Co-authored with PendragonY.

A Recession is Coming

The next recession is always ahead; the only question is how far. That is the nature of our system. There will be booms and busts in a perpetual economic cycle. Market booms establish the conditions for the subsequent market bust. And that bust is necessary to clean up the excesses of the last boom.

Usually, a big boom sets the stage for a big bust or recession. And a small boom is typically indicative of a minor slowdown. The most recent expansion cycle took us to only moderately higher levels than before the COVID crash. So if the next downturn occurs soon, we can expect it to be relatively mild.

The Federal Reserve hikes rates with the intention of slowing down the economy. In theory, rate hikes reduce inflation by making it more expensive for consumers to buy and making it more expensive for companies to expand. This discourages economic activity and reduces demand throughout the system, which should cause inflation to slow down.

Over the past year, we’ve seen the Fed hike at the fastest pace in 40 years. While the pace of rate increases has slowed and is likely near the top, the Fed’s opinions and actions continue to dominate the market. As we get closer to 2024, the Fed will continue to dominate the financial news and influence the direction of the markets, either through rate increases, pauses, or rate reductions.

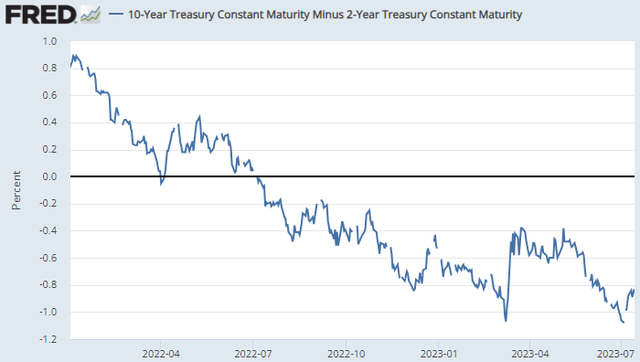

Historically, one of the most reliable indicators that a recession is nearing is the yield curve inverting. An “inverted” yield curve means that shorter-term U.S. Treasuries have a higher yield than longer-term U.S. Treasuries. Many analysts frequently watch the 10-year Treasury minus the 2-year Treasury.

The yield curve remains inverted, pointing to a recession starting in late 2023 or early 2024. Source.

St. Louis Fed

At High Dividend Opportunities, our focus over the past year has been identifying high-yielding opportunities whose distributions are expected to be relatively unimpacted by a recessionary economy. We have been slowly shifting our portfolio into a more defensive position, something we expect to continue doing until the next recession starts.

Protecting Your Income

We see four areas with securities capable of covering or even growing their distributions in the face of a recession. Let’s examine why those areas should do well over the next 6 to 9 months. We will also talk about an example investment in each area. Let’s dive in!

1) Bonds

Fixed-income investments have two advantages. Prices typically experience lower volatility than common stock though in extreme times like the COVID crash and rapidly rising interest rates, prices can decline. The primary reason bonds protect your portfolio is that the income is more secure. Unlike common stock dividends, the interest paid on fixed-income securities is an obligation to the issuer. If they fail to pay, they can be sued. This makes for a more reliable income stream whose importance is greater when a struggling economy pressures stock prices.

Traditional bonds can be intimidating for retail investors as you have to buy in $1,000 increments, are usually less liquid than stocks, and are accessed through the “fixed income” portion of your brokerage. Baby bonds are more easily accessible for retail investors and can be a great way to start building your bond portfolio. Let’s examine baby bonds in more depth.

What are Baby Bonds?

Many investors have limited knowledge of baby bonds or how they differ from regular bonds or stocks. Institutional investors tend to stay clear of them because of each bond’s small face value or the tiny issue size.

Baby bonds are debt securities that trade on exchanges, like stocks, rather than the traditional bond markets. They have a typical face value of $25, much smaller than the standard $1,000 for traditional bonds. Baby bonds also trade flat, meaning the buyer doesn’t pay the seller for the accrued interest. Instead, accrued interest is assumed to be included in the security’s market price. Baby bonds trade with a “ticker” and can be bought and sold through the same interface you buy common or preferred equities.

Distributions paid by these debt securities are considered “interest income” for tax purposes and are NOT eligible for the preferential 15% to 20% tax rate on common stock dividends. Unlike the semiannual payments of regular bonds, baby bonds typically have quarterly interest payments.

