Investment Thesis

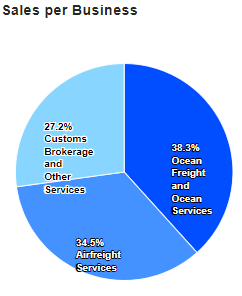

Through its subsidiaries, Expeditors International of Washington, Inc. (NASDAQ:EXPD) serves customers in the logistics industry across the Americas, Asia, Europe, the Middle East, Africa, and India. It specializes in transporting merchandise but also offers services for documents, insurance, coordination, etc. Below is the company’s revenue distribution per business line.

Market screener

The company has been performing excellently, recording a share price appreciation of about 66% over the last five years. Despite recent worrying industry trends, its shares have gained about 29% over the last 12 months. The company is trading at $121.77, about 2% of its 52-week high price of 124.22. I attribute this good performance to its diversified business model as well as its competitive advantage. Its good performance can further be affirmed by its attractive ROCE.

Further, with a very solid balance sheet, I think the company has a lot of financial flexibility, which, together with its competitive advantage, bodes well for its success when the industry is evolving and needs much adaptation. Given this background, I am bullish on this stock.

Competitive Advantage

In my view, Expeditors International’s extensive network provides a competitive moat because of the company’s ability to capitalize on connections and develop possibilities in more than 60 countries. The fixed expenses often associated with developing new technologies are diminished through economies of scale. Expeditors are well-positioned to take early advantage of economic expansions in the future because of their large cash reserve and lack of debt in the current low-growth economic climate.

In addition, I believe that the company’s diversification into air freight, ocean freight, and customer brokerage services gives them an edge in the market. This is because they can leverage the most profitable industry to cushion the blow of any struggling division.

The Industry Trends

Last year, air freight saw a drop in demand, rising fuel costs, stopped aircraft, and shortened routes. Air freight rates rose due to rising jet fuel prices and grounded flights limiting belly capacity. Due to a broken supply chain, a global economic downturn, the risk of a worldwide recession, high fuel costs, and the Ukraine crisis, air freight businesses had a subdued fourth quarter of 2022. In the first quarter of 2023, this sector was still declining, signaling a possible tough 2023 FY. Below are the trends which will shape the cargo industry this year.

To begin with, the industry is expected to face increased capacity and falling rates. Experts estimate that once passenger planes have recovered their belly room, the air freight sector will see a capacity growth in 2023. Shipping costs can go down as a result of this as well. Consumers’ purchasing power has been limited by global inflation, further contributing to falling demand. Therefore, in 2023, demand is not anticipated to return to pre-COVID levels. Although demand has decreased and cargo space has increased, typical international air freight rates will remain in the $2.60–$2.80 per kilo range.

Compared to 2019 freight rates, this price is over 35% more than the 2019 rates. This point to a financially secure and less gloomy future for the air freight industry in 2023. Freight prices are unlikely to rise in 2023. Remember that the sector is still recovering from the pandemic, so a rate increase will hurt its profitability. Due to inflation, consumers spend conservatively, which is not good news for the sector.

Another trend is the shift from air freight to ocean freight. Xeneta experts estimate that air cargo will shift to ocean freight in 2023. Due to changing purchasing preferences and maritime freight unpredictability, air freight demand has skyrocketed throughout the pandemic. Due to equipment shortages, port congestion, blank sailings, and other sea freight issues, shippers had to employ air freight instead. However, ocean freight has returned to normal with enhanced schedule reliability, capacity, and decreased freight rates. Many freight forwarders are switching to sea freight to save money. Forwarders are also switching from air freight to marine freight due to environmental consciousness.

Lastly are the falling revenues and the rise in digitization. IATA estimates that air cargo sales will total roughly $149.4 billion, which is $52 billion less than last year. Freight volumes peaked in 2021 at 65.6 million tonnes, but due to the uncertain economic scenario, this could drop to 57.7 million tonnes. That is to say; the air freight industry will continue to feel the effects of the aforementioned socioeconomic pressures. On the digital front, in 2023, the rate of digitization in the air cargo industry will increase dramatically. More and more money will be spent on artificial intelligence-powered process automation by airlines and airports around the world. Access to real-time data and openness in the shipping procedures are two further competitive aspects that will rise to the forefront.

Strong Balance Sheet

The company’s balance sheet shows EXPD has a very strong financial footing. With a market cap of $18.79B and a total debt of $ 520.62 million, the company is almost fully deleveraged, offering them a very safe haven for debt-related risks. Regarding liquidity, the company has a very impressive cash balance of $2.35B, which can cover its total debt by about 5x. Further, with a current ratio of 2.42, the company can adequately cover its current liabilities with its current assets, which is a very good position to be in.

