The MELI Investment Thesis Remains Robust – Made Even More Attractive By The Discount

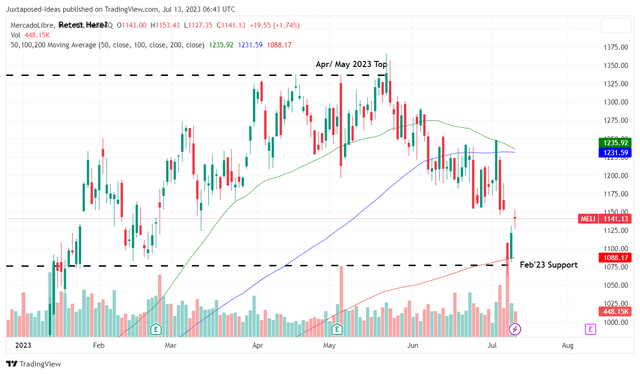

We previously covered MercadoLibre, Inc. (NASDAQ:MELI) in May 2023, ending with a Buy rating but with a critical caveat. We had recommended interested investors to wait for another retracement to the $1Ks for an improved margin of safety, due to the excellent support at the January/ February 2023 levels.

MELI YTD Stock Price

Trading View

True enough, the MELI stock has drastically pulled back over the past week, thanks to Brazil’s new cross-border tax rule, potentially triggering headwinds in its e-commerce prospects. Investors interested in finding out more may consider referring to this article by a fellow analyst in Seeking Alpha.

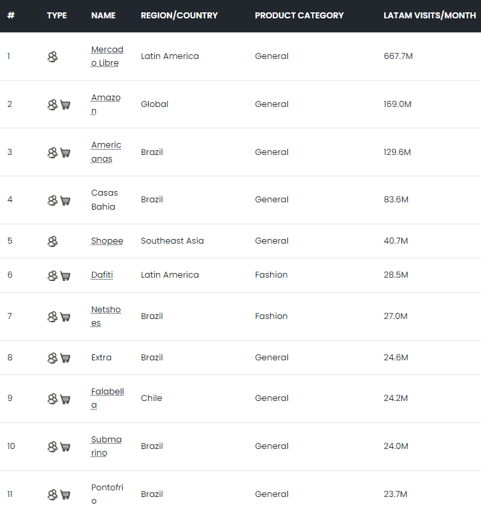

The Largest Online Marketplaces in Latin America

Web Retailer

For now, we share the same conclusion that the BofA’s downgrade by -19.6% to a price target of $1.35K has been overly done, given MELI’s leading mindshare with 667.7M of monthly visits by June 2023, well exceeding the next ten online marketplaces in Latin America combined.

As a result, we believe there may be another reason why the stock has been so reactive to the downgrade.

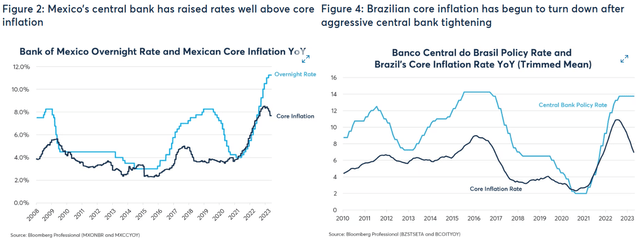

Mexico & Brazil Core Inflation – Overnight Rate

CMEGroup

Given that Brazil, Mexico, and Argentina commanded MELI’s largest geographic segments, we suppose part of the headwind is attributed to the region’s elevated core inflation index and the bank’s aggressive tightening over the past few quarters.

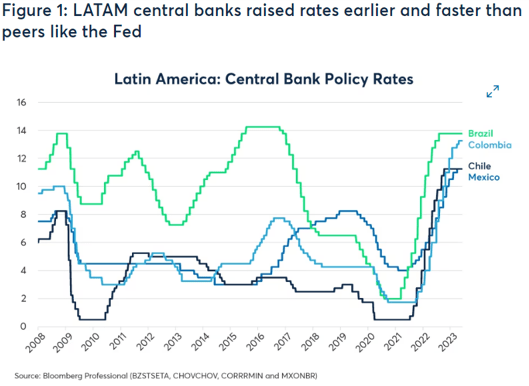

Latin America Central Bank Policy Rates

CMEGroup

For example, the Brazil central bank maintained its benchmark policy rate at a record high of 13.75% and the Mexico central bank at 11.25%, as an effort to tamp down the rising inflationary pressure.

This cadence may impact MELI’s e-commerce sales indeed, due to the potentially tightened discretionary spending. This is on top of the increased credit risks, with Mercado Credito reporting a moderated annualized Interest Margins After Losses spread of 39% (-9 points QoQ) in the latest quarter.

