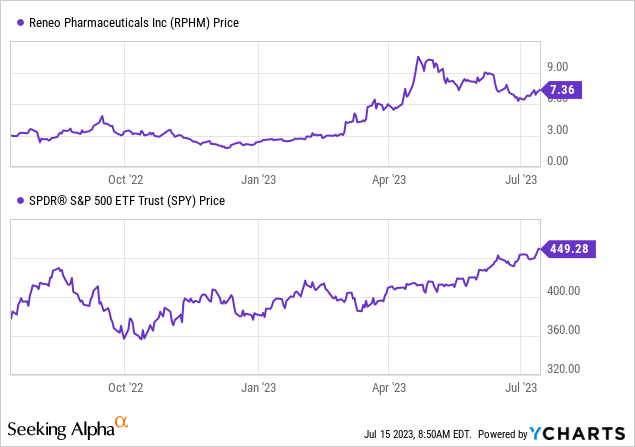

Per Seeking Alpha data, RPHM shows robust momentum, significantly outpacing the S&P 500 index over the past 6, 9, and 12 months. The stock has surged by 183.08% in 6 months and 144.52% over a year, contrasting with the S&P 500’s returns of 12.66% and 18.86%, respectively.

However, while the company’s strong performance and solid balance sheet – with a market capitalization of $247.72M, minimal debt at $1.34M, and substantial cash holdings of $93.79M – are appealing, it’s crucial to remember the inherent risks associated with investing in micro-cap companies. These risks include limited liquidity, higher volatility, and less public information. In addition, the lower enterprise value of $155.28M compared to the market cap might indicate the stock’s undervaluation, but it could also reflect higher risk or market skepticism.

Micro-cap companies like Reneo are also more vulnerable to business challenges and market fluctuations. Their performance often depends on the success of single or a few products, in this case, a specific drug under development. Thus, any setbacks in the drug’s clinical trials or approval process can significantly impact the stock’s value.

The Therapeutic Potential of PPARδ Agonists: Advancements and Challenges

PPARδ (peroxisome proliferator-activated receptor delta) is part of a nuclear receptor family that plays essential roles in cellular functions, including metabolism. Several attempts have been made to develop PPARδ agonists due to their potential benefits for various conditions. GW501516, developed by GlaxoSmithKline, aimed to treat metabolic and cardiovascular diseases, but development ceased due to cancer concerns in animal studies. Another PPARδ agonist, seladelpar by CymaBay Therapeutics, is being explored for treating primary biliary cholangitis, an autoimmune liver disease. Elafibranor, developed by Genfit, is a dual PPARα/δ agonist initially studied for non-alcoholic steatohepatitis and primary biliary cholangitis, but development was discontinued for the former due to unmet trial endpoints. Despite challenges, the interest in PPARδ agonists remains due to their therapeutic potential.

Mavodelpar Shows Promise in Phase 1b Trial: Boosting Mitochondrial Function for PMM

Reneo Pharmaceuticals completed an open-label Phase 1b trial for mavodelpar, a potential treatment for primary mitochondrial myopathies [PMM] caused by mtDNA defects. The drug was generally well-tolerated, showing promise for improving mitochondrial function and boosting cellular energy levels.

The study consisted of two parts, each lasting 12 and 36 weeks respectively, and involved daily oral doses of 100mg mavodelpar. 17 patients completed the first part, but the trial was cut short due to the COVID-19 pandemic.

The main measure used to assess patient function was the 12-minute walk test (12MWT), revealing an average increase of 104.4 meters after 12 weeks. However, there were 114 treatment emergent adverse events, mostly mild to moderate in severity, with constipation and headache being the most common.

Additional outcome measures included the peak oxygen consumption during maximal exercise, a sub-maximal exercise test, a 30-second sit-to-stand test, and several patient-reported outcomes related to fatigue, pain, and general health. Improvements were observed in all areas.

Muscle biopsies revealed significant increases in the expression of certain genes, indicating potential mitochondrial function improvement.

