Given the likelihood of volatility in the second half and the following year, it appears prudent to invest in a stock or ETF that can perform well in both bearish and bullish conditions. Crescent Capital (NASDAQ:CCAP) is one of the companies that can help investors achieve consistent returns in difficult market conditions and has the potential to outperform the S&P 500 in a bull scenario. This is because the company’s business model and investment strategy appear to be well-suited to capitalizing on both current and future market conditions.

Why BDCs Look Attractive for H2 and 2024?

Although the stock market emerged from a bear market in the first half of 2023, volatility remains a significant risk in the second half and the following year. The possibility of slower economic growth and a higher terminal level than expected could reverse the upward trend seen in the first half of 2023. Traders anticipate another quarter-point rate hike in the second half of 2023, followed by a rate cut in early 2024. Powell, on the other hand, believes that stronger-than-expected economic and job growth indicates that more restraint is required. A majority of Fed officials also believe the interest rate should be raised another half a percentage point above its current range of 5.00%-5.25% in order to achieve the desired level of inflation and employment. I believe there is a good chance of a downturn if the Fed decides to pursue a half-point rate increase in the second half and maintains rates at a higher level in 2024’s first half.

To prepare for potential volatility, a portfolio should include stocks that can perform well in both downturns and bull markets. Historical trends indicate that high-yielding stocks can help reduce volatility and generate healthy returns during bull markets. However, due to Fed policies and economic deterioration, all high-yielding stocks do not currently have strong fundamentals. Therefore, investors must exercise greater caution when selecting stocks.

In my opinion, one industry that is thriving in the current market conditions is business development, which primarily provides financing to middle-market companies. Demand for direct lending has been increasing over the years, but it has recently accelerated as regional banks that provide financing to start-ups and middle-market businesses have come under pressure. During the first quarter earnings call, the CEOs of several BDCs highlighted rising demand and new investment opportunities. For example, Crescent Capital’s president and CEO, Jason Breaux, stated that banks’ continued restrictions on new activity due to capital and liquidity issues increase the opportunity set for direct lenders. Furthermore, the CEO stated that the platform’s new investment opportunities are compelling in terms of pricing, call protection, and spreads on new originations.

Why Crescent Capital is a Good Choice?

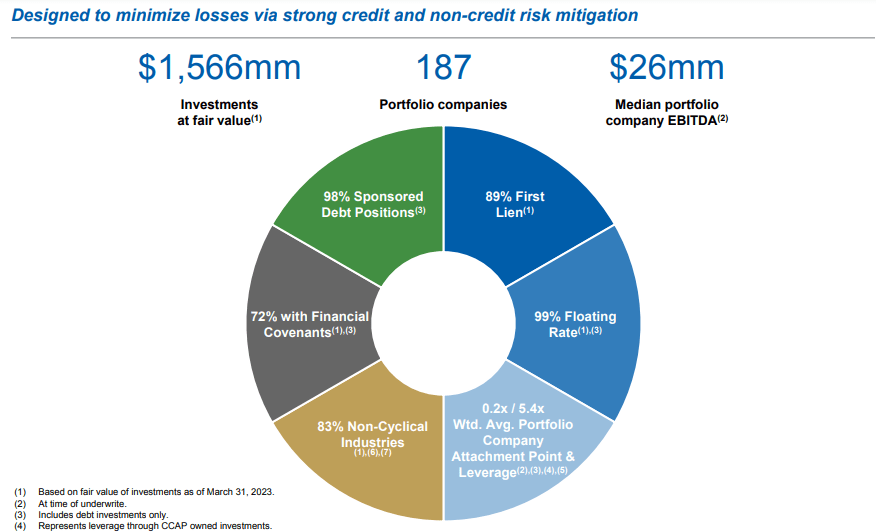

A number of businesses in the BDC industry are worth considering due to their significant income growth potential, high dividend payouts, and prospects for share price upside. Crescent Capital is one such company that has benefited from increased demand for alternative financing and higher interest rates. The company, like many other BDCs, appears appealing for a variety of reasons, including a high dividend yield, the possibility of supplemental dividends, and low valuations. However, its conservative portfolio management strategy makes it more attractive than many others in uncertain conditions. Instead of creating a concentrated portfolio, the company believes in diversifying its investment portfolio to reduce risk. Its $1.6 billion investment portfolio is spread across 187 companies in 20 industries, with an average investment size of less than 1% of the total.

CCAP’s Portfolio Diversification (Q1 Earnings Presentation)

Furthermore, 89% of its portfolio is primarily composed of senior secured first lien and unitranche first lien loans. Moreover, the company only lends almost exclusively to private equity-backed companies. And, 99% of its debt investments at fair value were floating rates, which means that the interest on its investments rises when the Fed raises policy rates. As of the end of the latest quarter, the weighted average yield on its income-producing securities increased quarter-over-quarter from 10.8% to 11.4%. On the other hand, only 66% of its liabilities are on a floating rate. Overall, its investment portfolio continues to perform well with strong double-digit year-over-year weighted average revenue and EBITDA growth. In the latest quarter, its total investment income of $39.3 million increased approximately 14% quarter over quarter and 48% on year over year basis. Its adjusted net investment income per share of $0.54 for the first quarter of 2023 increased from $0.49 per share for the prior quarter and $0.41 per share in the first quarter of 2022.

