Review and Outlook

|

Wedgewood Composite Net |

2Q 8.1 |

YTD 18.7 |

1-Year 19.7 |

3-Year 13.3 |

5-Year 13.5 |

|

Standard & Poor’s 500 Index (SP500, SPX) |

8.7 |

16.9 |

19.6 |

14.6 |

12.3 |

|

Russell 1000 Growth Index |

12.8 |

29.0 |

27.1 |

13.7 |

15.1 |

|

Russell 1000 Value Index |

4.1 |

5.1 |

11.5 |

14.3 |

8.1 |

|

Wedgewood Composite Net |

10-Year 11.7 |

15-Year 12.0 |

20-Year 10.6 |

25-Year 10.2 |

30-Year 12.2 |

|

Standard & Poor’s 500 Index |

12.9 |

10.9 |

10.0 |

7.6 |

10.0 |

|

Russell 1000 Growth Index |

15.8 |

12.9 |

11.5 |

8.0 |

10.4 |

|

Russell 1000 Value Index |

9.2 |

8.4 |

8.5 |

7.0 |

9.2 |

Top performance contributors for the quarter include Meta Platforms (META), Apple (OTC:APPL), Alphabet (GOOG,GOOGL), Copart (CPRT) and Microsoft (MSFT). Top performance detractors for the quarter include PayPal (PYPL), Texas Pacific Land (TPL), CDW, Tractor Supply (TSCO) and Booking Holdings (BKNG).

During the quarter we sold First Republic Bank (OTCPK:FRCB), trimmed Meta Platforms and added to PayPal.

| Q2 Top Contributors |

Avg. Wgt. |

Contribution to Return |

|---|---|---|

|

Meta Platforms |

8.53 |

2.80 |

|

Apple |

7.82 |

1.37 |

|

Alphabet |

7.69 |

1.17 |

|

Copart |

5.53 |

1.13 |

|

Microsoft |

5.62 |

1.05 |

Q2 Bottom Contributors

|

Q2 Top Contributors |

Avg. Wgt. |

Contribution to Return |

|---|---|---|

|

PayPal |

4.18 |

-0.58 |

|

Texas Pacific Land |

1.70 |

-0.47 |

|

Tractor Supply |

6.26 |

-0.47 |

|

CDW |

5.61 |

-0.29 |

|

Booking Holdings |

4.24 |

0.071 |

| 1 Portfolio contribution calculated gross of fees. The holdings identified do not represent all the securities purchased, sold, or recommended. Returns are presented net of fees and include the reinvestment of all income. “Net (actual)” returns are calculated using actual management fees and are reduced by all fees and transaction costs incurred. Past performance does not guarantee future results. Additional calculation information is available upon request. |

Meta Platforms was the top contributor to performance during the quarter. The Company managed to grow adjusted expenses more in line with revenue growth, which helped re- establish managements credibility with investors with respect to future profitability and returns. The Company also guided to accelerated revenue growth as product investments are beginning to bear fruit relative to easier comparisons from a year ago. Meta has been at the forefront of investing in some of the most valuable artificial intelligence IP extant, particularly with its ranking and recommendation systems that are in use across its suite of user-facing products and advertiser-facing tools. Despite the recent frenzy of attention around “Gen-AI,” Meta has been researching and developing generative-AI tools for years, so we don’t expect to see a large ramp up in expenses around this phenomenon. Although we trimmed Meta as positions reached our maximum weighting, it ended the quarter as our largest holding.