Following these results, Reneo initiated the STRIDE study, a Phase 2b trial for mavodelpar. The trial, which enrolled 200 patients, is expected to yield results in late 2023. The company also launched the STRIDE AHEAD study, a long-term safety trial. The data from these studies is planned to be submitted to the FDA and the EMA in 2024.

Mavodelpar Shows Promise for LC-FAOD Treatment: Phase 1b Study Results

Reneo Pharmaceuticals has completed an open-label Phase 1b study of mavodelpar, a treatment for long-chain fatty acid oxidation disorders (LC-FAOD) linked to nDNA defects. The study enrolled 24 patients and aimed to assess safety and tolerability of the drug, as well as measure changes in functional tests. Improvement was seen especially among patients with LCHAD and CPT2 defects.

Despite common adverse events such as rhabdomyolysis and myalgia, mavodelpar was generally well tolerated. Given the results, Reneo is planning to continue the development of mavodelpar for specific genotypes of patients with LC-FAOD.

The company also conducted the FORWARD study, a 16-week observational, non-interventional study involving 58 patients to understand LC-FAOD’s natural history and symptom progression.

In addition, mavodelpar was tested on healthy volunteers in a placebo-controlled Phase 1 trial where it demonstrated potential in improving muscle strength.

Reneo is also conducting a 104-week carcinogenicity study in rats and mice. Results are expected in late 2023. Even though other PPAR agonists have shown potential liver and cardiac toxicity, no adverse effects associated with these agonists were observed with mavodelpar.

Commercially, Reneo plans to retain rights to mavodelpar in the US and key European markets while seeking partnerships for other territories.

As part of a License Agreement with vTv Therapeutics in December 2017, Reneo gained an exclusive, worldwide license to vTv’s PPARδ agonist program, including mavodelpar. The deal involved an upfront payment of $3 million to vTv and the issuance of common stock. It also outlines milestone payments, sales-based payments, and royalties that Reneo must pay to vTv. The agreement lasts until the expiration of the last royalty term, with the possibility of earlier termination under certain conditions.

My Analysis & Recommendation

In conclusion, Reneo Pharmaceuticals appears to be a high-potential company in the field of rare genetic mitochondrial diseases. The significant progress and promising results of the clinical trials for mavodelpar, a potential treatment for PMM and LC-FAOD, underscore the company’s potential for growth and the value of its core product. The firm’s decision to further develop mavodelpar based on Phase 1b trial results indicates confidence in the drug’s therapeutic effectiveness.

Reneo’s addition to the Russell 3000 index is a noteworthy achievement, highlighting its strong performance and growth. Moreover, the robust stock momentum that has significantly outpaced the S&P 500 index in recent periods implies a positive investor sentiment. The recent capital raising also adds to the company’s cash reserves, thus strengthening its financial position.

Despite this, it’s important to remember that the company’s success largely hinges on mavodelpar’s development and approval. Any setbacks could have substantial implications on its share value. Therefore, investing in Reneo comes with its inherent risks, typical of clinical-stage biopharmaceutical companies.

The potential market for mavodelpar in treating rare genetic mitochondrial diseases is significant. Given the scarcity of effective treatments for conditions such as PMM and LC-FAOD, a successful mavodelpar could find a substantial patient population. This could mean considerable revenue for Reneo, especially considering the generally high price points for rare disease treatments.

As an investor, I’d currently recommend a ‘Hold’ position on Reneo Pharmaceuticals. While the company shows promise with its ongoing clinical trials and strong stock performance, the inherent risks associated with clinical-stage companies, such as the dependency on a single product’s success and the volatility associated with such stocks, cannot be ignored. An investment in Reneo is essentially a bet on mavodelpar’s success, and while signs are promising, it’s crucial to monitor the upcoming trial results and FDA communications closely. The expected results from the 104-week carcinogenicity study in late 2023 could also be a significant inflection point for the company and should be kept in sight given the history of PPARδ agonists.

Read the full article here