While its <90-day Non-Performing Loans have declined to 9.5% (-0.5 points QoQ/-3.9 YoY) of its portfolio, most of this is attributed to the management’s prudence in reduced loan originations as well.

Therefore, while MELI’s execution seems more than impressive despite the uncertain macroeconomic outlook, as discussed in-depth in our previous article, we believe Mr. Market may have turned more cautious, thanks to Powell’s hawkish commentary with at least two more rate hikes in 2023.

However, we also believe that things are looking more optimistic in the Latin America region, since the rate tightening has been working beautifully after all. For example, Brazil already recorded a drastically moderated inflation rate of 3.16% (-0.78 points MoM/ -6.91 YoY) and Mexico at 5.06% (-0.78 points MoM/ -3.09 YoY) by mid-June 2023.

With market analysts projecting a potential rate cut by August 2023 and the region’s inflation index nearing its pre-pandemic levels in 2019, things appear to be turning around, potentially boosting consumer confidence and MELI’s top line moving forward.

Therefore, we believe investors should ignore the noise, since the Latin American economy seems to be returning to normalization much sooner than the US economy. This led us to believe that the recent moderation in its stock prices may have been an outright gift for those whom have been very patient.

In addition, MELI’s balance sheet is robust with cash/ short-term investments of $3.21B (+5.9% QoQ/ +57.3% YoY), while its long-term debts remain stable at $2.46B.

Combined with expanding its annualized FQ1’23 top-line at $12.14B (+1.1% QoQ/ +35% YoY) and annualized FQ1’23 retained earnings at $4.45B (+22% QoQ/ +124.5% YoY) despite the aggressive rate hikes over the past three quarters, we believe its prospects are very bright indeed once the Latin America economy normalizes.

So, Is MELI Stock A Buy, Sell, or Hold?

Despite the market analysts’ projected expansion in MELI’s top-line at a CAGR of +24% through FY2025, similar to Shopify’s (SHOP) at +20.2%, it appears that the former’s valuations have been moderated thanks to the Latin American discount, compared to Amazon’s (AMZN) at +10.9% and Sea Limited’s (SE) at +11.2%.

Then again, part of MELI’s moderation to NTM EV/ Revenues of 4.17x, compared to its 1Y mean of 4.44x and 5Y mean of 9.36x, may also be attributed to its maturing top-line growth, compared to the pre-pandemic levels of +39.6% and hyper-pandemic levels of +66.2%.

The same has also been observed with MELI’s NTM P/E valuations of 58.04x and SE’s at 20.31x, despite the market analysts’ projected EPS expansion at a CAGR of +47.6%.

Based on this valuation and the market analysts’ FY2025 adj EPS projection of $30.67, we are looking at a long-term price target of $1.78K, suggesting an excellent upside potential from the current levels, thanks to the drastic moderation of -16.1% from the May 2023 top.

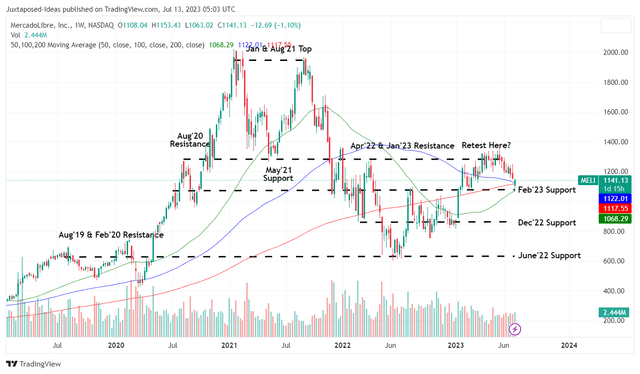

MELI 5Y Stock Price

Trading View

However, we believe that the pullback may not be over yet, with MELI currently retesting its January 2023 support level of $1.1K. Depending on how the market sentiments shift over the next two weeks, prior to the FQ2’23 earnings call in August 2023, it is not overly bearish to assume a further slide to $960.

Therefore, while we may continue to rate the MELI stock a Buy, thanks to its robust fundamentals, investors may want to calibrate their expectations.

This buy rating does not come with a specific entry point as well, so investors may want to observe the situation a little longer to rebalance their dollar cost average, accordingly, especially given the stock’s sharp recovery since the January 2023 bottom.

In addition, we have seen a similar geopolitical discount for Petrobras (PBR), an oil/ gas producer based in Brazil, where its valuations and stock prices continue to be depressed compared to its US peers, due to the country’s political uncertainties.

Then again, with the Latin America banks likely to cut rates soon, we suppose the MELI investment thesis remains robust, especially given its stellar risk management in the credit segment and sustained growth in the e-commerce segment despite the central bank’s sky-high interest rates over the past few quarters.

Therefore, interested investors may want to add at this dip, due to the improved margin of safety, thanks to the recent moderation.

Read the full article here