Main Thesis & Background

The purpose of this article is to evaluate the SPDR Bloomberg Barclays High Yield Bond ETF (NYSEARCA:JNK) as an investment option at its current market price. This is a high-yield bond fund with a primary objective “to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Bloomberg Barclays High Yield Very Liquid Index”.

I covered JNK almost exactly two years ago when I was cautious on the outlook for the fund. Over time, it is true this would not have been the best investment, as its performance since that review has proved:

Fund Performance (Seeking Alpha)

As I look at the macro-backdrop, I have concerns about getting too risk-on. This includes junk debt because it, by nature, has elevated risk. But for investors who understand and can accept this, there is some underlying value here. This is due to a relatively high yield for the sector, a resilience in corporate America’s earnings, and the fact that this is a sector offering a contrarian play as retail investors flee it. For these reasons, I believe an upgrade to buy is reasonable for the right person, and I’ll explain why below.

Why Now? Other Investors Are Fleeing

The first topic to discuss is why junk bonds – and JNK by extension – are showing up on my radar at this moment. The idea stems from my natural contrarian instinct. Whenever I see any stock/fund/sector getting disproportionately hit, I begin to wonder if it is justified. If not, the contrarian in me will generally move in to buy.

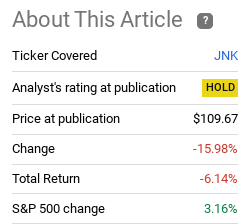

This is relevant to JNK because high yield ETFs have been a sector that has seen a lot of outflows recently. Roughly 10% of assets under management have been pulled from this sector since the year started, clearly showing a change in appetite for the debt these funds hold:

Inflows and Outflows (Various Sectors) (Bloomberg)

This isn’t really “good” news. There are very valid reasons why investors are disproportionately yanking funds from these products. Interest rates may continue to go up, recession risks are elevated, and defaults and bankruptcies have been quietly picking up steam this year. All of these factors are bearish for junk bonds.

But there are positive signals too. Corporate earnings have been reasonably strong in recent weeks, and continued strength in the jobs market is pushing out when a recession is likely to hit (in the U.S.). These push-pull factors suggest the next move for junk bonds is not entirely clear.

With that being the case, I see the sell-off in this sector as a chance to buy the unloved. A compelling buy or sell case is hard to make, yet investors are getting bearish on this sector on the whole. For me, this suggests it could be time to take the opposite side of the bet.

Yields Are Up, Making JNK’s Income More Attractive

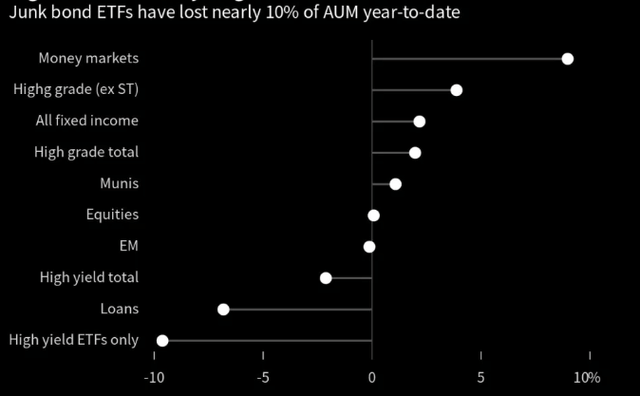

The next topic for discussion has to do with current yields. As the Fed has raised rates and inflation was anything but transitory, corporate debt has begun to offer historically high yields – at least if we look back for the past decade. And in the more immediate term, such as the past two years, the amount of debt yielding between 5-10% has skyrocketed:

Yield Comparison By Year (OakTree Capital)

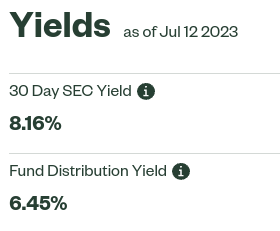

This has extended to JNK, as it should, in that the fund is starting to offer what I view as a strong income stream. Unlike prior reviews where the fund was offering in the 4-5% range, JNK’s current yields are much more attractive:

JNK’s Current Yields (State Street)

This does not guarantee positive returns going forward. But it does tell me that investors are getting adequately compensated for the risk they are taking. With an SEC yield over 8% I have to assume there is a heightened chance of some duration and credit risk. But the income is high enough that I can stomach some of that risk for the payoff.

