Introduction

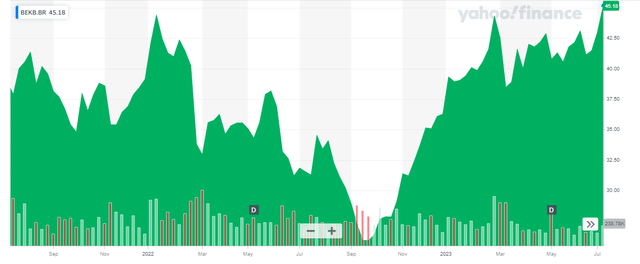

It has been four years since I last discussed Bekaert (OTCPK:BEKSF) (OTCPK:BEKAY) and back in 2019 I argued that Bekaert was worth having a look at, but I wasn’t too sure about the company’s ability to generate strong free cash flows which should allow the Belgian company to focus on reducing its net debt. Just a few quarters after that article was published, COVID hit and Bekaert definitely wasn’t immune to the economic shock created by the worldwide health crisis. But it looks like Bekaert handled everything well and has come out of the COVID pandemic as a stronger company with more robust cash flows and a stronger balance sheet. And while it took a while, the stock is now trading more than 100% higher than where it was when I published a ‘buy’ rating in a 2018 article.

Yahoo Finance

Bekaert has its primary listing on Euronext Brussels where it is trading with BEKB as its ticker symbol. The average volume in Brussels is 42,000 shares per day which represents a monetary value of approximately 2M EUR. There are currently approximately 53M shares outstanding (including the impact of the recent share buyback program), resulting in a market capitalization of approximately 2.4B EUR.

2022 was robust, but I’ll be looking for confirmation in 2023

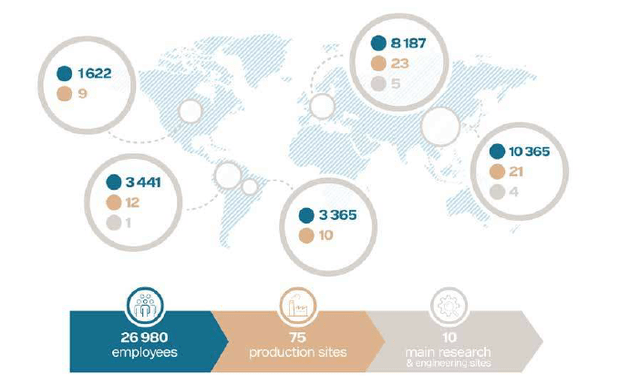

As a reminder, Bekaert is a large producer of steel wire with 75 production facilities. 23 of those facilities are in Europe while Bekaert also has a strong exposure in Asia and South America, as you can see below.

Bekaert Investor Relations

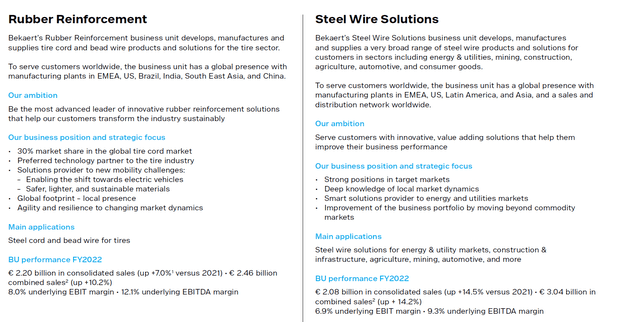

Bekaert split up its activities in four business units of which the ‘rubber reinforcement’ and ‘steel wire solutions’ are the most important units as they represent about 2.3B EUR in consolidated revenue which represented almost 2/3rd of the entire consolidated revenue in 2022.

Bekaert Investor Relations

The two remaining business units are the specialty business unit (which manufactures products to reinforce concrete, masonry and plaster as well as rubber hoses and belts) and the Bridon-Bekaert Ropes Group which produces steel wire ropes and cords. The high exposure to the rubber reinforcement sector means Bekaert’s performance is correlated to the tire market as one of its more important suppliers.

