Introduction

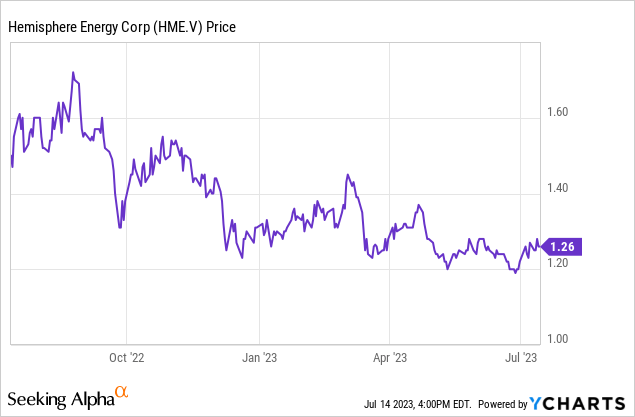

Hemisphere Energy (TSXV:HME:CA) (OTCQX:HMENF) is a small oil producing company with an output of just over 3,000 boe/day, but rather than getting ahead of itself by pursuing relentless production growth, the company focused on repaying its entire net debt (and currently has a net cash position) and start paying a rather healthy dividend to its shareholders. While the C$125M market cap is pretty low, I think the strong balance sheet and robust results in Q1 make Hemisphere an interesting idea to have exposure to the oil price.

The Q1 results provide a better indication of what we can expect this year

While we still have to wait for Hemisphere to report its Q2 results (likely at the end of August), I wanted to have a look back at the Q1 results and try to extrapolate from there.

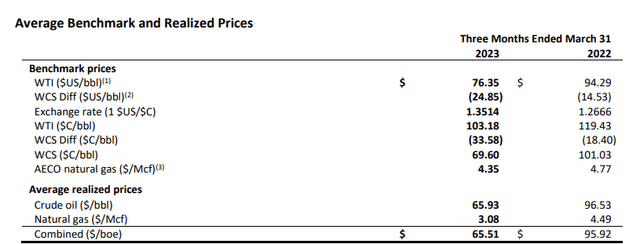

As mentioned in the introduction, Hemisphere Energy is a small producer and the average production rate in the first quarter was just 3,171 barrels of oil-equivalent per day, of which about 1% consisted of natural gas. A pure (heavy) oil producer. And although the WCS differential has been pretty high in the past year or so (and this was one of the reasons I didn’t buy my position in Athabasca back), the situation has improved. Right now, the discount is approximately US$11.50 per barrel below WTI which is a substantial improvement compared to the US$20-plus discount we saw in the final quarter of last year and the first quarter of this year.

Hemisphere Investor Relations

As you can see in the image above, the company had to deal with an average differential of almost US$25/barrel which explains why it reported a realized price of just US$50/barrel (C$66/barrel) for its heavy oil while the WTI oil price was approximately C$100/barrel.

Before diving into the details, I’d quickly like to explain how a lower price differential can and will have a major impact on Hemisphere’s financial results. Let’s assume the WTI oil price will average US$75/barrel for this quarter. If the average differential would be, say, $15/barrel (higher than today), Hemisphere’s realized price would be around US$60 and close to C$80/barrel. That’s C$14/barrel higher than what Hemisphere realized in the first quarter and this would add almost C$4M per quarter in revenue. That’s C$0.16 per share per year.

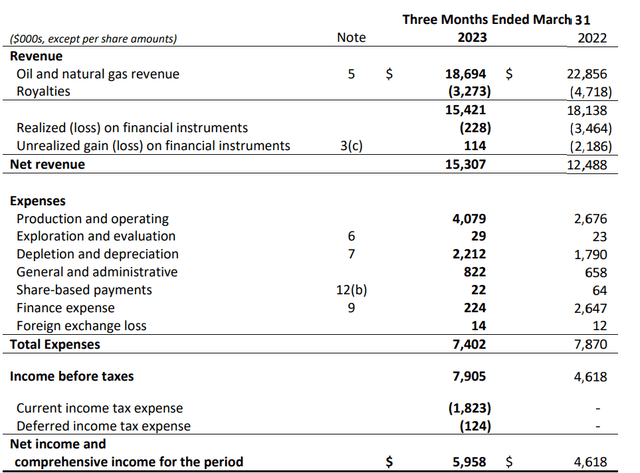

Let’s now first have a look back at the Q1 results. Hemisphere reported a total revenue of C$18.7M and a net revenue of C$15.3M after deducting the relevant royalty payments. As the company remains a low-cost producer, the total operating expenses were just C$7.4M (and about 30% of all operating expenses were related to the depreciation and depletion expenses). This resulted in a pre-tax income of C$7.9M and a net income of C$6M for an EPS of C$0.06.