It’s Not All Bows And Roses

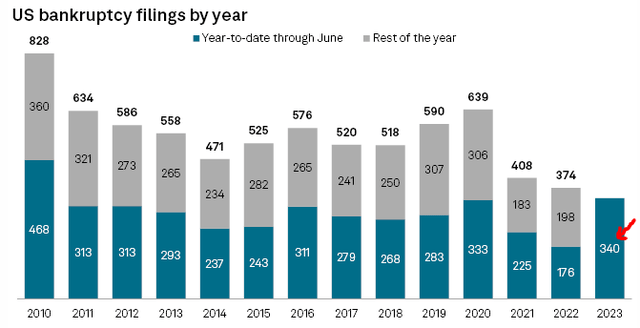

While the contrarian and dividend seeker in me sees some positive attributes for JNK, I have to manage expectations here. I want to emphasize this investment is not right for everyone. That is true all the time but especially now with many macro-headwinds on the way. One of the central risks is that the credit market is currently seeing an uptick in distressed debt and bankruptcies. That is not a good setup for those who want exposure to this space. While bankruptcy can mean a lot of things, and current levels are manageable, if the trend keeps going in the wrong direction we could see further pressure on ETFs like JNK:

Bankruptcy Filings (U.S.) (S&P Global)

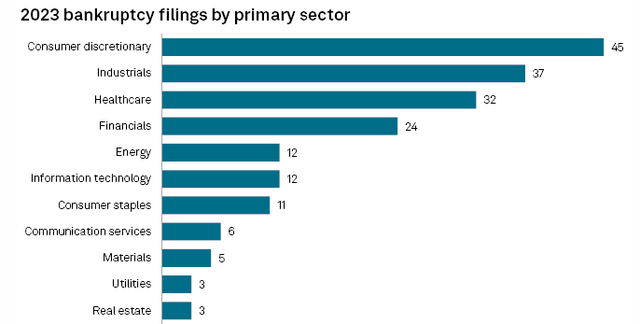

What the second half of 2023 will bring is still unknown, but readers cannot take too much comfort in this statistic. Bringing this back to JNK in particular, we see the sector with the largest number of filing is Consumer Discretionary:

Bankruptcies by Sector (S&P Global)

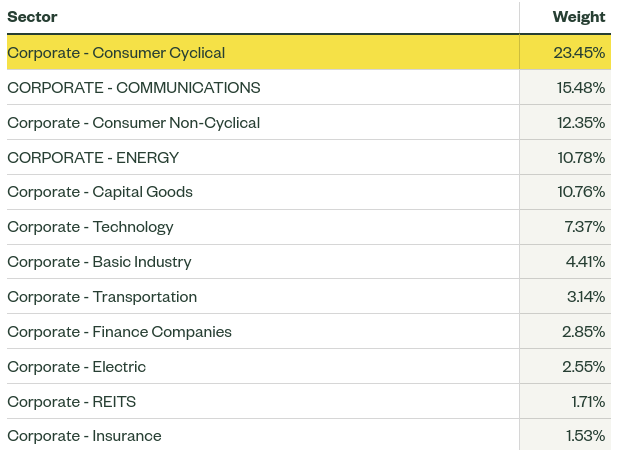

This just happens to be JNK’s largest sector by weighting:

JNK’s Holdings (State Street)

My takeaway from this is to monitor what is happening in the Consumer space very closely. There has been some recent weakness and that directly impacts JNK. If that continues, my bull thesis will come under pressure, and retail investors may have to be more nimble than usual in this regard.

Interest Rates Have To Come Down Long Term For This To Work Out

Going back to my prior paragraph, this investment thesis is one that needs to be revisited more often than my typical calls. I say this because I generally prefer quality, large-cap equities. Especially those that pay dividends. This can often be a “set and forget” type of investment. Similarly, in the bond realm, I prefer IG-rated munis. This is another area that I feel comfortable with long-term exposure. But with junk debt, I take more care. This is a more risky and volatile sector, so I am more agile with my holdings (and therefore my ratings on Seeking Alpha). My advice is for my followers to show similar diligence.

A key reason for this is that even though I see a reasonable investment environment at this moment, I see challenges looming longer term. So if I buy JNK, I will look to hopefully capture a short-term win. In order for me to hold this for the long-term, I will want to see lower interest rates more broadly and/or much stronger corporate earnings to make up for the higher rate backdrop. This is critical to deciding how long I will own this if I buy it.

The reason is that higher interest rates puts pressure on the refinancing ability of corporations – especially the lower rated companies that are most in need of borrowing. When rates are low, companies can easily refinance maturing debt, so the need to be able to pay off principal balances is not so great. But when rates are high, this refinancing is more expensive. This is why distressed debt and bankruptcies rise. A company can only afford so much in debt service – eventually the limit is reached and something breaks.

