Investment Summary

The share price for Wallbox N.V. (NYSE:WBX) has been very volatile since the start of 2023, but right now is still up over 20%. The coming earnings report from the business is set on August 2, 2023, and estimates suggest that WBX will still post a negative bottom line, but a surprise here might cause for a catalyst in the share price. I find the market environment still quite difficult to navigate, and the likelihood of WBX significantly beating expectations seems too low to make a bet and buy into the business right now.

However, recent tailwinds like reaching 1000 Supernova DC Fast Chargers make me hopeful that WBX will experience continued momentum and eventually reach a positive EPS. Investors who wish to have a smaller position in a growth company operating with exposure to the EV market might want to consider WBX. For those already invested, I see a limited downside in holding the shares, but perhaps a better buying opportunity might appear in the near term to average down a position. Rating WBX a hold for now. In my last article about the company, I rated it a hold, even though I maintain the same rating I am more positive towards the business this time around.

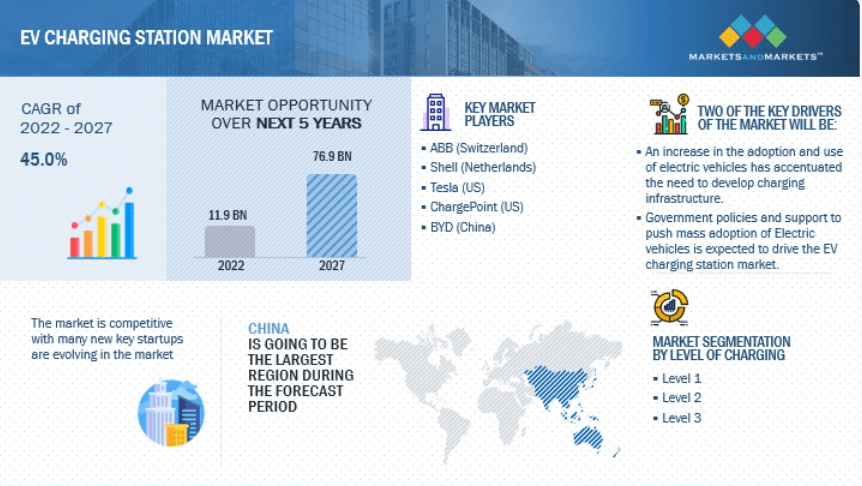

The Charging Market Is Growing

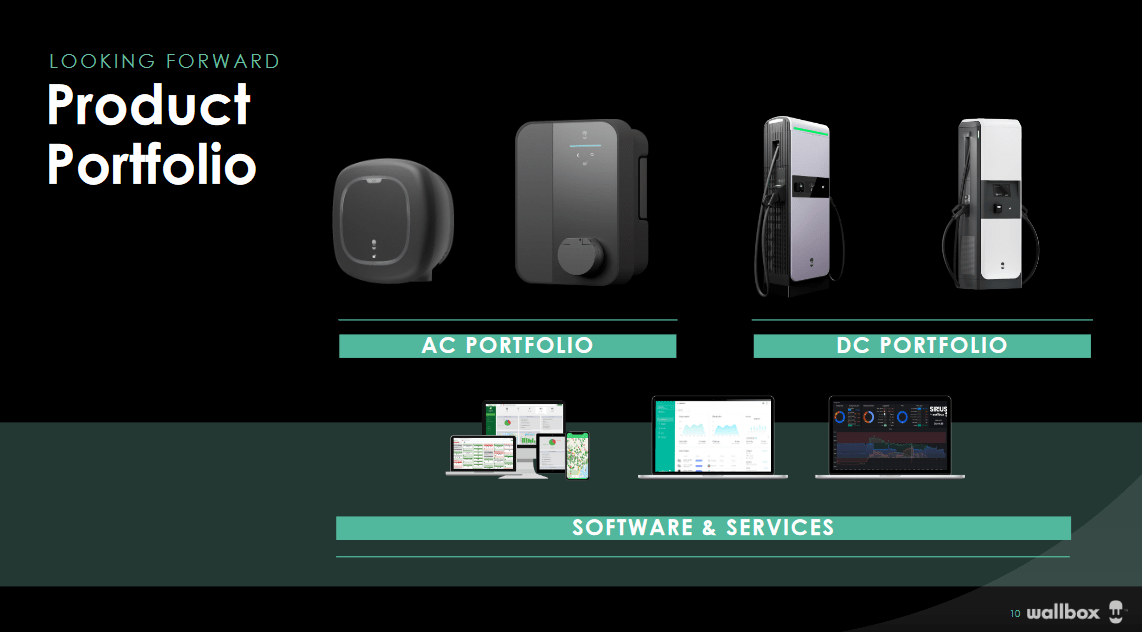

The portfolio for WBX right now is heavily leaned toward AC charging which represents 70% of the revenues and the remaining parts are made up of DC charging and Software and Services at a quite equal distribution.

