Source: Own processing

Precious metals royalty and streaming companies represent a very interesting sub-industry of the precious metals mining industry. They provide some leverage to the growing metals prices, similar to the typical mining companies; however, they are less risky in comparison to them. Their incomes are derived from royalty and streaming agreements. Under a metal streaming agreement, the streaming company provides an upfront payment to acquire the right to future deliveries of a predefined percentage of metal production of a mining operation.

The streaming company also pays some ongoing payments that are usually well below the market price of the metal. They can be set as a fixed sum (e.g., $300/toz gold) or as a percentage (e.g., 20% of the prevailing gold price), or a combination of both (e.g., the lower of a) $300/toz gold and b) 20% of the prevailing gold price). The royalties usually apply to a small fraction of the mining project production (usually 1-3%), and they are not connected with ongoing payments. They can have various forms, but the most common is a small percentage of the net smelter return (“NSR”). The NSR is calculated as revenues from the sale of the mined products minus transportation and refining costs.

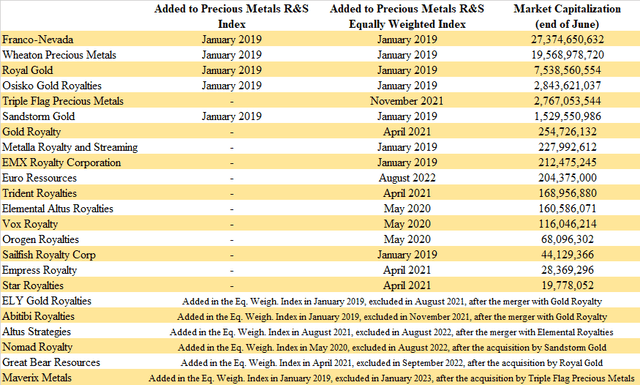

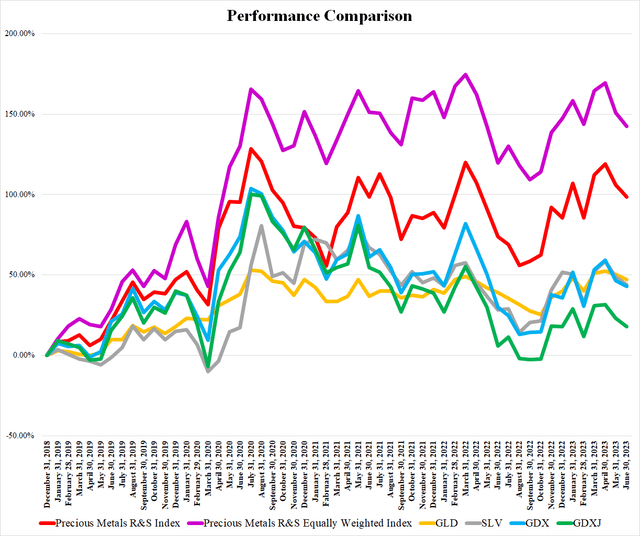

To better track the overall performance of the whole sub-industry, I created a capitalization-weighted index (the Precious Metals Royalty and Streaming Index) consisting of 11 companies (in June 2020, expanded to 15). Later, based on the inquiries of readers, I also introduced an equal-weighted version of the index. Until March 2021, both indices included the same companies and were calculated back to January 2019.

However, some major changes occurred in April 2021. Due to the boom of the royalty and streaming industry and the emergence of many new companies, the indices experienced two major changes. First of all, the market capitalization-weighted index was modified to include only the 5 biggest companies: Franco-Nevada (FNV), Wheaton Precious Metals (WPM), Royal Gold (RGLD), Osisko Gold Royalties (OR), and Sandstorm Gold (SAND). The combined weight of these 5 companies on the old index was around 95%, therefore, the small companies had only a negligible impact on their performance. The values of the index were re-calculated back to January 2019, and between January 2019 and March 2021, the difference in the overall performance of the old and the new index was only 2.29 percentage points. The second change is related to the equally weighted index that was expanded to 20 companies.