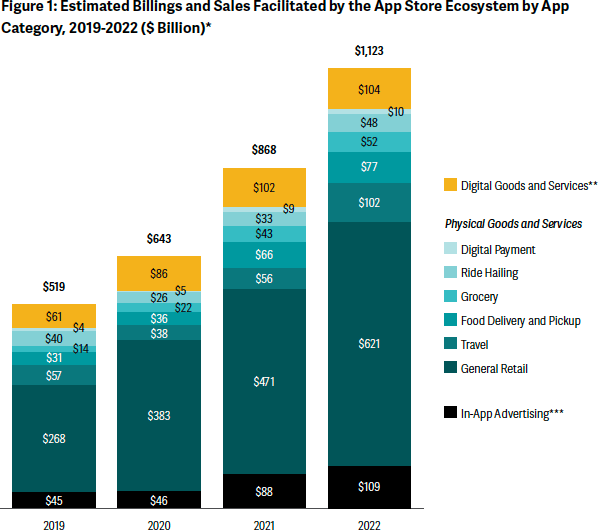

Apple contributed to positive performance during the quarter despite declining revenues and operating earnings mostly driven by difficult comparisons in its Mac segment. iPhone sales grew as supply chain bottlenecks seem to be in the rearview mirror, with component prices falling. The Company also highlighted the torrid growth of its App Store ecosystem, which saw over $1.1 trillion in billings on the platform during 2022, more than double the billings in 2019. Apple has tremendous leverage across the mobile economy due to the App Store’s mission-critical relevance to both developers and users. We continue to hold Apple as a top weighting in the portfolio because this asset-light ecosystem drives sustainably high returns on invested capital.

Alphabet was also a top contributor to performance as revenues returned to year-over-year growth after a brief period of post-pandemic advertising spending digestion. The Company’s Cloud division also turned a small profit on a roughly $30 billion revenue run- rate. The Company’s internal engineering prowess should continue to drive longer hardware useful life and better profitability for this unit over time. Alphabet and its Google subsidiary have been pioneers in AI development, creating some of the most important software and hardware specifications and standards that developers rely on today. Alphabet should be able to continue to capitalize on its long-term AI investments by rolling out product improvements for users and advertisers featuring more automation that can deliver better returns.

Copart helped contribute to portfolio performance during the quarter. Gross profit rose +11% and operating income grew +12% as the Company benefitted from a combination of a reversion of automobile total loss frequency to levels closer to pre-pandemic levels, as well as continued share gains at U.S. automobile insurance customers. As vehicles, particularly in the U.S., become ever more sophisticated and complex, they become more difficult and expensive to repair. If a vehicle can’t be repaired, Copart’s auctions are the destination of choice for the lion’s share of insured vehicles that are declared total losses. Copart should continue to benefit from this long-term trend, especially as insurers struggle with their own labor retention issues, which we think will incentivize them to utilize more of Copart’s ancillary salvage processing services. We continue to hold Copart as a core position, as its high returns on capital from its dominant competitive positioning should be sustainable over time.

Microsoft also contributed to performance during the quarter. Revenues grew +10% (foreign exchange adjusted) whereas operating income grew +14%, helped by +18% growth in Office365 and 31% growth in Azure and other cloud services. Although the Company guided to a deceleration in its core businesses, Microsoft has ample opportunity to drive attractive double-digit growth over a multi-year timeframe. We recognize investors have disproportionately favored software and tech stocks year to date, driving multiples to relative and historical highs. As a result, we paired some of our weighting in Microsoft earlier in the year; however, it remains a core position in portfolios.

PayPal was the leading detractor from performance during the quarter. Total payment volume grew +12% (foreign exchange neutral) while revenues grew +10% (FX-neutral) and adjusted operating earnings grew +19%. E-commerce industry sales trends have normalized back to their pre-pandemic trend of growth, with high-margin branded payments keeping track with the industry. Despite this, investors were concerned PayPal’s fast growing, private label payments solutions will dilute Company returns. However, payments are a very scalable business, and we expect the Company will be able to manage both private label and branded to achieve attractive returns and double-digit growth. Although multiples in the payment industry have compressed, especially after the multi-year process of being added to the financial sector, PayPal’s businesses are substantially different enough from traditional spread-based businesses, in addition to having much more compelling growth drivers, that PayPal’s well-below market multiple should revert to its higher, historical average.