Product Line (Investor Presentation)

The DC charging segment in the industry still makes up a very large percentage at 43.6%. The challenge for WBX will come from competing with far larger businesses like Tesla (TSLA) and Schneider Electric (OTCPK:SBGSF). These companies have far larger budgets to deploy than WBX, and the growth processes of WBX rely on them efficiently entering new and emerging markets to get ahead of the larger competitors.

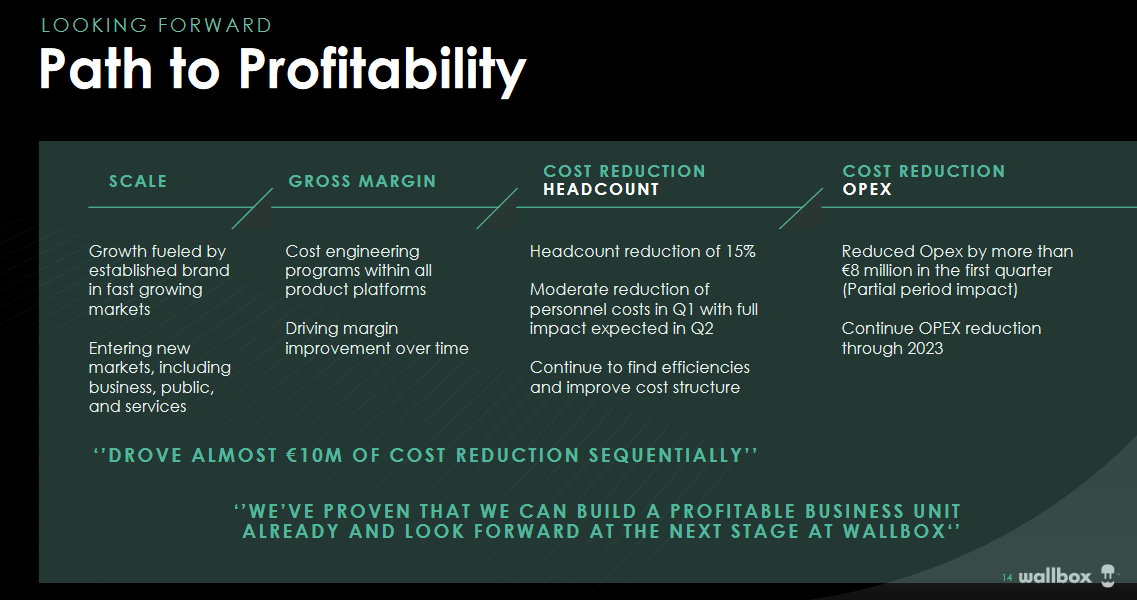

Company Targets (Investor Presentation)

The priority for WBX and its growth does include reaching solid margins, and the Q1 report for 2023 showed gross margins expanding by 90 basis points QoQ. The rising interest environment seems to be a challenge for WBX though and the gross margins are still below its TTM of over 40%. Interest expenses landed at $5.1 million in 2022, and I think for 2023 it will be heading higher.

Market Outlook (alliedmarketresearch)

But for the long-term, I don’t think this will weigh too much on the results of WBX. They should, in my opinion, be able to outgrow, and the need to take on debt to fuel growth will disappear. Asserting themselves in key markets will be why they will succeed and reach profitability eventually.

