Markets are hot again. Investors have cheered the cooldown in inflation data, hoping that will lead to an end of the Fed’s historic rate hikes. Amid lower rate expectations, the dollar has weakened and stocks have soared, particularly in the growth space, leading many investors to wonder if there’s still room for upside left.

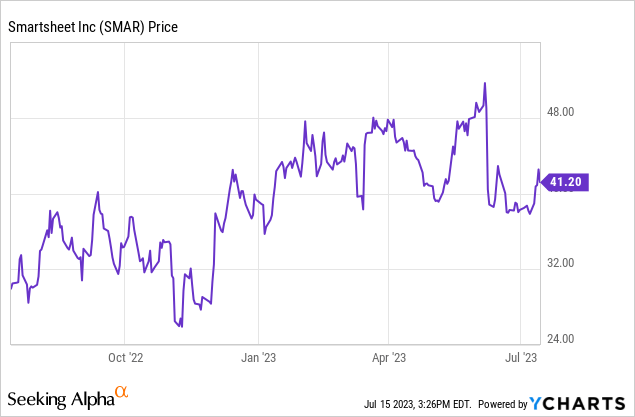

My strategy here is to chase laggards, particularly among “growth at a reasonable price” stocks. Smartsheet (NYSE:SMAR), in my opinion, is one incredibly appealing candidate for this trade. Up only 6% year to date after suffering a bruising recent correction after releasing Q1 results, I think Smartsheet is a great rebound play.

Focus on the long term rather than this quarter’s billings

I remain very bullish on Smartsheet. While I acknowledge that the company is facing growth headwinds (mostly macro driven, and more a function of the challenging macroeconomy for enterprise software companies rather than Smartsheet-specific execution concerns), I think the stock’s recent fall from the ~$50s is a gross overreaction to recent results.

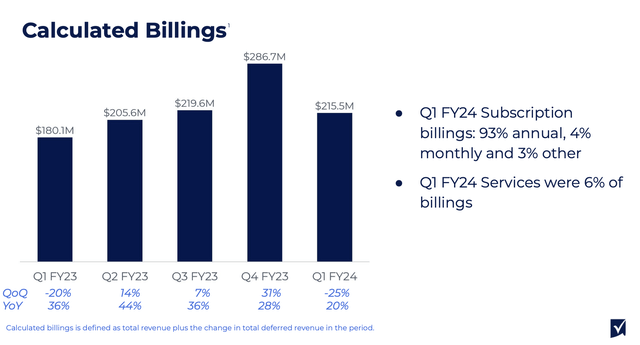

In a nutshell: the markets panned Smartsheet’s deceleration to 20% y/y billings growth, even though the company had forecasted 20% full-year billings in its initial guidance (and held its outlook there). While billings is certainly a great long-term growth indicator that captures deals to be recognized as revenue in future quarters, we also have to acknowledge the fact that it’s an imperfect metric, influenced by the timing of deal closings and contract duration lengths – which may make billings a very lumpy metric. In other words, one quarter’s deceleration may not spell continued doom for Smartsheet.

When we take a step back from the short-term noise surrounding Smartsheet, I find that the long-term bull case for this stock is still very much vibrant and relevant:

- Remote work is going to continue being the “new normal”. Now realizing that productivity doesn’t suffer as much as originally thought when teams go remote, some companies are relaxing their expectations for employees to be fully back in the office even after the pandemic subsides. Some companies have even let their employees know it’s okay to work remotely indefinitely. But remote teams need a workspace to collaborate in, and tools like Smartsheet are perfect complements for that. This is especially true for distributed teams, where people are in different locations and some are in-person while others are remote: tools like Smartsheet help to rein in the geographic distance.

- Smartsheet is moving to bigger and bigger deals, and expansion rates remain high. As Smartsheet has proven its utility and flexed its muscles as a more prominent public company, the company has been able to sign larger deals. In its most recent quarter, its count of >$100k ACV customers grew 55% y/y to more than 1k such customers. The average customer is also upgrading their relationship with Smartsheet: net revenue retention rates are clocking in around 130%, which exceeds most other SaaS stocks.

- Horizontal software and broad use cases. Smartsheet is broadly applicable to virtually any industry and virtually any team or function within a company, making its addressable market wide.

- High gross margins. Smartsheet’s 80%+ pro forma gross margins are among the highest in the software industry, and enable the company to achieve significant operating leverage as it scales.

- Nearing profitability. Despite still-robust growth rates, Smartsheet is able to hover around breakeven profitability (on a pro forma operating margin basis), demonstrating the leverage inherent in the software business model made possible by high gross margins.

Valuation checkup

In the wake of Smartsheet’s recent correction, I find the stock’s current valuation multiples to be quite appealing. At current share prices near $41, Smartsheet trades at a market cap of $5.50 billion. After we net off the $489.5 million of cash on the company’s most recent balance sheet, Smartsheet’s resulting enterprise value is $5.01 billion.