Texas Pacific Land Corp also detracted from performance during the quarter. Oil and gas production on the Company’s royalty interests were up slightly year over year while water- related and surface revenues surged +35%. The Company’s holdings span nearly 880,000 acres in West Texas. Most of this land is located in the highly productive Delaware Basin of the Permian Basin. Although oil and gas prices will always be volatile over the short-term, we expect development activity on their acreage will grow at a solid pace, primarily driven by both domestic and multinational producers looking to maximize returns on increasingly scarce oil and gas capital expenditures.

CDW detracted from performance during the quarter as the Company’s gross profit slightly declined. Many of CDW’s larger customers (by employee base) saw a slowdown in near- term spending as they navigated the banking turmoil earlier this year, in addition to digesting purchases made during the pandemic “omni-office” boom. CDW organizes itself across several end-markets, with each of these end markets at different stages of building out their omni-office presences. In the meantime, the post-pandemic IT environment has quickly evolved from supply scarcity (due to vendor shortages and strong demand) where CDW flexed its balance sheet to ensure inventory availability, to more recently helping customers manage never before seen levels of complexity related to a work-from- everywhere workforce. CDW’s outstanding returns on capital, cheap multiple, and mission-critical functions it offers to vendors and customers continue to be an attractive risk-reward for portfolios.

Tractor Supply also detracted from portfolio performance during the quarter. Despite uncooperative weather earlier in the quarter, the Company has executed nearly-flawlessly since the pandemic erupted in 2020. The Company is seeing early signs of a downshift in inflation which should benefit its margins after management made aggressive overhead and price investments for the benefit of employees and customers early in the pandemic. In addition, Tractor Supply continues remodeling its store fleet which increases a store selling space by up to 80%. Because the Company has not participated in the year-to-date rally for all-things-AI, we think shares are becoming more attractive both on a relative and absolute basis and continue to hold Tractor Supply as a core position.

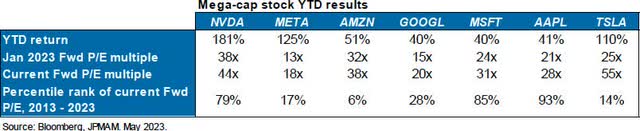

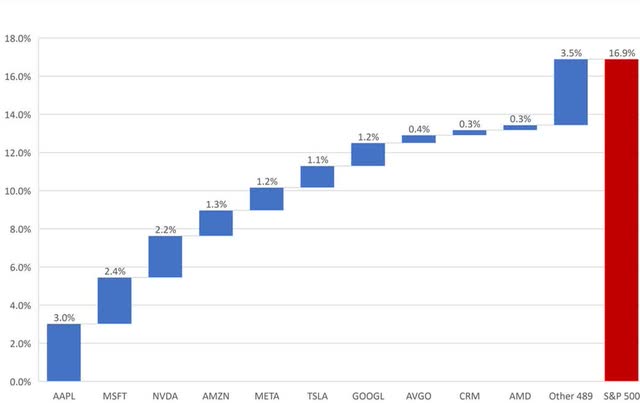

Please note in the table on the top and the tables below the outsized performance of a handful of large cap technology stocks. The NASDAQ 100 gained +39% – it’s best first- half gain since 1983.

S&P 500 2023 YTD Return Contribution

Source: FactSet

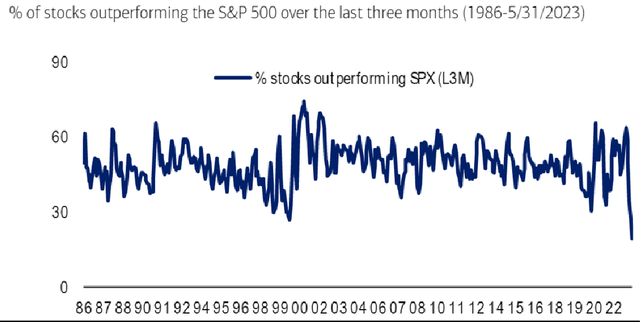

Historically Narrow Breadth

Source: BofA US Equity & Quant Strategy and FactSet.