Oxford Lane Capital Baby Bond

Oxford Lane Capital (OXLC) is a Closed-End Fund (“CEF”) that primarily invests in collateralized loan obligation (“CLO”) equity. OXLC uses preferred shares and baby bonds to leverage its portfolio and invest in more CLO equity. As with all CEFs, there are regulatory limits on leverage that such funds can employ. This adds a safety layer to the bonds and the preferred shares.

Oxford Lane Capital Corp 6.75% Notes due 03/31/2031 (OXLCL) is one of the baby bonds issued by OXLC. Due to its current discounted pricing at $23.40, OXLCL’s yield to maturity is 8.0%.

The two baby bonds issued by Oxford Lane, OXLCL and OXLCZ, are senior-most in the CEF’s capital structure. Combined, they carry a $200 million face value, with OXLCL representing $100 million of that. This puts the bonds ahead of multiple preferred issues that the fund has issued for its leverage requirements.

The common stock is also part of the HDO portfolio but represents a higher risk/reward. For example, during the COVID crash, while the distribution of the common shares was cut, none of the preferred issues had their payments interrupted. The bonds are even lower risk. This indicates the level of safety provided to the baby bond interest payments, even in black swan events.

Between the discount to par and the moderately high coupon, OXLCL provides a generous income stream that is much safer than the common equity. Just what one wants as the economy slows down. OXLCL pays $0.421875 in quarterly interest payments. The current price of around $23.40 produces a generous 7.2% current yield to collect patiently.

2) Preferred Stocks

As we progress towards the back half of 2023, we want to continue focusing on increasing our exposure to fixed income. Our perspective is that the Fed is near the end of its rate increases, so we are likely looking at the best prices on preferred stocks. Now is the time to shop for those great bargains.

Preferred shares are equity but have priority over the common shares. Preferred shares pay out a pre-determined dividend rather than paying out whatever the Board decides to pay out. While preferred dividends can be suspended, they have to be reinstated if the common shares are paid a penny. This provides a more stable income that is only suspended when a company is experiencing distress.

Preferred shares will provide a more stable income, particularly when the economy turns sour. Income stability provides overall financial security when a recession starts and can also produce cash flows to support the purchase of other income-producing securities that get discounted by the recession.

At HDO, we encourage members to have a diverse portfolio of preferred stocks, with almost 50 individual picks in our Model Portfolio. For those looking to take advantage of the current dip in preferred prices, driven by the Fed’s rate hikes, preferred funds can be a great way to gain exposure to preferred. However, note that these funds will provide the underlying total return of a preferred portfolio; they won’t necessarily have the same income stability you can get from a portfolio you hold directly. I’d recommend holding these funds in addition to a fixed-income portfolio, not as a substitute.

PFFA

Virtus InfraCap U.S. Preferred Stock ETF (PFFA) is an actively managed exchange-traded fund (“ETF”) built with a portfolio of preferred securities issued by American companies with over $100 million in market capitalization. The fund focuses on current income through deep diversification, with its investments spread across 213 preferred issues.

PFFA currently pays a monthly dividend of $0.165. This calculates to a yearly payment of $1.98. Since the COVID crash in 2020, PFFA has modestly increased its dividend yearly. This produces a very generous yield of 10.0% from this income-oriented sector. The use of modest leverage ranging between 20-30% enhances the production of income.

3) Energy Pipelines

Energy was a big winner last year, and while this year has been generally flat, it has been a bit of a wild ride in its own way. The energy sector tends to be recession resistant. Despite the economic climate, we need to keep the lights on, heat our homes, and commute to work or for our errands.

The sanctions imposed on Russia due to the war in Ukraine will continue and might even intensify. The tensions with China might increase. Europe will continue to develop its ability to import LNG, and Iran’s unrest could lead to sanctions or other disruptions to the global hydrocarbon supply. In response to a slowing global economy, OPEC+ countries just expanded their production cuts through the end of the year. Currently, the U.S. is the only major source of additional production, and midstream companies serving the U.S. energy industry will do well under such circumstances.

While the energy sector tends to be recession-resistant, that isn’t the same as recession-proof. Recessions can cause demand disruption, so sticking with companies that can maintain dividend payments through short-term disruptions is crucial.

