Introduction

Let’s face it, people smoke. I mean, I don’t, and chances are you don’t either, but many people do. We know it’s not good for our health, and usually, smokers know this too, yet, people continue smoking. What a world.

While I have my own viewpoints, I do not believe it is my place to judge those based on which vice they choose to splurge on, especially on a public forum. And as an investor, I think it’s important to analyze many industries. Intertwining personal beliefs and politics with investing makes an already difficult endeavor that much more challenging.

Case in point…

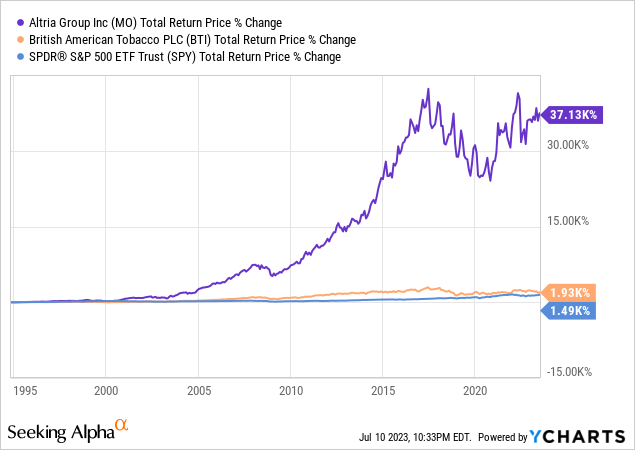

If you invested in Altria (NYSE:MO) in 1995, then reinvested your dividends you would have earned a return of 37,000+% meanwhile, shared invested British American Tobacco (NYSE:BTI) would have increased by over 1,900%, both of which are market-beating returns.

Investors who are overly dogmatic with their personal beliefs and apply them to investing are likely to glance over opportunities like these businesses. Regardless of my own beliefs I still chose to write about these companies from time to time just as I did with Altria and Phillip Morris (PM) in the past, if you’re curious you can read that article here.

Assuming you are still with me and interested in learning more about these companies, let’s dive into these two companies and determine which of the two is the “Best of Big Tobacco“.

Industry Overview

Before we dive into the head-to-head comparison let’s first touch on the industry.

The cigarette market is huge, in fact, it’s estimated that 1.3 Billion people smoke worldwide… all to get that kick of nicotine. While huge markets are normally to prospective investors, a shrinking customer base, which is also a feature of the industry, is equally unattractive.

Smoking has been on the decline since 1964 in the USA and similar trends can be seen worldwide as consumers are becoming more health conscious. But, as in other industries, just because the market is shrinking doesn’t mean that it cannot be a worthwhile investment. It’s all about the price you pay versus what you get.

In the tobacco industry volumes are broadly on the decline with the average sales price continuing to increase. These price increases allow tobacco companies to grow revenues despite reduced customer appetite.

It also helps that smokers are often very brand loyal, not wanting to switch away from one brand once they’ve formed the habit. This makes the brands that Altria and BTI own potentially very attractive to investors who love pricing power.

Scrutiny x Big Tobacco

Despite major historical, fines, and payments to governmental agencies worldwide the industry continues to face political scrutiny. Sometimes this scrutiny can be devastating for shareholders, as was the case when the USA took action against Juul in the USA.

Perhaps ironically, the newer products which are receiving some of the most scrutiny such as vapes and heated tobacco devices are considered by some to be healthier than traditional cigarettes. It’s my view that scrutiny is to be expected if you chose to invest in these businesses as their a strong historical precedence of doing so.

Because of that scrutiny and declining consumer demand, this industry’s future is unclear, there may always be a demand for nicotine, but the market may grow increasingly regulated which could harm shareholder profits over the long term and slow innovation.

Competitive Positioning: Altria versus British American Tobacco

At the end of the day, both of these companies provide the same product: nicotine. While that is true, they cater to different markets with differentiated products and categories.

