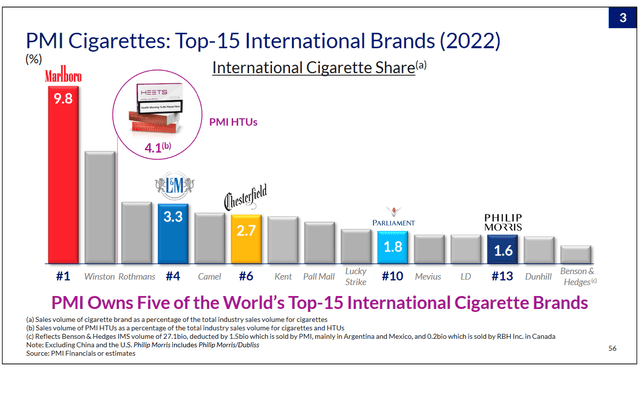

I give Philip Morris International Inc. (NYSE:PM) a buy rating. I think they have a very strong dividend and can be a good investment for a dividend investor. PM is a tobacco company that operates in markets outside the United States and sells cigarettes and smoke-free products. The company is a leader in the tobacco industry, with a market share of 28.4% in its key markets, excluding China and the US. The company sells its products under well-known brands like Marlboro, Parliament, L&M, Chesterfield, and HEETS.

Corporate Slides

The company has been investing in smoke-free products, such as heat-not-burn and vapor devices, to reduce the health risks of smoking and cater to changing consumer preferences. These products are designed to minimize exposure to harmful chemicals and satisfy the needs of adult smokers who want to quit or switch from cigarettes. The company’s flagship smoke-free product is IQOS, a heat-not-burn device that heats tobacco instead of burning it. The company also offers Nicocig, a vapor device that delivers nicotine without smoking.

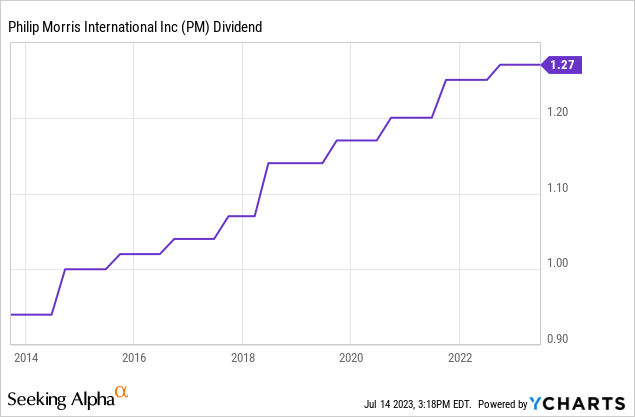

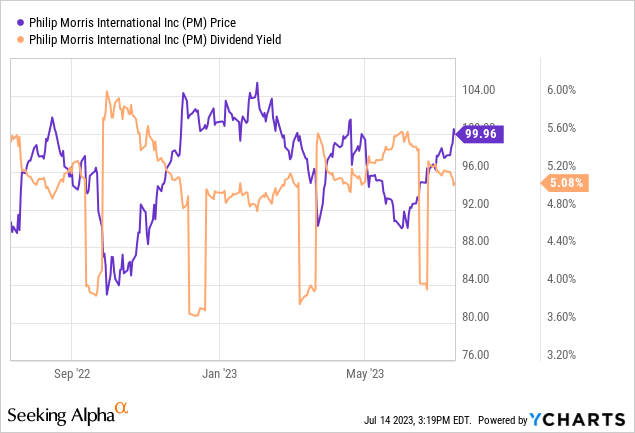

The company has a robust financial performance, with revenue of $80.67 billion and earnings of $9.05 billion in 2022. The company generated $10.4 billion of free cash flow and returned $7.6 billion to shareholders through dividends and share repurchases in 2022. The company has a dividend yield of 5.06%, which is higher than the industry average of 4.27%.

More on dividends

One of the main attractions of PM as an investment is its high dividend yield well above the S&P 500 yield of 1.74%. A high dividend yield means investors can receive a substantial income from their investment, regardless of stock price fluctuations.