Company Commentaries

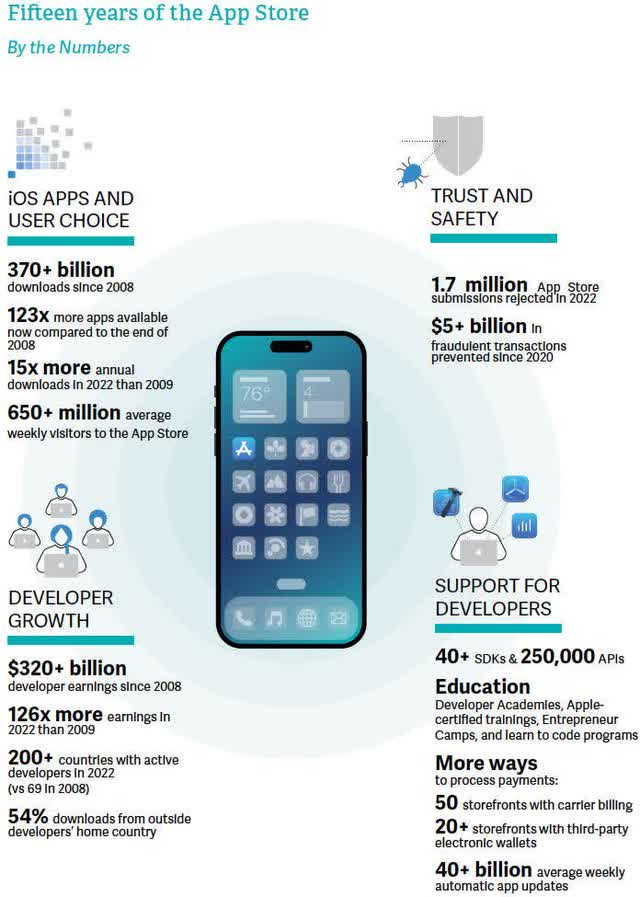

Apple – Is There An App For That?

In January 2007 Steve Jobs introduced the iPhone at Macworld in San Francisco. At the time of that momentous day, Jobs had not planned for third-party developers to build native software applications ((apps)) for the iPhone’s internal operating software (iOS). However, later that year, bowing to considerable pressure from the developer community, Jobs relented. When the second-generation iPhone (3G) was released in the summer of 2008, Apple announced the opening of the iPhone App Store at the same time. According to the Company in July 2009, after just the first 12 months since the launch of the App Store, 1.5 billion apps were downloaded from 65,000 apps from more than 100,000 developers from 77 countries.

That early symbiotic relationship between the iPhone (hardware) and the App Store (software) completely redefined the utility of the iPhone (think Intel and Microsoft). Too bad American Express coined the phrase, “Don’t Leave Home Without It.” That perfectly describes the utility of the modern iPhone. Heck, for years now, most of us won’t walk from the kitchen to the garage without it.

Those days bring back fond memories for us. We’ve owned Apple stock since 2005. At the time of both launches of the iPhone in 2007 and the much-anticipated iPad in early 2010, we opined in our Client Letter that each device was so revolutionary that Time magazine would award each device the “Invention of the Year” award. So, it was – they were both easy calls. Fast forward 15 years since the launch, and even a cursory retrospective of the App Store inspires awe at its enormity and influence of the App Store. Surely, there will be a lifetime achievement award in the App Store’s near future.

During the early years of the App Store, the growth of the App Store ecosystem was quite striking, but seen in retrospect of the current size, scale and scope of the ecosystem, those early year stats seem rather quaint.

Here are a few more App Store data points released from the Company:

- 2012: The Company saw 40 billion total downloaded apps. 20 billion in 2012. 500 active accounts on the App Store. 775,000 apps available in 155 countries in 23 categories, including games, business, health, sports, fitness and travel.