Altria

First, let’s talk about Altria, over the past few years Altria has consistently aimed to reinvent itself by diversifying away from standard cigarettes into new growth categories, such as vaping and marijuana through Juul and Cronos respectively (CRON).

Obviously, those two investments have not panned out as expected, both destroyed millions of dollars in shareholder value. Yet Altria persists, most recently, on June 1st, 2023 Altria announced the closing of its acquisition of NJOY Holdings, maker of NJOY ACE, the only FDA- Marketing Approved pod based, vape in the US.

When this was announced, I found this move a bit shocking given the failure that was its investment in Juul, it seemed to me that Altria was simply repeating the same mistake it had just made only a few years back.

But it is true, that vaping remains a strong growth market as consumers, especially younger generations, gravitate towards vaping as a healthier alternative to traditional cigarettes. I don’t doubt that vaping has the potential to be healthier than traditional cigarettes, but I do have concerns about whether any company can grow a brand to the scale of Marlboro in this space.

For that reason, I am skeptical and concerned about future M&A moves made by Altria.

British American Tobacco

On the other hand, compared to Altria, BTI has stayed closer to its roots in terms of its M&A strategy and market positioning, I think this is a big plus for investors.

Yes, non-combustible nicotine is still an important part of the strategy for BTI but compared to Altria’s M&A track record, BTI appears to be much more focused on standard horizontal transactions to take market share. Just look at the track record and BTI’s largest deal to date (Reynolds).

When British American took over Reynolds they acquired some of the most iconic brands in the history of smoking in the US including, most notably, Camel and Newport. These brands have especially strong brand recognition with minority consumers which will likely serve as a tailwind for consumption as those minority populations are expected to outgrow the white population in the US over the coming decades. That population growth may be enough to keep volumes steady even as the proportion of smokers decreases over time.

Ultimately, I would much rather my companies invest in marketing a familiar product to a growing customer base than I would if they were to go out and acquire companies with relatively weaker brand awareness. Brands matter.

In short, British American Tobacco, through its acquisition of Reynolds, cemented its place at the core of American Tobacco for many decades to come while Altria appears to continue purchasing expensive lottery tickets to discover the newest growth business.

You can decide what strategy you think is best.

Financials

Now that we’ve covered the industry, let’s take a look to see how these two companies compare in terms of financial performance. Who will “smoke” who, Marlboro or Camel?

Revenue Growth

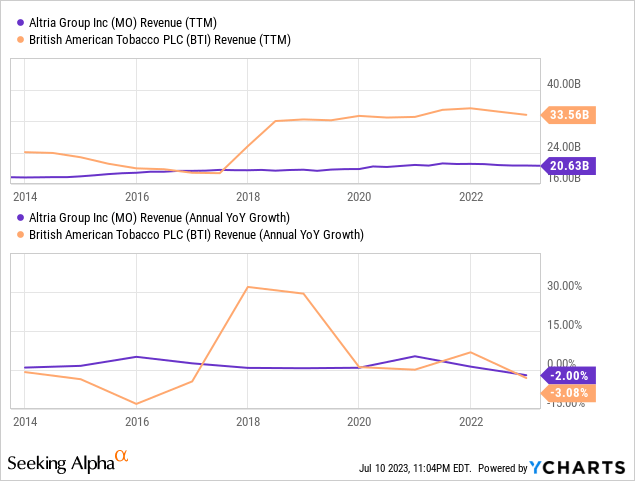

As you can see in the chart above, and as I hinted earlier both companies have been able to grow their revenues, albeit slowly (aside from a major acquisition from British American in 2017 when they acquired Reynolds for nearly $50 Billion.

Apart from infrequent major acquisitions, these companies usually have flat to marginally positive revenue growth as modest price increases slightly outpace declining volumes.