However, investors can also reinvest their dividends, rather than receive them as cash, to boost their long-term returns. This can be done through a dividend reinvestment plan, or DRIP, which allows investors to automatically buy more company shares with their dividend payments without paying any commissions or fees. And if the price drops, it allows a dividend investor with DRIP turned on to gain even more shares with their dividends, thus, increasing their dividend snowball.

A dividend snowball is when by reinvesting dividends, investors can benefit from the power of compounding, which means that they can earn rewards on their tips and on their original investment. This can result in a significant increase in the number of shares owned and the portfolio’s value over time.

For example, let’s assume that an investor bought 100 shares of PM at $100 per share on January 1, 2003, for a total investment of $10,000. If the investor had received the dividends as cash and kept them in a savings account earning 1% interest per year, they would have received a total of $16,383 in prizes by December 31, 2022. He / she would have a total portfolio value of $26,383.

However, if the investor had enrolled in a DRIP and reinvested all the dividends into more shares of PM, they would have accumulated a total of 1,024 shares by December 31, 2022. He/she would have a total portfolio value of $46,706. That’s an increase of 77% compared to the cash dividend scenario.

The dividend snowball is one of the most compelling reasons to invest in a great dividend producer like PM and other tobacco companies.

Corporate Slides

Philip Morris compared to peers

Another way to evaluate PM as an investment past its dividend is to compare its price-to-earnings ratio (PE ratio) to its peers in the tobacco industry.

A lower PE ratio indicates that a stock is undervalued or cheap relative to its earnings. In comparison, a higher PE ratio indicates that a stock is overvalued or expensive relative to its earnings. However, the PE ratio should also be considered against the industry average and the company’s growth prospects..

Today PM has a PE of 16.12. Of the four industry comparisons below, PM is higher than 3 and those three all have very similar PEs. This suggests that a premium is being paid for PM compared to its industry competitors.

Some of PM’s main competitors in the tobacco industry are British American Tobacco PLC (BTI), Imperial Brands PLC (OTCQX:IMBBY), and Japan Tobacco Inc. (OTCPK:JAPAY), Altria (MO). Here is how their PE ratios compared to PMs as of 7/14/2023:

|

Company |

Forward PE Ratio |

|

PM |

16.12 |

|

BTI |

7.78 |

|

IMBBY |

10.48 |

|

JAPAN |

1095 |

|

MO |

9.17 |

Therefore, based on the PE ratio alone, PM was not the cheapest stock among its peers in the tobacco industry. The lack of great value relative to its peers is a part of why I gave PM a buy rating instead of a strong buy rating. However, investors should also consider other factors, such as dividend yield, growth potential, competitive advantage, and risk profile, when comparing stocks.

Diversification

The company has a diversified geographic exposure, with 57% of its revenue coming from emerging markets in 2022. These markets offer higher growth potential and lower penetration of smoke-free products than developed markets. The company also benefits from favorable demographics, such as a large and growing population of adult smokers and rising disposable income. Besides being a good dividend investment I like tobacco companies like PM as a good geographical diversification play.

Risks

The company also faces challenges, such as regulatory uncertainty, litigation risks, currency fluctuations, and competition from illicit trade and other tobacco companies. The company faces regulatory uncertainty and litigation risks in some markets, such as the EU, where plain packaging laws and excise taxes have been implemented or proposed to discourage smoking. The company also faces lawsuits from governments and individuals seeking compensation for health damages caused by smoking.

The company is exposed to currency fluctuations, reporting its financial results in US dollars but generating most of its revenue in foreign currencies. A stronger US dollar reduces the value of the company’s foreign earnings and affects its profitability.

The company faces competition from illicit trade and other tobacco companies in some markets, such as Latin America, Eastern Europe, and Asia. Illegal trade undermines the company’s pricing power and market share by offering cheaper and unregulated products. Other tobacco companies also compete with the company by launching their smoke-free products or offering lower-priced cigarettes.