- 2013: The Company achieved $10 billion in customer spend in the App Store. App developers have earned $15 billion on the App Store. (Note: Apple keeps 30% of customer spend.)

- 2014: App Store billings increased 50% over 2013. In the first week of January 2015, nearly $500 million spent on apps and in-app purchases. Now, 1.4 million apps available in 155 countries. To date, App Store developers have earned a cumulative $25 billion.

- 2016: Record customer holiday spend of $3 billion in December. $240 million on January 1, 2017. App Store subscription billings up 74% over 2015 to $2.7 billion. App developer earnings $60 billion.

- 2017: During the week starting on Christmas Eve, record app downloads and record purchases of nearly $900 million in that seven-day period. $300 million on New Year’s Day alone. Cumulative developer earnings up 30% to $86 billion.

- 2018: Holiday spending $1.22 billion.

- 2019: App Store ecosystem $519 billings and sales. 2 million apps in 175 countries visited by 500 million people each week.

Thus far we have chronicled the largesse of the App Store regarding the significant monetary benefit to the Company and App Store developers. However, we have only scratched the surface of the true enormity of Apple’s App Store ecosystem.

In June 2020, the Company released a study of the App Store ecosystem in conjunction with the economic consulting firm Analysis Group. In that study, the Analysis Group found, in the calendar year 2019 alone, the App Store ecosystem supported $519 billion in global billings and sales. The study notes direct payments made to app developers from Apple – as large as they have become – are but a fraction of the total sales from other app generated sources such as physical goods and services, rather than digital billings. Specifically, the study found that 85% of the $519 billion accrues solely to third-party developers and businesses of a multitude of varieties and size.

All of us have long become quite familiar with the concept and reality of electronic commerce (e-commerce). When considering all the business individuals and businesses transact over the apps on their respective iPhone and iPad, think in terms of mobile commerce (m- commerce).

Fast forward to 2023. This past May the Analysis Group updated its App Store ecosystem study. Their findings are nothing short of staggering. Here are their key findings:

The App Store ecosystem facilitated a groundbreaking $1.1 trillion in billings and sales worldwide in 2022. More than 90% of this figure originated from transactions that did not happen through the App Store, meaning that these amounts accrued solely to developers and other third parties, and that Apple collected no commission on them.

We estimate that the App Store ecosystem facilitated more than $1.1 trillion in billings and sales worldwide in 2022, up from $868 billion in 2021, $643 billion in 2020, and $519 billion in 2019. Of that total, $104 billion, or 9%, originated from billings and sales of digital goods and services consumed on iOS apps; $910 billion, or 81%, from sales of physical goods and services made on iOS apps; and $109 billion, or 10%, from in-app advertising on iOS devices.

The App Store ecosystem grew 27% between 2020 and 2021 and 29% between 2021 and 2022, in line with the 27% growth from 2019 to 2020. Overall, such growth is a sign of a flourishing marketplace, where apps innovate, grow, and compete.

Each of the three top-level ecosystem categories grew each year, but at somewhat different rates.

Specifically, iOS-app-based sales of physical goods and services accelerated, growing 30% from 2020 to 2021 and 34% from 2021 to 2022. In-app advertising in iOS apps continued to grow at high rates: Increasing 10% from 2020 to 2021 and 24% from 2021 to 2022.

Key to the thesis in our +18-year holding in Apple stock has been the growth and stickiness of the Company’s ecosystem. Back in the day, the ecosystem was referred to as Apple’s “halo effect.” In short, the halo effect a company might possess is when the delight of a product or service entices additional purchases, and in turn if this generates more delight, consumer loyalty becomes entrenched.