EPS Growth

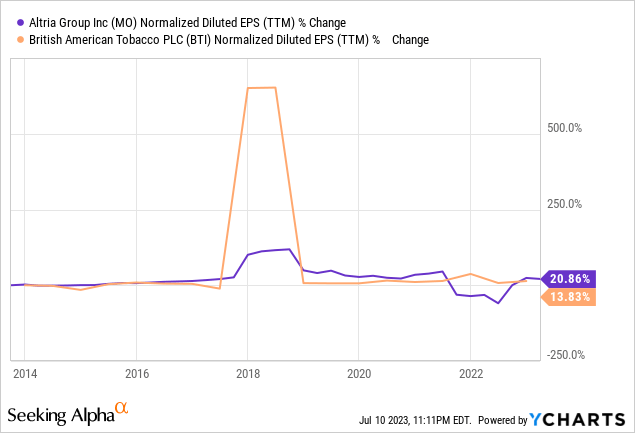

A similar story unfolds when looking at EPS growth over the past decade, improved pricing has improved margins and yielded marginally improved profitability over the past decade. Due to secular headwinds facing the industry, opportunities for growth in their core product are limited, which in my view, increases the likelihood of further industry consolidation as time moves on.

As some of the largest companies in the space, Altria and BTI are more likely to be on the acquiring side vs. the target.

Dividends

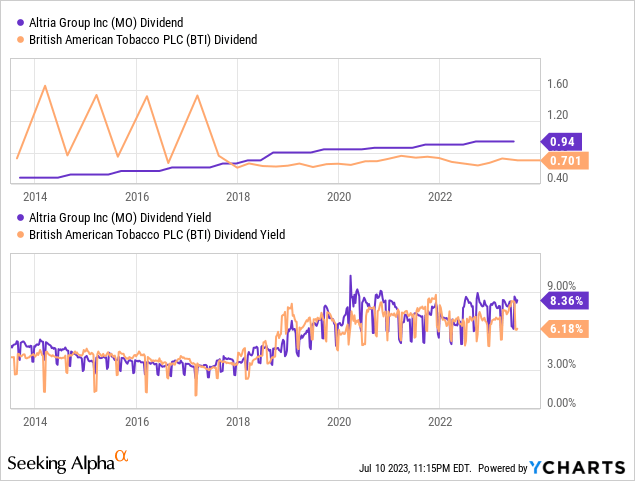

As companies mature, and growth eventually stalls, it’s natural that they return capital to shareholders, and boy do these two companies return capital back to shareholders.

In fact, both companies yield around 8%, meaning that roughly $12.50 invested converts into $1 of dividends paid annually to the shareholder. There are few companies that even trade at 12.5x Price to Earnings, let alone distribute that amount of capital back to shareholders.

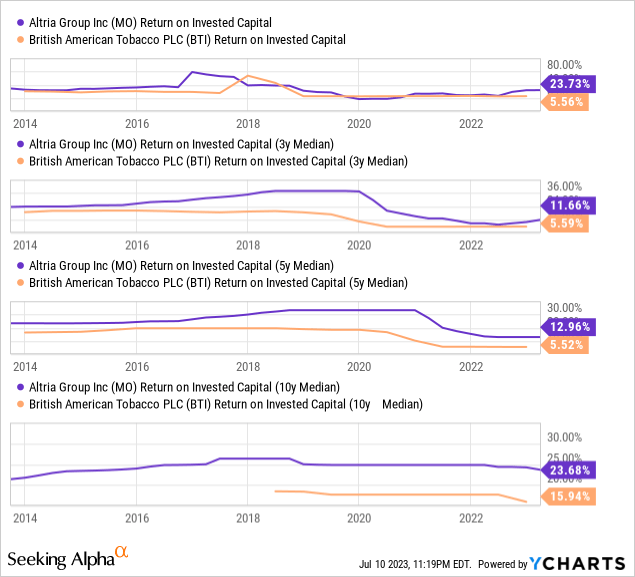

Returns on Invested Capital

In addition to a strong capital distribution program, both companies also have a relatively strong record when it comes to returns on invested capital. Historically, apart from some flops, these companies have been able to generate returns on invested capital in the high teens to low twenties.