Further, with a decent cash flow from the operation of 2.26B, the company’s liquidity position is secure and very reassuring as it is in a prime position to replenish its cash reserves should it be depleted. With such a solid financial footing, EXPD enjoys a very flexible and safe financial position. Given the rising necessity to digitize the sector, the company can comfortably fund such an investment by cash or even pursue debt financing without hurting its financial health. Further, its attractive cash reserves bode well for investors as they have a higher chance of receiving share buyback, increased dividend distribution, or both.

Dividend and Share Buybacks

The company’s robust liquidity and shareholder-friendly initiatives have paid off for EXPD investors. The company’s dedication to rewarding its shareholders through dividends and buybacks has impressed me. In 2020, when the COVID-19 pandemic decimated the world, the corporation repurchased 4.6 million shares at an average price of $72.26. They bought back 4.4 million shares in 2021 at an average price of $117.54.

The company’s management increased the semi-annual cash dividend by 15.5% in May 2022, declaring a new payout of 67 cents per share, translating to $1.34 per share annually. At an average price of $108.88 per share, EXPD repurchased 14.5 million shares of common stock that year. The company announced a 3 percent dividend increase in May this year, bringing the dividend payout to 69 cents per share semiannually.

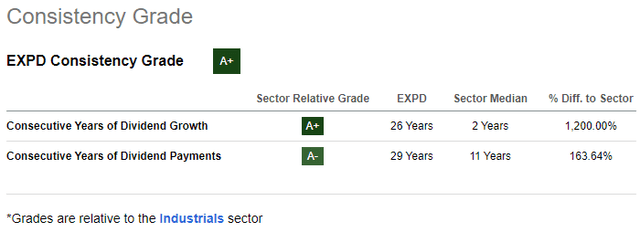

The company’s 29 years of uninterrupted dividend payments, well over the industry average of 11, attest to its reliability and consistency as a dividend payer. In addition, its dividend growth history is 26 years long, while the industry median is only two years.

Seeking Alpha

In my view, this history makes the company one of the best dividend payers in the industry. Given its solid financial footing, I expect its dividend payment to improve over time.

My Take On Investing Here

Given the evolving industry based on the trends discussed in this article, the industry faces some uncertainties that pose risks. However, I find EXPD to be in a prime position to weather the storms. To begin with, it has diversified in both air and ocean freights, which positions them in a good position to capitalize on the changing preference from air to ocean freights.

In addition, businesses in this sector may be compelled to make substantial investments in technology due to the projected rise in digitalization. Given its solid financial footing, represented by a deleveraged balance sheet and very strong liquidity, the company is in a stronger position to execute that investment. It offers the company much-needed flexibility to fund CapEx with cash or seek debt financing.

Further, its growing dividend history, consistency, and share buyback make the company a good choice for investors, as the management is committed to rewarding its shareholders. With its strong liquidity and decent cash flows, I expect these trends to continue.

With a PE ratio of 15.98, lower than the industry median of 19.75 by about 19%, it appears the company is undervalued. Further, a DCF model from finbox estimates a fair value of $140.46 with an upside potential of 14.7% which lends credence to my assertion that the company is undervalued. Given this discounted valuation, I recommend the company to potential investors, given its strong standing in an evolving industry.

However, investing here has its share of risks, which investors should watch closely as it can affect their investment. These risks are discussed below.

- Regulatory risks: The logistics industry is subject to various laws and regulations, both domestically and internationally. Compliance with these regulations, such as customs and trade regulations, can incur costs and administrative burdens. Changes in regulations or non-compliance can potentially lead to fines, penalties, or restrictions on the company’s operations.

- Exchange rate risk: EXPD operates globally and generates a significant portion of its revenues from international markets. Fluctuations in currency exchange rates can lead to translation losses, impacting the company’s financial results.

- Technology disruption: The company relies on advanced information systems and technology to manage its operations efficiently. Any interruption or failure in these systems, such as cyber-attacks or technical glitches, can impact the company’s ability to provide services, leading to potential revenue losses and damage to its reputation.

In conclusion, I find EXPD a good investment since it stands a better chance of leveraging the evolving industry. Further, it has an attractive history of dividend payment and share buybacks which is very appealing to investors. Given its discounted valuation, I recommend the stock to potential investors but beware of the potential risks.

Read the full article here