Upcoming Report

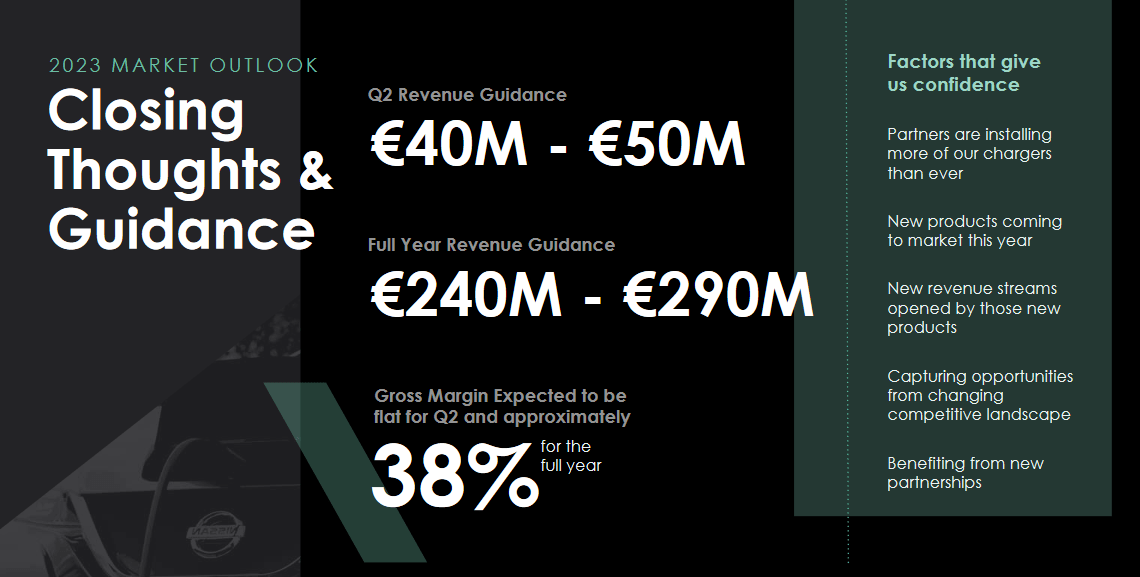

As I stated in the beginning, on August 2 WBX is reporting its second quarterly results to 2023. In the report, a lot of attention will be placed on the margin expansion of the business. Still with a negative bottom line, if we see a surprising beat it could signal that profitability will be here sooner than expected. The guidance for 2023 sits at $240 – $290 million, representing a 161% CAGR in the last 3 years. That sort of result will probably not persist, but a top-line growing faster than the industry I still find likely, which right now is 45% between 2022 and 2027, as seen in the image above here.

Company Guidance (Q1 Report)

For me to change my rating to a buy with WBX, I would like to see the gross margins returning to above 40% and more partnerships announced. The company itself is guiding for a gross margin of 38% which I think would result in my hold rating remaining. I want to see stronger momentum to make the investment case here feasible. It’s a speculative opportunity, but if they can grow faster than expectations, the risks become smaller and the returns larger.

Risks

One of the key considerations for Wallbox is its profit margins. As mentioned earlier, the company is not expected to achieve profitability until 2026. Any delays in reaching this target could create uncertainty in the market, potentially leading to a significant decrease in the company’s share price. The absence of a positive net margin leaves the company reliant on other factors beyond fundamentals.

In addition to margin concerns, the charging space is highly competitive. Wallbox currently holds a relatively small market share compared to major players like ChargePoint Holdings Inc. In the United States, ChargePoint commands around 65% of the charging solutions market. However, Wallbox may have a competitive advantage due to its diversified market presence. While the American market is the largest and fastest-growing, Wallbox has a global footprint, allowing for quicker revenue generation in multiple regions. This broader market reach could contribute to the company’s success.

Financials

The financials of WBX are as you might expect with a newer company, not that developed just yet. The cash position sits at $89 million currently and is enough to pay off all the long-term debts. That puts WBX in a position where their debt position presents a very small risk to the business, I think. The one risk it would bring is higher interest expenses, but with hopefully solid margin expansion going forward, this will make those expanses less of a threat.

Stock Price (Seeking Alpha)

What caught my attention was the inventory levels remaining very high, at $117 million. Seeing as WBX is a company that produces products and needs to deliver them to generate revenue, having a strong turnover here is key to growing margins. Currently, the ROA is negative 14.8%. If we see improvement here in the Q2 report, I will be viewing that as a bullish signal that a higher share price might be ahead.

Valuation & Wrap Up

As for my last article on Wallbox, I had them as a hold rating. I am still managing that, but I am more positive about the outlook of the business. The milestone they recently reached regarding their DC Fast Charges makes me optimistic. The share price has also been trading lower the last few months and if we see a beat in the coming report that should result in a catalyst for the share price. In conclusion, rating WBX a hold here still.

Read the full article here