The company faces the threat of declining cigarette consumption and consumer preferences, as more smokers quit or switch to alternative products, such as e-cigarettes, nicotine patches, or gums. According to the World Health Organization (WHO), the global smoking prevalence has declined from 27% in 2000 to 20% in 2016, and is projected to drop to 17% by 2025.

The company faces the threat of social stigma and ethical concerns associated with its business, as tobacco is widely regarded as a harmful and addictive substance that causes diseases and deaths. The company also faces criticism from anti-smoking groups and activists who question its sincerity and motives in promoting smoke-free products and a smoke-free future.

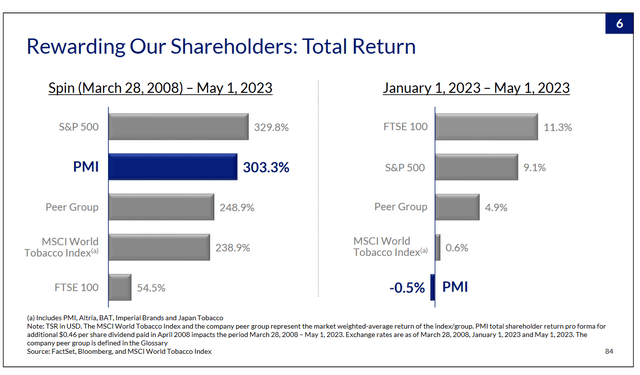

Many of these risk are baked into the cake for a tobacco company. This industry is trying to survive and adapt but at the end of the day it has to many things going against it. In the long run, these companies will most likely continue to underperform the market. Now, the reason people invest in tobacco companies despite this is because of their great dividend yield and likely ability to continue to produce cash flow to pay that dividend from their strong revenue in third world countries.

Future outlook

Corporate Slides

Despite the above mentioned challenges, the company has opportunities to grow its business and enhance its value proposition. The company has a chance to expand its smoke-free product portfolio and increase its market share in this segment, which accounted for 28% of its total shipment volume in 2022. The company expects to reach 50% by 2025. Smoke-free products have higher margins and lower regulatory barriers than cigarettes.

The company can enter new markets or increase its presence in existing markets where smoke-free products are not widely available or adopted yet. For example, the company launched IQOS in China in 2019 through a joint venture with China National Tobacco Corporation (CNTC), the state-owned monopoly that controls 98% of the Chinese tobacco market. China has over 300 million smokers, making it the largest tobacco market in the world.

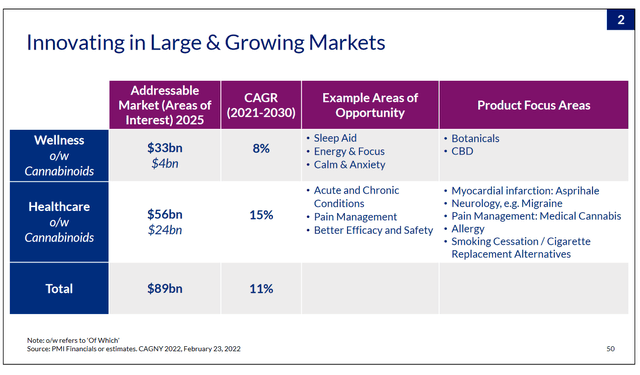

The company has an opportunity to leverage its scientific research and development capabilities to create new products that can address the health concerns of smokers and non-smokers alike. For example, the company is developing oral nicotine products that can deliver nicotine without combustion or inhalation. The company is also exploring effects outside of the tobacco and nicotine sector, such as botanical wellness products that can offer stress relief, sleep quality, and cognitive function benefits.

Conclusion

In conclusion, Philip Morris International is a leading tobacco company transforming its business to offer smoke-free products that can reduce the health risks of smoking. The company has a solid financial performance, a generous dividend yield, diversified geographic exposure, and an innovation pipeline. However, the company also faces many challenges, such as regulatory uncertainty, litigation risks, currency fluctuations, and competition from illicit trade and other tobacco companies. Overall, I think PM is a good investment for someone looking to perform a dividend snowball strategy which is why I give it a buy rating but most other investors should probably look elsewhere.

Read the full article here