Introduction

Invitae (NYSE:NVTA) is a leading provider of genetic testing services, digital health solutions, and health data services. Their genetic tests cover various clinical areas, such as hereditary cancer, women’s health, and rare diseases. Invitae uses proprietary technology to expand the reach of genetic information and simplify data acquisition. They offer actionable insights for critical healthcare decisions through digital health solutions. With over 3.6 million patients served and 20,000 genes encompassed, Invitae envisions a three-stage business evolution, aiming to make comprehensive medical genetic information accessible worldwide through strategic partnerships.

Recent developments: In May, Raymond James and Piper Sandler downgraded Invitae due to concerns over its challenging balance sheet.

Q1 2023 Earnings

In Q1 2023, Invitae recorded $117.4 million in revenue, a decrease from Q1 2022’s $123.7 million due to exited businesses and geographies. However, after accounting for these exits, the revenue grew 10% YoY. GAAP gross profit rose 8.8% to $28.9 million, and non-GAAP gross profit jumped 24.3% to $56.2 million. GAAP and non-GAAP gross margins were 24.6% and 47.9% respectively, indicating an improvement from Q1 2022. The company’s cash and equivalents decreased to $388.7 million from $557.1 million in the previous quarter. Net loss was $192.2 million, or a net loss per share of $0.77. The company continues to expect over $500 million in 2023 revenue and a non-GAAP gross margin of 48-50%. Ongoing cash burn guidance remains at $250-275 million for 2023, though reported cash burn will be higher due to a voluntary repayment of a $135 million term loan.

NVTA Stock Assessment

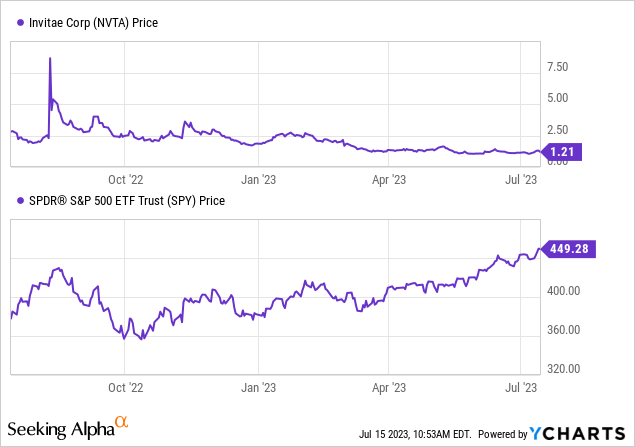

Per Seeking Alpha data, Invitae has forecasted improvements in its earnings per share (EPS), expecting a growth of 83.9% in 2023 and 27.8% in 2024. While its sales are projected to decrease by 3.65% in 2023, there’s an anticipated growth of 13.07% and 12.48% in 2024 and 2025, respectively. The company has seen more FY1 Up revisions (73%) compared to FY1 Down revisions (27%). Its valuation is currently challenging to gauge with several metrics not measurable (NM), although its EV/Sales ratio stands at 3.05. In terms of growth, revenue YoY is 6.13% and its 3-year CAGR is 28.47%. However, profitability appears to be a concern with a gross profit margin of 19.88% and negative ROE and EBIT Margin. Momentum is also negative with a decline of 56.94% over a year.

The company’s market cap is $315.42M, with a high total debt of $1.62B and cash of $378.7M.

Invitae has significant debt, issued through convertible senior notes due in 2024 and 2028, totaling $1.5 billion. The management highlighted potential risks associated with this, including increased vulnerability to adverse economic conditions, limited access to additional finances, and potential competitive disadvantage. The company’s ability to service this debt hinges on their future performance and cash flow, which may not be sufficient. A failure to service their debt could lead to a default, requiring alternatives like asset sales, debt restructuring, or dilutive equity capital raising. They also mentioned that the conversion of these notes could adversely affect their liquidity, and accounting rules may require a reclassification of this debt, reducing net working capital. This indicates a precarious financial position with high debt posing significant risk.

