Good CPI

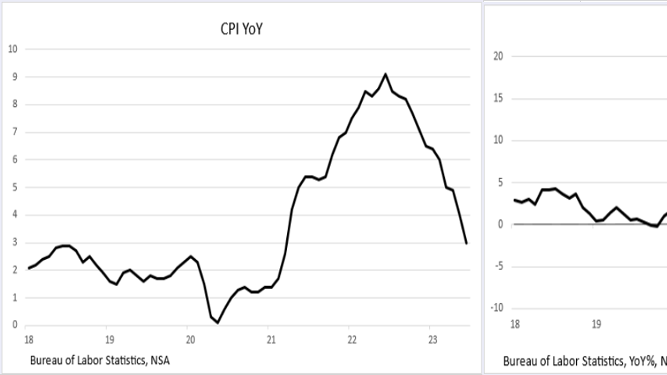

The news of the week revolved around inflation. First, CPI (Consumer Price Index) on Wednesday (July 12). As we have forecast in past blogs, the rate of inflation has begun to melt. The +0.2% rise in both the headline (0.180% to the third decimal place) and core (+0.158%) was below the +0.3% expectation (for both). That brought the arcane year-over-year inflation rate to 3.09%.

The year-over-year calculation doesn’t say much about the current trend. The three-month and the six-month calculations give better trend information. The latest three-month annualized rate of change is 2.7%, while the six month is 3.3%; clearly headed in the right direction. The sub-index that Fed Chair Powell says is key, Services ex-Rent and Energy, actually deflated in June (-0.005%). What’s the likelihood that Powell discusses this index at the July press briefing? (Answer: Nil)

Better PPI

Then on Thursday (July 13), the PPI (Producer Price Index) headline number, at +0.1% for the month of June also came in below the consensus view (+0.2%). On a year over year basis, the annual rate of change in headline PPI is just +0.1%. This compares to +6.4% last December and +11.2% a year ago (June ’22). Looking closer at the near-term trends, over the past six months, the annualized rate of change in PPI was -0.3%, and -0.7% over three months! Once again, the trend is toward lower prices! Looking at “Core Crude PPI” which measures prices at early stages of production and is a very reliable leading indicator for the more popular CPI, we note that June’s month over month result was -2.4%, and this measure is -13.6% lower than in June ’22. Note the steep downward trends in both the CPI and PPI in the chart at the top of this blog.

Despite these very positive trends, Fed governors continue to tell their audiences that rates are going to stay “higher for longer.” As a result, the markets currently place 90%+ odds that there will be a .25 percentage point (25 basis point) rise in the Federal Funds rate at the upcoming July 26-27 Fed meeting. Given the trends in inflation noted above, and since monetary policy acts with long lags, it doesn’t appear that an additional rate hike is needed. (And some commentators now argue that current rates are overkill – we are in this camp.) Nevertheless, it appears that such a hike is baked in, lest the Fed lose credibility and allow its influence on the free-market yield curve to be diminished.

The Fed did announce this week that James Bullard, the President of the St. Louis Fed, will be stepping down from his Fed post and will take a position on the Purdue faculty in mid-August. Bullard, who has been the most vocal rate hike hawk among the Fed governors, indicated that he would not participate in any rate setting discussions or decisions at the Fed’s July meetings. We hope that this event marks the beginning of a more dovish Fed, as the data discussed above indicates, but we are not holding our breath.

Projections

The table shows what the headline CPI would be if the monthly inflation rate remained at June’s +0.2% (last column on the right). Because we see Recession ahead, we also included columns for +0.1% and +0.15%. Note that at the +0.2% monthly rate, the December ’23 headline CPI would be 2.85%, and it would fall to 2.43% a year from now (right-hand column). As you can see from the table, at +0.1% or +0.15%, by this time next year, CPI headline would be 1.21% or 1.81% respectively, both well below the Fed’s 2% target. Our opinion is that it is highly likely that we will see negative readings in the monthly CPI prior to year’s end. So, we continue to scratch our heads as to why the Fed is pushing rates higher (credibility!). Perhaps the Bullard retirement is a sign of a more benign future Fed.