Hemisphere Investor Relations

That’s a great result, but in the oil and gas space the net free cash flow result is more important, especially in Hemisphere’s case where the depreciation and depletion expenses are pretty low.

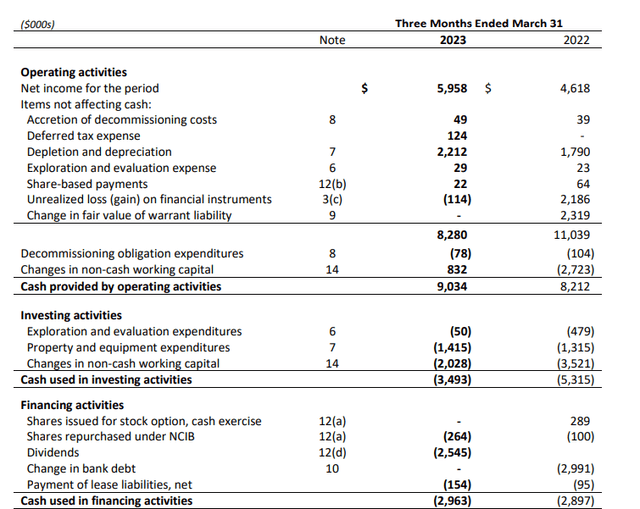

The operating cash flow in the first quarter was approximately C$8.3M, and after making the lease payments, Hemisphere’s net operating cash flow was approximately C$8.1M. The total capex was just C$1.5M, resulting in an underlying free cash flow of C$6.6M.

Hemisphere Investor Relations

That’s great, but let’s not forget Hemisphere has been budgeting a full-year capex of C$14M which works out to an average of C$3.5M per quarter. If I would apply that to the Q1 cash flows, the underlying free cash flow result would be approximately C$4.6M or C$0.045/share. This means that the quarterly dividend of C$0.025 per share per quarter would still be fully covered and Hemisphere would still retain about C$8M per year to buy back its own shares.

Keep in mind the company will drill nine wells during the summer and these wells should be online by the end of this quarter which means the full-year production guidance of 3,300 boe/day remains feasible despite a slightly lower production rate in the second quarter.

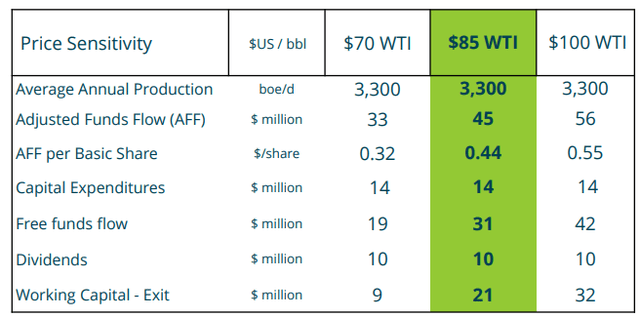

Hemisphere Investor Relations

The US$85 scenario above sounds optimistic but it actually is no longer that unachievable as the base case scenario uses a US$20 WCS differential and a 1.35 exchange rate. This means that in the company’s base case a US$85 WTI price translates into (85-20) * 1.35 = C$88/barrel. But using US$75 WTI and a US$15 differential and a 1.31 exchange rate, the net received price comes in at C$79/barrel. That’s exactly in the middle of the US$70 and US$85 scenarios above, which means that at the current oil price and a slightly lower price differential we are looking at a C$39M adjusted funds flow (on a normalized basis going forward of course, as Hemisphere still will have to recover from a weaker first semester) and a C$25M free cash flow result for a FCFPS of C$0.24-0.25.

Investment thesis

This also bodes well for the dividend which is variable (in theory, the company doesn’t make any major adjustments) based on 30% of the AFF. At C$39M in Adjusted Funds Flow, the potential dividend could even increase to C$0.12 per share but I expect Hemisphere to prefer to buy back its own shares at the current value rather than hiking the dividend by one cent.

I’m adding to my position in Hemisphere as I like the risk/reward ratio at the current share price of C$1.25. The company is debt free, and based on the current oil price, exchange rate and oil price differential the company should generate about C$0.25/share in free cash flow. While I wait for the share price appreciation, I’m happy to rake in the 8% dividend.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here