The previous editions of the monthly report can be found here: May 2019, June 2019, July 2019, August 2019, September 2019, October 2019, November 2019, December 2019, January 2020, February 2020, March 2020, April 2020, May 2020, June 2020, July 2020, August 2020, September 2020, October 2020, November 2020, December 2020, January 2021, February 2021, March 2021, April 2021, May 2021, June 2021, July 2021, August 2021, September 2021 (extended), October 2021 (extended), November 2021 (extended), December 2021 (extended), January 2022 (extended), February 2022 (extended), March 2022 (extended), April 2022 (extended), May 2022 (extended), June 2022, June 2022 (extended), July 2022, July 2022 (extended), August 2022, August 2022 (extended), September 2022, September 2022 (extended), October 2022, October 2022 (extended), November 2022, November 2022 (extended), December 2022, December 2022 (extended), January 2023, January 2023 (extended), February 2023, February 2023 (extended), March 2023, March 2023 (extended), April 2023, April 2023 (extended), May 2023, May 2023 (extended), June 2023 (extended).

Source: Own processing

The big three remains unchanged. Franco-Nevada, Wheaton Precious Metals, and Royal Gold have a combined market capitalization of nearly $55 billion, which represents more than 86% of the whole industry. After Osisko Gold Royalties, Triple Flag Precious Metals (TFPM), and Sandstorm Gold are added, their combined market capitalization accounts for nearly 98% of the whole industry. The biggest company, Franco-Nevada, has a market capitalization of more than $27.37 billion. On the other hand, the smallest one, Star Royalties, has a market capitalization of less than $30 million.

Source: Own processing

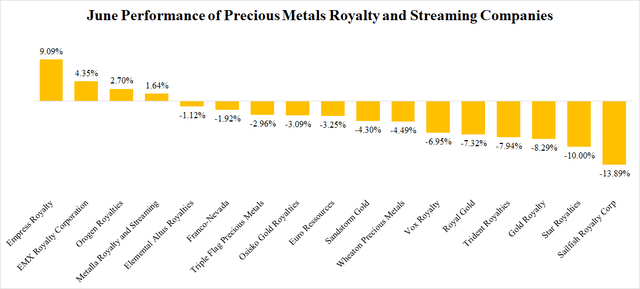

In June, only 4 out of the 17 companies recorded a positive share price performance. The highest gains recorded were by Empress Royalty (OTCQX:EMPYF) whose share price grew by more than 9%. The markets reacted positively to the announcement of a new strategic investor. On the other hand, the biggest decline was recorded by Sailfish Royalty (OTCQX:SROYF). Its shares lost nearly 14% of their value. The decline lasted for the first half of the month, however, there was no company-specific news that could be blamed.

Source: Own processing

The June performance of precious metals was not good. The share price of the SPDR Gold Trust ETF (GLD) declined by 2.22%, and the share price of the iShares Silver Trust ETF (SLV) declined by 3.33%. This contributed to the negative performance of the gold mining industry when the VanEck Vectors Gold Miners ETF (GDX) declined by 2.59%, and the VanEck Vectors Junior Gold Miners ETF (GDXJ) declined by 3.98%. Unfortunately, the precious metals R&S companies did similar to GDXJ. The Precious Metals R&S Index declined by 3.59% and the Precious Metals R&S Equally Weighted Index declined by 3.4%.

The June News

The transaction activity started to pick-up finally. Royal Gold announced a $250 million acquisition of gold-platinum-palladium and copper-nickel royalties. Osisko Gold Royalties completed a $150 million transaction that was announced back in December, and announced two smaller transactions with big upside potential (especially the $15 million acquisition of the Costa Fuego royalty).

Royal Gold (RGLD) announced that operations at Newmont’s (NEM) Penasquito mine have been suspended due to a strike. The 2% NSR royalty on Penasquito generated 7.2% of Royal Gold’s revenues in 2022.

Royal Gold also announced that it agreed to buy gold-platinum-palladium and copper-nickel royalties on producing Serrote and Santa Rita mine from ACG Acquisition Company for $250 million. $215 million will be paid to acquire an 85% Gross Smelter Return Royalty on gold produced at Serrote (reduced to 45% after the $250 million revenue threshold is reached), and a Gross Smelter Return royalty of 64 toz gold, 135 toz platinum, and 100 toz palladium for each million lb nickel produced at Santa Rita (after a $100 million revenue threshold is reached, the platinum and palladium portion of this royalty will be canceled). Further $35 million will be paid for a 0.5% copper and nickel Gross Smelter Royalty (in years 2023 and 2024), 0.75% (in 2025), 1.1% (after 2025, until the revenue threshold of $90 million is reached), and 0.55% (after the $90 million threshold is reached).

