Investment Rundown

The transportation industry has been quite volatile as rates have gone lower and companies have been faced with challenges to maintain strong margins. For J.B. Hunt Transport Services Inc (NASDAQ:JBHT) they had a poor start to the year with revenues down 7% YoY and the bottom line taking a beating too, with EPS going from $2.29 – $1.89 instead. This shift hasn’t stopped the share price however, and it’s still on a rampage after making lows of around $160 back in May.

This has resulted in JBHT reaching a p/e of 22 on a forward basis, which is quite in line with what they have been historically trading at. I think that the quite diversified set of revenue streams the company has lends them very well to times like this when they can lean into winning parts of the business and hedge against significant downturns. I think a decrease in revenues for 2023 was inevitable as rates have gone much lower than some of the highs that were achieved in 2022. This construed the potential of JBHT in my view and an investment case is still present, resulting in a buy rating from me.

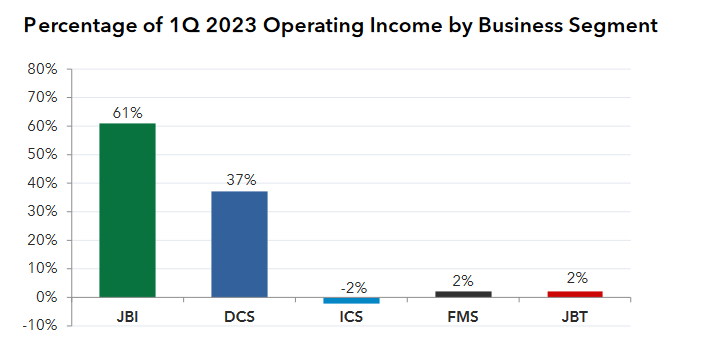

Company Segments

Within JBHT there are 5 primary revenue streams which they have. The largest one by far is the Intermodal (JBI) segment, representing 48% of the total revenues. Next up is the Dedicated Contract Services segment which generates 27% of the revenues. In the JBI segment, they focus on container and dry shipments and boast one of the largest fleets in the US right now. For the second segment, they offer on-site management and services to customers which made it one of the highlights from the last quarter as the segment posted strong growth results. In Q1 2023, they had 541 more trucks operating compared to the year prior, and 49 fewer than by the end of Q4 2022.

Revenue Streams (Investor Presentation)

The increased number of vehicles in use tells me that JBHT sees strong demand still. For the coming Q2 report, this will be a key point for me to watch. Seeing them further leaning into this part of the business should help remedy any otherwise revenue losses in the JBI segment.

Upcoming Earnings Report

In the first quarter of 2023, JBHT saw a decrease in both the top and bottom lines. But the EPS fared far worse than the revenues, decreasing by around 18% compared to revenues falling 7%. The lower truck rates for Q1 in 2023 seem to have been a driving force for this.

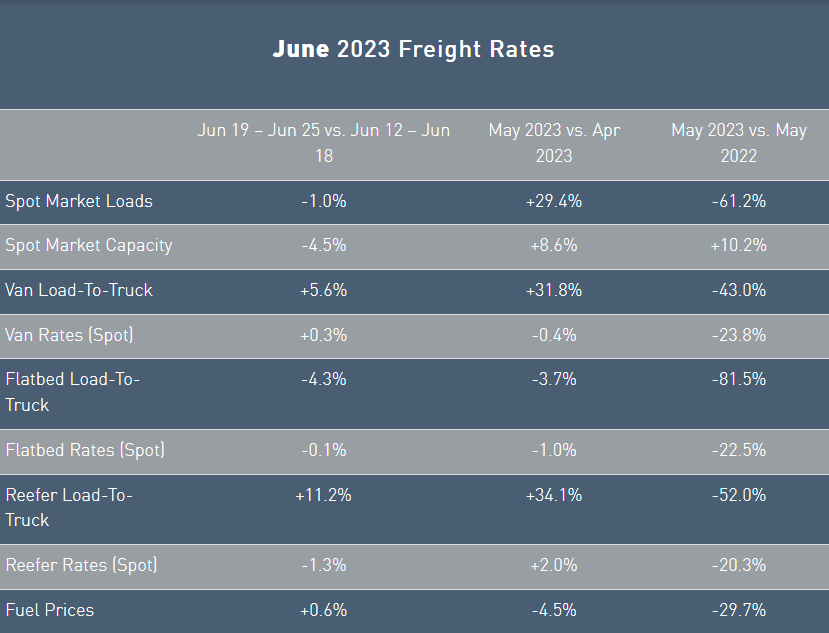

Spot Rates (dat.com)

But it seems we are trending higher for the rates, as the month-to-month changes above here show spot market loads for example growing by 29.4%. In Q2 of 2023, I think we are likely to see an EPS growth QoQ as the gas prices haven’t changed drastically between the selected periods. Estimates seem to suggest the same, with the predicted EPS being $1.92 right now. A beat would signal a strong recovery for the industry and that investing in transportation companies might be a very reliable option still. For the moment, I like the tailwinds and they convince me we will see a recovery, resulting in the buy rating I have for JBHT.