Back in 2005, Apple’s cash-machine was the iconic iPod. Recall that back in late 2003 when Jobs opened the second-generation iTunes Music Store for both the Mac and Windows – the iPod and iTunes business boomed. In 2005, Apple’s sales were up +68%. Margins tripled. Earnings per share soared +359%. Apple’s halo effect and ecosystem growth were at their infancy of the juggernaut they would become.

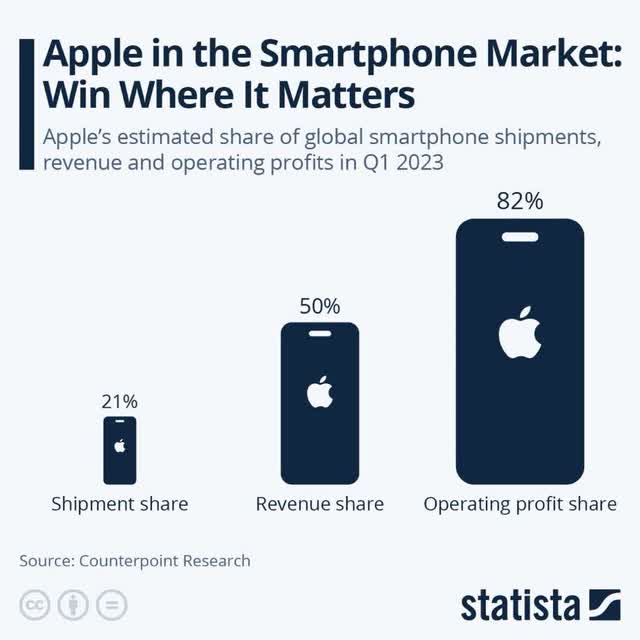

Today the Company boasts an active installed base of over 2 billion devices. The iPhone base is over 1 billion alone. Based on management’s recent comments on the iPhone’s base of business, one can infer that as much as a third of iPhone users still don’t own any other Apple hardware product. The economics of the iPhone alone are worthy of Ripley’s Believe It or Not! and Guinness World Records. Believe it or not, the iPhone’s profit share is nearly 4X its shipment share.

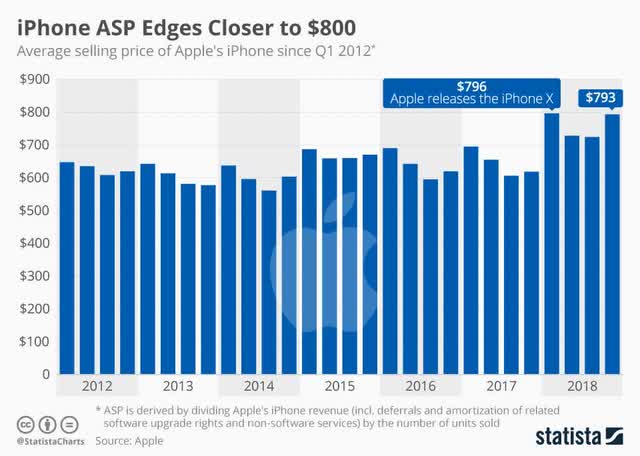

The long history of technology hardware is often a path toward commoditization, then obsolescence. In our view, the single stat that has defied Apple bears over the years is the resiliency of the iPhone’s incredibly sticky average selling price, owing to its App Store driven personalization and concomitant utility, which eclipsed $900 last year and is now closing in on $1,000. Guinness would be proud.

Lastly, according to a recent Piper Sandler survey, 87% of teens in the U.S. have an iPhone. The Financial Times reports 34% of all iPhone owners in the U.S. are gen Z (post-1996) and 50% of all phone usage in the U.S. now happens on an iPhone.

Don’t leave home without it, indeed.

In other Apple hardware, the Mac and Watch installed bases are at an all-time high. A significant number of iPad, Mac and Watch purchasers are new to these products. The halo- effect/ecosystem of these hardware products in turn drives Apple’s diverse services business – 978 million paid subscriptions and counting.