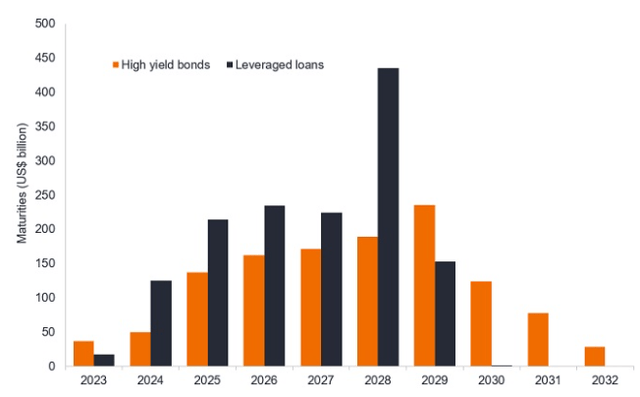

Why is this a longer term risk? The good news is that there isn’t a ton of next set to mature in the high yield and leveraged loan realm this year. But next year we will see a modest increase in maturities, so a persistently high interest rate environment is going to pose more of a challenge in just a couple of quarters. Even more worrying, in 2025 and 2026 a lot of debt is coming due. This is going to fundamentally shift this landscape for junk bonds if something does not change by then:

Volume of Debt Maturing (US) (Bank of America)

This is not meant to be alarmist. The second half of 2023 just got underway, so 2025 and 2026 are a long ways off. And a lot can happen in two years, especially with a presidential election in 2024. But I would not be doing my job if I did not highlight this risk. Readers shouldn’t wait until the end of 2024 to prepare for a more challenging 2025 or 2026. We need to understand what might happen in the future today to help us shape our portfolios. That is why I am saying to approach JNK with shorter time horizon at this time.

2023 Has Been Equities’ Year. Can That Change?

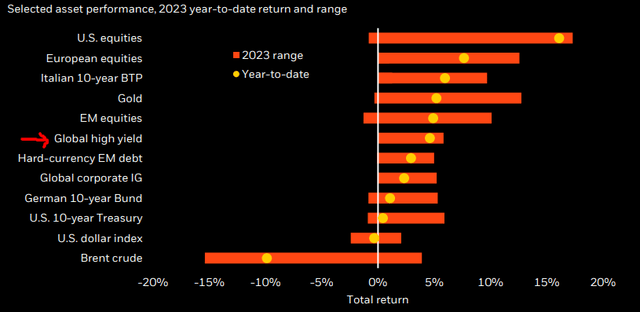

Another reason for looking at JNK right now has to do with the broader macro-picture. What I mean is that equities have been leading the way in a broad fashion. That is great news for people like myself that are generally overweight equities, but it presents a challenge in knowing how the second half of the year will turn out. When 2023 got underway, last year’s losers turned out to be this year’s winners – and vice versa. Could we see a similar picture emerge later this year and in to 2024? If so, then areas like high yield debt could be poised to out-perform due to this year’s average (at best) performance:

YTD Performance (Various Sectors) (BlackRock)

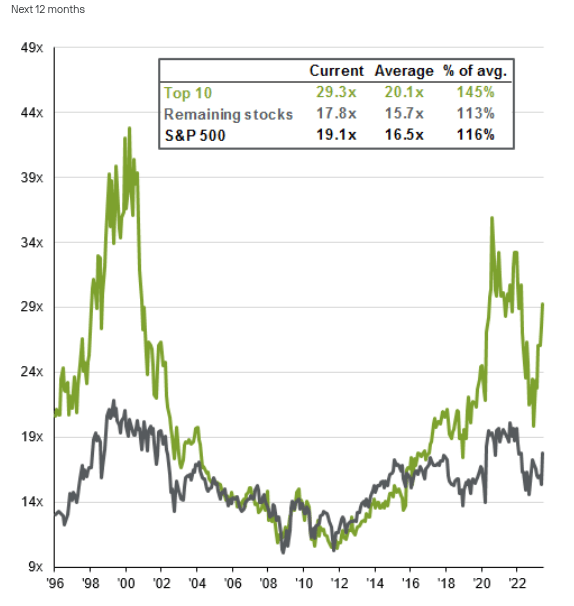

In all honesty, my primary conclusion from this graphic is to start a long position in crude oil or Energy stocks, but that is a separate discussion. When it comes to the bigger picture, the junk debt market doesn’t seem to be overpriced or frothy. Investors have been moving out of it and in to equities, it seems. And the net result is that equities are a bit pricey for my liking:

P/E Ratios (S&P 500) (JPMorgan Chase)

This brings me back to the contrarian play that doing a little of the opposite is justifiable. If stocks are out-performing, getting all the interest, and are expensive, why not look elsewhere for value? That is precisely why JNK is on my potential buy list.

Bottom Line

JNK and other junk bond ETFs are not for the risk averse. But for those who can handle both risk and volatility, potential rewards do abound. Current yields are quite high, and there is a contrarian buy argument to be made here. This is especially true with stocks looking to be a bit of the pricey side. There are definitely counterpoints to be considered. A recession remains a possibility, bankruptcies are rising, and the looming debt maturity profile is a concern. But all this considered, I think the risk-reward proposition for JNK is reasonable here. Therefore, I believe an upgrade to “buy” is warranted at this juncture.

Read the full article here