Build-A-Bear Workshop, Inc. (NYSE:BBW) operates as a multi-channel retailer of plush animals and related products. The company operates through three segments: Direct-to-Consumer, Commercial, and International Franchising.

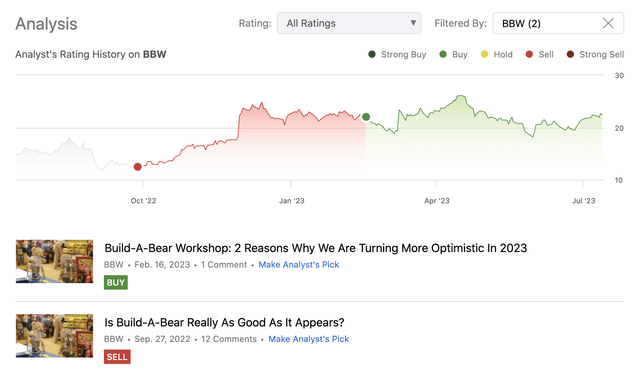

We have been following BBW since Q3 2022 and have published two articles about the firm on Seeking Alpha since then.

Analysis history (Author)

In Q3 2022 we have initiated a coverage with a “Sell” rating due to the significant macroeconomic headwinds, including poor consumer sentiment, increased raw material prices and elevated levels of inflation. At that time we believed that these factors are likely to negatively impact the firm’s financial performance in the near term.

Much to our surprise, the stock price has climbed gradually from that point onwards. Early 2023 we have revised our previous thesis and saw that despite these headwinds BBW has managed to keep its net profit margin stable, while also increasing the firm’s efficiency, as indicated by the asset turnover. This led to a rating upgrade to “buy”, however we highlighted a number of factors that investors need to pay close attention going forward. These were inventory management and the development of accounts receivable in relation to revenue growth.

Today, we are going to take a look at the macroeconomic environment to get a broad picture about what to expect going forward. We will also focus on some of the risks and their developments that we have mentioned earlier.

Macroeconomic environment

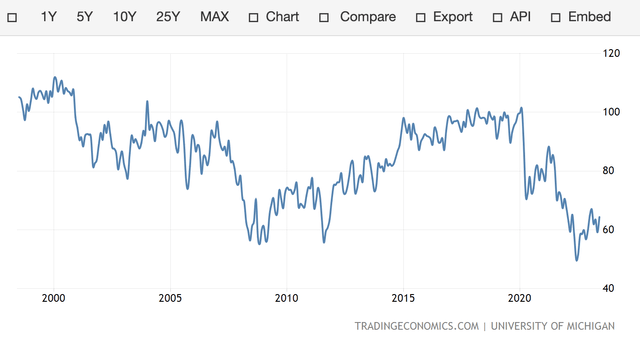

When writing about firms in the consumer discretionary sector, normally we like to refer to the consumer confidence to define our expectations about the near future. Consumer confidence is often treated as a leading economic indicator, which aims to capture the consumer’s financial outlook in the near term. Low readings are generally bad as they indicate that people are less confident in spending larger sums on durable, discretionary items as they are more uncertain about their financial future.

U.S. Consumer confidence (tradingeconomics.com)

When we discussed consumer sentiment in our previous articles, the readings were at historic lows. Since then sentiment has somewhat improved, but it still remains around the lows seen during the 2008-2009 financial crisis.

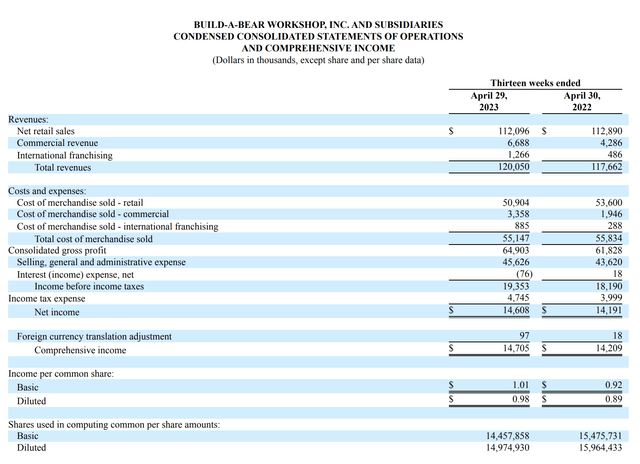

Despite the challenging environment, BBW’s financial results in the previous quarter have been outstanding, despite missing analyst estimates in terms of revenue:

- Generates total revenues of $120.1 million representing a record for this fiscal quarter

- Achieves pre-tax income of $19.4 million, a record level for the third consecutive fiscal first quarter

- Delivers first quarter diluted earnings per share of $0.98, the highest in its history for the period

- Fiscal year-to-date the Company returned $28.6 million to shareholders through dividends and share repurchases

Income statement (BBW)

From the income statement it is visible that despite the poor consumer sentiment, the demand for BBW’s products remain high, leading to strong revenue generation.

Further, the firm has also reiterated its guidance for the full year.

