Introduction

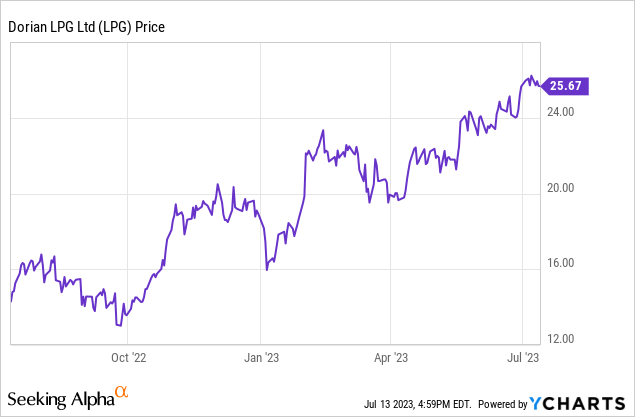

After discussing BW LPG (OTCPK:BWLLF) (OTCPK:BWLLY) and Avance Gas (OTCPK:AVACF), it only makes sense to have a look at US-listed Dorian LPG (NYSE:LPG). Dorian’s financial year ended in March which means the company recently published its full-year results and annual report. Dorian ended FY 2023 on a high note as its average charter rates exceeded the results posted by BW and Avance Gas, and I was obviously curious to see the free cash flow performance of Dorian.

FY 2023 was great for Dorian, but the upcoming worldwide fleet expansion makes it trickier

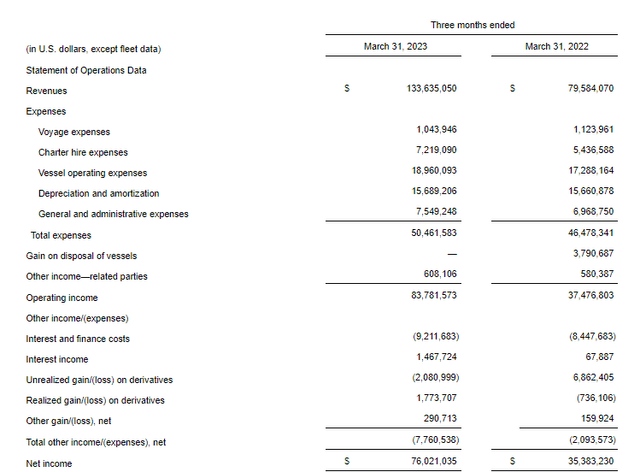

It is interesting to compare Dorian’s Q4 results (the March quarter) with the Q1 results of its Scandinavian peers Avance Gas and BW LPG. While the latter reported a lower average TCE rate of less than $60,000/day, Dorian LPG handsomely beat that result by reporting a total fleet time charter equivalent rate of just over $68,000 per operating day thanks to spot prices exceeding $70,000/day.

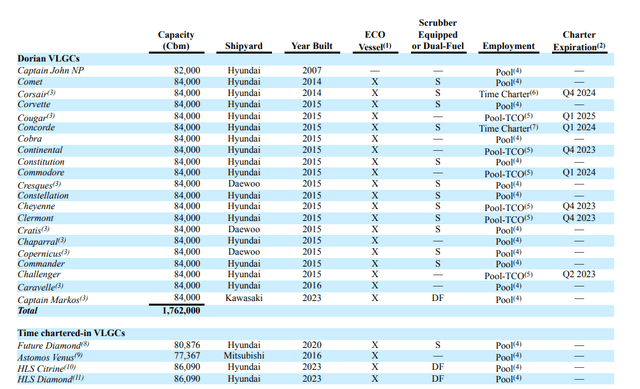

Dorian LPG Investor Relations

Needless to say, this resulted in a very strong fourth quarter as Dorian saw its revenue jump to almost $144M (an increase of almost 70% compared to the final quarter of the preceding financial year). This ultimately resulted in a net income of $76M which worked out to an EPS of $1.90. A brilliant result for a stock trading in the mid-$20 range, that’s for sure.

Dorian LPG Investor Relations

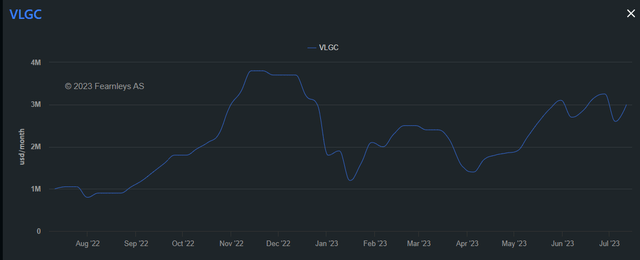

However, I share the sentiment of fellow author Geoffrey Seiler, and I have voiced the same concerns in my articles on BW LPG and Avance Gas. However, the VLGC charter rates remain pretty strong, and definitely stronger than I had anticipated, so it looks like the next few quarters may be quite resilient. VLGCs charter rates are currently around $100,000/day (see below) and that is well ahead of my expectations. This indicates that both Q1 FY 2024 and Q2 will be very strong for Dorian as the additional capacity appears to be well-absorbed by the market.