Osisko Gold Royalties (OR) released the 2023 Asset Handbook and the 2022 Sustainability Report. Osisko also announced the completion of the $150 million acquisition of a 3-4.875% copper and 100% silver stream on the CSA mine, announced back in December. The streams should generate around 428,000 toz silver and 3-4.9 million lb of copper per year between 2023 and 2025. Osisko has also purchased shares of CSA’s acquirer, Metals Acquisition Limited (MTAL) worth $40 million.

On June 28, the company announced the acquisition of a 1% copper NSR royalty and 3% gold NSR royalty on Hot Chili’s (OTCQX:HHLKF) Costa Fuego copper-gold project for $15 million. According to the fresh PEA, the mine should be producing around 209 million lb copper and 49,000 toz gold per year on average, over the first 14 years of its initial 16-year mine life.

On June 29, Osisko announced an amendment to the Gibraltar mine silver stream. Taseko Mines (TGB) increased its stake in the mine from 75% to 87.5%, and it agreed to increase the silver stream owned by Osisko from 75% to 87.5% of the overall silver production of the mine, in exchange for $10.25 million.

Sandstorm Gold (SAND) reported the renewal of its ATM program. On June 15, Sandstorm completed the previously announced sale of the 1.66% NPI on the Antamina mine to Horizon Copper (OTCPK:RYTTF) for a $149.1 million secured convertible note and 2,329,849 shares of Horizon. Sandstorm holds 34% of Horizon’s outstanding shares that restarted trading on June 21, after more than a year-long interruption. A detailed article about Horizon Copper can be found here. Sandstorm also announced several news regarding its portfolio, including the growth in reserves at Lundin Gold’s (OTCQX:LUGDF) Fruta del Norte mine, the beginning of underground mining at Rio Tinto’s (RIO) Oyu Tolgoi mine, or maiden reserves estimate at Barrick Gold’s (GOLD) Robertson deposit.

On June 29, Sandstorm declared another quarterly dividend of C$0.02 ($0.015) per share. It will be paid on July 28, to shareholders of record as of July 18.

Vox Royalty (VOXR) made a $7.26 million equity financing by selling 3.025 million new shares at a price of $2.4 per share. The net proceeds amounted to $6.19 million. Vox also provided a portfolio update. The most important news is that the Mt. Ida processing plant has been commissioned. The 1.5% NSR royalty on portions of Mt. Ida should start generating cash flows next year.

Trident Royalties (OTCQX:TDTRF) reported its 2022 financial results. The revenues amounted to $7.85 million, operating cash flow of -$3.53 million, and net income of -$3.68 million. The company ended the year with cash of $16.58 million and net debt of $23.42 million.

Sailfish Royalty (OTCQX:SROYF) declared a quarterly dividend of $0.0125 per share. It will be paid on July 17, to shareholders of record as of June 30.

Orogen Royalties (OTCQX:OGNRF) announced the acquisition of the Firenze gold-silver project in Nevada. The project was acquired through staking, under the Orogen-Altius Nevada Alliance.

Empress Royalty (OTCQX:EMPYF) reported that Gleason & Sons LLC acquired nearly 7 million of its shares which means an almost 6% equity interest in Empress.

Star Royalties (OTCQX:STRFF) announced that Sabre Gold Mines (OTCQB:SGLDF) released a PEA for its Copperstone gold project. The proposed mine should be able to produce 40,765 toz gold per year on average, over a 5.5-year mine life. Star holds a 6.6% gold stream on Copperstone.

The July Outlook

The gold and silver prices have been stagnant, while the broader stock market declined slightly during the first trading days of July. This contributed to the relatively calm performance of the precious metals R&S companies. However, the upcoming earnings season may lead to increased volatility in the latter part of the month. Moreover, the deal activity started to increase again, which may be another factor affecting the July performance of this stock market segment.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here