Antero Midstream

Antero Midstream Corporation (AM) had a very positive quarter, producing $46 million in Free Cash Flow (“FCF”) after dividends. Moreover, management raised the guidance for FCF after dividends by $35 million to a $125-155 million range.

AM’s goal coming into FY 2023 was to get the debt-to-EBITDA ratio below 3.5x. Based on current guidance, the company will exceed that target without paying off any debt. The company maintains a long-term goal of 3x debt/EBITDA. Hence, we don’t expect AM to raise its dividend until that goal is reached.

Currently, AM pays a quarterly dividend of $0.225. This represents a yearly dividend of $0.90 or a 7.4% yield at current prices. This is a solid income stream, even if the company doesn’t raise dividends for a few years.

4) Agency MBS

Owning a home is a large part of the “American Dream”, and something that the U.S. government has actively encouraged. As part of making homes more accessible, government-sponsored enterprises have become an integral part of the U.S. mortgage system. The “agencies” encourage investors to provide capital for mortgages by guaranteeing them. If a mortgage guaranteed by one of the agencies defaults, the agency will buy it back at par value. By removing credit risk, there are a lot more investors willing to provide more capital at much lower interest rates.

Agency MBS (mortgage-backed securities) usually have a slightly higher interest rate than U.S. Treasuries, and the Fed’s aggressive hiking cycle has increased this difference. This creates an opportunity to get higher coupon MBS at cheap prices. You can invest in Agency MBS directly through your broker’s bond service and find yields of 5-6%.

A more aggressive way to invest in agency MBS is through agency mortgage REITs. These mREITs invest in agency MBS on a leveraged basis, allowing them to multiply their return and produce very large dividends for shareholders. Historically, agency MBS goes up in price during recessions, while short-term interest rates come down as the Fed cuts. This creates a very bullish environment for agency mREITs to pay out dramatically higher dividends.

Annaly Capital Management, Inc

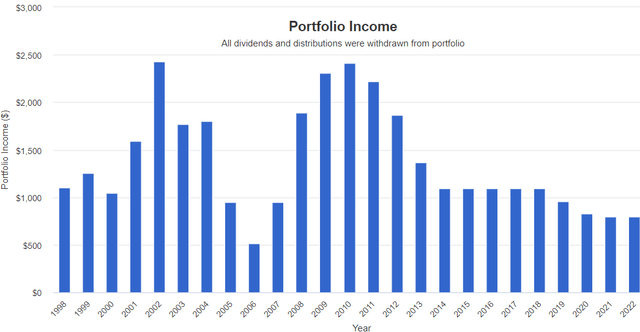

Consider the oldest publicly traded agency mREIT, Annaly Capital Management, Inc (NLY). It has been through the Dot-com bust and the Great Financial Crisis. Here is a look at NLY‘s dividend history with $10,000 invested (assuming no reinvestment). Source.

Portfolio Visualizer

Note that NLY’s dividend has varied quite a bit over the years. A $10,000 investment in 1998 would have produced annual dividends ranging from $500 to over $2400.

What is most interesting is to note the timing of the higher dividend years – they were in the heart of recessions. When the recession is happening, and other companies are at higher risk of cutting, agency mREITs are more likely to be raising. That’s a great feature to have in a diversified portfolio – you want some stocks that are doing the opposite of everything else!

Conclusion

As we stare into the recession barrel in the upcoming quarters, we expect fixed-income securities (baby bonds and preferred stock) from CEFs, and common stock in midstream energy companies and agency MBS to provide safer income streams. While this article presents a few attractive areas, several other investments are trading at bargain prices. We recommend that investors evaluate their needs carefully and look closely at each opportunity to ensure it aligns with their portfolio goals.

With the economy weakening and the Fed changing its hawkish course by pausing the hikes in this past meeting, it is crucial to be prepared for a sudden policy reversal. Investors must shop for bargains amidst price volatility; what trades at a reasonable price today may be too expensive next week. Or the bargain may become more attractive. We can’t time the market, but carefully making small purchases is prudent to handle the uncertainty.

The four picks discussed in this article present a source for generous income. Even if the recession arrives slower than expected, holding these investments gives you regular cash infusions. And when the recession does come, your income is safe, catering to your lifestyle needs or producing cash to buy more bargains. This forms the basis of the income method, and that is the beauty of income investing.

Read the full article here