Fearnley Shipbrokers

That being said, it could also make sense to have a look at Dorian from a more conservative point of view by checking the company’s performance using the full-year average charter rate of just over $50,000/day.

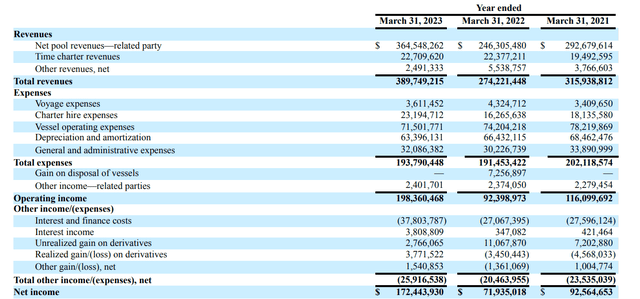

The total revenue during FY 2023 was just under $390M which resulted in an operating income of just over $198M which is more than double the result generated in the preceding year.

Dorian LPG Investor Relations

And while the interest expenses increased (which obviously doesn’t come as a surprise), the bottom line shows a net income of just over $172M which is higher than the net profit in FY 2022 and 2021 combined. This means the full-year EPS came in at $4.31 based on the weighted average share count of 40.03 million shares. Using the current share count of 40.4M shares, the EPS would be $4.27. This means that in excess of 40% of the full-year net profit was generated in the final quarter with an average TCE of just under $70,000/day. With current charter rates close to and sometimes even slightly exceeding $100,000/day, Dorian LPG’s FY 2024 will likely be very strong as well, even if/when the charter rates decrease towards the second half of its financial year as the average cash cost (including interest & principal payments) will be around $25,000/day.

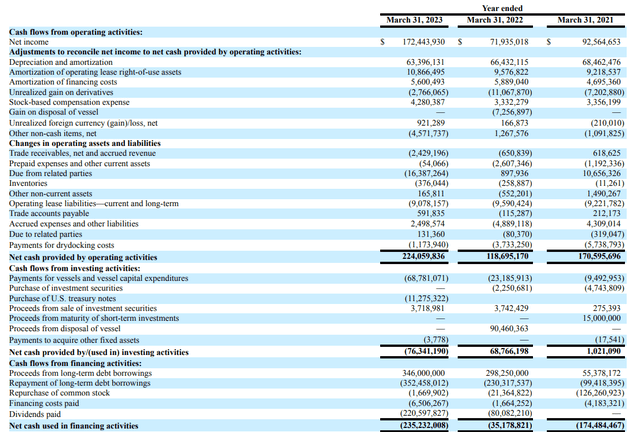

One of the main points of my investment theses for VLGC owners is the ability to convert paper profits into positive cash flows. In Dorian’s case there was no overhang from a non-recurring item (like the sale of a vessel) that boosted the income statement so I was expecting a pretty strong conversion rate. And I was not disappointed.

As you can see below, Dorian reported an operating cash flow of $224M but this included a $26M investment in the working capital position while it also excluded $6.5M in financing costs that were paid.

Dorian LPG Investor Relations

This means the underlying operating cash flow was approximately $244M which is basically sufficient to cover the cost of three newbuilt VLGC vessels. Considering the company currently owns 22 vessels (after the delivery of the Cristobal earlier this week) with an average age of around 8 years and depreciates these vessels over a 25 year period, you could argue the sustaining capex (including fleet renewal and normal average drydocking expenses) should be less than $100M per year. Which means the underlying free cash flow result in FY 2023 was approximately $145M or just over $3.5/share. And again, that’s based on an average TCE rate of just over $50,000/day. For every $10,000/day added to that result would add about $1.5/share to the annual free cash flow result. This means that if Dorian’s average TCE rate this year would come in at $70,000, the sustaining free cash flow result per share will exceed $6 which bodes very well for the current ‘irregular’ quarterly dividends of $1/share.

Of course we have to make sure to not get ahead of ourselves as it is more likely the charter rates will move down in the longer run, but it definitely does look like Dorian will be printing cash this year, even if the charter rates drop by 50% in the second semester.

Investment thesis

I like the fact Dorian LPG is paying a variable dividend which fully depends on the financial performance and health of the company. After all, a dividend is not an ‘entitlement’ but is a mechanism for a company to share its profits with its shareholders. And I think it makes perfect sense that in bad years the dividend is lower and in good years the dividend is higher. The most recent dividend was $1/share which brings the LTM dividend payments to $4, which represents in excess of 15% of the current share price. And that dividend should be sustainable as long as the charter rates remain above $55,000/day while the current charter rates indicate Dorian could have a surprisingly high dividend ready for its shareholders in the near future.

I used to ‘play’ the VLGC market with BW LPG and Avance Gas, and both companies are very well-run. This meant I lost track of Dorian LPG, but I have recently started to write put options again. While the stock is trading slightly above NAV (but not much, considering newbuild VLGCs are about $90-95M these days), Dorian will make up for this by the strong earnings profile that will last for a few more quarters: if it generates $8 in earnings this year and pays out $5, it will add $3/share to the NAV. Dorian is a well-managed company and I have no issue paying a small premium over NAV.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here