I believe that this metric is particularly important for investors because in essence, when you invest in a company, you are allowing them to be stewards of your capital, it’s best to choose those that will respect that role and act as stewards.

Valuation

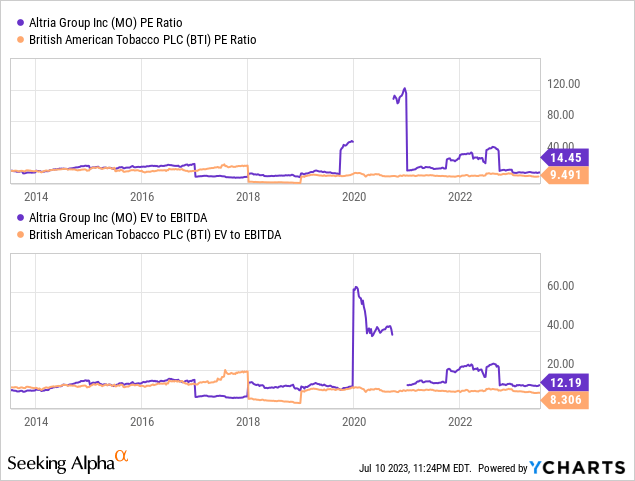

Valuation-wise, both companies trade at a steep discount to the market overall. Altria’s 15x PE and BTI’s 10x ratio are some of the lowest among major companies putting these companies in the steep value territory.

Looking forward things appear to be even cheaper, at least if analyst expectations are to be trusted. According to Yahoo Finance, the average analyst expects an EPS of $5.20 and $5.12 in 2024 for Altria and BTI respectively.

These forward EPS expectations correlate to a forward PE ratio of 7.9x and 6.4x respectively for Altria and BTI.

Risks

Before we get to the conclusion, let me first highlight some risks.

First, we have a shrinking customer base, everyone is familiar with the facts: smoking is losing popularity. The question is therefore where should these businesses go from here? Is it best for these businesses to diversify, and move into categories unrelated to nicotine, Marijuana for example? Or would it be better for them to focus on their core business, and simply return the maximum amount of capital to shareholders as the ship slowly sinks?

This existential question is likely to be a recurring theme for these companies as management must weigh the company’s long-term existence (and their job) with maximally efficient capital allocation. If we see these companies increasingly throw “good money after bad” in an attempt to revitalize the business I would grow concerned, it’s for that reason, I see capital allocation as the greatest ongoing risk.

Secondly, there is a short-term risk: a low valuation is no guarantee of future increase, and many cheaply valued companies stay cheap. This may be the case for Altria and BTI as they are so-called “sin stocks” and are often blacklisted by many investors. Therefore, I think an investment in either company should be more of a long-term play, short-term sentiment is hard to predict.

Conclusion

In conclusion, the tobacco industry presents both challenges and opportunities for investors. While smoking rates have been declining globally and regulatory scrutiny is increasing, companies like Altria and British American Tobacco have managed to navigate these headwinds and deliver modest revenue growth.

Both Altria and BTI have demonstrated resilience by implementing price increases and benefiting from brand loyalty among smokers. This has allowed them to maintain stable financial performance, with consistent EPS growth and strong returns on invested capital.

Furthermore, these companies have shown a commitment to returning value to shareholders vis-a-vis juicy dividend yields. Their mature status and discounted valuations compared to the overall market make them potentially intriguing investment options.

All in all, I rate Atria a “Buy” and British American Tobacco a “Strong Buy“.

Sure growth is slow, but EPS is holding up and their valuations are dirt cheap. Given BTI’s discount to Altria and similar growth profile, I rate it as the better buy right now.

Read the full article here