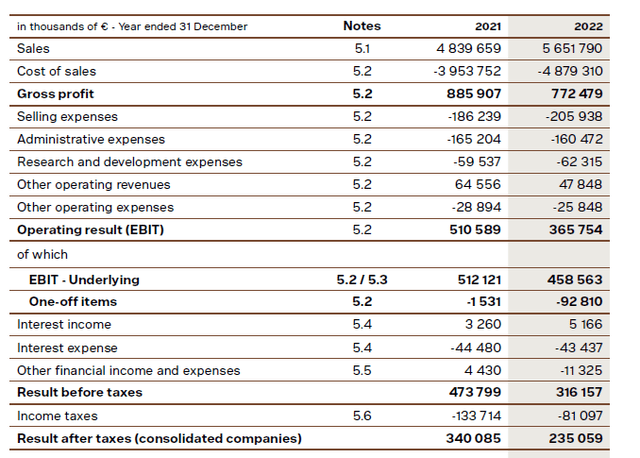

While Bekaert reported a strong revenue growth in 2022, unfortunately its COGS increased at a faster pace which ultimately resulted in a 13% decrease of the gross profit. And as you can see below, unfortunately the other operating expenses also increased as selling expenses jumped by about 10% while the administrative expenses decreased by just 3%. As the ‘other operating revenue’ (due to a lower restructuring income versus 2021, when an asset was sold) also decreased, the EBIT dropped to 366M EUR.

Bekaert Investor Relations

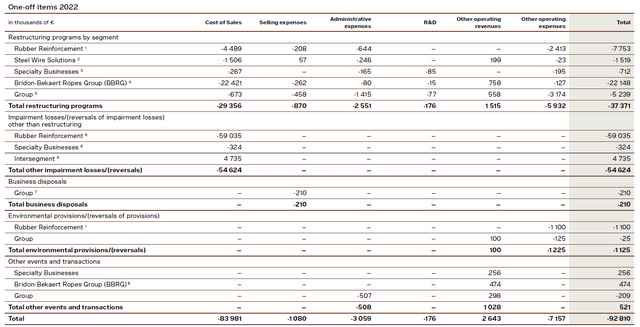

Sounds pretty bad but keep in mind there were almost 100M EUR in non-recurring items included in the operating expenses and on an underlying basis, the EBIT was approximately 459M EUR representing an EBIT margin of 8.1%. I have to commend Bekaert for being very transparent when it comes to the non-recurring items as the company published a very detailed table with all the details. As you can see below, about 55M EUR was related to a non-cash impairment charge while about 30M EUR of the non-recurring items was included in the COGS.

Bekaert Investor Relations

And despite these 92.8M EUR in non-recurring items, the reported net income was still a very decent 289M EUR (including a 54M EUR contribution from the results of associates and joint ventures) of which 269M EUR was attributable to the shareholders of Bekaert. This represented an EPS of 4.78 EUR based on the average share count of 56M EUR throughout 2022. Excluding the non-recurring expenses would have added 1-1.25 EUR per share to the after-tax result which would have come in close to 6 EUR per share.