Caution

A note of caution here. In the CPI column of the table, note the CPI index for May, June and July 2022. The headline inflation rate is simply the percentage change in the index over the prior 12 months. Thus, the 3.09% number is the percentage change from June ’22 to June ’23 (i.e., 303.841 vs. 294.728). Note that between May ’22 and June ’22, there was a very large leap in the index (from 291.268 to 294.728). This is known as the “base effect.” The much larger denominator in the June ’23 calculation impacted the annual percentage change calculation. That is partly why the headline rate of inflation fell a whole percentage point (from 4.13% to 3.09%). Now note that in July ’22, the CPI index fell slightly (from 294.728 to 294.628). This will have a negative impact on headline CPI when July’s CPI data are released in mid-August. Under almost any likely scenario, as shown in the table, if month over month inflation is between +0.1% and +0.2%, which would be very encouraging results, the headline year over year rate will rise to the 3.2% to 3.3% range. Once again, this would be due to the “base effect” from a downtick in the index in July ’22. This may cause a stir in the markets, but it isn’t anything to be concerned about as long as the monthly change remains tame.

One more positive note on inflation: there is a strong correlation between the Institute for Supply Management’s (ISM) Manufacturing Prices Paid Index and the CPI (see chart). If past is prescient, as is obvious from the chart, inflation will continue to melt.

Employment – Less Than Meets the Eye

The employment reports from earlier in the month showed the headline Payroll Report number at +209K. This was the weakest reading in 2.5 years (since December 2020). The consensus view was for +230K, and this was the first time in 15 months that the consensus was higher than the actual.

Starting with the +209K headline number:

- Revisions for the prior two months removed -110K from those counts;

- The Birth/Death add-on for small businesses (which are not surveyed) was +60K. This is a trend line number which is simply added by BLS; it ignores the business cycle;

- The Challenger Gray and Christmas Company shows that layoffs in June were +25% higher and hiring announcements were -87% lower than a year earlier (June ’22). This was led by slowdowns in the leisure/hospitality, finance, and retail sectors;

- Initial unemployment claims have spiked. The four-week moving average is now +45K higher than it was in February;

- Subtracting the monthly revisions (-110K) and the Birth/Death add-on (-60K) results in a net add of only +39K, nowhere near the +209K headline. And, since government added +60K jobs, the private sector actually lost more than -21K jobs.

But wait! There’s more. The growth in second jobs (multiple job holders) was +233K, and these multiple job holders now represent 5% of total employment. This is in the high end of the range for the last decade and is a reliable indicator of economic stress. Another such indicator is “Part-Time for Economic Reasons” (those with a part-time job who want a full-time job but can’t find one). In June, these rose +452K, the largest rise since the pandemic lockdowns in April, 2020! In addition, employment in the “Temporary Help” sector fell -13K in June, and such employment has contracted in five of the last seven months. It is intuitively obvious that employment must be weak when the head hunters are cutting their own heads. Note in the chart the downtrend in non-farm payrolls beginning in early 2022, especially in the private sector.

When looked at in detail, the employment report was quite weak, and we think a sign of things to come. (We note that in the week ending July 14 Microsoft

MSFT

Final Thoughts

From the incoming data, it appears that today’s Fed is as wrong about “elevated” inflation as it was two years ago with its “transitory” call. Unfortunately, this Fed doesn’t appear to pay attention to detailed analysis. It looks like they accept the headline numbers without any further analysis. As a result, we think that, for credibility’s sake, a +25 basis point hike in rates on July 27th is a lock because this Fed has been telling markets for over a month (since its June meeting) that rates will be “higher for longer,” and their June dot-plot actually implies two more rate hikes before year’s end. The latest CPI and PPI numbers are quite recent and they are not likely, for those credibility reasons, to deter the Fed from one more hike. But we wouldn’t be surprised if the decision to hike isn’t “unanimous.” And the Bullard retirement (the Fed’s biggest hawk) is a positive sign that the eventual move toward “ease” will not be as hard to accomplish as we previously thought.

The recent inflation data discussed above have convinced markets that this will be the last rate hike this cycle. This is reflected in the low market odds of a September hike. We agree with that assessment as we believe that the inflation numbers will continue to weaken and possibly even turn into deflation before year’s end.

The base case scenario for the Fed’s economic staff is for a mild recession beginning in this quarter (Q3) or in Q4. Looking ahead, when the Recession becomes well recognized, the Fed will lower rates (likely to happen once the U3 unemployment rate (currently 3.6%) rises to the 4%+ level). Because the Fed sees the neutral rate (one that is neither “tight” nor “loose”) in the 2.5% vicinity, we don’t see them lowering rates to levels below 2%, unless the Recession is quite severe.

Our final thought: When the Recession becomes well recognized and is the base case, the equity markets are not likely to do well, but fixed-income investments will thrive.

(Joshua Barone and Eugene Hoover contributed to this blog.)

Read the full article here