In 2013 the Company reported its non-hardware services revenue amounted to $16 billion. Fast forward ten short years and the Company’s services business is set to generate over $80 billion in record revenues in 2023. More important still, the Company’s services business generates gross margin over 70% – nearly double the Company’s hardware gross margin of 37%. That said, management currently believes that its services business is still underpenetrated relative to its 2 billion active devices.

Over the past two fiscal years (September), the Company has generated well over $100 billon in operating income.

At the height of Apple’s respective power, the titans of the Gilded Age (e.g., Vanderbilt, Astor, Rockefeller, Carnegie, Morgan, Ford and Duke) would be in awe of the $3 trillion in market capitalization, circa-2023 Apple.

In addition, Apple’s “fintech” ecosystem franchises, most notably Apple Pay are in their infancy. Flagship Advisory Services estimates Apple controlled approximately $800 billion of payment flows in 2022.

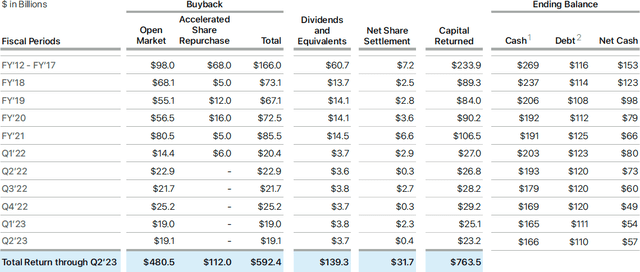

Apple gushes so much cash, despite spending $25 billion in research and development, said cash can’t profitably be reinvested into their existing business lines. This happy problem has led to massive capital returning to shareholders in the form of share buybacks and dividends.

To date, Apple has returned a staggering $763,500,000,000 in capital to very happy Apple shareholders – in large part in share buybacks. Since initiating its share buybacks in 2012, the share count has reduced from over 26 billion shares to just under 16 billion shares. This sizable reduction has been material in the accretion in earnings per share over the past ten years.

Source: Company Reports

Apple stock closed the quarter at $194 – an all-time quarter record – and up +45% year to date. In addition, the stock has compounded over the past 1, 3 and 5 years at +30%, +27% and +33%, respectively. These rates of return will be impossible to duplicate – the current size of both Apple’s business and heightened valuation will see to that. Recall that Apple stock declined -32% from early January 2022 through this past January. We are rooting for another such decline – though we have zero ability to accurately forecast the timing of such. Apple will have a first-class problem for years to come – too much excess cash. Long-term shareholders should root for periodic share price declines so management can swing a fat accretive buyback bat.

|

David A. Rolfe, CFA, Chief Investment Officer |

Michael X. Quigley, CFA, Senior Portfolio Manager |

Christopher T. Jersan, CFA, Portfolio Manager |

|

The information and statistical data contained herein have been obtained from sources, which we believe to be reliable, but in no way are warranted by us to accuracy or completeness. We do not undertake to advise you as to any change in figures or our views. This is not a solicitation of any order to buy or sell. We, our affiliates and any officer, director or stockholder or any member of their families, may have a position in and may from time to time purchase or sell any of the above mentioned or related securities. Past results are no guarantee of future results. This report includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions or forecasts will prove to be correct. These comments may also include the expression of opinions that are speculative in nature and should not be relied on as statements of fact. Wedgewood Partners is committed to communicating with our investment partners as candidly as possible because we believe our investors benefit from understanding our investment philosophy, investment process, stock selection methodology and investor temperament. Our views and opinions include “forward-looking statements” which may or may not be accurate over the long term. Forward-looking statements can be identified by words like “believe,” “think,” “expect,” “anticipate,” or similar expressions. You should not place undue reliance on forward-looking statements, which are current as of the date of this report. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. While we believe we have a reasonable basis for our appraisals and we have confidence in our opinions, actual results may differ materially from those we anticipate. The information provided in this material should not be considered a recommendation to buy, sell or hold any particular security. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here