Risks

The trucking industry continues to face an ongoing shortage of qualified drivers. This scarcity of skilled drivers may lead to increased labor costs, service disruptions, and capacity constraints. Fluctuations in gasoline prices can have a significant impact on J.B. Hunt’s operational expenses. If the company is unable to pass these costs onto clients by increasing rates, a sudden increase in gasoline prices can lead to higher expenses and reduced profitability. We have seen very volatile gas prices in the last 12 months and they seem to be trending upwards. If JBHT doesn’t see a strong growth in volumes for the coming couple of quarters I think the higher trending gas prices will suppress the bottom line and possibly make JBHT look even more expensive from a p/e point of view.

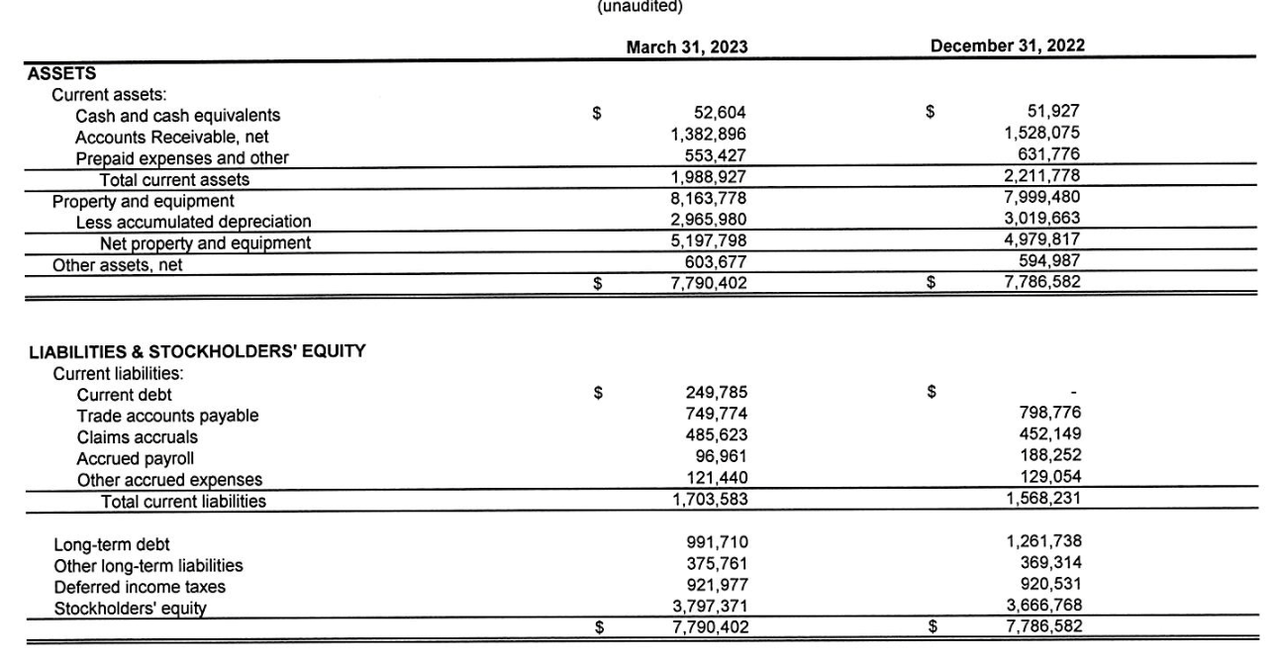

Financials

Looking at the assets they haven’t made any drastic shifts between Q1 2023 and Q4 2022. The most notable increase comes from a larger property and equipment selection, which is valued at $8.1 billion. Growing just under $200 million. The higher truck fleet that JBHT has seems to be the reason for this.

Balance Sheet (Q1 Report)

Where I would like to see some improvement is regarding the cash position that JBHT holds. Right now sitting at $51 million. Comparing it to the current debt is a ratio of 0.2. This is far from sufficient to cover current debts and opens up the risk that JBHT will have to divert capital from other sources to cover expenses. This could lead to the company halting or slowing down buybacks. But I don’t find it impossible we see some sort of share dilution either if the spot rates aren’t growing fast enough to fuel FCF growth. Pair that with higher trending gas prices and JBHT has some challenges to deal with. However it shouldn’t be left unsaid that JBHT has a solid net debt/EBITDA ratio right now of 0.78. This is far under the preferred threshold of 3. Those are however a little skewed and I think we will see a higher ratio around 1.5 instead, as future reports will report earnings with lower rates than in 2022.

Final Words

JBHT has grown into a significant position in the industry and right now it seems to be growing on the back of rates increasing and solid growth in the second largest segment in the business, Dedicated Contract Services. I think the future still looks very bright and the coming quarters should result in a QoQ growth compared to the Q1 FY2023 results. This could ignite the share price and we might see a p/e of around 25 – 26 instead, depending on the coming results for JBHT. On July 18th, we will have the results for Q2 of 2023 ad I am looking forward to reading it. With that said, I remain confident in the company and will apply a buy rating to JBHT.

Read the full article here