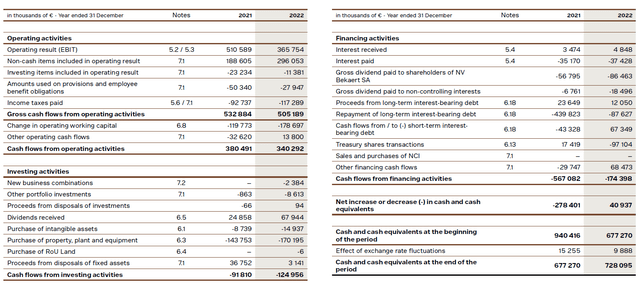

That’s a pretty good result and as a substantial portion of the non-recurring items appeared to be a non-cash charge, I was expecting a strong net cash flow result from Bekaert. Looking at the cash flow statement, the operating cash flow was 505M EUR and this included 117M EUR in cash taxes paid although only 81M EUR was owed based on the 2022 result. We should however also deduct the 32.5M EUR in net interest payments, the 18.5M EUR in distributions to non-controlling interests and 20M EUR in lease payments (which is included in the repayment of interest-bearing debt). On an adjusted basis, the operating cash flow was 470M EUR. Bekaert also received a 68M EUR dividend from investees but I elect to use the 54M EUR in net attributable profit from those associates and joint ventures. This means that on an underlying and normalized basis, the incoming cash flow was 514M EUR.

Bekaert Investor Relations

The total capex was 185M EUR, which results in a net free cash flow result of approximately 329M EUR or approximately 6.2 EUR per share. And as Bekaert spent about 205M EUR on its capex + lease payments versus the total depreciation and amortization expenses of 203M EUR, the strong free cash flow does not mean Bekaert is ‘under-investing’ in its assets as its capex number is almost equal to its depreciation expenses. Also important: the free cash flow result includes about 28M EUR in cash payments to cover employee benefit obligations (which helps to reduce the pension fund deficit).

Of course that was 2022 and the economic landscape has definitely changed in the first six months of this year and that’s why it was important to see the company’s Q1 trading update. And while the company’s revenue decreased in the first quarter, it reconfirmed its mid-term EBIT margin targets. Unfortunately, the Q1 trading update did not include any detailed financial results, but as Bekaert will release its more detailed H1 report within the next few weeks, we’ll know more then.

As a reminder, Bekaert has set its 2022-2026 targets to generate a 3% annual revenue increase and to maintain an EBIT margin of 9-11% throughout that five year period. If I would now apply the lower end of that range to the 2022 revenue of 5.65B EUR, the revenue should reach 6.3B EUR in 2026 and applying a 9% EBIT margin should result in a total EBIT of 567M EUR. After deducting 40M EUR in interest expenses (I expect the interest expenses to increase by 25% due to higher interest rates, partially offset by a lower gross debt and net debt level) and applying an average tax rate of 28%, the net income would be 379M EUR before, and about 425M EUR after incorporating the contribution from associates and joint ventures. Assuming a 40M EUR net income attributable to non-controlling interests (this is just a guesstimate at this point but it’s twice the attributable income from 2022), the net income attributable to Bekaert’s shareholders would be 385M EUR for an EPS of around 7 EUR per share (subject to an acceleration of the share buyback programs which could further reduce the share count and thus increase the per-share performance).

Investment thesis

I am encouraged by Bekaert’s mid-term outlook, but I am not sure what to think of the Q2 performance as Bekaert undoubtedly must feel the impact of a slowdown of the world economy. So although the company sounds upbeat, I think I’ll have to set my expectations a bit lower for this year and only expect additional growth from next year on (if the recession doesn’t hit Bekaert too hard). Fortunately the balance sheet remains strong with 728M EUR in cash and 1.16B EUR in gross debt (excluding the 77M EUR lease liabilities). This means the debt ratio is currently less than 0.7x the adjusted EBITDA and as the current YTM for the 4 year bonds is just 3.70%, the market clearly isn’t worried about Bekaert’s financial strength.

I currently have no position in Bekaert but I own some of its bonds (which seemed like a good idea at the time they were issued in 2020 when a 2.4% YTM was a good result in a zero interest rate environment). I may however sell the bonds and initiate a long position in the equity as a (pre-tax) YTM of 3.7% is not very appealing in this market. And while I acknowledge Bekaert is a cyclical company and while I probably shouldn’t expect too much from the company in 2023, the stock is currently trading at just around 4.5 times its EBITDA and, given Bekaert’s own EBIT growth projections and ability to retain free cash flow to reduce its net debt, the EV/EBITDA ratio will continue to decrease at the current share price. Applying a 6x EBITDA multiple based on a flat performance in 2023, Bekaert should be trading in the mid-60 EUR range.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here