Dividend Returns are Likely to Increase

Crescent’s portfolio management strategy and strong earnings growth allow it to maintain a yield of more than 10%. Additionally, its earnings growth potential opens up room for strong dividend growth. In 2022, the company’s earnings significantly outpaced its annual distribution of $1.64 per share, lowering the earnings-based payout ratio to 78%. As a result, the company paid $0.20 per share in annual supplementary distributions to comply with the legal requirement of distributing 90% of income in dividends. In 2023, there is more room for a lofty supplemental dividend because Crescents’ earnings are predicted to grow at a double-digit rate in 2023 when compared to 2022. The company generated a net investment income of $0.54 per share in the first quarter of 2023, outpacing the quarterly distribution of $0.41 per share. Wall Street anticipates NII of $2.18 per share for the full year, up significantly from the annual distribution of $1.64 per share.

Valuation and Price Upside

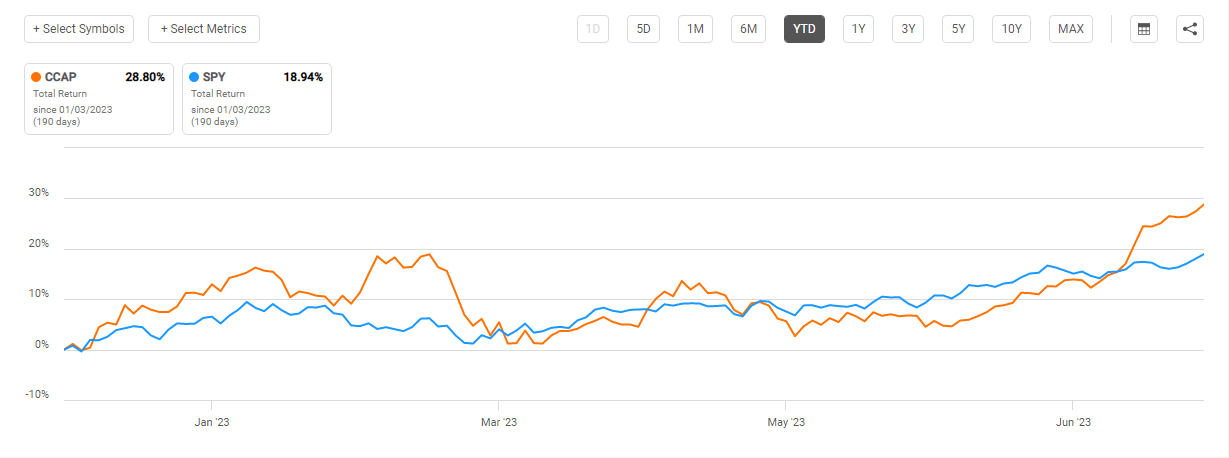

CCAP’s Total Returns Vs S&P 500 (Seeking Alpha)

Crescent Capital’s total returns have outperformed the S&P 500 index so far in 2023, thanks to strong share price growth and a high dividend yield. Its stock is up about 20% year to date. Its outperformance versus the broader market index demonstrates its ability to perform well in bullish market conditions. After some volatility in the first quarter, CCAP’s shares regained upside momentum. Better-than-expected first-quarter results and forecasted double-digit percentage growth for the full year are driving the upward momentum. Prospects for higher cash returns in 2023 also added to investor confidence.

Despite solid price gains, its shares are still trading at a discount considering forward valuations and net asset value. CCAP’s stock is currently trading at 7.33 times forward earnings, compared to the sector median of 9 times. The forward price-to-book ratio of 0.83 is also significantly lower than the sector median of 1.03. Seeking Alpha’s quant system also gave the stock an A on its valuations factor, indicating that it is trading at cheap valuations. Aside from that, other share price drivers such as revenue, earnings, and dividends are all supporting the price increase. Furthermore, since 99% of its debt is subject to a floating rate, a potential half-percentage-point rate increase in the second half is also likely to improve its financial performance in the following quarters.

Risk Factors to Consider

Crescent Capital has been subjected to a number of risk factors. For example, a severe economic downturn could increase its accruals, reducing its profitability and portfolio size. Furthermore, because it has a floating nature portfolio, a rate cut could reduce its interest income and earnings. Interest rates are expected to start falling in the middle of 2024. To maintain its growth trends and offset the impact of falling interest rates on income, the company must increase its lending capacity and other sources of income.

In Conclusion

Currently, it appears prudent to invest in a stock or ETF that has the potential to reduce risk in a bear market while outperforming in a bull market. Crescent Capital’s business model has that potential because it is expected to benefit from Fed policies and rising demand. The company’s high dividend yield is not only secure, but it also has the potential to pay out higher dividends in 2023. Furthermore, the share price is expected to perform well in both bullish and bearish conditions due to its healthy dividends, strong financial outlook, and conservative portfolio management strategy.

Read the full article here