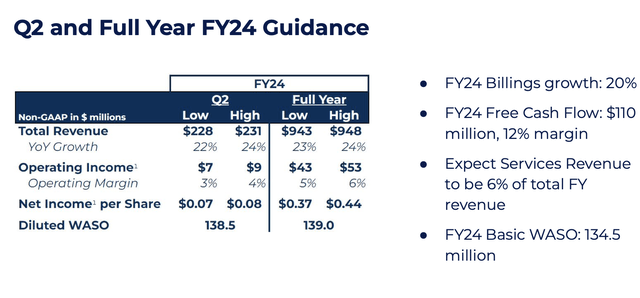

For the current fiscal year, Smartsheet has guided to $943-$948 million in revenue (+23-24% y/y growth), while holding its full-year billings guidance at 20% y/y (in line with Q1 results).

Smartsheet outlook (Smartsheet Q1 earnings deck)

Smartsheet’s valuation stands at 5.3x EV/FY24 revenue – which is quite reasonable for a company with double-digit pro forma operating margins (given 10% margins in Q1, Smartsheet’s forecast of 5-6% margins for the year looks conservative) and >20% y/y growth.

Stay long here and hold out for a rebound.

Q1 download

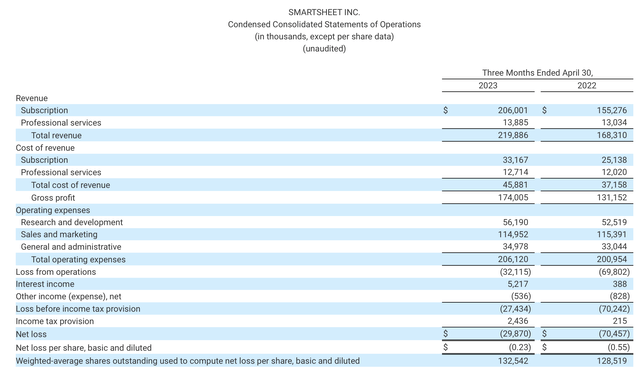

Let’s now go through Smartsheet’s latest quarterly results in greater detail. The Q1 earnings summary is shown below:

Smartsheet Q1 results (Smartsheet Q1 earnings deck)

Smartsheet’s revenue grew 33% y/y to $206.0 million, blasting past Wall Street’s expectations of $200.3 million (+29% y/y) by a four-point margin. Revenue growth also largely kept pace with 35% y/y growth in Q4.

It’s the billings picture, however, that threw investors off. Billings of $215.5 million decelerated sharply from 28% y/y growth in Q4 and 36% y/y growth in Q3, signaling that >30% y/y revenue growth is unlikely to hold for much longer:

Smartsheet billings (Smartsheet Q1 earnings deck)

Peter Godbole, the company’s CFO, noted on the Q1 earnings call that macro challenges have led to lengthened sales cycles, which is very similar commentary to what other software companies are noticing:

However, the macro environment remains challenging, the effects of which are most pronounced in our higher velocity transactional opportunities that are often associated with our SMB and mid-market customers. We also see the macro impacting the length of sales cycles for our larger opportunities and the demand environment for our marketing solutions.

Consistent with our approach from previous quarters, we are expecting to remain conservative with respect to our full year guidance. With that said Mark mentioned a number of areas that would support our growth this year and beyond, including healthy demand for our capability-based products, our newly introduced Free plan and the self-discovery and usage of capabilities. Additionally, we are making marketing investments that we expect to generate a contribution in the second half of this year.”

It’s worth noting, however, that the company’s addition of a new Free tier may help to drive a pipeline of demand amid tough macro conditions, and raise paid user conversion in the future. The company’s second-half marketing push may also help to lift billings growth above current levels.

Management expects billings to grow 6% sequentially in Q2 (implying $228.4 million in billings, up 11% y/y), then for growth to accelerate in the second half of the year.

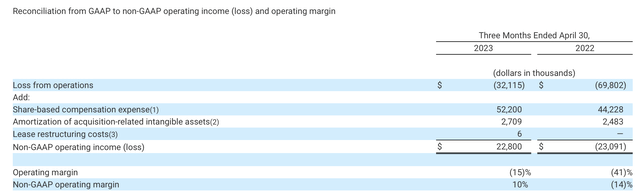

Amid top-line challenges, we should note that Smartsheet delivered excellent profitability. Pro forma operating margins soared 24 points to 10%, up from a -14% loss in the year-ago quarter.

Smartsheet operating margins (Smartsheet Q1 earnings deck)

Smartsheet also delivered $31.3 million of free cash flow, up from a -$9.1 million cash burn in the prior-year quarter.

Risks and key takeaways

For Smartsheet, there are two key risks investors should be mindful of: first, that the current slowdown in business momentum is sustained, and the company permanently loses share, and second, that competitors like Asana (ASAN) and Atlassian (TEAM) take advantage of Smartsheet’s slowdown and rebound faster, edging in on the market.

I’d argue, however, that Smartsheet’s ability to produce >20% y/y billings and revenue growth is a testament to a company that is still enjoying a greenfield market opportunity, and that these risks are more than priced into Smartsheet’s modest 5x forward revenue multiple. Stay long here.

Read the full article here