Invitae’s Strategy for Growth

Last month, Invitae management highlighted their excitement about the company’s entry into personalized cancer monitoring and minimal residual disease product at the William Blair Growth Stock Conference. They’re focusing on data aggregation from different stages of life to provide insights and solutions for providers, patients, and policymakers, with an aim to transform healthcare. Despite struggling financials, the company has served over 4 million patients, and they’re optimistic about maintaining their leadership in genetic testing. They’re driven by a ‘flywheel’ model, focusing on customer experience, lowering cost and improving reimbursement, and delivering insights and solutions. The company also plans to expand in several areas, including oncology, women’s health, rare disease, and their data business. They foresee these strategies to yield improved margins, capital management, debt management, and product launches, ultimately fueling their growth in the genetic information and genomic testing industry.

My Analysis & Recommendation

In conclusion, as I analyze Invitae’s position in the genetic testing and digital health solutions landscape, I see a company that is unquestionably a leader in its field. Invitae’s innovative vision for expansion and their robust growth strategies, particularly their ventures into personalized cancer monitoring and data aggregation, is commendable. However, their financial status poses some concern.

While Invitae demonstrated a resilience with a 10% YoY revenue growth in Q1 2023, adjusted for exited businesses, the burden of their substantial debt cannot be ignored. The dwindling cash reserves add another layer of risk, making the company vulnerable to adverse economic conditions. The genetic testing industry is highly competitive, and Invitae’s high indebtedness could limit their ability to innovate, invest, and stay competitive. The genetic testing field has low barriers to entry and is filled with numerous players, each offering unique solutions. In such a competitive environment, Invitae’s financial vulnerabilities could significantly hamper their ability to gain a competitive edge.

The growth strategies that Invitae has put in place, including expansion into various areas like oncology, women’s health, rare disease, and data business, are certainly promising. However, it’s important to note that the tangible returns from these strategies and their impact on the financials remain uncertain at this point.

Taking into account the negative momentum, high debt, weak profitability, and the recent downgrades from market analysts, I find myself surrounded by financial concerns that could potentially overshadow the promising growth opportunities that Invitae presents.

With these considerations in mind, I recommend selling Invitae’s stock. The substantial debt and challenging profitability make it difficult for me to maintain confidence in the company’s financial stability. While Invitae’s growth strategies are ambitious, the associated risks and uncertainties steer me towards a more cautious outlook. In an industry as competitive as genetic testing, Invitae’s financial vulnerabilities could significantly impact their ability to stay ahead. As an investor, I believe it’s crucial to balance potential growth opportunities with risk tolerance, and in Invitae’s case, the risks appear to outweigh the potential rewards at this time.

Risks to Thesis

When the facts change, I change my mind.

Certainly, while I maintain a ‘Sell’ recommendation for Invitae’s stock due to the reasons stated above, it’s important to acknowledge the risks associated with this recommendation as well.

Firstly, Invitae operates in an industry with a massive growth potential. The genetic testing market is rapidly expanding and expected to continue its growth trajectory. This trend is driven by advancements in genomic medicine and a heightened awareness of personalized healthcare among patients. If Invitae manages to seize upon these industry trends and successfully capitalizes on their ambitious growth strategies, the company might perform better than my current expectations, leading to a potential appreciation in its stock price.

Secondly, Invitae’s partnerships with over 100 biopharmaceutical companies and health systems could unlock new revenue streams and foster robust growth. The company’s innovative offerings and efforts to make genetic information more accessible can increase their market share and improve profitability, thereby potentially providing an upside to the stock.

Lastly, the company’s focus on cost reduction and improved reimbursement could strengthen its financial standing in the future. If Invitae successfully manages to lower its operating costs and improve margins while boosting its cash collections, this could positively impact its financial health and potentially make my ‘sell’ recommendation less accurate.

Read the full article here