The retailer said it expects 2023 revenue growth of +5% to +7% year-over-year with growth recording in all three of its segments. That guidance range works out to revenue of around $492M to $501M vs. $496M consensus. Build-A-Bear also expects pre-tax income to increase 10% to 15% for the full year. On the development front, 20 to 30 experience locations are expected to be added this year with capex spending targeted at $15M to $20M.

This reiteration can give reasons for further optimism among investors, as management also appears to believe that the challenging macroeconomic environment is not going to have severe impacts on the firm this year.

For these reasons, we remain bullish on BBW’s stock in the near term.

Company specific considerations

In our previous writing we have been elaborating on net profit margin, inventory management and the increase in accounts receivable. So let us look at these two topics once again to see how the picture has changed over time.

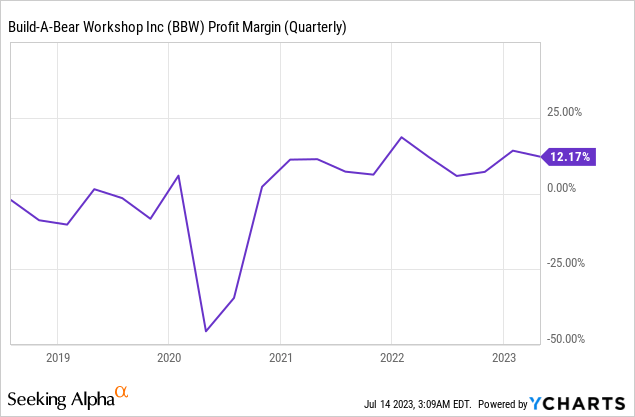

Net profit margin

Profit margin has continued to be relative constant, which is a good sign in the current market environment. We believe that with a potentially improving macro environment, BBW will likely be able to even expand its margins in the longer term.

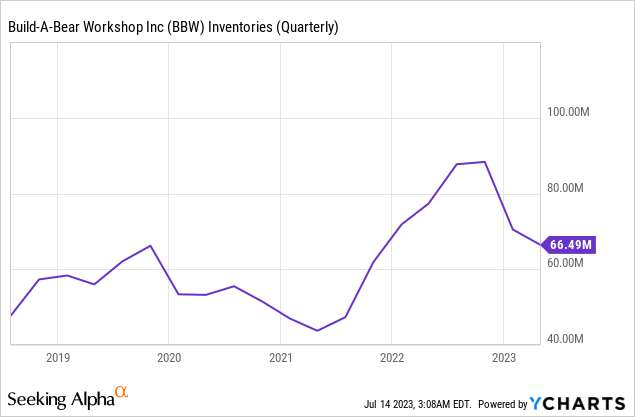

But, as mentioned in our previous article, excessive inventory and the need to get rid of excessive inventory may require significant discounting, leading to a margin contraction in the near term. To assess this, let us look at the inventory levels.

Inventory

Inventory levels have fallen significantly since late 2022, which is a good sign. Even better that the firm has managed to achieve this reduction without hurting its net profit margin materially.

This development is definitely a positive one since our last writing and for these reasons, we once again believe that maintaining our bullish view is justified.

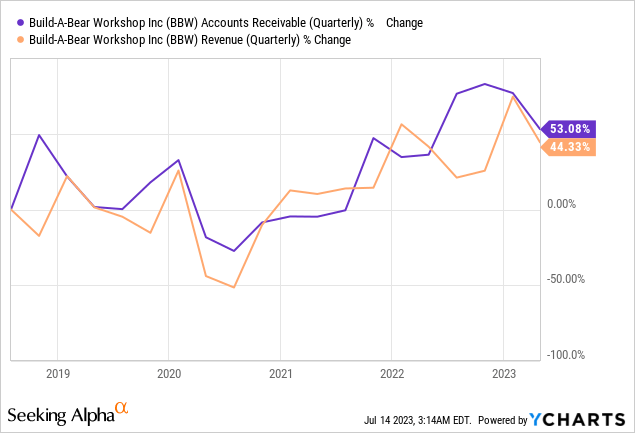

Accounts receivable

We normally look at accounts receivable growth in relation to revenue growth to gauge whether the company is inflating its sales figures or not. In general, when accounts receivable grow much faster than revenue, it is likely that the firm is selling more on credit to pull forward demand from future periods or has changed its revenue recognition policy.

Fortunately, we are once again happy to see the recent developments. Accounts receivable growth has slowed substantially and it is currently roughly in-line with revenue growth. The divergence that we have seen in the previous quarters has practically closed.

To sum up

The demand for BBW’s products continues to remain strong despite the challenging macroeconomic environment. Although the firm has missed revenue estimates in the previous quarter, the firm has delivered outstanding results, including record sales and record pre-tax income.

The company has managed to keep its profitability stable and has reduced its inventory substantially from the 2022 highs. Accounts receivable growth has also slowed, making us less suspicious about revenue manipulation.

The firm has also reiterated its full year guidance.

For these reasons, we maintain our “buy” rating.

Read the full article here