Introduction

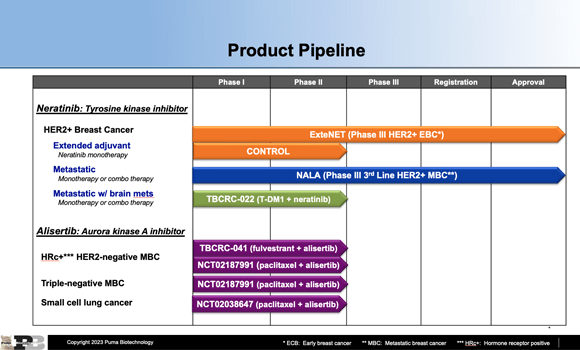

Puma Biotechnology (NASDAQ:PBYI) is a biopharmaceutical firm focused on enhancing cancer care through innovative solutions. The company is recognized for the commercialization of Nerlynx, an oral neratinib for HER2+ breast cancer treatment. They recently in-licensed alisertib, an aurora kinase A inhibitor targeting rapidly proliferating tumor cells, which they believe holds potential for treating various cancers such as hormone receptor positive and triple negative breast cancers, small cell lung cancer, and head and neck cancer. Puma currently markets Nerlynx through a direct specialty sales force in the US and through exclusive sublicensing agreements in over 18 countries globally.

Puma’s pipeline (Puma Biotechnology)

Q1 2023 Earnings

In Q1 2023, Puma Biotechnology reported a net product revenue of $46.8 million from sales of Nerlynx, an increase from $40.7 million in Q1 2022. The company also shifted from a net loss of $3.4 million in Q1 2022 to a net income of $1.4 million in Q1 2023. When excluding stock-based compensation, the non-GAAP adjusted net income was $4.2 million. Total revenue in Q1 2023 was $52.8 million, a rise from $45.7 million in Q1 2022. The company’s operating costs and expenses slightly increased, from $46.4 million in Q1 2022 to $48.4 million in Q1 2023. Looking ahead to Q2 and full year 2023, Puma expects net product revenue to range from $47-50 million and $205-210 million respectively, while net income is expected to fall between $0-1.5 million in Q2 and $20-24 million for the full year.

PBYI Stock Assessment

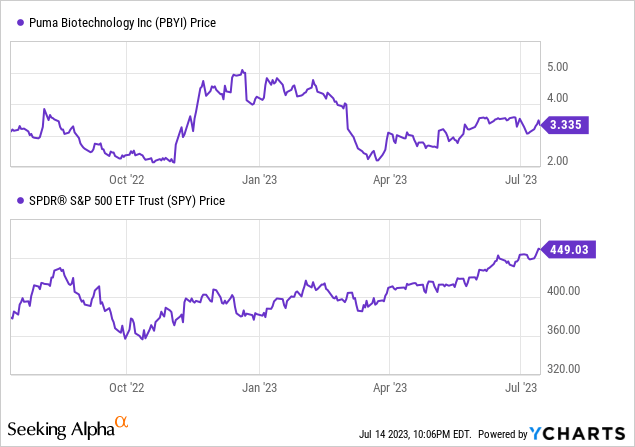

Per Seeking Alpha data, Puma Biotechnology shows promising growth (Graded “A+”) and profitability (“A-“) metrics. For 2023, Puma’s sales are estimated at $231.41M, indicating a YoY increase of 1.5%. However, a YoY EPS decrease of 51.22% is expected for 2024, with a further 5% drop anticipated for 2025. On the positive side, the company’s earnings revisions have been upward, with no downward revisions. Puma’s valuation is favorable (“A”) with a non-GAAP forward P/E of 5.41 and a GAAP trailing twelve months [TTM] P/E of 33.52. The firm also boasts a gross profit margin of 75.55% and a return on equity of 29.13%. While the company’s 3-month momentum is positive (+12.26%), it has underperformed over a 6-month period (-27.80%) compared to the S&P 500.

Puma’s market cap is $162.54M, with total debt of $113.64M and cash reserves of $71.22M, resulting in an enterprise value of $204.96M.

Nerlynx: Promising Results, Challenges, and Market Potential

Nerlynx (Neratinib), Puma Biotechnology’s flagship product, is an oral agent that binds irreversibly to and inhibits the tyrosine kinase domains of HER2 and EGFR, essential in the treatment of HER2-positive breast cancer. Compared to other HER2-targeted tyrosine kinase inhibitors, Nerlynx has shown promising results, with a pathological complete response [pCR] rate of 56% in an arm of the I-SPY2 trial.

However, it’s essential to note that while HER2-targeted TKIs, including Nerlynx, demonstrate efficacy, they also come with significant toxicities, most of which are related to off-target inhibition of EGFR. As such, it may face competition from more HER2 selective TKIs like tucatinib, if data shows its effectiveness in the neoadjuvant setting.

Puma’s recent financials indicate an increase in net product revenue from sales of Nerlynx, marking a growth trajectory. However, the future market opportunity and growth potential will be determined by clinical outcomes, the extent of adverse side effects, the progress of competitors’ drugs, and market acceptance. Hence, while investors can anticipate growth based on current momentum, caution is advised given the dynamic and competitive nature of the biopharmaceutical industry.

Q1 2023 Earnings Call Review

During their latest earnings call, management emphasized that the total revenue for Q1 2023 amounted to $52.8 million, indicating a 15% year-over-year growth. This revenue figure encompasses $46.8 million generated from Nerlynx sales and $6 million from royalties. Despite a slight decline compared to Q4 2022, new prescriptions experienced an 11% increase from the previous quarter. The company highlighted its acquisition of the licensing rights for alisertib, an anticancer drug from Takeda, which has demonstrated efficacy in treating various cancer types and possesses a comprehensive safety database. Puma Pharmaceuticals plans to hold a meeting with the FDA in Q2 2023 to discuss the registration process for alisertib specifically in small cell lung cancer. Clinical trials for alisertib are anticipated to commence by Q4 2023. Additionally, the company acknowledged the drug’s potential in hormone receptor-positive HER2-negative breast cancer and expressed its intention to initiate clinical trials for this indication in the first half of 2024. Overall, Puma remains optimistic about the future and is actively evaluating additional drugs to potentially diversify its portfolio and leverage its existing infrastructure.

My Analysis & Recommendation

In reviewing Puma Biotechnology’s current performance and future prospects, I see potential for significant growth and investor value. The company’s promising Q1 2023 results, consistent revenue increase, and its strategic acquisition of alisertib from Takeda underscore Puma’s potential to diversify and strengthen its product portfolio.

With a forward P/E ratio of 5.41, Puma appears to be undervalued, especially when considering its gross profit margin of 75.55% and a return on equity of 29.13%. However, there are a few red flags. Firstly, its EPS is expected to decline over the next two years, which could be a concern for investors. Moreover, Nerlynx, Puma’s leading product, despite having promising efficacy, comes with significant toxicities. Its niche revenue could be under pressure from other HER2-selective TKIs like tucatinib.

As a microcap company, Puma inherently carries a higher risk due to its size and niche focus. Investors should be aware of the potential volatility, limited liquidity, and susceptibility to market manipulation often associated with microcap stocks.

Given these considerations, I recommend a ‘Hold’ on Puma Biotechnology. The company’s performance and future prospects indicate potential, but the inherent risks and the uncertainties in the competitive landscape warrant a cautious approach. For investors with a higher risk tolerance and long-term horizon, Puma offers an intriguing, albeit risky, opportunity to capitalize on advances in cancer therapeutics.

Read the full article here